MercadoLibre (MELI) - Amazon in the Amazon

Daniel Wu

Thu 3 Apr 2025 25 minutesMercadoLibre (NASDAQ: MELI) is the leading e-commerce and fintech ecosystem company in Latin America, co-founded in a Buenos Aires garage during the dotcom boom by Marcos Galperin, who remains Chairman and CEO to this day. The company began life as an online auction marketplace inspired by eBay and has since evolved to encompass a broad range of services including third- and first-party sales, logistics, advertising, and fintech. Today, MercadoLibre more closely resembles Amazon Retail and Alibaba’s Ant Financial, albeit with brighter prospects than both.

The company is present across Latin America, with e-commerce operations in 18 countries and fintech services in eight. The largest markets for both segments are Brazil, Mexico and Argentina.

Since its founding, MercadoLibre has benefited from strong regional tailwinds: a growing middle class across Latam, increasing internet and smartphone penetration, and a relatively underdeveloped retail and banking infrastructure that the company played an important role in digitalizing. The onset of the pandemic in 2020 provided a further accelerant to the adoption of e-commerce and digital financial solutions, and MercadoLibre emerged as one of the biggest structural winners of this period even as other pandemic darlings have faded away. Since the end of 2019, just before the pandemic, revenue has increased by 9x (55% CAGR) and earnings flipped from a -$3.7 loss per share to positive earnings of $37.7 per share.

MercadoLibre went public on the Nasdaq Stock Exchange in August 2007. From the IPO price of $18 a share, the stock has returned over 120x or 31% annualized, far outperforming Amazon’s 55x price appreciation over the same period! However, it was not all smooth sailing as the stock experienced six 40%+ drawdowns on its way to 120-bagdom, including a 90% (!!) drawdown in 2008 and more recently a 69% drawdown during the 2022 bear market.

Although the stock has performed extremely well for patient shareholders, we have always found the business challenging to analyze, in large part because of the many different revenue streams with wildly different unit economics that comprise the company. MELI’s disclosure is surprisingly robust compared to the likes of Amazon or Alibaba, but a lot of valuable detail is obscured in the footnotes of its filings. This deep dive is our attempt at breaking down the economics of MELI’s constituent operations in a way that might be more useful for investors than the company’s high level geographic segmentation.

But first, let us revisit a time when garage startups were still cool.

Origin Story

MercadoLibre (Spanish for “Free Market”) was founded in 1999 in Buenos Aires, Argentina, during the dot-com boom. The idea was born while Marcos Galperin was pursuing his MBA at Stanford University. Galperin observed the explosive growth of online marketplaces like eBay in the US and recognized a market gap in Latin America – a continent with 500 million population but no ascendant e-commerce platform at the time. Inspired by eBay’s auction model, he envisioned creating an online marketplace tailored to Latin America’s needs.

With initial backing from John Muse of private equity firm Hicks Muse, Galperin returned to Argentina and teamed up with friends and classmates Hernan Kazah and Stelleo Tolda to launch MercadoLibre out of a garage in Buenos Aires. The founding vision was not only to emulate the successful online marketplace concept, but to “revolutionize commerce in Latin America through technology,” as the team later reflected.

Several macro trends and regional dynamics provided tailwinds to MELI’s growth in the early 2000s. First and foremost was the rapid rise of internet connectivity in Latin America. Between 2000 and 2007, the number of internet users in Latam skyrocketed from about 18 million to over 122 million – a 32% annual growth rate, far outpacing North America’s internet growth in that period. This explosion of internet users created a ripe environment to scale an e-commerce platform. Even though internet penetration per capita was still low (around 21.5% in Latin America vs 71% in the U.S. by 2007), the sheer population size meant a huge untapped market.

Demographic trends in the region added further to the tailwinds. By the early 2000s, a rising middle class in countries like Brazil and Argentina was seeking greater variety of products and better prices, which online shopping could offer. In many Latam cities, retail options were limited, so an online marketplace connecting buyers and sellers across the country (or region) was appealing. The success of eBay and Amazon abroad helped validate the model to investors and users. During this period, MELI also evolved beyond the eBay auction model and pivoted to a platform for everyday shopping, which dramatically broadened the platform’s appeal.

