The Ever-Widening U.S. Wealth Gap & Its Global Ripple Effects

Simon Turner

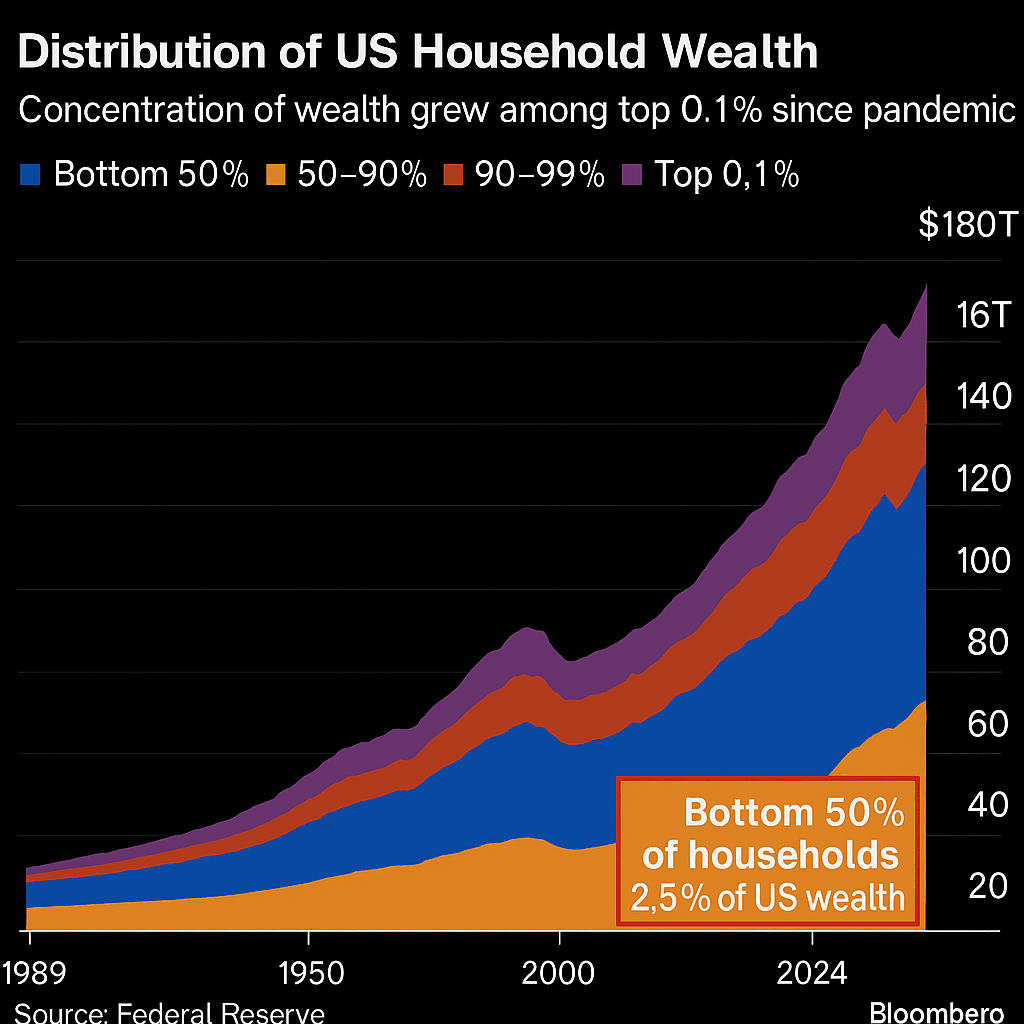

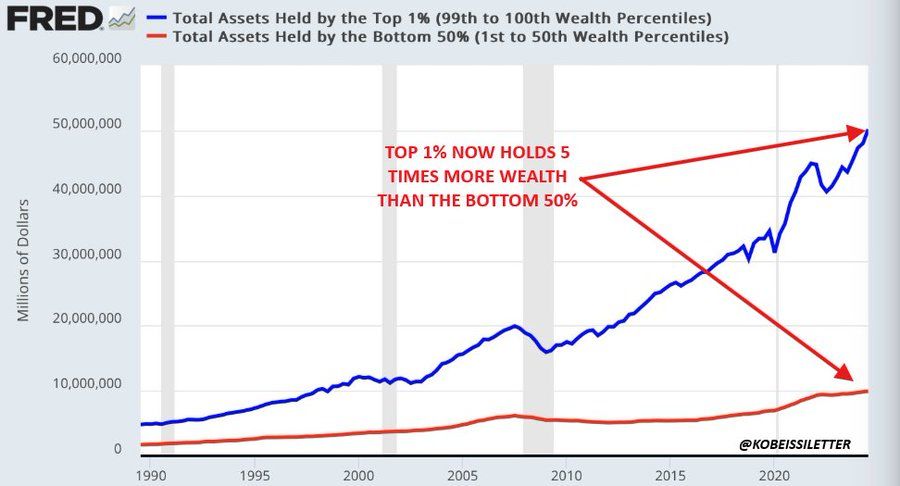

Wed 24 Sep 2025 5 minutesReady to be shocked? The bottom half of American households, some 65 million families, now own just 2.5% of total U.S. wealth. And at the other end of the spectrum, the top 1% controls wealth that outstrips the bottom 50% by more than $US40 trillion.

This cautionary tale of growing inequalities isn’t just a sociological talking point. It’s fuelling polarised perceptions of the U.S. economy, and it’s also altering capital flows across the globe. Whilst it’s an American challenge, it has evolved into a global investment issue.

U.S. Net Worth at Record Highs, Confidence at Record Lows

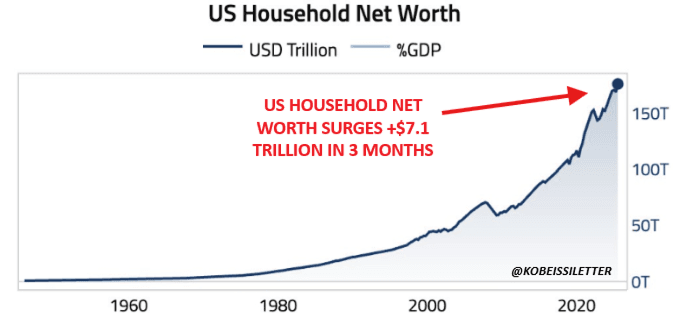

By way of background, U.S. household wealth has been rising consistently in recent decades, and the post-pandemic trend has been particularly positive.

In the second quarter of 2025, U.S. household net worth jumped by a staggering $US7.1 trillion in just three months, amounting to an average of $US79 billion added every single day. The latest Federal Reserve Z.1 report pegs total U.S. household net worth at a record $US176.3 trillion, or 581% of GDP.

Behind these bullish headline figures lies a growing paradox. While rich Americans are accumulating historic wealth gains, U.S. consumer sentiment is collapsing. Case in point: expectations about household finances over the next year recently fell to the lowest reading ever recorded.

This divergence between asset-rich Americans celebrating their booming equity portfolios and ordinary households fearing stagnation and recession could not be sharper. As rich Americans get richer, the rest of the population are suffering.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

