The Hidden Risks of Bank of Mum and Dad Financing

Ankita Rai

Thu 28 Aug 2025 6 minutesParents are increasingly stepping in to help children and grandchildren break into the property market, but good intentions don’t always translate into positive outcomes.

Too often, Bank of Mum and Dad (BoMaD) arrangements are struck informally, with little documentation or planning, leaving families exposed to disputes, divorce settlements, or their own future financial shortfalls.

The BoMaD can take many forms, such as acting as a guarantor on a mortgage, lending money outright, or providing rent-free housing. These gestures can make a real difference, but they also carry hidden risks if not carefully managed.

1. Is it a Gift or a Loan?

The biggest trap with BoMaD financing is ambiguity.

In law, money that flows from parent to child is presumed to be a gift unless there’s clear evidence otherwise.

This becomes particularly fraught during divorce proceedings. If a child separates from their partner, an undocumented contribution can be treated as part of the couple’s joint assets and can be lost in a settlement.

Beyond the legal risks, money can also carry subtle strings. A parent may provide funds, but then expect a say in where the child buys property or how they live. Children, in turn, can feel obligated in ways that extend far beyond the financial benefit.

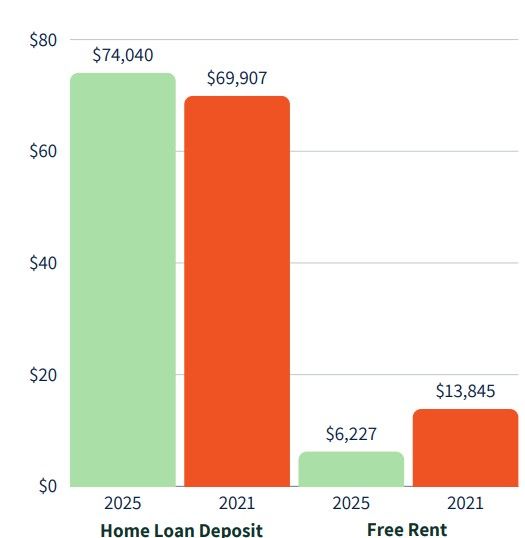

The scale of this support makes the stakes even higher. The Productivity Commission estimates BoMaD is now one of the nation’s top ten mortgage lenders, with 60% of first-home buyers receiving parental support. Mozo research shows that the average deposit gift has climbed to $74,000 in 2025, against a backdrop of house prices rising by more than 50% over the past five years.

Average amount gifted for a home deposit

Given the significant sums involved, it’s even more crucial to put clear documentation in place, whether that means a formal loan agreement or a Binding Financial Agreement (BFA). A key benefit of a BFA is asset protection: it can safeguard not only pre-relationship assets and inherited wealth, but also financial gifts or loans from family members.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Making Loans Work

Loans are often preferable to gifts for asset protection. But for a loan to hold up, it needs to look like a commercial arrangement, with clear documentation, scheduled repayments, and ideally secured against the property title.

Without a mortgage or caveat registered on title, courts are more likely to view the advance as a gift. In contrast, a registered mortgage not only makes the loan enforceable but also discourages disputes and makes recovery far more realistic.

Time limits add another layer. Even when loans are properly written, parents often make them repayable on demand. Such loans are subject to a six-year limitation period. If no repayments are made, it can become unenforceable after six years.

Therefore, regular repayments and updated agreements are the strongest evidence that a loan was genuine. Even small, consistent payments can protect the parent’s position.

3. The Guarantor Trap

Another common option is becoming a guarantor on a home loan.

By using the equity in your own home as security, your child can avoid Lenders Mortgage Insurance and qualify for a larger loan. On paper, it looks like a simple way to help without advancing any money, as long as the child keeps up the repayments.

But the problem is that guarantees are sticky. They last until the loan is repaid and can tie parents to a 30-year liability. If you want to refinance or downsize, the guarantee can stand in the way. In a worst-case scenario where the guarantor cannot meet the obligation, the lender has the right to sell the property to recover the limited guarantee amount.

