Family SMSFs: What Investors Need to Know Before adding Kids to Super

Ankita Rai

Thu 21 Aug 2025 6 minutesFor years, SMSFs have mostly been the domain of older trustees managing their own retirement nest eggs. However, that’s starting to change, as more families are experimenting with multigenerational SMSFs by bringing children into the fold to create larger funds and boost cash flow.

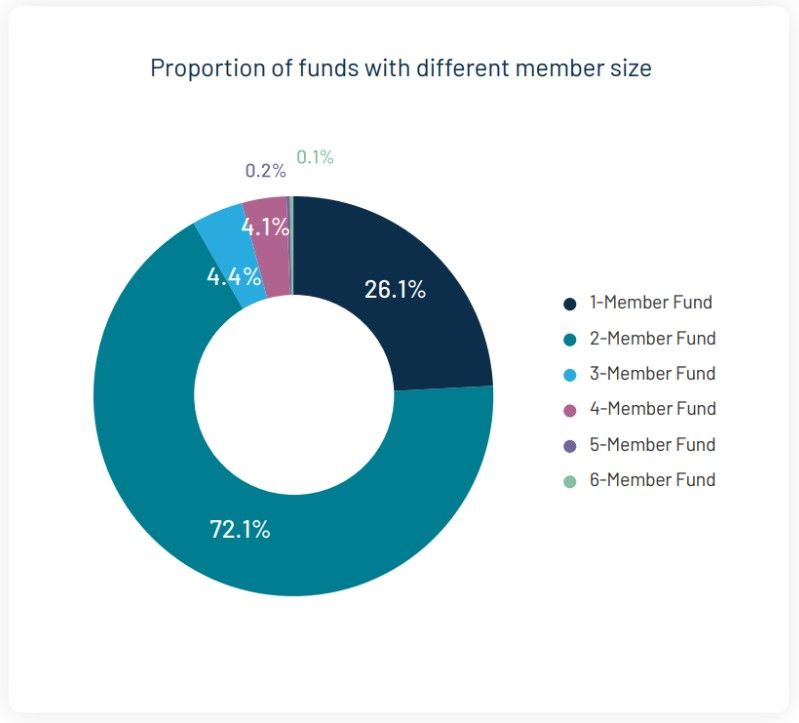

That said, the traditional ‘mum and dad’ structure continues to dominate. Class figures show that 72.1% of SMSFs have two members, usually couples, while 26.1% are run by a single member. Only 0.3% stretch to five or more members.

The appeal of adding children to SMSFs is obvious.

Bigger balances boost scale, opening doors to assets that might otherwise be out of reach. Yet those advantages come with added complexity. More members also mean more competing voices and more chances for conflict. Still, for investors, there are clear upsides…

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Case for a Multigenerational SMSF

With more members on board, a fund can move from a modest retirement vehicle to something with real scale and align more closely with the family’s long-term goals. Here’s how that plays out:

1. Bigger balance, bigger opportunities

Pooling accounts creates a much larger investment pot, giving the fund access to assets that would be out of reach for just one or two members. Families and small businesses, in particular, can gain flexibility, better diversification, and lower fees by combining their super.

One area where this is particularly evident is in commercial property. Many family SMSFs purchase business real estate, a warehouse, office, or industrial property, and lease it back to the family business.

This not only supports the business and helps build members’ retirement savings, it also provides protection if the business runs into trouble, with rental income continuing to flow into the SMSF.

There are also tax advantages. Rental income within an SMSF is generally taxed at a rate of just 15%.

