Defining the X Factor in Active Funds Positioned for Outperformance

Simon Turner

Mon 17 Nov 2025 8 minutesIf you’ve read through more than a few fund manager presentations, you’ll notice that most describe themselves as superior stock pickers with a passion for finding the market’s hidden gems. But then, when you check their top ten positions, you’ll often make the chilling discovery that they share something in common: their hidden gems are called Nvidia, Apple, Microsoft, Amazon, and Alphabet. It’s surely no coincidence that these are the five largest stocks in the S&P 500 and have all massively outperformed in recent years. The upshot is many funds are currently exposed to the same few overcrowded stocks.

In a momentum-driven market like this, knowing how to identify future winners is likely to require a different skillset to identifying winners over the past few years. This ‘X factor’ is likely to require a deeper understanding of how to identify future winners while not being swayed by what the rest of the market is obsessing over. And it’s likely to result in the best performing active funds having different top ten positions to the rest of the market…

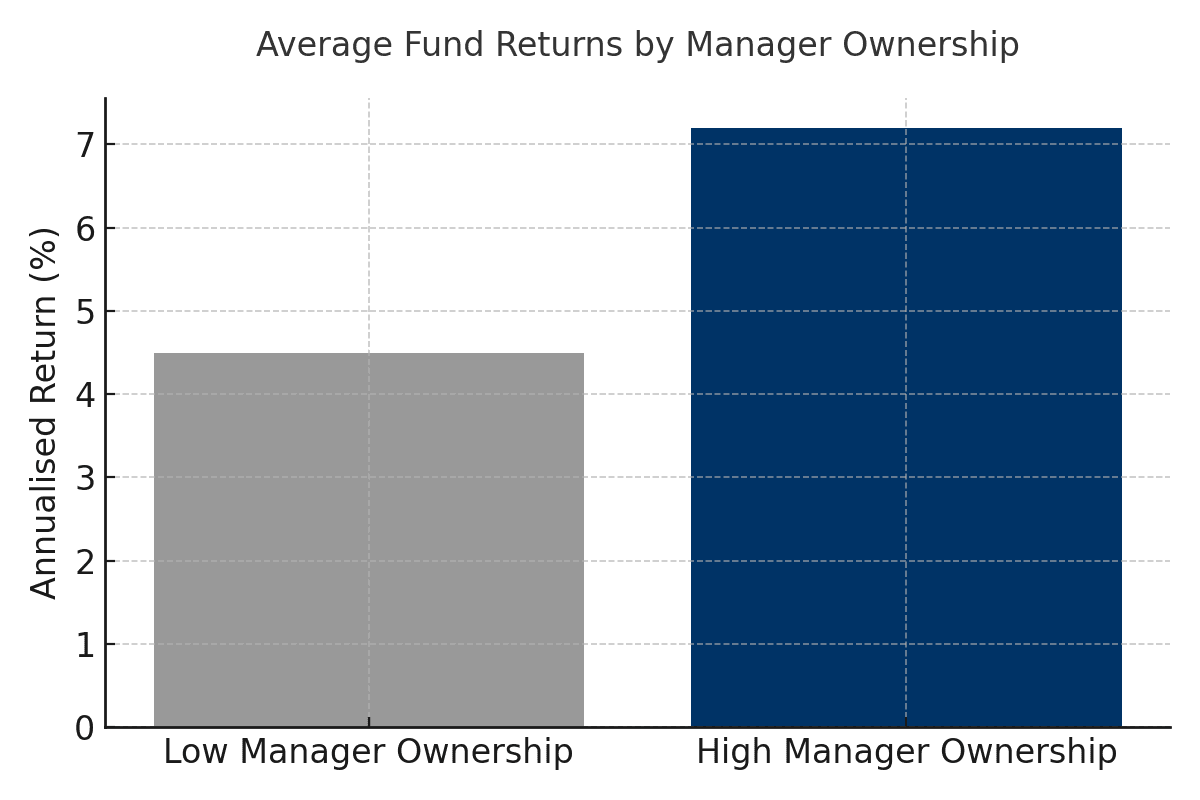

Skin in the Game: Why Ownership Matters

One of the oldest and most useful indicators of the X Factor in global funds and stocks alike is skin in the game.

The evidence is compelling. There are plenty of studies that prove skin in the game is economically and statistically significant when identifying superior funds (and stocks for that matter). Conversely, funds whose managers have low ownership are more likely to underperform.

This makes intuitive sense. When a fund manager’s interests are aligned with their investors, they’re incentivised to deliver their A game at all times. It’s this guarantee of focus that makes skin in the game such a powerful ingredient in outperforming funds.