But MELI’s success was not preordained. As the first mover, the company had to solve multiple friction points to drive initial e-commerce adoption. These included cultural skepticism toward online transactions, low credit card penetration and overall lack of secure, trusted digital payments infrastructure, patchy logistics networks, and a diverse set of regulations across the region. As Marcos Galperin recalled, “Everyone said this is never going to work in Latin America – no one will buy a product they haven’t touched, not in that culture.”

To address the lack of payments infrastructure, MELI developed the Mercado Pago digital payment platform in 2003. To overcome the cultural skepticism and low trust in online transactions, the company introduced measures like a robust buyer/seller feedback system and escrow-like payment protections via Mercado Pago to assure users that they wouldn’t be scammed. To address the shipping pain point, MELI launched Mercado Envios, its integrated shipping service, in 2009. Rather than leaving delivery entirely to users and third parties, Mercado Envíos allowed sellers to print shipping labels and use MELI’s negotiated carriers, eventually even using MELI-operated fulfillment centers and last-mile delivery in major cities.

Not all challenges were within management’s control either. In addition to seeing off a huge field of competitors, the company survived the bursting of the dotcom bubble, Argentina’s debt default in 2001, the Global Financial Crisis, and frequent periods of political turmoil in its core markets. The dotcom crash was a particularly grim period, and the fledgling company barely survived a shareholder vote to shut down operations as funding dried up. These challenging periods ingrained in the cofounders the importance of persistence, resilience and adaptability. To this day, Marcos Galperin and the management team emphasize resilience and building for the long term – exemplified in the company’s motto “lo mejor está por venir”, or “the best is yet to come”.

Business Overview

MELI is the largest e-commerce and fintech ecosystem in Latin America. The company operates two business segments Commerce and Fintech, and three main geographic segments Brazil, Mexico and Argentina, with a fourth catch-all bucket of “Other Countries”.

The Commerce segment consists of MELI’s first party (1P) and third party (3P) marketplace operations, logistics, advertising and on-marketplace payment processing. The Fintech segment consists of off-marketplace merchant acquiring, financing, consumer and merchant credit, and an expanding range of digital wallet operations.

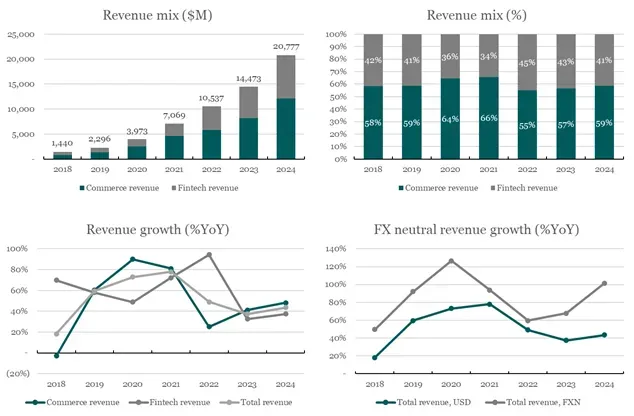

MELI has achieved extremely strong revenue growth over the past several years, with a 56% CAGR for both segments since 2018. More importantly, MELI did not experience the sharp post-COVID growth hangover that many pandemic beneficiaries faced. This is in part due to the highly complementary and synergistic nature of the two segments – when one segment faced weaker growth, the other was able to punch above its weight. This also highlights the benefits of riding multiple secular tailwinds, as even after the pandemic acceleration, Latam e-commerce penetration was still well behind the US, and financial inclusion and digitalization of payments was still in full swing.

As these two segment revenue lines each aggregate multiple different operations within the MercadoLibre ecosystem, we will discuss growth rates later at the business line level, which is more relevant than headline growth rates for assessing MELI’s future growth prospects. One other thing to note is that due to the inflationary (or hyperinflationary) environment in many Latam markets and their consequent structural FX depreciation, MELI’s FX neutral growth is materially higher than its USD growth and rather meaningless as it strips out currency depreciation while still incorporating the uplift from local inflation.

It also goes without saying that the key metric for Commerce is Gross Merchandise Value (GMV) and the key metric for Fintech is Total Payment Volume (TPV), but to avoid repetition we present the headline numbers here and will address them later in the deep dive when we discuss their related revenue lines.

