The Innovation Game: China vs the U.S.

Simon Turner

Wed 19 Nov 2025 8 minutesIt’s hardly a secret that the countries who win the technology war will dominate the global economy. The US economy is living proof that technology leadership is the route toward economic dominance. But they are not the only superpower with the ambition of technology-led global domination. China is also aiming for technology leadership in the same market segments, such as artificial intelligence, robotics, electric vehicles, and semiconductors.

The resulting question for investors is: Is this a genuine battle between these two superpowers? Or are the U.S. and China building innovation machines with such distinct philosophies, capital systems, and social architectures that it’s more a relay than a war?

One thing’s for sure: understanding how the U.S. and China innovate differently is the key to identifying where value and risk will be created in the all-important global technology sector looking forward…

A Shared Love of Innovation

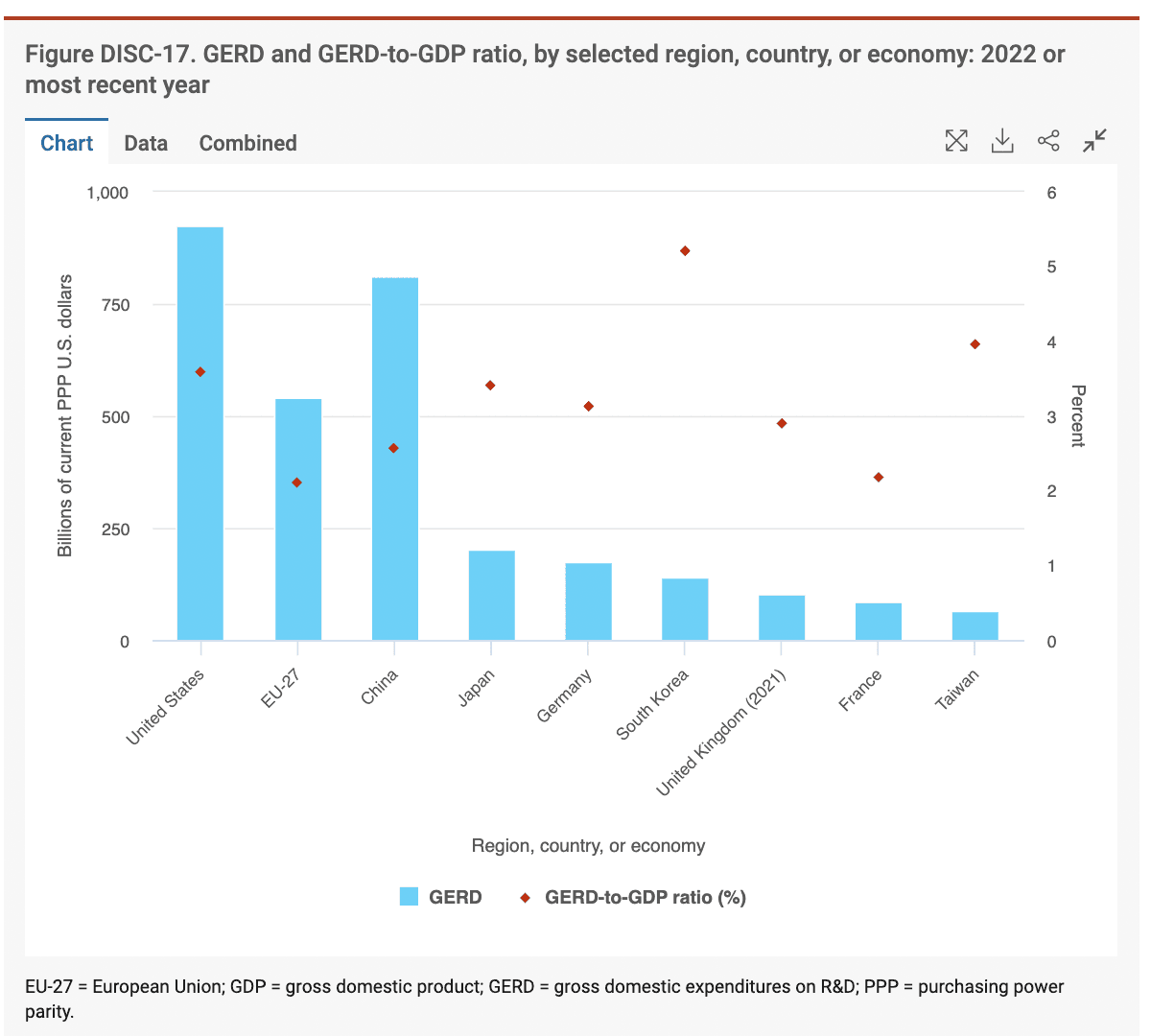

If we step back for a view of Gross Domestic Expenditure on R&D (GERD) by country, the numbers tell the story of global innovation. Based on 2022 data, the U.S. spent 30% of the $US3.1 trillion spent globally on R&D, whilst China spent 27%.

So together, the U.S. and China are spending almost 60% of global R&D. These are huge sums which reveal a shared love of innovation and technological dominance. Both countries are continuing to invest unprecedented sums in their economic futures in the belief the investment will be worth it.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Frontier Model: America’s Ecosystem of Breakthroughs

The U.S. has long been the world’s pre-eminent incubator of frontier innovation.

From Silicon Valley’s start-up culture to the clusters of innovation emerging in Boston, Austin and Seattle, America’s innovation model is characterised by a fluid interplay of venture capital, research universities, corporate R&D, and public funding.

Its magic lies in the ecosystem’s bottom-up, market-driven capacity for rapid experimentation and scale.

The key drivers of its success include:

Competition for venture funding forces ideas to mature quickly or die;

Intellectual property protections reward success with outsized profits;

Labour mobility ensures that human capital flows efficiently toward the most compelling opportunities.

