How AI Will Change Investing Forever

Simon Turner

Mon 7 Apr 2025 6 minutesThe only thing that’s certain is change. The world of investing is no exception. Long gone are the days when a stockbroker with encyclopedic knowledge of the markets was your best ally. Welcome to the era of AI in which algorithms, data crunching, and predictive analytics are the game-changers for many investors.

It’s hard not to feel a mixture of excitement and apprehension about how AI is poised to change investing forever.

On that note, here are some of the biggest AI-driven changes investors can expect, some of which are already happening…

1. Dawn of the Robo-Advisors

AI has already arrived in the investment world in the form of robo-advisors.

These automated advisory platforms offer investors a way to manage their portfolios without the hefty fees associated with traditional financial advisors.

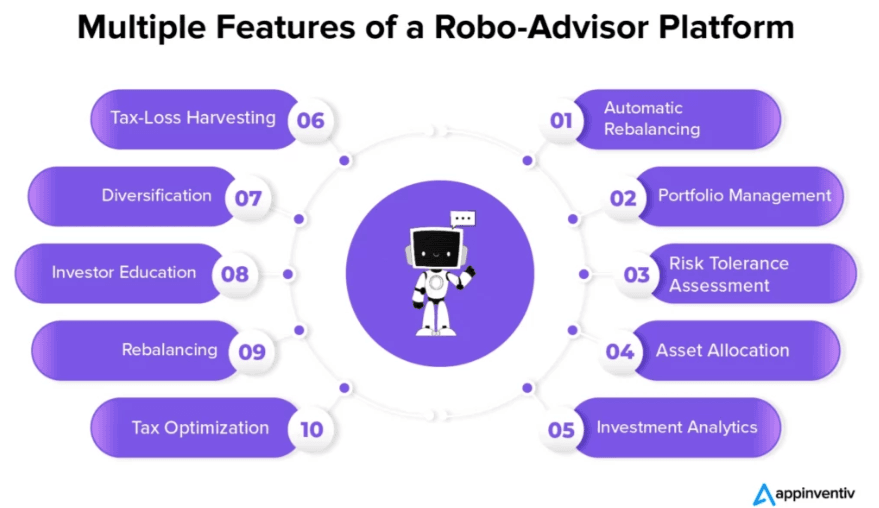

Robo-advisor platforms like Stockspot leverage AI algorithms to analyse users’ financial situations and risk tolerances ahead of providing personalised investment strategies that would have previously required hours of human analysis. They’re essentially democratizing access to financial advice.

Thanks to recent advancements in machine learning, these platforms are refining their algorithms to become more adept at predicting market trends and individual stock performances. Imagine algorithms not just rebalancing investor portfolios, but also predicting the volatility of the market weeks in advance.

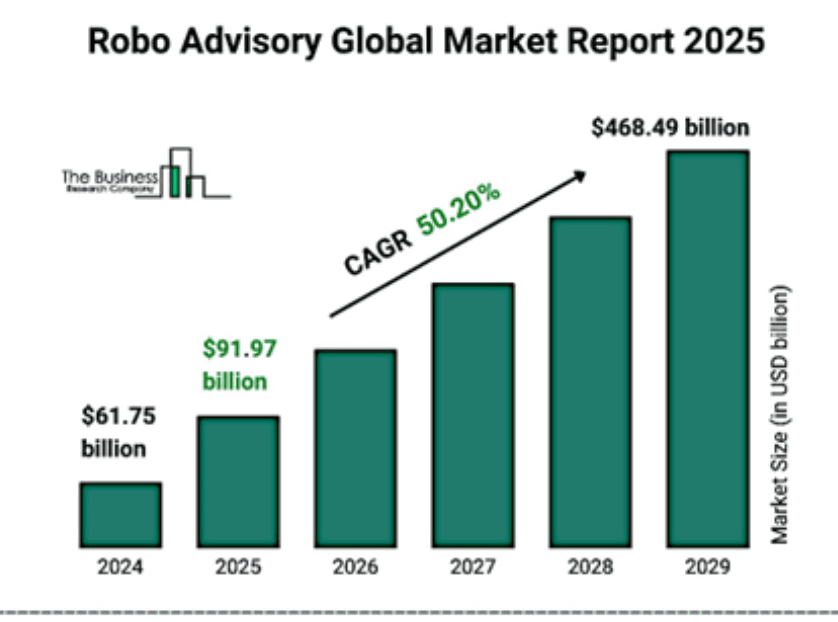

As a result of these growing advantages, the robo-advisory market is positioned for strong growth in the coming years.

The implications for investors are positive:

Now’s a great time to investigate your robo-advisory options as a means of gaining access to customised financial advice at a low price.