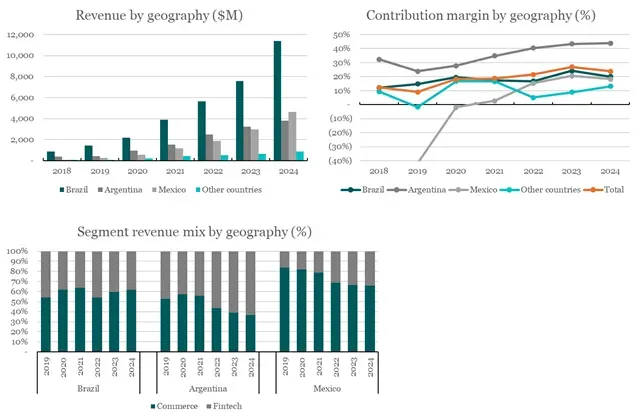

Unfortunately for investors, MELI does not report operating income by business segment, as management manage the company on a country-by-country basis. Segmenting revenue by geography, we can see that Brazil is by far the largest market for MELI at ~55% of revenue. Mexico also overtook Argentina as the second largest market in 2024, which is not surprising given Mexico’s GDP is nearly triple that of Argentina, and MELI has much lower market share in the former country.

Conversely, Argentina, being the oldest market for MELI, has the highest contribution margin by far. We attribute this to its dominant position in both e-commerce and digital payments in the country and the higher mix of Fintech revenue compared to Brazil and Mexico. While the 40%+ Argentine margin is an aspirational indicator of what could be achieved, we do not believe Brazil and Mexico will reach those levels on any relevant timescale. Competition is more intense in these markets and Fintech revenue, in addition to being lower mix, is of different composition compared to Argentina as well. We will revisit these points as we progress through this deep dive.

Unfortunately, again, for investors, this revenue and earnings segmentation by geography is not particularly useful for analyzing MELI’s growth drivers, unit economics or future prospects. For example, while Commerce revenue comprises ~60% of total revenue, we believe it is actually Fintech that contributes the majority of earnings. This is corroborated by the high contribution margin from Argentina, where Fintech is over 60% of revenue mix, and by management’s directional comments regarding the profitability of Fintech.

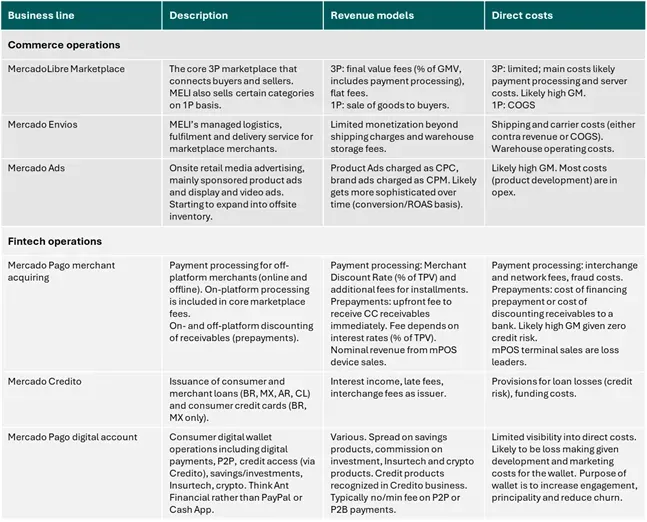

Our preference, then, is to understand this company from a business line perspective, which starts with the Commerce and Fintech segments and decomposes further into the various operations within the MELI ecosystem. The remainder of this deep dive will focus on breaking down the drivers and economics of the following operations that we believe are key to the MercadoLibre ecosystem:

- MercadoLibre Marketplace, including 1P sales;

- Mercado Envios logistics service;

- Mercado Ads;

- Mercado Pago merchant acquiring operations;

- Mercado Credito consumer and merchant credit; and

- Mercado Pago digital wallet

Commerce operations

The business lines within MELI’s Commerce operations are relatively straightforward to understand for DM investors and there is a prominent analogy in Amazon and to a lesser extent, Alibaba. We present our revenue estimates for the Commerce business lines below and discuss each in more detail over the following sections.

