Asset Allocation Secrets: Navigating Clear & Present Geopolitical Danger

Simon Turner

Mon 22 Sep 2025 8 minutesIf you follow the news, the world is probably feeling mighty unsafe right now, with geopolitical risks dominating the headlines. Of course, the media thrives on amplifying fear, so for investors the real question isn’t whether the news headlines are dramatic. That’s always the case. It’s whether the real geopolitical risks are material, and how they might affect investors’ portfolios looking forward.

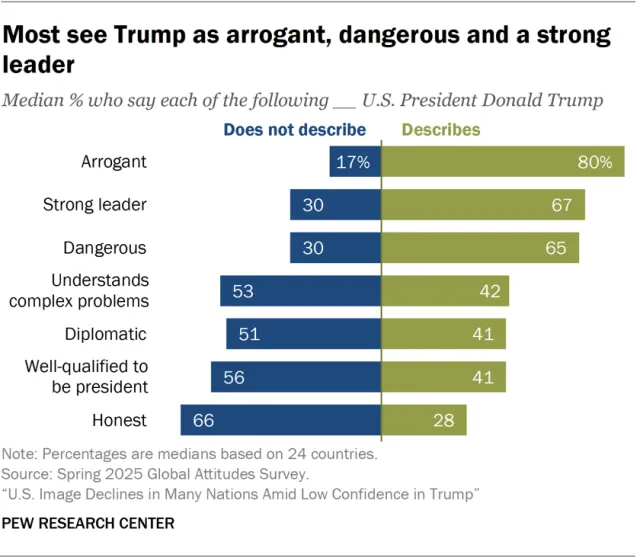

In 2025, the evidence suggests the dangers are clear and present. Trump is reshaping U.S. policy with unusual speed and unpredictability, while conflicts, climate shocks, and AI-focused technological rivalry are adding layers of complexity to markets. At times, reality is feeling closer to fiction, yet investors must learn to navigate a growing set of geopolitical threats which appear to be here to stay…

How High Are Global Geopolitical Risks Right Now?

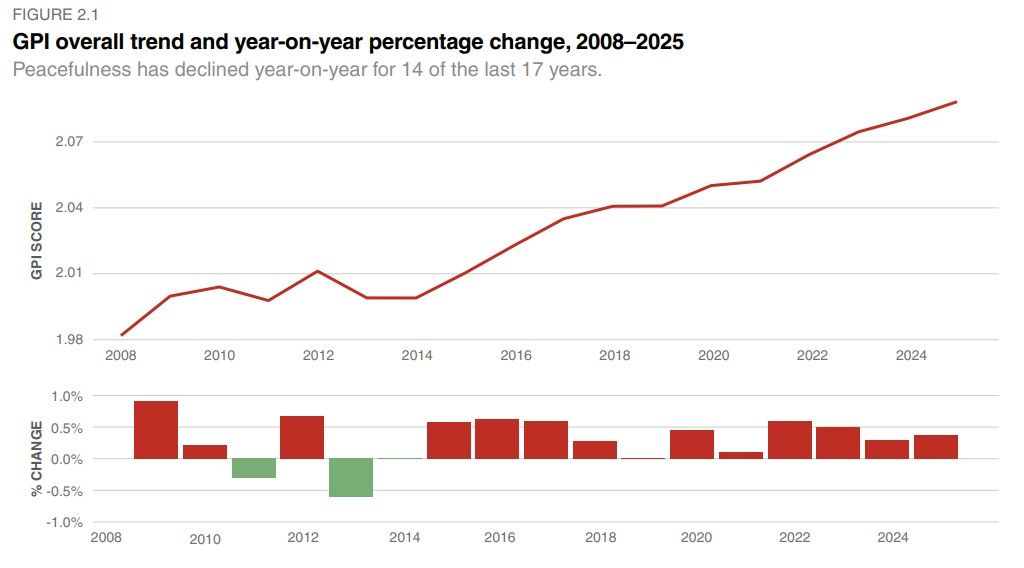

Unlike most years when the news headlines exaggerate the risks, 2025 is shaping up as a rare moment when perception matches reality. Measured against the past 15 years, geopolitical risk is elevated and trending higher.

The Global Peace Index illustrates this deterioration: 78 countries recorded worsening conflict this year, while 86 increased military spending as a share of GDP.

