The Canary in the Private Credit Coalmine

Simon Turner

Mon 13 Oct 2025 6 minutesSavvy investors are always on the lookout for the proverbial canary in the coalmine, particularly when markets keep hitting all-time highs with seemingly unstoppable momentum.

A canary may be making its presence known in the listed US private credit space at the moment.

While the global equity market continues to defy gravity care of US mega-cap tech momentum and the hope of lower Fed rates, the listed US private credit players are beginning to price in a very different cycle: one marked by tightening borrower cash flows, rising loss expectations, and compressed margins.

Whilst it’s an American private credit development, within the interconnected global financial system this canary’s song may have global ramifications…

The Warning Signs in US Private Credit

The global private credit boom of the past five years has been built on a simple story. Rising short-term rates improved the yields on floating-rate loans while default rates remained remarkably low, allowing private credit funds to distribute chunky yields well in excess of most income-focused asset classes. During this golden period for the asset class, most investors have convinced themselves that private credit is immune to the usual credit cycle.

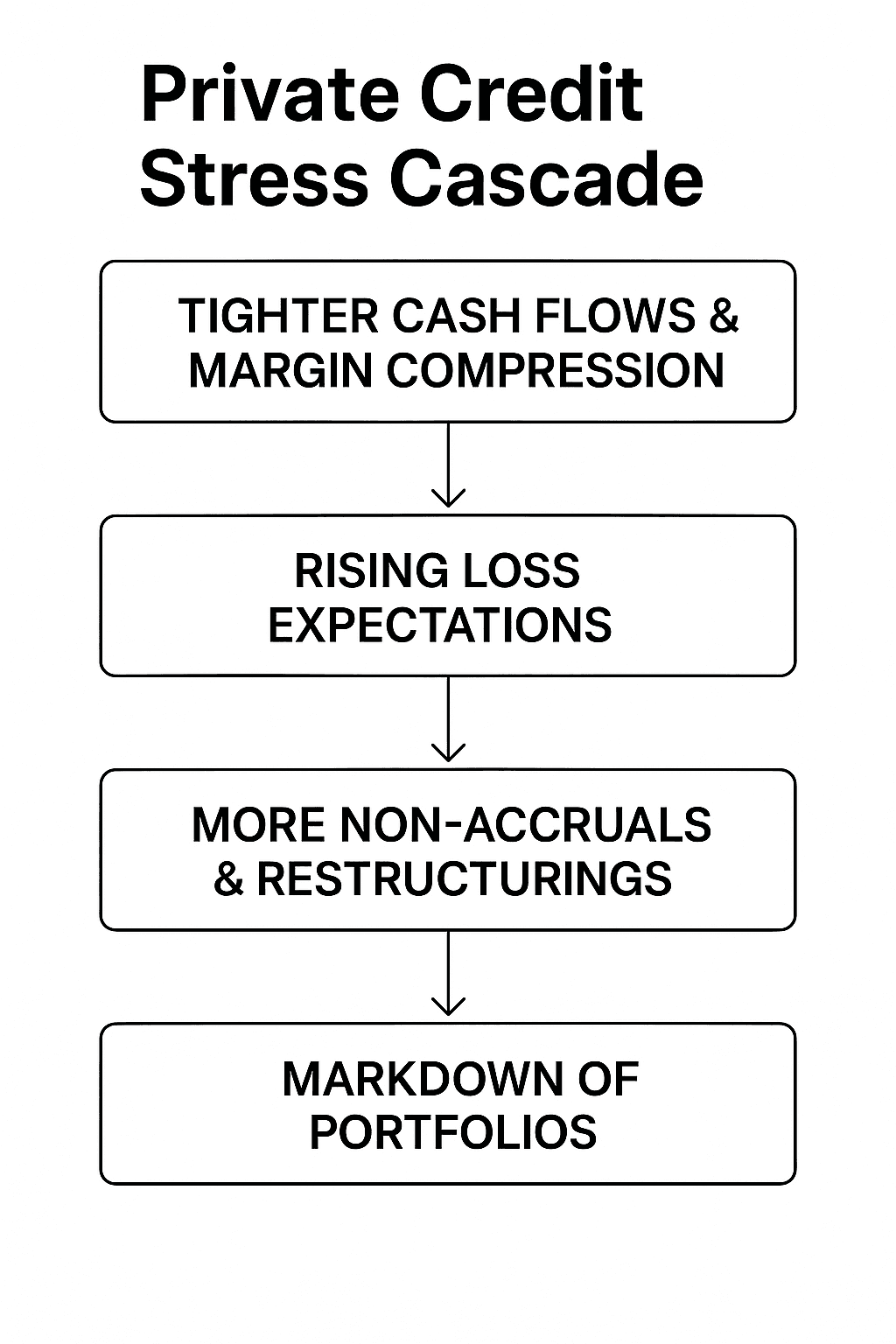

That illusion may be starting to fade in parts of the private credit universe. The issue is US borrowers are feeling the strain of those higher interest rates. Many are paying 10%+ on their loans, and the arithmetic no longer works. The easy levers for many borrowers have already been pulled: costs have been cut, prices have been raised, and sponsors have been tapped for support. What remains are the tougher potential responses such as asset sales, restructurings, and write-downs.

Behind the scenes, US private credit lenders are facing a tougher market on multiple fronts. Fierce competition for deals has steadily compressed spreads and pushed leverage up. That’s fine in a strong economy but leaves little cushion when growth slows. Moreover, hundreds of billions of loans will need refinancing between 2025 and 2027, often at higher spreads and tighter liquidity. The credit risk maths is likely to become ugly quickly when cash flows weaken and debt maturities cluster.

It’s noteworthy that these issues are only becoming gradually apparent since most US private credit portfolios are valued quarterly. In the meantime, managers can amend and extend loans by modifying covenants or maturities to buy time. In other words, the system appears relatively tranquil while financial stress is building behind the scenes.

US private credit manager share prices are focused on pricing in the truth. For example, there’s been a steep decline in Blackstone’s listed credit vehicle and Blue Owl’s stock in recent weeks. These stock moves aren’t proof of an impending crisis, but they’re a reflection of the market’s opinion that future NAVs and dividends will trend lower than the reported figures suggest.