An Engine of Inequality

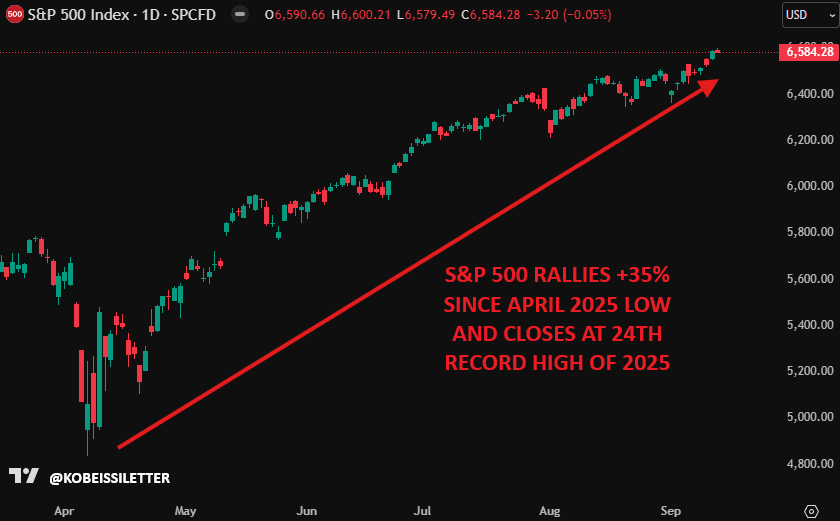

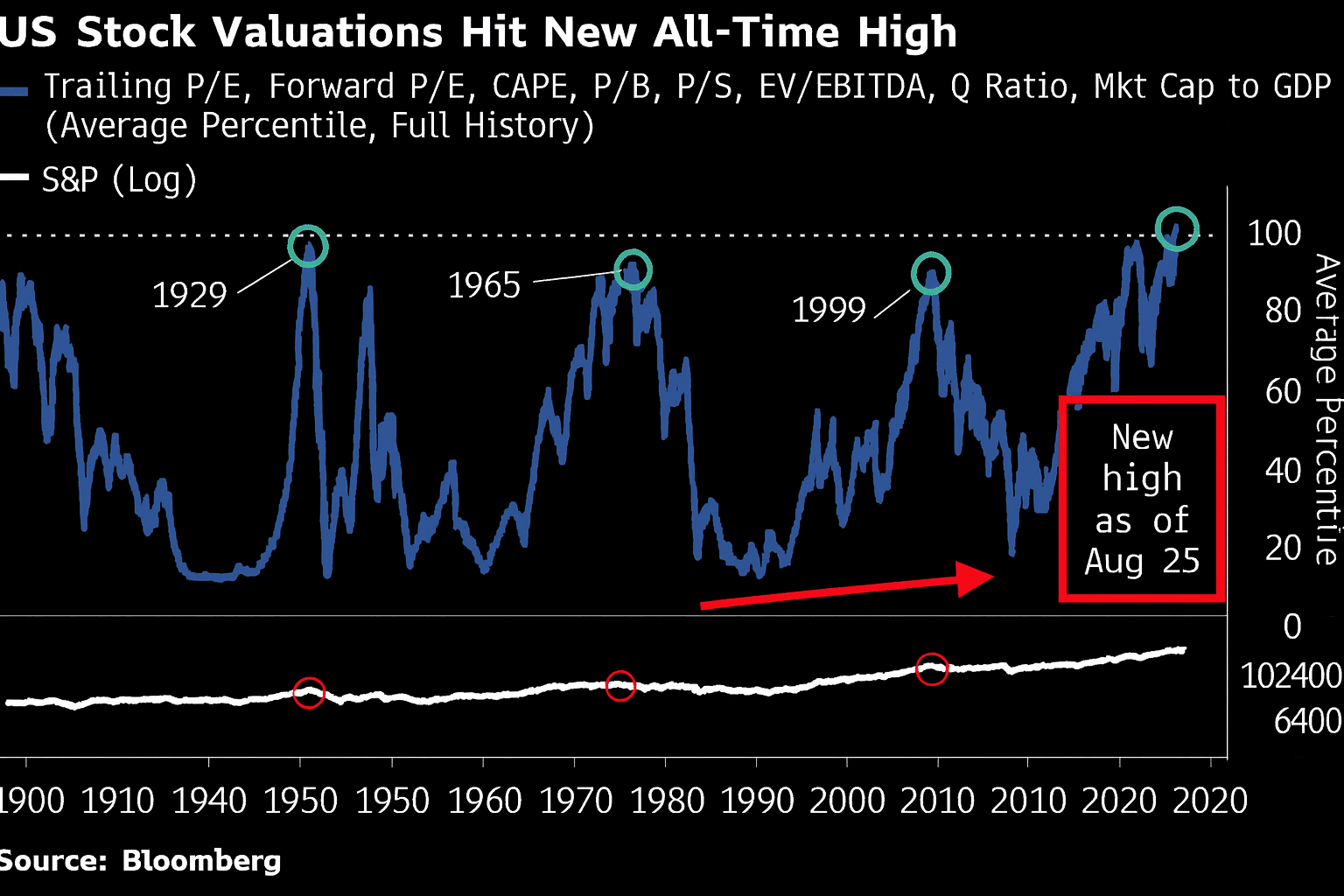

The main driver of the U.S. household wealth surge has been American equities with the S&P 500 staging one of its most dramatic rallies in history over the past five months.

Fed rate cuts are now being delivered into this environment of soaring valuations.

This is unprecedented. For the first time in three decades, the Fed is cutting rates while inflation remains high, with PCE inflation at 2.9% p.a. and core CPI above 3% p.a.

Inflation’s Uneven Toll

Despite appearances, all may not well be in paradise.