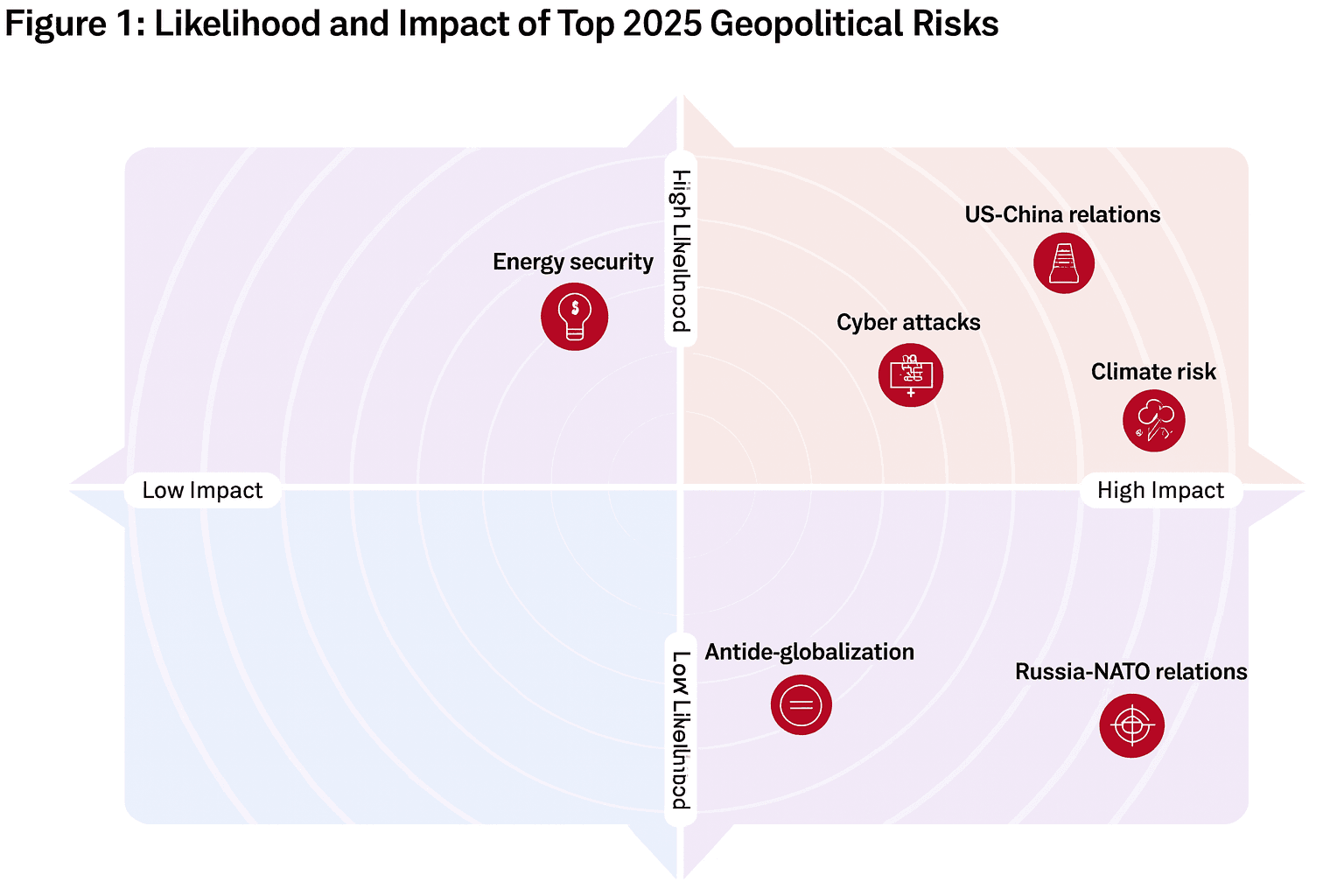

Conflict and defence budgets only tell part of the geopolitical story. As shown below, S&P Global highlights the likelihood and potential impact of a broader array of geopolitical risks, ranging from Russia–NATO tensions to U.S.–China rivalry.

Markets are responding. Goldman Sachs estimates a $US10 per barrel risk premium is already baked into Brent crude.

Central bankers are also paying attention. The Caldara–Iacoviello Geopolitical Risk Index, historically linked to higher inflation, provides policymakers with ample warning that rising geopolitical tensions can push up prices faster than traditional models expect.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Seven Main Geopolitical Risks

So global geopolitical risks are high right now. Let’s discuss the seven main risks for a clearer picture of the challenges investors need to navigate…

1. Trump’s Unpredictable Tariff Shocks

Few leaders have unsettled markets like Donald Trump.

In April 2025, the U.S. imposed a 10% baseline tariff on nearly all imports, quickly followed by punitive reciprocal tariffs against select trading partners. While still under legal challenge, these tariffs are already filtering into global prices, with major retailers warning of higher prices in the coming months and years.

The WTO has warned that world trade growth could falter as a result, while the IMF flagged U.S. tariffs as a downside risk to its global economic growth forecasts. The ECB has gone further, calling them a potential destabiliser of global financial stability.

👉 Investor Takeaway: Tariffs don’t just move trade flows. They reignite inflation, cloud central bank policy, and heighten currency volatility. Valuation discipline should be non-negotiable in exposed regions. Liquidity management, too, should be deliberate, with tiered reserves that allow funds to ride through market volatility without forced selling.

2. De-Globalisation & the Friend-Shoring Era

The long arc of globalisation has clearly been fractured in recent months.