Hence, prioritising fund managers (and management teams) with skin in the game helps investors avoid the classic principal–agent problem: managers acting on behalf of clients but without aligned interests.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Under-Researched, Under-Owned: The Hidden Opportunities

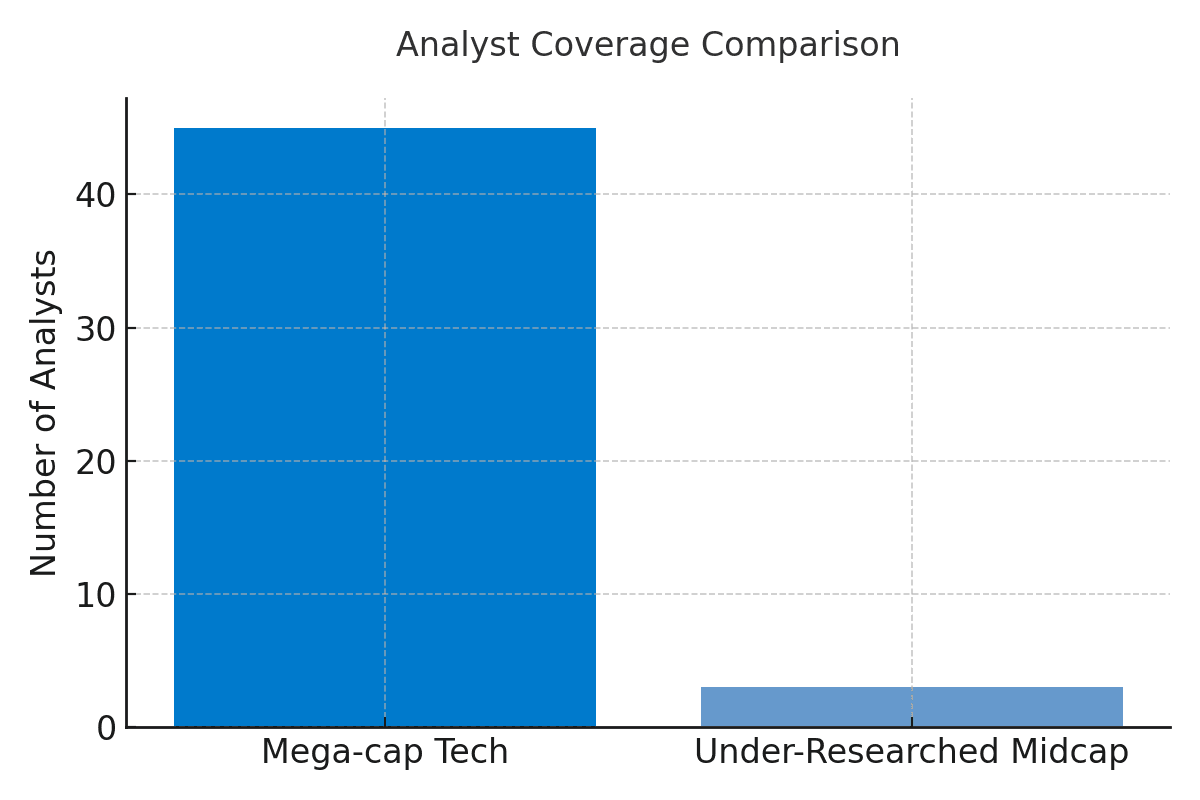

Our next step in finding X Factor fund opportunities is to veer far away from the madding crowd.

By investing in funds exposed to opportunities that are not yet fully appreciated or owned by the crowd, investors are often able to benefit from positive surprise momentum as a powerful tailwind. As and when unappreciated stocks with low analyst coverage and equally low market followings reveal their strengths to the world, they often have a long way to run to reach fair value. In other words, buying winners early can be a highly profitable strategy.

As mentioned above, there’s often a glaring gap between the way fund communicate to investors and the way they invest. So how do you identify the funds which genuinely invest away from the crowd?

For starters these funds’ top ten holdings won’t include the five largest stocks in the S&P 500 when their marketing materials wax lyrical about a contrarian strategy focused on uncovering hidden gems.