With competition from AI on the rise, financial advisors will increasingly be challenged to prove their worth—and many will.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. More Accurate Predictive Analytics

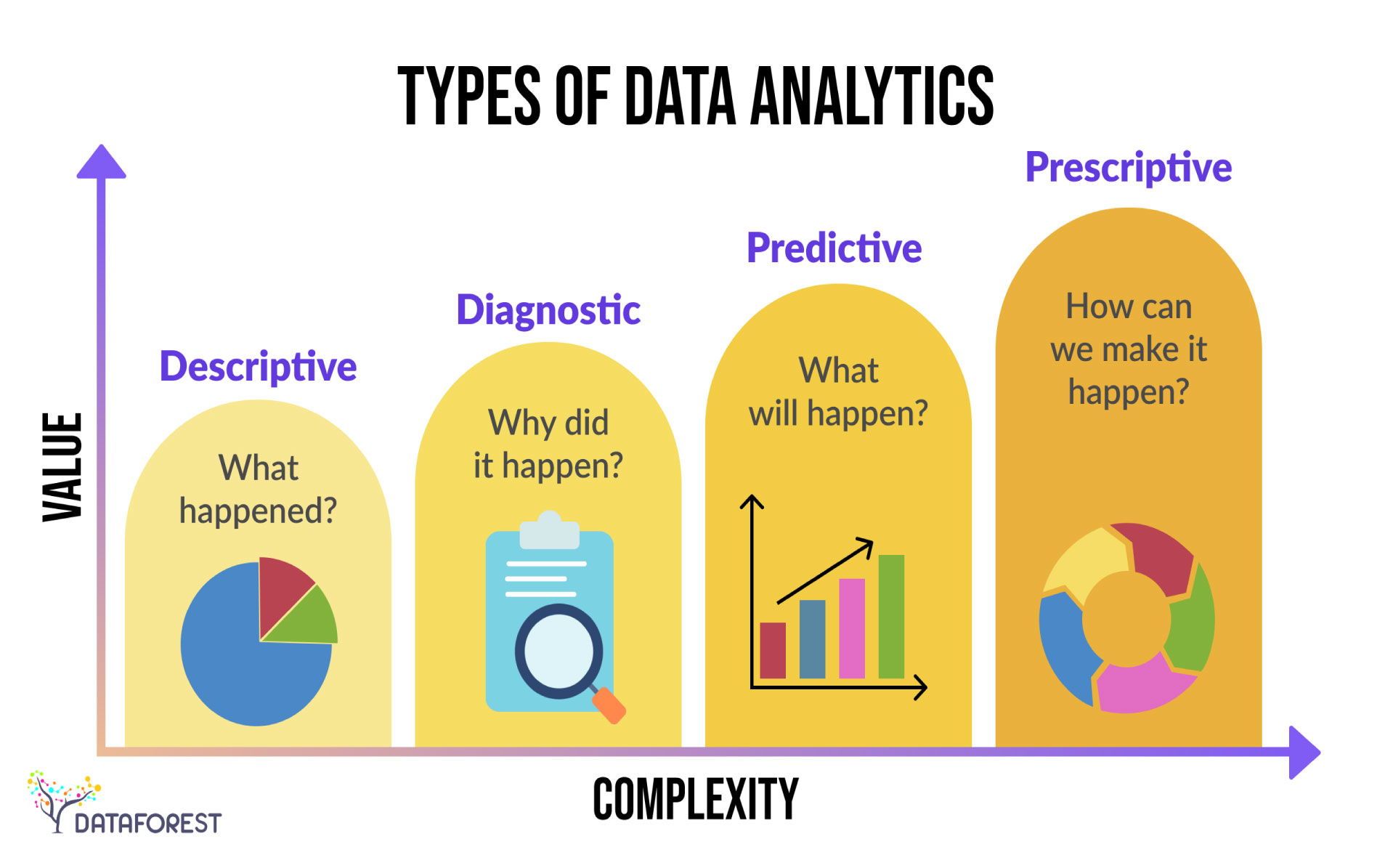

The evolution of AI has ushered in the era of more accurate predictive analytics, and it’s providing insights that were previously unimaginable.

Institutional investors are already embracing machine learning models that analyse vast datasets in real-time, from news articles to social media sentiments, economic indicators, and even weather patterns.

These high-value-add insights help investors make decisions based not just on historical performance, but also on a thorough understanding of the present and projections for the future.

Imagine trying to evaluate how a tweet from a certain pop star could influence the stock of an up-and-coming clothing company. In the past, it would have taken days or weeks for analysts to sift through the data, but now AI can process this information at lightning speed, identifying patterns and correlations that can lead to profitable trades.

The implications for investors are positive:

With the help of AI, investors have better chances of making insightful early decisions that can lead them to outperform the market.

Investors are able to invest in managed funds and active ETFs which are already leveraging predictive analysis to the benefit of their investors.

3. Better Understanding Human Behaviour

Ironically, AI promises better understanding of human behaviour, which is perhaps the most unpredictable element in financial markets.

For example, by utilising natural language processing, AI can analyse investor sentiment from various sources. With the emergence of such technology, traders are beginning to recognise sentiment analysis as a useful tool to anticipate market movements.

The implications for investors are positive:

Investors can now get a better handle on market emotions — the optimism or pessimism that often drives price movements.

AI can help investors craft strategies that counteract the herd mentality that often plagues financial markets.

