Riding the Liquidity Wave Without Wiping Out

Simon Turner

Tue 7 Oct 2025 6 minutesIf you’ve noticed a change in the way markets have been functioning in recent years, you’re not wrong. The exponential growth of U.S. money supply, fuelled by decades of deregulation, cheap debt, and increasingly aggressive central bank stimulus has arguably changed the very nature of investing.

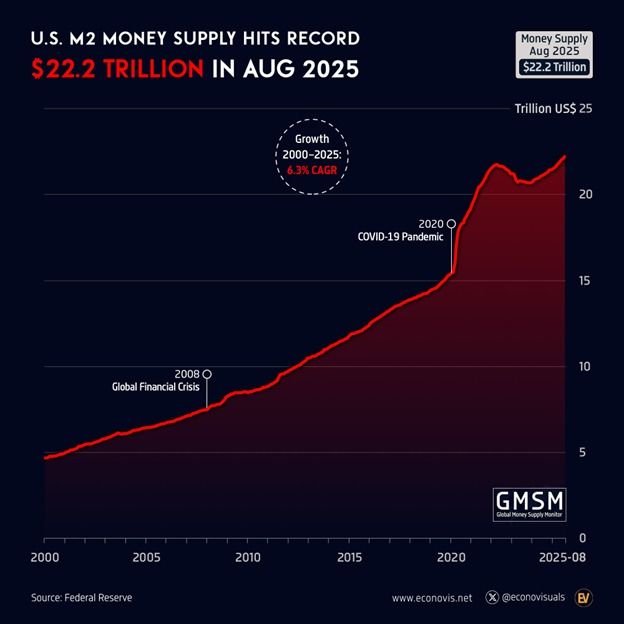

This unusually powerful liquidity wave continues to power ahead. US M2 money supply surged 4.8% in August 2025 to a record $US22.2 trillion. That’s the fastest pace of growth since July 2022. Moreover, inflation-adjusted M2 rose 1.8% in August, its twelve-straight monthly increase.

The implications for global investors remain impossible to ignore…

A New Global Playbook

Money oversupply is not a uniquely American phenomenon.

Japan, Europe, China, and the developed world in general has been pumping liquidity into the global financial system for the four decades since money markets were deregulated. The 2000s brought many governments the realisation that recessions could be blunted, even cancelled, by flooding the system with stimulus via low or negative interest rates. The global financial crisis further entrenched this playbook, and the pandemic supercharged it. Now, the US is doubling down on this philosophy with a debt-fuelled public spending spree that will inject yet more cash into an already saturated financial ecosystem.

The result is a global investment world swimming in cash. This flood of liquidity is keeping asset prices buoyant, regardless of whether fundamentals justify it.

Money Oversupply Leading to Valuations Being Detached from the Past

This unprecedented wave of liquidity has been the driving force behind global equity markets for some time now.

Most markets have officially reached expensive territory as a result.

Australian stocks are trading at 20 times projected earnings, well above the long-term average of 15x. This isn’t a post-pandemic peak, but it’s historically stretched.

In the US, valuations are even more extreme. Wall Street is trading at more than 26 times forward earnings, and most of that froth is concentrated in the Magnificent 7. Nvidia, which now holds the title of the world’s most valuable company, trades at a staggering 43 times projected earnings.