Supply chains are being rerouted, duplicated, and reinforced to favour political allies rather than pure economic efficiency. The UNCTAD Trade Policy Uncertainty Index reached record highs in 2025, while the WTO projects weaker-than-normal trade momentum as a result.

This doesn’t mean that cross-border commerce is dying. Far from it. But resilience is replacing efficiency as the new corporate mantra, and that comes at a cost. Higher inventories, duplicate factories, and friend-shoring are adding to capital expenditure while squeezing profit margins.

👉 Investor Takeaway: Geopolitics and supply chain surety is now embedded into the cost of doing business. So diversification needs to cover shock channels, not just asset classes. That means pairing equities with explicit exposure to energy, commodities, and defensive sectors such as healthcare.

3. Energy Security: From Russia to New Dependencies

Europe has been pivoting away from using Russian gas, cutting its reliance from over 40% in 2021 to under 20% today.

However, this newfound independence has created a new dependency: the US now supplies more than half of all EU LNG imports. Storage buffers at 90% of capacity offer a degree of insurance, but energy security has evolved into a global pressure point.

👉 Investor Takeaway: Russian gas cut-offs are no longer the looming energy threat investors need to be aware of. It’s now the risk of chokepoints in LNG shipping, or shifts in U.S. energy export policy. The upshot is that investors should increasingly read energy markets as geopolitical barometers, not just economic ones. Maintaining some energy sector exposure is likely to be a prudent risk mitigation strategy.

4. U.S.–China: A Rivalry Without Resolution

The U.S.–China relationship still defines the global economy, but change is afoot.

Washington has tightened export controls of advanced computing chips, intensifying the technological divide. Meanwhile, the South China Sea, through which over $US3 trillion of trade flows each year, remains a simmering risk. China’s unilateral control measures around the Scarborough Shoal and escalating warnings to the Philippines raise the odds of politically-driven disruption.

For investors, this rivalry increases the likelihood of periodic bouts of volatility in Asian currencies, technology stocks, and commodities. Also, the bifurcation of global supply chains between Western and Chinese will carry efficiency costs for decades to come.

👉 Investor Takeaway: The risk of periodic bouts of volatility in Asian currencies, technology stocks, and commodities, is high and rising. Currency management, in particular, is becoming more important. With the Australian dollar tethered to China and commodities, dynamic hedging of U.S. assets may offer some balance during periods of geopolitical-driven volatility. Also, bear in mind that the bifurcation of global supply chains between Western and Chinese will raise supply costs for decades to come.

5. Russia–NATO: At a Costly Stalemate

The Ukraine war remains one of the defining conflicts of our age.

By mid-2025, Russian casualties were estimated to be nearly one million killed and wounded, while thousands of civilians have been harmed in Ukraine.

NATO has responded with an historic military build-up. For the first time in history, all members are on track to spend at least 2% of GDP on defence in 2025.

👉 Investor Takeaway: Defence and aerospace firms are enjoying strong order books, but Europe’s broader economic growth is likely capped by its proximity to the war and energy constraints. The war is less likely to trigger sudden global shocks than in 2022, but its grinding persistence remains a heavy weight on markets.

6. Climate: From Heatwaves to Food Prices

Climate risk is no longer a distant theme. It’s immediate and it’s a geopolitical issue.

2024 was the hottest year on record, roughly 1.5°C above pre-industrial averages, and brought unprecedented ocean warming. Water scarcity now affects one in four people globally, with four billion experiencing shortages for at least one month a year.

The impact is already visible in food prices. The FAO Food Price Index climbed to 130.1 in August 2025, up 7% year-on-year, fuelled by droughts, floods, and disrupted supply chains.

👉 Investor Takeaway: Climate change is not just an ESG talking point. It’s evolved into a real, ongoing driver of commodity volatility, migration pressures, and political instability.

7. Cybersecurity: The Invisible Front Line

Cyberwarfare has evolved into a major geopolitical risk which no government or company can ignore. State-backed groups are increasingly targeting grids, banks, and supply chains with rising sophistication.

It’s a costly issue. IBM’s 2025 analysis puts the average global cost of a breach at $US4.4 million, with U.S. breaches costing over $US10 million apiece.

👉 Investor Takeaway: Cyber preparedness is now as central to investor due diligence as balance sheets or cash flows. As a result, cybersecurity should arguably be a thematic exposure in most growth-focused portfolios.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Elevated Geopolitical Risks Are Here to Stay

Global geopolitical risk is undeniably elevated and entrenched. From Trump’s tariff shocks to U.S.–China rivalry, from Europe’s new energy dependencies to climate-driven food inflation, the risks are sadly sticky and structural.

For investors, the challenge is to build portfolio resilience before these elevated geopolitical risks lead to market volatility. That means treating geopolitics not as noise, but as a set of structural forces that are here to stay. Yes, the world is riskier than it once was, but with the right tools, diversification, and foresight, investors can position themselves to navigate whatever is coming.

Interested in Learning More About Asset Allocation? Check Out Our Recent Discussions Here

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.