The result is an innovation-driven American economy that repeatedly produces transformational firms such as OpenAI, Nvidia, Tesla, and SpaceX. In short, success breeds success. Company-specific breakthroughs cascade across the broader economy.

Then there’s the institutional capital advantage the U.S. is famous for. America’s capital markets remain the deepest and most liquid in the world, so are able to support the type of large-scale innovation that smaller economies can only dream of.

The upshot for global investors is that exposure to U.S. innovation has become synonymous with owning the future. Yet this dominance brings its own risks in the form of high valuations, regulatory scrutiny, and growing political polarisation over data privacy and AI governance.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Diffusion Model: China’s Engine of Scale

If the American model is about frontier breakthroughs, China’s is about diffusion and execution.

While the country may trail in certain scientific measures like R&D intensity (its R&D as a percentage of GDP was 2.6% in 2022 compared with the U.S. at 3.6%), it compensates with speed, coordination, and the ability to mobilise entire supply-chains.

When Beijing sets a strategic priority, industry alignment follows with remarkable efficiency. This has been demonstrated in the electric vehicles sector, where Chinese manufacturers such as BYD and NIO have leveraged scale advantages, vertical integration and state-support to dominate global markets.

And in sectors like semiconductors, where U.S. export controls have sought to limit China’s access to advanced chips, the story is one of resilience and adaptation. Chinese players like SMIC and Hua Hong have responded by closing the technology gap faster than many expected, while government-led initiatives aim to localise the full chip supply chain.

China’s innovation model is not purely top-down like in the U.S. It’s an intricate partnership between the state, private entrepreneurs, and a vast digital consumer base that provides real-time feedback and data at enormous scale.

As a result, their innovation ecosystem thrives on incremental improvement and rapid iteration. What the U.S. might patent, China mass-produces, refines and redeploys across new domains within months.

This diffusion-led model creates investment opportunities of a different nature to the slam-dunk, winner-takes-all models the U.S. specialises in. Chinese innovation tends to leverage cost advantages within large global addressable markets.