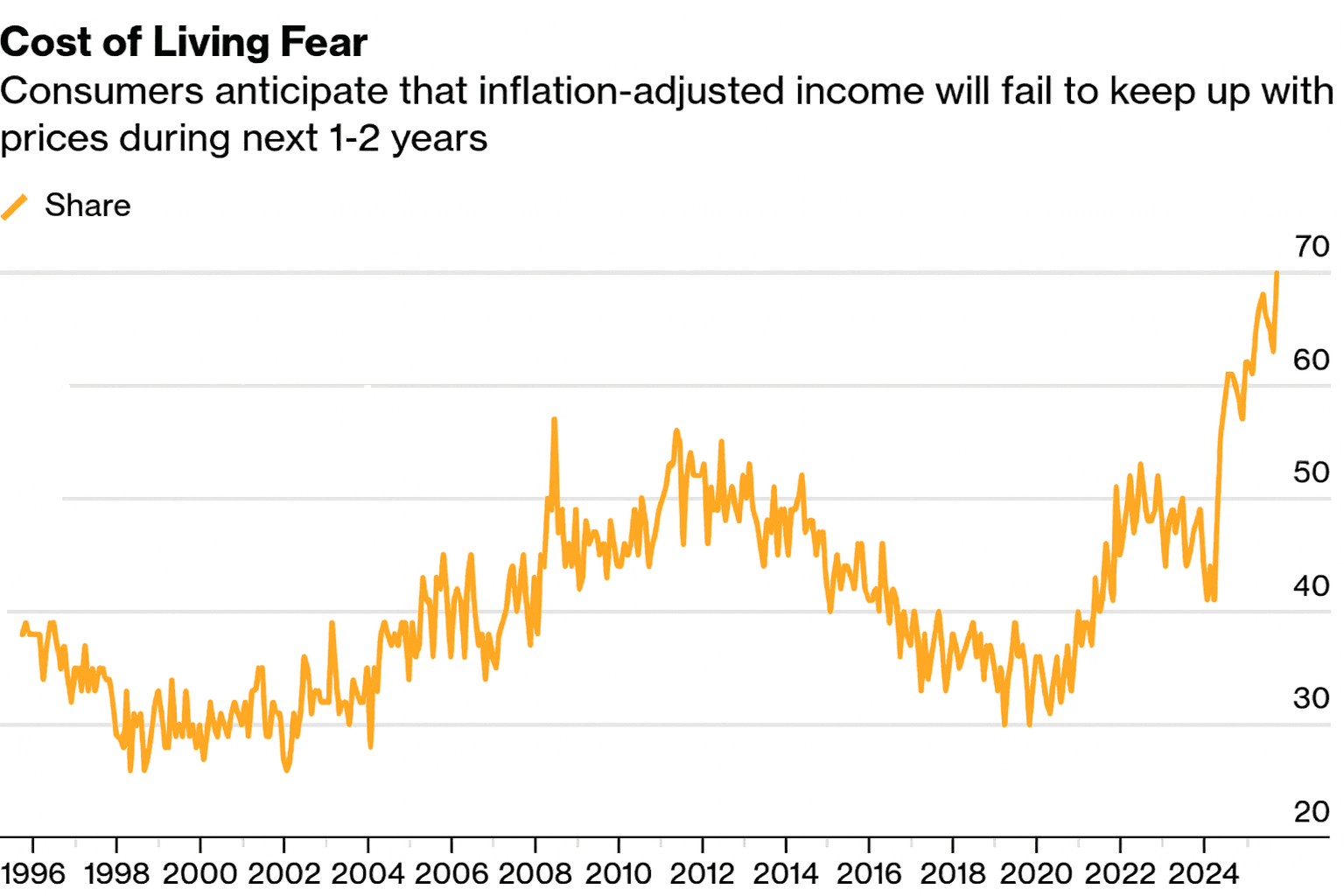

While the U.S. equities bull market rages, the broader American labour market is weakening. Wages are not keeping pace with rising prices. Recent surveys show that 70% of U.S. consumers believe their incomes will fail to keep up with inflation as the cost of essentials such as housing, healthcare, food is biting harder for those without significant asset buffers.

This is exacerbating the creation of a two-speed American economy. For the top 10%, their booming wealth is far exceeding the drag of higher living costs. But for the majority, inflation is corrosive, eroding their disposable income and confidence.

In short, inflation is acting as a regressive tax that weakens consumption at the lower end but bolsters nominal growth in financial assets. This dynamic is self-reinforcing. As households spend more cautiously, corporates are leaning on cost-cutting, buybacks, and margin preservation, which is proving supportive of high equity valuations in the short term.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Global Knock-On Effects

The widening wealth gap in the U.S. is reshaping the global investment landscape, and Australia is not immune. Rate cuts in the U.S. are boosting global liquidity, and pushing flows into U.S. and global equities, particularly the momentum-driven Nasdaq. At the same time, local consumption trends are showing similar signs of strain as in the U.S., which could leave sectors tied to household demand lagging.

In equities, investors with disciplined exposure to global equities and real assets are positioned to benefit, while those relying on domestic demand stories may find it tougher going.

Beyond equities, the implications ripple across currencies, commodities, bonds, and politics.

