Introducing Syndicated Loans as a Yield Enhancer

Simon Turner

Wed 17 Sep 2025 6 minutesIt’s well known that most Australian portfolios are overweight equities to the detriment of their debt exposure. It’s easy to understand why. Local and global equities have performed strongly over the long term, and particularly since the pandemic selloff. It’s also easier for most investors to understand equities than debt.

However, seasoned investors understand the need for a diversified asset allocation plan with exposure to multiple asset classes which don’t fully correlate with one another. That means including debt in your investment plan to enhance your risk-adjusted returns. It also means being aware of the debt opportunities on offer, not just investment grade bonds.

There’s a range of compelling opportunities to be aware of across the debt universe. For example, you may not be aware of an emerging segment called syndicated loans which pays investors superior yields for secured senior debt…

What is a Syndicated Loan?

A syndicated loan is provided by a group of lenders, a syndicate, to fund a single borrower, which might be a corporation, a large project, or a sovereign government.

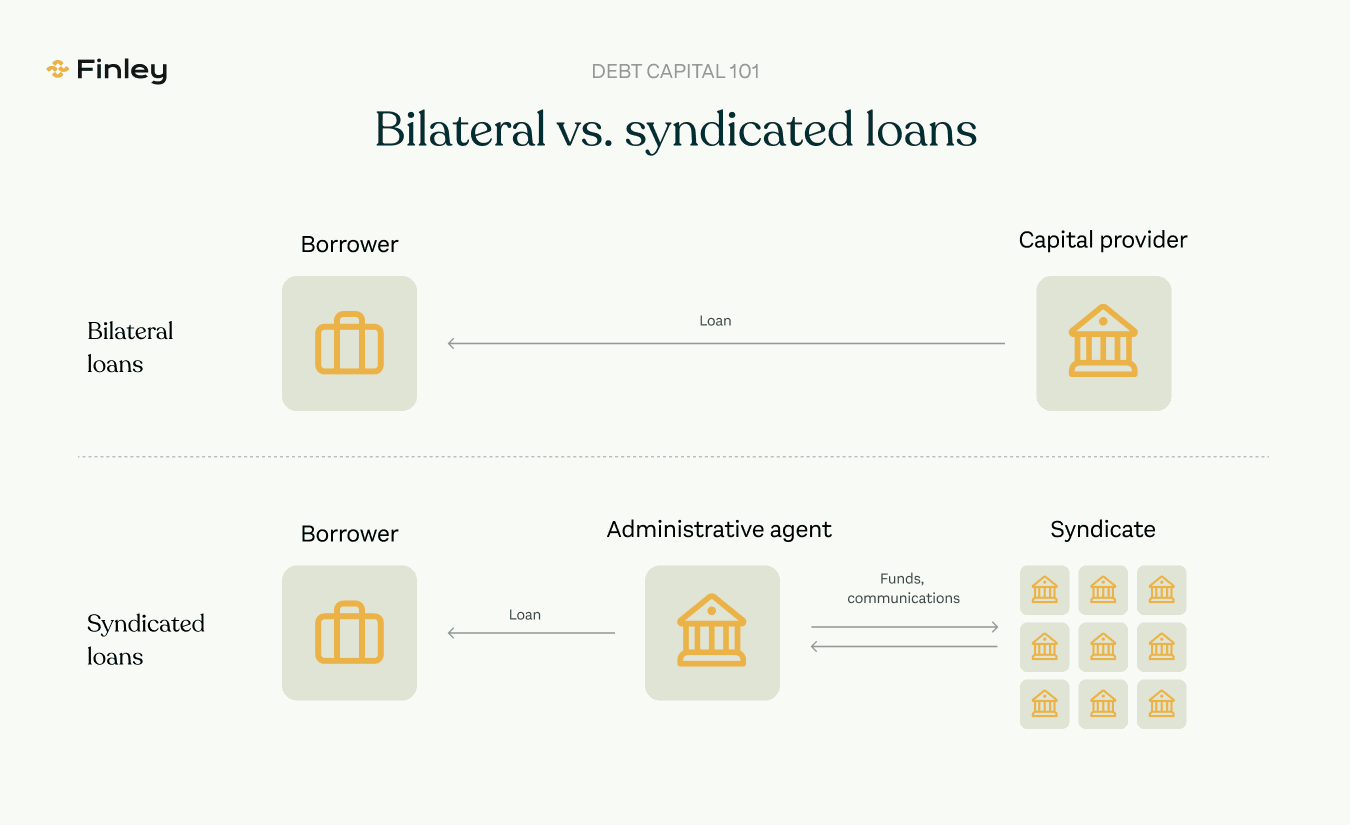

These loans are typically senior secured debt, and often run into the billions of dollars, hence the need for a syndicate of lenders. They are different from bilateral loans in that syndicated loans tend to involve an administrative agent as well as multiple lenders.

Syndicated loans can take the form of a fixed sum, a credit line, or a combination of both.