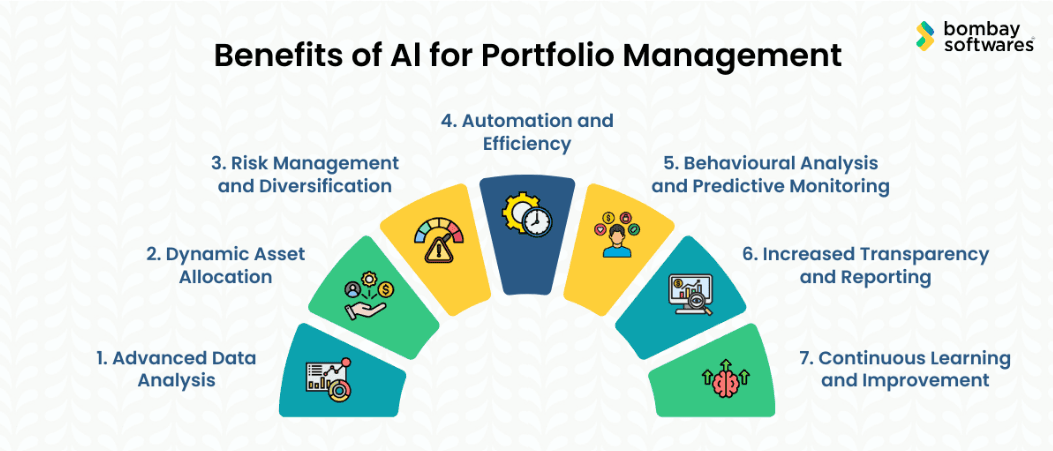

4. Disrupting Traditional Portfolio Management

Traditional portfolio management skills are seeing seismic shifts due to AI advancements.

No longer does stock picking rely on gut instinct and years of experience. Instead, machine learning models can process thousands of potential investments, consider myriad factors, and perform risk assessments with impressive precision.

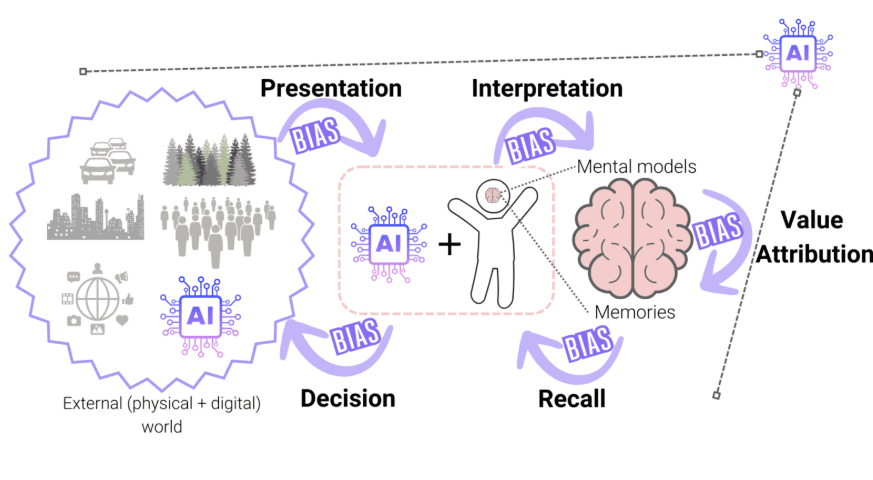

These AI-driven systems are designed to minimise human error, the enemy of the emotionally charged human investor who has a hard time separating from their biases.

Moreover, the introduction of algorithm-based trading is pushing fund managers to adapt. Firms that fail to incorporate AI into their investment strategies risk falling behind.

The implications for investors are positive:

As AI-driven portfolio management gathers momentum, human investors are likely to evolve more into supervisors rather than active investors. This process is likely to start gathering momentum within the managed funds universe to the benefit of their investors.

Without being the victims of their emotional biases, the owners of AI-managed portfolios are likely to benefit from improved performance.

5. The Ethical Conundrum

With great power comes great responsibility. The evolution of AI in investing raises ethical and regulatory questions. As algorithms become more complex, the potential for bias, manipulation, and lack of transparency will grow.

Will investors truly understand how their money is being managed, and who is responsible when algorithms make costly errors?

As regulators catch up, the need for guidelines governing AI investment implementations has become paramount. Looking forward, the investment world must strike a delicate balance between innovation and accountability, to ensure that this brave new world of AI-driven investing remains trustworthy.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Embracing the Future of Investing

The rise of the investment machines in isn’t a sci-fi plot. It’s a tangible shift in how investments are conceived and carried out, and the investment landscape will transform in ways we’re only beginning to grasp.

This evolution offers great promise for the future of investing, with the potential to make markets more efficient, accessible, and responsive.

Embracing this change isn’t just an option; it’s a necessity. As we venture into this new frontier, the question is not whether you will adapt, but rather how enthusiastically you embrace the future of investing—guided, of course, by the remarkable intelligence that is artificial.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.