Latam e-commerce market

Before jumping into the individual businesses, it is worth setting the stage with a snapshot of the Latam e-commerce market and MELI’s position within it.

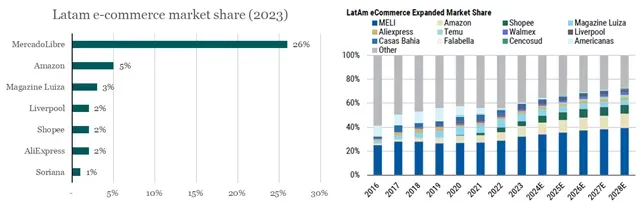

According to Euromonitor, the Latam e-commerce market reached $139 billion in sales in 2023, which we estimate grew further to ~$150 billion in 2024. After growing at 15% CAGR between 2015-2019, growth accelerated following the pandemic to 24% CAGR in the five years to 2024. Although the e-commerce growth rate decelerated to high single-digit growth in 2024 (in USD), we would note that the major Latam currencies (BRL, MXN, ARS) experienced significant depreciation against the USD throughout the year. Latam e-commerce penetration remains well below the levels of the US, UK and China, which allows us to underwrite strong double-digit FX neutral growth well into the future.

MELI is the dominant e-commerce platform in Latam. Euromonitor estimates that MELI had 26% market share in 2023 with a significant gap to #2, while Morgan Stanley estimates MELI’s market share is greater than the next 11 largest operators combined. We will address competition concerns towards the end of the deep dive.

MercadoLibre Marketplace

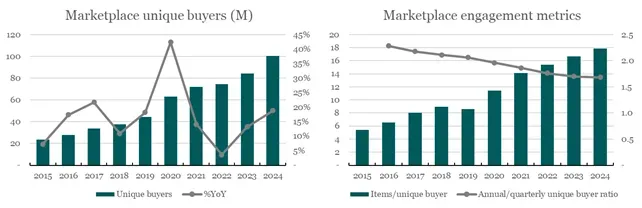

MELI’s core operating business is the MercadoLibre Marketplace that connects buyers and sellers. The Marketplace boasts over 100 million unique active buyers generating $51.5 billion GMV in 2024. Unique active buyers have grown steadily over time yet represent less than a quarter of the Latam adult population, or less than 40% if we just consider the three main countries. Shopping frequency (engagement) has also increased consistently, which we can infer from the rising number of items purchased per unique buyer, and the shrinking ratio between annual unique buyers and average quarterly unique buyers.

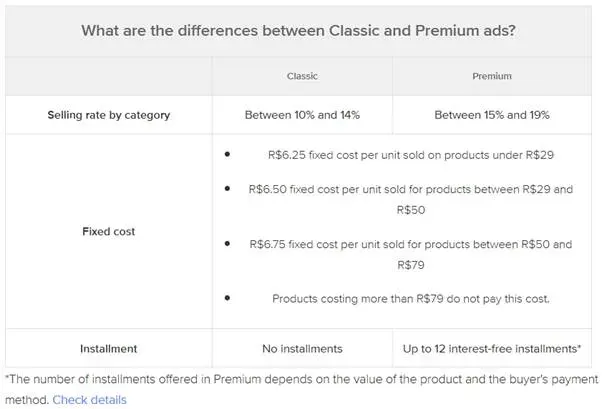

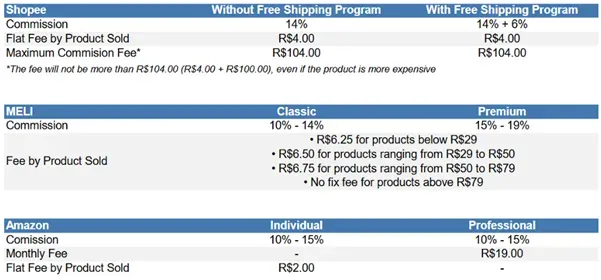

Merchants list their products on the marketplace and pay a final value fee that varies depending on the type of listing (Classic or Premium) and the product category, with high ASP categories like electronics having a lower fee than low ASP categories like fashion or makeup. There is also a fixed cost per unit on products below a certain price threshold. We assume this is to help offset the relatively higher handling costs on lower priced items, although it does make MELI notably more expensive for selling low price goods than competitors who offer lower or zero flat fees.