A softer U.S. dollar is lifting gold and commodity prices, which is providing tailwinds for Australia’s resource-heavy market.

At the same time, bond markets are facing instability as central bankers walk the line between higher-than-targeted inflation and accommodative policy, making active management in fixed income more important than ever.

Overlaying all of this is a rising geopolitical risk premium, as inequality is feeding populism and policy volatility in the U.S. These risks may eventually cascade through to valuations, trade, and capital flows.

For investors, the lesson is clear: diversify across asset classes, lean on managers with a proven track record, and ensure your portfolio is exposed to the opportunities that U.S. inequality brings while avoiding the dangers.

Riding the Two-Speed Economy

The U.S. wealth divide is no longer just a domestic challenge. It’s a macro force with cross-border consequences. With the bottom half of American households holding just 2.5% of total wealth, the mechanics of inequality are increasingly defining global capital allocation.

For Australian investors, it’s clear this is an era when the Fed’s monetary policy, global inflation, and U.S. wealth distribution are interacting in ways that are simultaneously inflating asset prices and corroding consumer resilience.

The prudent path may not be in betting against equity markets, but in balancing your exposure with diversification, discipline, and a clear-eyed recognition of the forces driving markets higher. The challenge is ensuring your portfolio is positioned to enjoy the gains while being robust enough to withstand the inevitable reckoning when the extraordinary U.S. wealth inequalities catalyse more significant economic challenges.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.