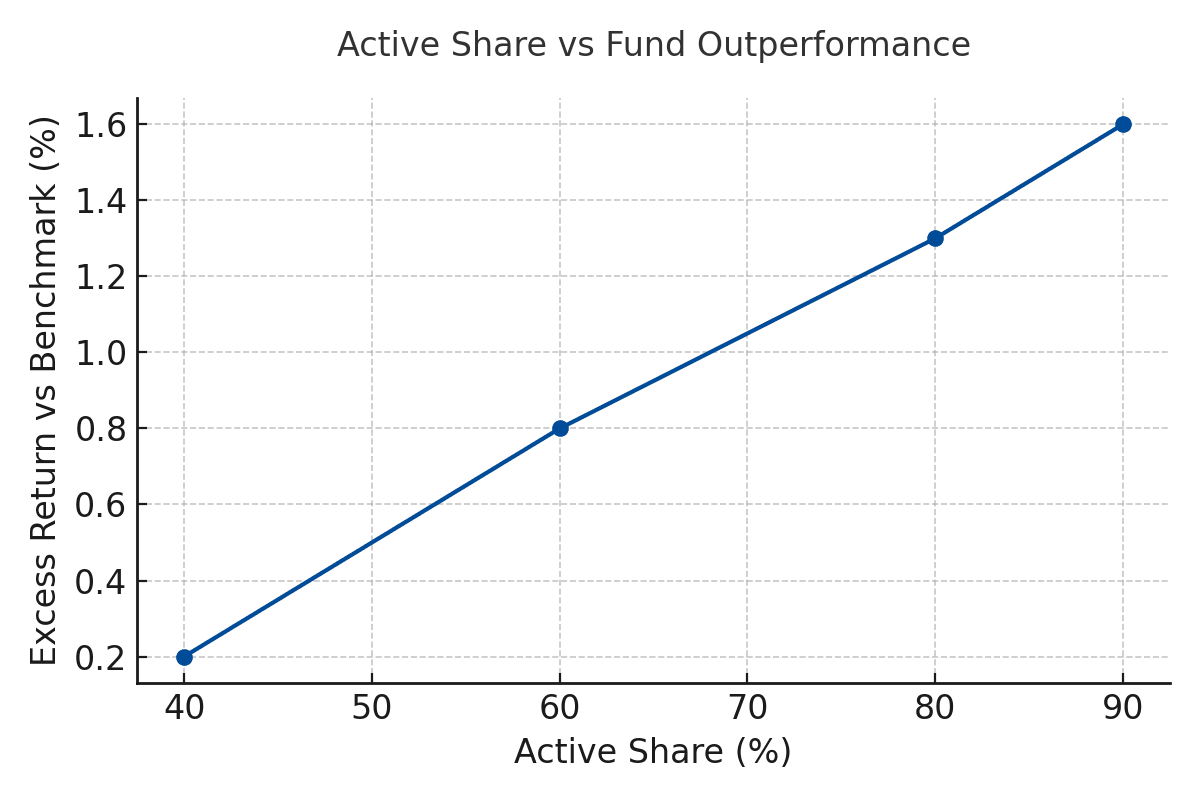

There’s a useful fund metric that can help with this. It’s called Active Share. It was formulated by Martijn Cremers and Antti Petajisto (2009) to quantify how different a fund’s holdings are from its benchmark. A higher Active Share (e.g. >80 %) indicates a truly differentiated portfolio. Interestingly, in the original study, funds with the highest Active Share beat their benchmarks by approximately 1.26% p.a. after fees.

Moreover, as Antti Petajisto explains: ‘The most active stock pickers outperformed their benchmark indices even after fees, whereas closet indexers underperformed. These patterns held during the 2008–09 financial crisis and within market-cap styles. Closet indexing has increased in both volatile and bear markets since 2007. Cross-sectional dispersion in stock returns positively predicts performance by stock pickers.’

The key takeaway is that ignored stocks are less subject to follow-the-herd risk, so may provide better upside as and when a catalyst triggers a re-rating. Hence, this investment philosophy tends to be genuinely ingrained into X factor fund strategies.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Fundamentals + Catalyst: The Valuation Edge

Having skin in the game and finding high-quality stocks is only half the battle when searching for funds with the X Factor.

The other parts of the investment process they need to master are paying a reasonable price and having a clear catalyst for a re-rating.