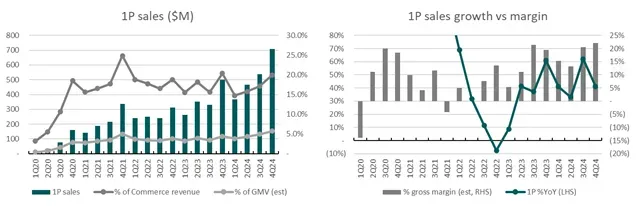

In addition to the 3P marketplace, MELI also launched its 1P business in 2020 with an initial focus on the electronics category. This has since expanded into categories that are insufficiently served by 3P merchants, where MELI can enhance price competitiveness and assortment for consumers by acting as the merchant itself. While this initiative was an early success, management decided to pull back on 1P in 2022 and early 2023 in response to deteriorating macro conditions and unsustainable unit economics – we estimate 1P gross margins were likely breakeven or negative from Q4 2021 through Q2 2022. 1P sales reaccelerated sharply from Q2 2023 onward and reached nearly 6% of GMV in Q4 2024 while sustaining a healthy high-teens gross margin, so whatever changes were made to the 1P operation appear to have been effective. The bankruptcy of Americanas, an omnichannel competitor in Brazil, in January 2023 also helped MELI gain 1P share.

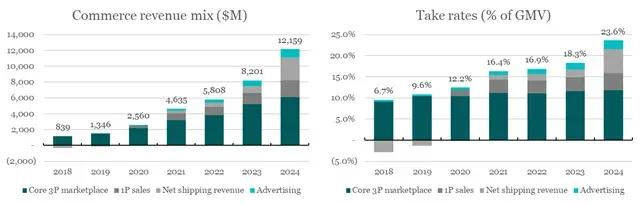

As the 1P sales mix increases as a percentage of GMV, it has a distortive effect on Commerce revenue and headline take rates, as it is essentially “gross” revenue with high associated cost of sales rather than high margin fee revenue. This needs to be taken into account when assessing historical growth and take rates and forecasting the same.

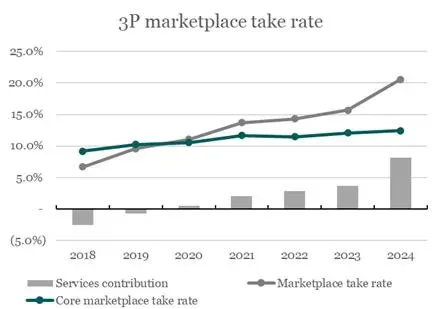

To arrive at the core 3P marketplace take rate, we must back out the revenue from 1P sales, net shipping (a la logistics) and advertising that are embedded in total Commerce revenue. We can observe from the chart below that the core 3P marketplace take rate – that is, the final value fee and fixed fee – has increased only gradually over recent years, potentially even due to mix. This is what we want to see – that MELI’s overall marketplace take rate expansion (the grey line) is not coming from squeezing merchants on core fees but rather through adoption of value-added services. In this case, the services contribution is coming from net shipping fees and advertising. We will discuss our assumptions about net shipping and advertising in the next two sections.

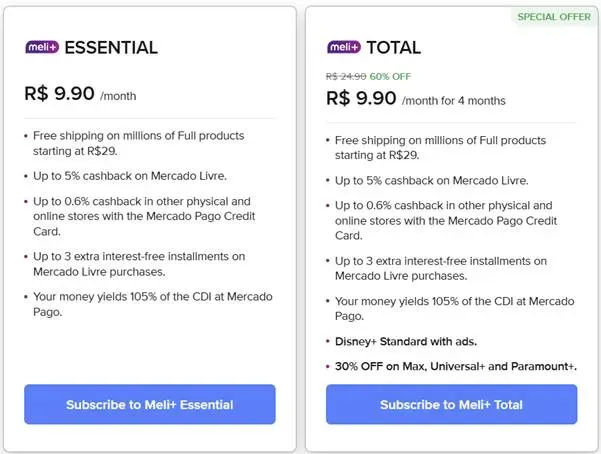

Finally, one last Marketplace-related offering that deserves mention is Meli+, MercadoLibre’s loyalty program that was relaunched in Q3 2023 to be more like Amazon’s Prime membership. For a modest monthly fee, Meli+ members receive lower free shipping thresholds, cashback and extra installments on Marketplace purchases, and cashback on various Mercado Pago spend amongst other benefits. For a higher fee, members also get access to Disney+ and discounts to other popular streaming services.