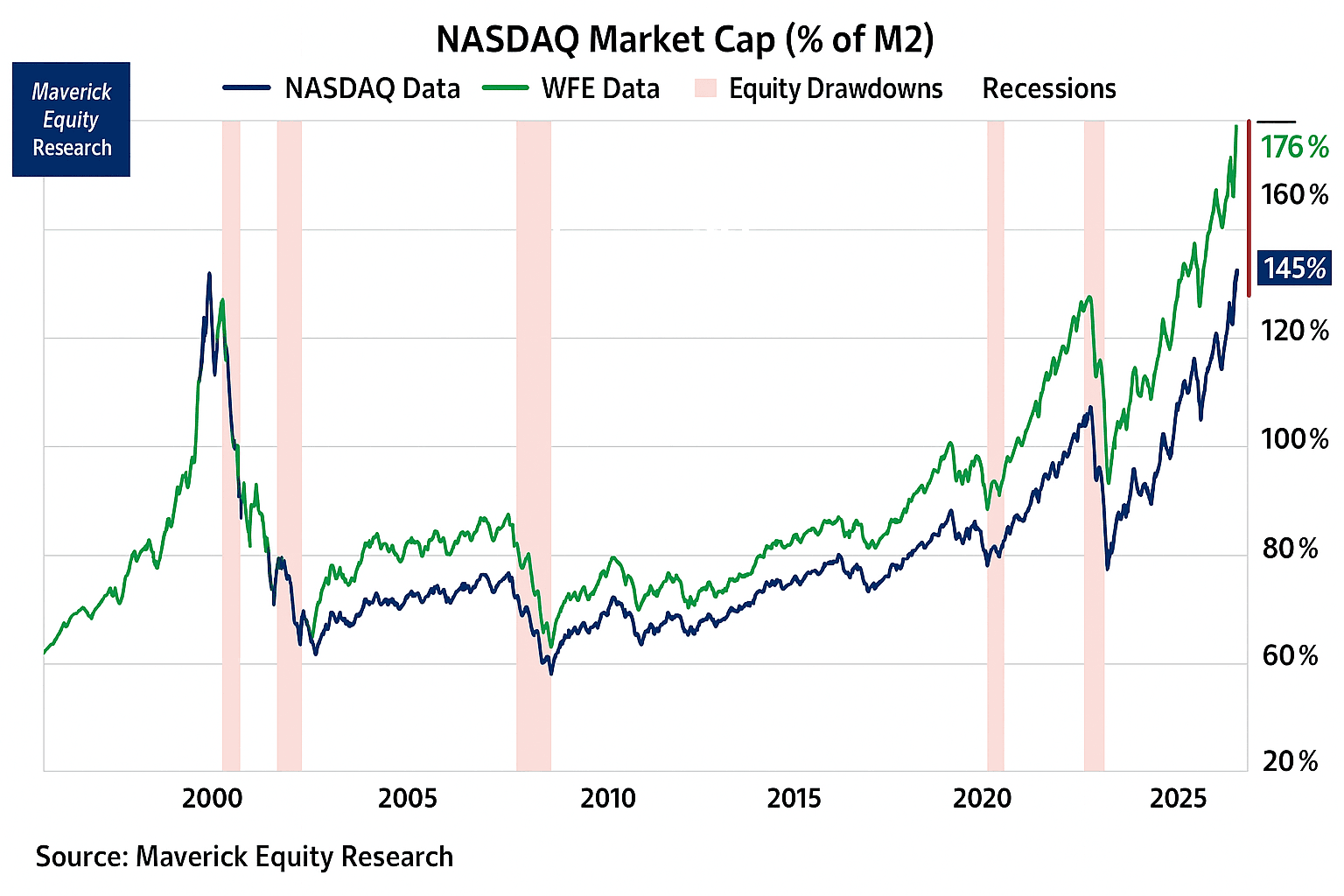

Arguably more importantly, the Nasdaq’s market cap relative to the US M2 money supply recently hit a record 176%, which exceeds the 2000 Dot-Com Bubble peak by 45%. Never in the history of financial markets has the rise in stock prices exceeded the growth of the money supply by this much. At the same time, the Nasdaq’s market cap relative to US GDP has risen to a record 129%, almost double the Dot-Com peak.

In a world of elevated geopolitical risk and Trump’s unpredictability, that’s a fragile setup. A single shock, whether it be political, military, or economic, could surely trigger a sharp correction from these lofty levels.

There’s also the risk is that we enter a liquidity trap whereby cheap and plentiful money ceases to stimulate real growth. Asset prices may rise, while productivity and earnings growth could lag behind, eroding long-term returns.

Herein lies the conundrum investors currently face. Even if a correction occurs, the global money oversupply is likely to stop the proper flushing out the market probably needs right now to bring valuations to a more palatable level. This is why recent equity market downturns have been much shorter and shallower than historical averages.

The reality is all that money eventually needs a home. Hence, more investors are reaching the conclusion that the opportunity cost of not owning equities may be worse than the risks of owning them. So the next market pullback is likely to trigger rapid inflows regardless of fundamentals at the time.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Implications for Investors

The optimal playbook here doesn’t appear to be to avoid risk altogether. That’s almost impossible when liquidity is this abundant. The more prudent strategy is arguably to position your portfolio to absorb future shocks while still riding the liquidity wave whilst it remains an undeniable force behind global markets.

Here are four strategies to help with this:

1. Stay Globally Diversified, but Be Valuation-Aware

Global equity ETFs remain essential for capturing growth in areas Australia doesn’t specialise in such as technology, healthcare, and consumer brands, but weightings matter in this frothy market.

For example, overexposure to the Magnificent 7 trade could leave a portfolio vulnerable to a single sector unwinding.

Now’s the time to be valuation-aware.

2. Don’t Ignore Bonds, Even in a Low-Real-Yield World

While higher inflation has eroded the real return of most fixed income strategies, a global money oversupply often pushes capital back into bonds when equities wobble.

Hence, don’t ignore bond funds while markets are expensive like this.

3. Real Assets as Inflation Hedges

A world flooded with liquidity carries an inherent risk of inflation flare-ups. So focus on markets and sectors with genuine inflation-protection engines, rather than purely liquidity-driven momentum.

Real asset-focused funds, infrastructure funds, commodities funds, and property funds can serve as partial hedges against rising inflation.

4. Tilt Towards Quality & Cash Flow

In an overvalued market propped up by liquidity, not every investment style carries the same risk.

A tilt toward quality-focused funds exposed to companies with strong balance sheets, consistent cash flows, and pricing power tends to weather liquidity shifts better than more speculative strategies.

👉 Key Takeaway: An oversupply of money doesn’t mean prices can’t fall. It just means the floor is likely higher than in a liquidity-starved environment, but the ceiling can also be artificial. So be ready for future volatility.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Liquidity Wave is a Blessing and a Curse

The global money oversupply conundrum is unlikely to resolve itself quickly. Central banks may eventually drain liquidity from the system through higher interest rates or quantitative tightening, but the political reality of the U.S. debt burden is making it hard for the Fed to reverse decades of policy.

This is both a blessing and a curse for investors. Asset prices are supported, downturns are being averted, and capital keeps flowing into equities. But valuations are being distorted, bubbles are emerging, and margins for error are disappearing. In other words, markets are sailing very close to the wind.

Investors can’t fight this rising tide, but surfing it with discipline has rarely been more important. That means positioning your portfolio for gains while accepting that the same liquidity keeping markets buoyant today could amplify volatility tomorrow.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.