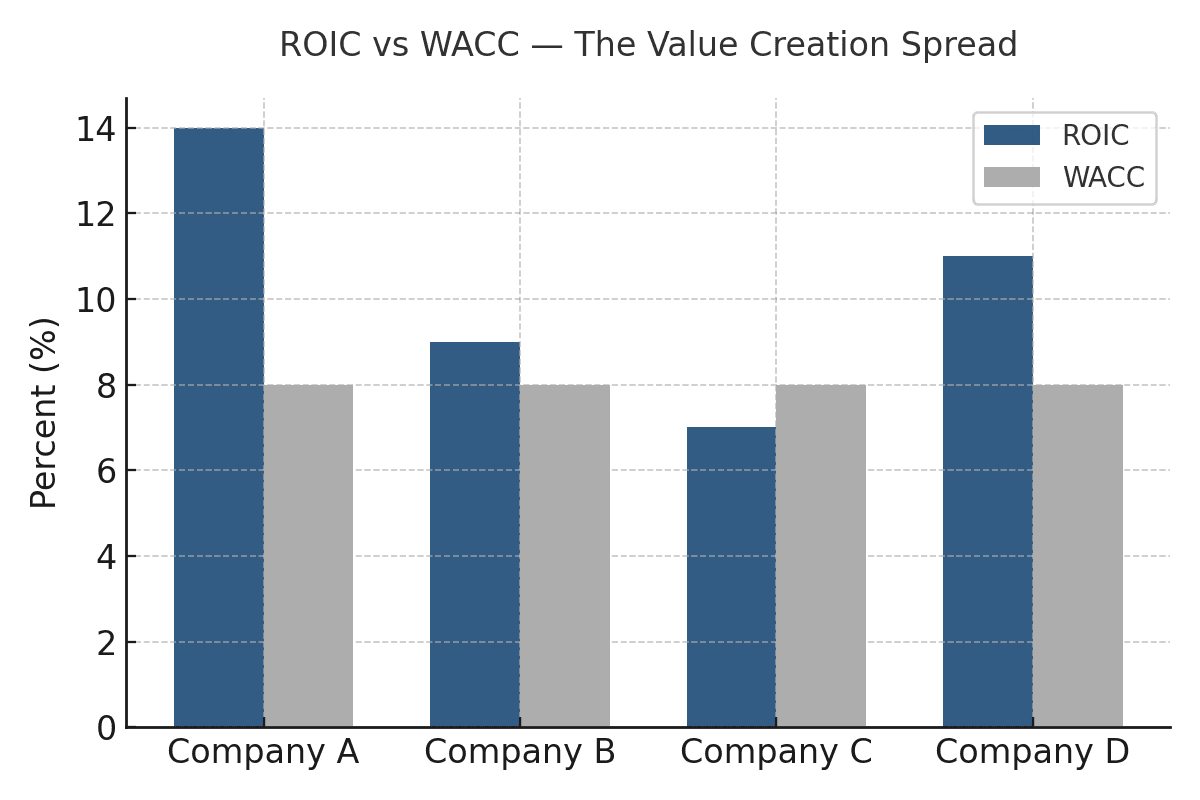

A recent McKinsey study found that 70 % of long-term equity appreciation is driven by growth in Return on Invested Capital (ROIC), rather than pure multiple expansion. That means X factor funds need to be able to identify stocks which are not only growing, but also benefitting from genuine operational leverage and efficient balance sheet management.

So the challenge for fund managers is to find high quality management teams who understand the importance of ROIC versus WACC (Weighted Average Cost of Capital), also known as the Value Creation Spread.

As shown below, company A’s value creation is far more positive than the other three examples. Stocks like this one are more likely to be top holdings in X Factor funds because the long-term value creation potential is much higher.

What a fund is prepared to pay for X Factor exposure like company A is also important. Most successful funds will pay close attention to a stock’s valuation metrics such as price/earnings ratio and free cash flow yield relative to its expected growth.

Valuation isn’t the end of it.

X factor funds will also have a catalyst in mind to unveil each of their stocks’ unappreciated attractions to the rest of the market. Identifying potential catalysts is easier said than done. Fundamental inflection points like regulatory shifts, industry evolutions, and interest-rate changes are the types of catalysts managers will be on the lookout for.

So in summary, investors should focus on active funds which combine excellent fundamental analysis with realistic catalysts that de-risk the value-unlocking process.

Concentration & Conviction: Avoiding Mediocrity

You may have noticed the term ‘conviction’ is bandied around a lot in fund management marketing materials. Arguably, too much.

But genuine conviction is indeed another ingredient of funds with the X Factor.

Conviction essentially translates into active portfolios with fewer, well-selected names as opposed to a ‘throw-everything-into-the-kitchen-sink’ portfolio that mainly mimics the index.

For investors looking for funds which invest with genuine conviction, the simplest way to find them is via the number of portfolio holdings. For example, a 15–30 stock portfolio is far more likely to reflect a high conviction strategy than a 100+ stock portfolio.

The logic is hard to hard to argue with: while the market becomes more and more crowded with passive index flows, a differentiated, concentrated portfolio that avoids mimicry is well-placed to outperform.