It also carries heightened policy risk. China’s regulatory clampdowns on fintech and online education in 2021 served as harsh reminders that the country’s political objectives can override commercial logic.

Those same policies underscore China’s determination to re-channel innovation toward the sectors the state views as ‘hard tech’ which includes semiconductors, robotics, clean energy and AI infrastructure.

The main takeaway for investors is that both countries are aiming to capture similar economic opportunities from very different angles. So they are thematically aligned, but philosophically opposed.

Interdependence in a Fractured World

It is tempting to imagine the U.S.–China innovation race as a zero-sum contest.

In practice, the two systems are deeply interdependent. American chip designers rely on Chinese manufacturers and rare-earth suppliers, while Chinese AI firms depend on U.S. software frameworks and open-source communities. Hence, total U.S.–China goods trade in 2024 reached a healthy $US582 billion, with a U.S. goods trade deficit of $US296 billion.

So the global supply chain still binds these two economies in a web of mutual reliance.

Yet the political overlay is undeniable.

Both Washington and Beijing are increasingly using industrial policy to secure technological sovereignty.

For example, the U.S. CHIPS and Science Act committed more than $US50 billion to domestic semiconductor production, while China’s ‘Made in China 2025’ plan continues to channel vast resources into strategic domestic technologies.

The result is a complex map of both cooperation and conflict.

Investors’ Lens: Navigating Two Worlds

For investors, the challenge is to translate this complicated geopolitical backdrop into a profitable portfolio strategy. Here are some takeaways aligned with that goal:

- The U.S. Opportunity is Impossible to Replicate

The U.S. offers exposure to frontier innovation, the kind that transforms industries and commands global pricing-power, the kind that can’t be replicated elsewhere. So for innovative AI, semiconductor, technology, and biotech opportunities, investors have no option but to be exposed.

For example, Global X FANG+ ETF (ASX: FANG) provides exposure to the main stocks forming the innovation engine of the U.S. economy.

- Aim for Intelligent Exposure to the Chinese Opportunity

China offers unique exposure to the scaling phase of technology, where adoption drives earnings and growth. Both are essential components of the global innovation cycle in automation, renewable infrastructure, and consumer-focused technologies.

Investors can benefit by investing in active regional funds and ETFs focused on capitalising on the country’s unique benefits.

- View U.S. and Chinese Exposure as Complementary Rather than Contradictory

Whilst the U.S. and China are competing for leadership in many of the same fast-growing segments of the global economy, the key is not to frame them as competing bets, but as complementary gears within the same engine of progress. In practice, investors can leverage the upside of both dynamics through global thematic funds and ETFs that mirror each ecosystem’s strengths.

For example, Global X Morningstar Global Technology ETF (ASX: TECH) views the technology opportunity set in a global context so includes both U.S. and Chinese stocks.

- Value Geopolitical Risk Fairly

The main long-term risk, of course, lies in geopolitics. Decoupling, sanctions and divergent regulatory regimes could disrupt returns in either country overnight.

Hence, sensible risk management through geographic diversification, currency management, and fund-selection is paramount.

But so is philosophical diversification, the willingness to recognise that innovation takes multiple forms, and that value creation in the twenty-first century will not be confined to one model or ideology.

The Innovative Road Ahead

So is the U.S. or China winning the innovation game? At the risk of side-stepping a more definitive answer, both are winning on their own terms. One supplies the breakthroughs that redefine possibility, while the other provides the scale that turns possibility into reality. Between them lies a space of creative tension where much of the world’s growth, and many of its best investment opportunities, will be forged.

For investors, the opportunity is to think globally while investing intelligently, to harness the strengths of each system without being captive to their rivalry. So the race for innovation is not about choosing sides. It’s about understanding how different gears turn the same engine forward.

Global Innovation-Focused ETFs Worth Checking Out

Learn More at Our Upcoming Event…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.