Lawyers warn that guarantees should be a last resort. If they can’t be avoided, there should be a clear plan for release, typically once the child’s equity reaches 20% of the property’s value.

Without an exit strategy, parents risk being locked into obligations long after their own circumstances have changed.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

4. Undermining Your Own Retirement

That leads us to perhaps the biggest risk of all: parents putting their own future on the line.

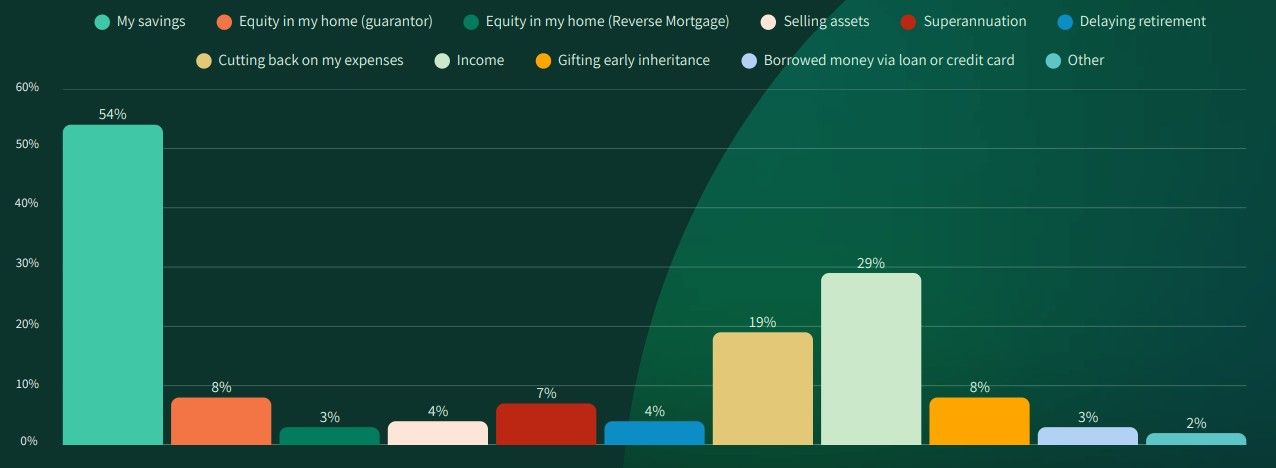

Mozo’s research shows that more than half of parents who help use their savings, while 19% cut back on living expenses, and some even delay retirement, as shown in the chart below.

Gifts and loans can also affect your age pension. Under the rules, any gift exceeding $10,000 in a single year (or $30,000 across five years) is still considered your asset for means testing purposes. That means pension payments can be reduced for up to five years, even though the money is no longer in your account.

Clearly, the generosity comes at a cost. A retirement shortfall can even flip the relationship, leaving children having to support their parents later in life.

5. Considering the Emotional Layer

Money is never just money in families. Parents often feel strong emotional pressure to say ‘yes’ when asked for help, and Mozo’s research shows one in three struggle to refuse even when the purchase looks unaffordable. That can mean enabling poor financial decisions or propping up lifestyles built on too much debt.

Fairness between siblings adds another complication. The Mozo research found that one in ten parents later regretted favouring one child, with the consequences often surfacing years later in estate disputes or fractured relationships.

Clearly, Bank of Mum and Dad arrangements don’t just carry financial risks. Sometimes the best way to support your children could be by saying ‘not yet’ and guiding them toward alternatives, such as rent vesting.

A Legacy That Lasts

For many families, the Bank of Mum and Dad is a powerful legacy. But without appropriate structure, it can unravel into disputes and financial strain.

That’s why support should never come at the expense of your own financial security. Striking a balance between helping your children and protecting your own future is what keeps family wealth intact.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.