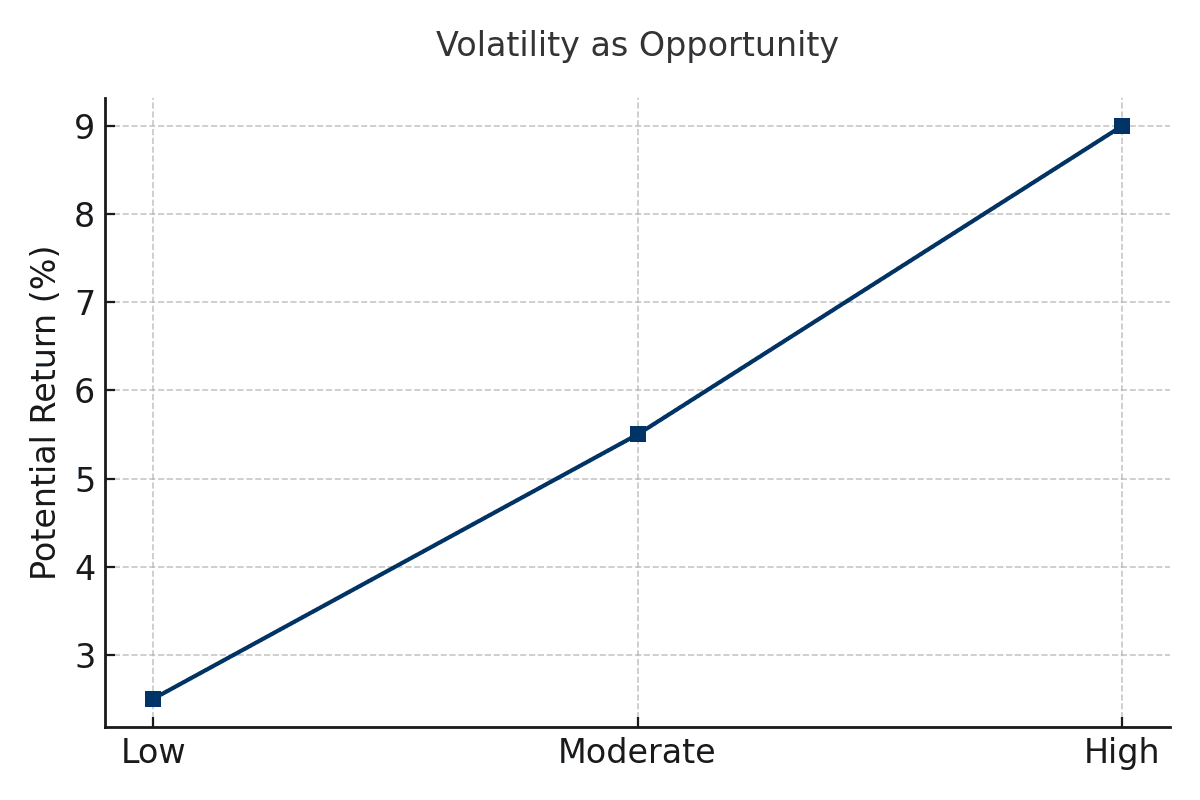

Volatility as Opportunity: Macro Awareness Without Macro Timing

The final ingredient of X Factor funds is an empowered attitude toward volatility.

In particular, funds which treat volatility as an opportunity to exploit rather than a risk to avoid, have a significant advantage over the rest of the market. In an era of shifting interest-rate regimes, rising geo-political tensions, trade dynamics and structural change, the best funds are positioned for change, rather than blind to it.

Investors should therefore look for funds which apply a top-down risk overlay to their bottom-up stock selection to ensure they are positioned to benefit from volatility.

Investing with the X Factor is an Art

In summary, there are four main components of active funds with the X Factor:

- Alignment: management ownership, real skin in the game.

- Insight: identifying under-researched companies with hidden potential.

- Discipline: paying a fair price, ensuring value creation via ROIC > WACC, and having a catalyst.

- Conviction: concentrated portfolios, independent of benchmark, disciplined through volatility.

As Warren Buffet once famously said: ‘Over the long term, markets are voting machines, but also weighing machines.’ Indeed, the X Factor isn’t about popularity. It’s about substance. It’s less marketing and more mastery. For active investors willing to invest beyond index huggers and passive flows, the journey to global out-performance starts with recognising these principles. And the real X Factor lies in investment teams that combine alignment, insight and conviction, rather than just chasing momentum.

A Couple of Active Global Funds Worth Checking Out:

Learn More at Our Upcoming Event…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.