Lenders (and their investors) benefit from this strategy. By forming a syndicate, they can gain access to larger, often de-risked, projects which would normally be out their reach. By lending a small percentage of a multi-billion-dollar project within a syndicate, the participating lenders benefit from the syndicate’s collective knowledge and experience. This often translates into a lower risk profile for the project, and thus enhanced risk-adjusted returns for the syndicate.

Where Syndicated Loans Rank in the Capital Stack

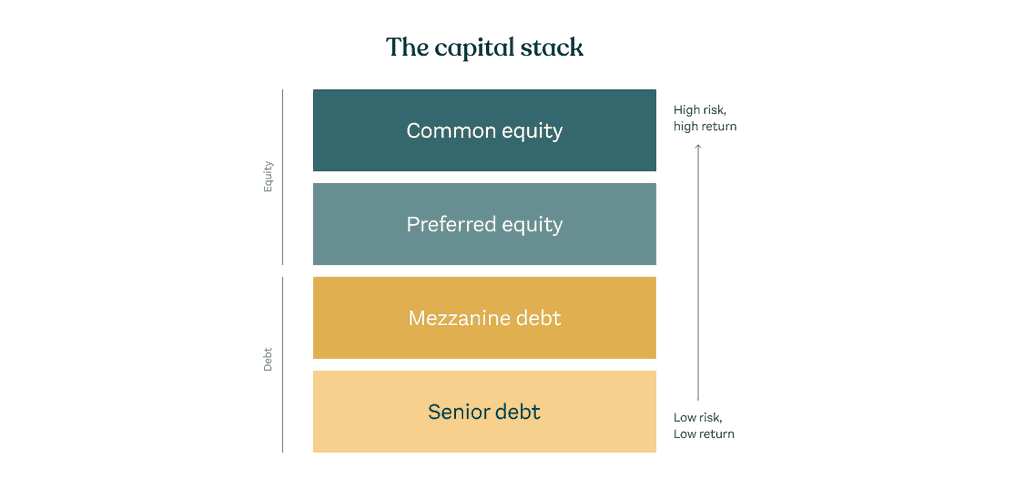

One of the most important lessons all debt investors need to understand is where the various debt instruments rank within the capital stack, which is essentially the ranking system for being repaid in the event of a company being wound up.

As shown below, the first to be paid out and thus the lowest risk capital is senior debt. This is followed by mezzanine debt, preferred equity, and common equity.

Most syndicated loans are senior debt, so they have the lowest risk profile within the capital stack. In addition, most larger syndicated loans are secured against assets which further reduces their risk profile.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A Yield Premium That’s Hard to Ignore

Debt investors are all about achieving the best possible yield for the risks they’re exposed to.

That’s one of the main advantages of syndicated loans. They’ll often generate a 2%+ yield premium versus investment grade credit exposed to similar financial risks (although there’s a reason for this which is covered below).

For example, Bentham Syndicated Loan Fund’s yield to maturity is currently 7.8% p.a., 2.6% above Betashares’ Australian Investment Grade Corporate Bond ETF’s yield to maturity of 5.2% p.a. Of course, we’re comparing apples with oranges here since an ETF is a highly liquid, diversified vehicle. But it illustrates the yield enhancement advantage of syndicated loans, particularly within a portfolio of these loans which is diversified across sectors and geographies.

As Darryl Bruce, Executive Director at Income Asset Management explains: ‘It is hard to ignore the yield pickup available to investors who sit pari passu in the capital structure alongside the world’s largest banks and institutional investors.’

But There Are No Free Lunches in Finance

You may be wondering, where’s the catch? Why is this yield advantage on offer for senior secured debt at the lower risk end of the capital stack?

Of course, in the investment world there are no free lunches. There is indeed a price to pay for this yield premium in the form of low liquidity.

For example, IAM’s Managed Discretionary Accounts, which provide direct ownership of a curated portfolio of investment-grade credit (60% of the portfolio) and higher yielding syndicated term loans (40%), offers investors limited, but not guaranteed, liquidity. When demand is high for syndicated loan portfolios, like now, trading out of this product is achievable. But as with most unlisted products invested in illiquid underlying instruments, investors shouldn’t assume the same level of liquidity during periods of market stress.

The most empowered approach to investing in syndicated loans is to regard them as an illiquid part of your portfolio, and to invest for the long term based on this assumption.

As per IAM’s MDA strategy, investing a satellite portion (e.g. 40%) of your debt portfolio in syndicated loans in combination with a core position (e.g. 60%) invested in more liquid, investment grade credit will enhance your yield whilst maintaining your liquidity and downside protection. With this lower risk approach, IAM are targeting a yield to maturity of the RBA cash rate + 3-3.5% p.a., which currently equates to 6.6-7.1% p.a. That’s likely to be aligned with most investors’ goals for their debt allocation.

A Yield Enhancement Opportunity To Be Aware Of

From an asset allocation perspective, investors’ debt market exposure tends to driven by yield and the expected defensiveness of the asset class. On the yield side of that equation, syndicated loans offer a compelling advantage to enhance your portfolio’s yield without exposing yourself to heightened project or business risks. The price of this opportunity is low liquidity, although this can be addressed by correctly setting your expectations, and portfolio weighting, at the get go.

A Syndicated Loan Fund Worth Checking Out...

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.