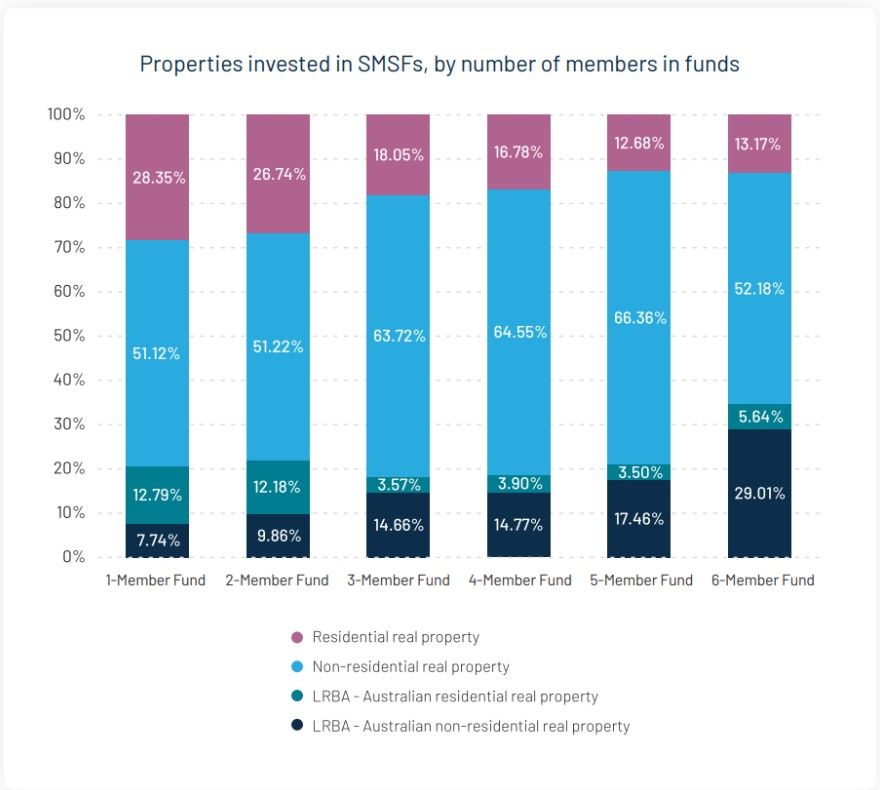

It’s no surprise, then, that SMSFs lean heavily towards commercial property. Class data shows 63.6% of SMSF property assets are in commercial real estate (as at 30 June 2024), compared to 36.4% in residential.

And it’s not just property. Larger funds tend to branch out into a wider mix of assets, from direct property and managed funds to unlisted trusts and ETFs as they negotiate better terms with managers and buy illiquid assets more comfortably.

2. Lower costs and more liquidity

Running an SMSF costs roughly the same whether there are two members or six. In fact, the more members you have, the cheaper it gets per person as pooling super spreads the fixed costs such as audits and compliance across the group.

This makes the structure especially attractive for adult children at the start of their super journey.

Scale also helps when it comes to performance. Research by Rice Warner shows that once an SMSF reaches around $200,000 in assets, its costs and returns can stack up well against larger APRA-regulated funds.

Moreover, adding younger members can strengthen the fund in another way too: liquidity. If parents are in pension phase and much of the fund is tied up in property, ongoing contributions from children can provide the cash flow needed to cover expenses and keep the fund running smoothly.

3. Estate planning and education advantages

A multigenerational SMSF can also double as a legacy plan. When a member dies, the fund doesn’t need to be wound up. It can keep going, allowing wealth to pass to the next generation without selling off assets or disrupting the investment strategy.

There are other benefits too. Older members have the opportunity to share their financial experiences, while younger members bring fresh investment ideas.

Involving younger members in trustee decisions also provides them with hands-on experience in super and investing, a skill set that can serve them well throughout their lives.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The challenges that come with family super funds

The upsides are easy to see. But when you pool retirement savings with family, you’re not just sharing investments, you’re also sharing control, which can lead conflict if expectations aren’t managed.

1. Family harmony is not guaranteed

Every member of an SMSF is also a trustee, which means everyone gets a say. Parents often assume they’ll stay in control, but once children turn 18, the law gives them equal responsibility. And with more voices around the table, disagreements are almost inevitable.

It might start with something small, an investment choice or pension. But these decisions can quickly expose differences in priorities between generations, or even between spouses in blended families.

2. Transparency cuts both ways

Being in the same SMSF means everyone sees the numbers. While parents may be fine with that, siblings or in-laws might feel differently. What’s tolerable when balances are small can become more sensitive as accounts grow into the millions.

Transparency can also highlight unequal contributions or withdrawals, which can breed resentment. Add to that the extra reporting, compliance, and tax obligations of a larger fund, and the penalties if things go wrong, and it’s easy to see how pressure can build.

3. Life stages change

What works for your children’s twenties may unravel in their thirties or forties. Marriage, divorce, kids of their own, or the desire to run an SMSF with a spouse can all change priorities.

Leaving the family fund isn’t straightforward either. Selling assets can trigger capital gains tax, insurance often needs to be re-established at a higher cost, and large illiquid holdings like property can make splitting particularly messy.

So while a multigenerational SMSF can work brilliantly for a time, it may not be a forever solution.

Is it right for your family?

These risks don’t make multigenerational SMSFs a bad idea, but they do require careful planning and strong communication.

Before inviting children in, ask the hard questions. Are you aligned on investment goals? How will decisions be made? Do members understand the compliance workload? Will votes be equal, or tied to balances?

Different generations often view investing differently, too. Unless everyone agrees on a shared strategy and understands the risks, the fund will struggle to hold together.

Either way, trustees would be well advised to seek specialist SMSF guidance before making the leap.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.