For private credit managers like Blue Owl, their vulnerability is twofold. Their revenues depend not only on assets under management but on performance fees. If fundraising slows while their performance fees evaporate due to markdowns or restructurings, their earnings will fall fast. That’s not to mention the impact of lower base rates. As short-term yields decline, their net interest income would shrink, while loan refinancing will occur at thinner spreads.

Whilst these risks are clearly rising, none of this yet spells a systemic crisis.

But it does mean the easy phase of the private credit cycle, the one that made everyone look smart, is ending. In its place is a more complex, less forgiving environment where the winning managers will be ones who genuinely underwrite, monitor, and manage credit risk rather than those who simply chased yield through leverage and opacity.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Lessons from the Coalface

While these private credit tremors are occurring in the US, the lessons are universal.

Many Australian investors have been attracted into private credit funds by the illiquidity premium: the belief that locking their capital away will earn them a structurally higher return without proportional risk.

That thesis only works if liquidity is never needed.

It’s important to remember: when markets turn, illiquidity is not a premium but a penalty.

In this environment, private credit investors should stress-test their assumptions.

What happens if spreads blow out 200 basis points and default rates double?

How much of your private-credit allocation can you redeem if the gates are closed?

The answers will determine whether you hold a resilient income stream or an illiquid trap.

So due diligence matters more than ever.

As we wrote a few months ago, investors should focus on private credit funds with conservative underwriting, real covenants, and diversified exposures by vintage, borrower type, and geography.

Scrutinise leverage at both the fund and borrower level. Fund leverage in addition to borrower leverage is usually a warning sign.

And be wary of apparently liquid private-credit funds promising monthly liquidity against quarterly-marked, non-traded loans. That mismatch is precisely what ratings agencies like Moody’s have flagged as a brewing risk.

In the next downturn, the structural integrity of private credit funds will matter far more than yield.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Heed the Signals

The recent divergence between the listed US private credit players and the S&P 500 is a flashing yellow light, not yet a red one. It’s a reminder to investors that credit risk is never truly dormant. It’s merely deferred.

For investors who’ve embraced private credit as a core income play, this is a timely moment to reassess your assumptions, tighten your risk controls, and ensure your private credit exposure can withstand a cycle that may soon become less forgiving.

The key takeaway isn’t that private credit is doomed. It’s that its benign phase has clearly passed, and the next act will require sharper risk discipline and greater realism about returns. So focus on private credit funds managers with discipline, portfolios with transparency, and structures built to last beyond the yield boom.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.