Zigging in Private Credit when Everyone Else is Zagging

Simon Turner

Wed 9 Apr 2025 7 minutesAfter our recent investor event, we sent out a survey regarding the topics investors would like to hear more about. One asset class dominated all others in the feedback: private credit.

Investors were clear: the prospect of solid risk-adjusted returns without the volatility of listed markets is fuelling their interest in private credit.

This feedback inspired some concern at our end. When an asset class becomes as ‘hot’ as this, it can be a signal that caution is warranted, or at least awareness of the risks.

With treading carefully in mind, we’ve put together a private credit loss avoidance cheat-sheet aimed at zigging when everyone else is zagging — and thus maximising risk-adjusted returns…

Private Credit on Fire as an Asset Class

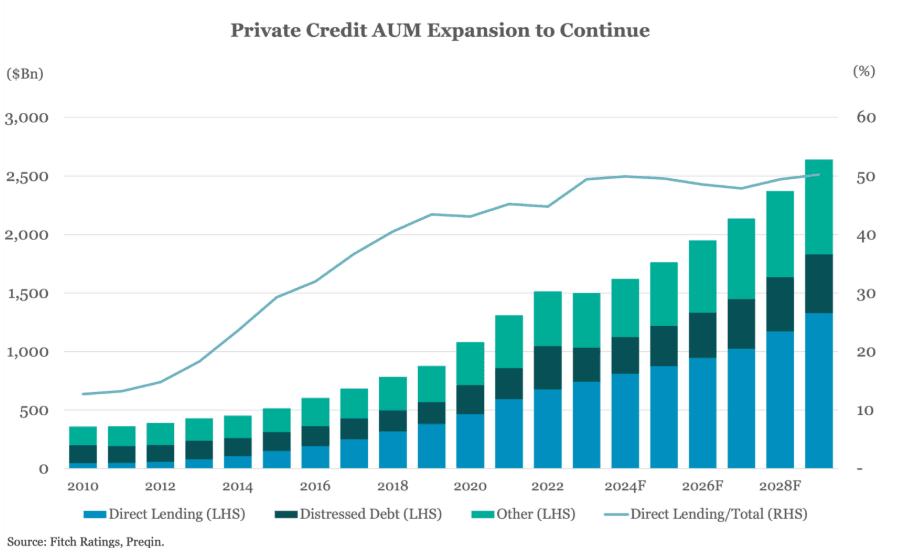

Once a cosy little niche in the alternative finance world, private credit has exploded into the global limelight, capturing headlines and attracting capital with assets under management (AUM) already exceeding $US3 trillion.

It’s a similar picture in Australia, with the private credit market managing an estimated $205 billion AUM — and already accounting for a 14% of total corporate lending.

It’s easy to see the sector’s attractions for investors and borrowers alike. Private credit boasts enticing yields, customisable structures, and a lifeline for borrowers which is often overlooked by the traditional banks.

The elephant in the room

The elephant in the room for private credit investors is their inability to know what private credit managed funds’ loan books are really worth.

The regulators concur, including APRA. In the words of APRA chairman John Lonsdale: ‘Private credit is a new and emerging risk that we are looking at. We attend the Basel Committee; it’s an issue being looked at there. I attend the FSB (Financial Stability Board) – the same. The Council of Financial Regulators as well looks at all the risks … so, it’s something that is live, that we are examining.’

Case in point: AustralianSuper recently lost $1.1 billion on a combined private credit/private equity investment in an online education start-up called Pluralsight. Long story short, Pluralsight’s floating rate loan terms were agreed when interest rates were at historic lows. Since then, rising interest rates made the company’s debt levels unsustainable and the investment a disaster.

The issue for investors is that there’s low to minimal visibility of the creditworthiness of funds’ private credit loans, the rationale behind their valuations, or the liquidity profile of their positions. This makes the risk-reward equation challenging to assess.

In short, better transparency is needed. It’s well-known that transparency builds trust and trust is an integral driver of AUM growth.

Part of the challenge is the private nature of the private credit markets. In contrast to the endemic openness and liquidity of public markets, private markets depend upon open communication and the availability of independent information.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Private Credit Loss Avoidance Cheat-sheet

While the regulators are trying to bridge the gaps, here’s our cheat-sheet aimed at avoiding private credit losses and thus maximising the sector’s attractive risk-adjusted returns…

1. Commit to conducting due diligence prior to investing

This may sound obvious, but many investors don’t conduct sufficient due diligence prior to investing in managed funds.

Whilst this is always advisable, it’s particularly advisable prior to investing in private credit funds given the private nature of this market and the lack of regulatory oversight.

2. Read the information memorandum (IM) in depth

When you’re reading the IM, here’s some key information to assess:

- The fund manager’s track record & experience – A longer track record is almost always better as there’s no substitute for experience. You’ll want to be investing with a manager who’s navigated multiple market cycles within this particular asset class. Spoiler alert: there aren’t too many of these managers around as the asset class was previously a lot smaller.

- Management fees – Make sure you’re aware of all the fund’s fees, including performance fees. Bear in mind, the average private credit fund management fee in 2024 was 1.1%.

- Timing & nature of loans in the portfolio – In particular, focus on floating rate loans signed when interest rates were lower. This is super important. In fact, PIMCO estimate that 40% of private credit borrowers cannot repay their floating rate loans at current interest rates. So you’ll want to know what portion of the loan book are on floating rate agreements, when they were signed, and the portion of them who are in loan stress, or close to breaking their covenants.

- Independent loan valuations – Ideally, independent valuations would occur quarterly, but at least annually is a more realistic goal. If independent valuations aren’t mentioned in the IM, that’s a warning signal.

- Fair value methodologies – The IM should detail the methodologies behind how the loans are valued. If not, that’s a red flag.

- The IM ‘smell test’ – This one is harder to define but high quality fund IMs tend to get to the point. Investors are able to easily access the useful information they need to make an investment decision rather than sifting through reams of marketing material. In other words, be careful when there are a lot of words in an IM but little useful information.

3. Request the fund’s loan documentation

Requesting a fund’s loan facility documentation can also be useful, if only for a gauge at how open a fund manager is likely to be.

Fund managers who are embracing transparency are likely to be helpful when asked for loan documentation, although be ready to sign an NDA beforehand.

It’s worth checking these documents to identify the key covenants and investor protections.

4. Consider talking with a fund manager prior to investing

A simple chat with a fund manager prior to investing in a fund is also worthwhile.

Here’s a tip: when discussing a private credit fund with its manager, it’s generally worth assuming the fund’s return expectations are a given. Instead, focus on the risks, namely: the transparency and independence of loan valuations, and the extent of loan stress within the portfolio — particularly amongst floating rate loans initiated when interest rates were lower.

Finally, listen to your gut instinct. If you feel like your questions aren’t being addressed, or you just feel uneasy, it’s generally a good idea to pass.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Compelling Reasons for Continued Optimism with a Caveat

The outlook for private credit is undoubtedly bullish. AUM growth is expected to remain strong for the foreseeable future. With RBA cash rates likely to remain higher for longer, the main argument in favour of private credit, solid income returns without the volatility of public markets, remains as compelling as ever.

However, now is the time for private credit investors to be more sophisticated about investing in the sector. Despite the asset class’s bright future, not all funds are created equal, and it is worth remembering that private credit is unregulated sub-prime debt. Conducting thorough due diligence prior to investing is more important than ever.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.