The company provides no disclosure around Meli+, so it is difficult to determine its impact on marketplace performance. Given its recent relaunch, we believe adoption is still relatively early compared to a mature program like Prime. We think it is also logical to assume that Meli+ will achieve its stated goal of increasing ecosystem engagement and reducing churn. Whether it can spin the “flywheel” to the same extent as Prime remains to be seen, especially as Meli+ currently does not offer unlimited free shipping.

“We don't disclose specific numbers on the loyalty program but we have seen very positive adoptions. The new program, the one that -- the lower price one, we have seen a lot of users engaging with that loyalty program and then the effects of people enrolling into a program are similar to what we have seen in the past. We've seen more usage, more -- better conversion, better engagement with our platform, so it's all very beneficial to us. So we're very excited about the relaunch of a program but it's still too early to share actual numbers on that.” CFO, Q3 2024 earnings call

Related to the loyalty program, MELI also launched the Mercado Play SVOD service in 2023, which, similar to Prime Video (but licensed content only), is a tool for reducing user churn and a surface for serving video ads.

Mercado Envios

Mercado Envios is MELI’s logistics operation that provides storage, warehousing and delivery to marketplace merchants. MELI offers three levels of service to merchants – fulfillment, whereby goods are stored and shipped from MELI fulfillment centers; cross-docking, whereby merchants deliver packages to a MELI cross-docking center that sorts and delivers the packages to buyers; and Flex, whereby the merchant ships directly to the buyer via a MELI-contracted courier.

Merchants that use Envios are eligible to access shipping subsidies that enable free or discounted shipping for consumers, with higher quality merchants receiving greater shipping benefits for their customers.

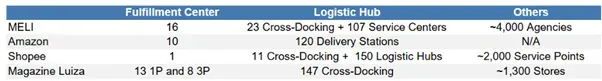

To provide these logistics services, MELI operates an expansive network of (primarily leased) facilities. In Brazil, MELI’s largest market, the company operates significantly more fulfillment capacity than competitors, giving it an advantage in terms of delivery speed, service coverage and service quality. It also operates 4,000 MELI Places local pickup and dropoff points, which makes the returns process in particular much smoother. MELI’s transportation network includes dedicated aircraft, trucks and thousands of last-mile delivery vans, predominantly owned and operated by third-party carriers.

“We know that having more volume shipped out of our own fulfillment facilities results in a much better user experience for buyers and sellers, in faster and more reliable delivery speeds, and in much better conversions of volume.” CFO, Q3 2024 earnings call.

Despite MELI’s ongoing investment in its logistics network, the business is still relatively capital light, in large part because most of the logistics infrastructure is leased. Management appears to be hyper-focused on maximizing efficiencies in the logistics network and expanding capacity on an as-needed basis rather than undertaking heavy investment cycles ahead of demand (e.g. Amazon’s mistake coming out of COVID). Having said this, the company did announce plans in September 2024 to double its fulfillment capacity in Brazil by the end of 2025 to increase fulfillment penetration from current levels (we estimate over 50% of packages) to similar levels as Mexico (over 70%).

Examples of management’s focus on logistics efficiencies:

“In 2024, we reached record levels of productivity in all geographies and a record number of shipments per route. Gains of scale on the back of a 29% year-on-year increase in items shipped also helped cost per package in local currency to either decline year-on-year or rise below inflation in our major geographies.

“There are no silver bullets when it comes to driving logistics efficiency. Instead, our focus is on dozens of small incremental gains that compound over time. Examples of this include grouping initiatives that increase the number of items per delivery, a new shelving system in our fulfillment centers that improves productivity whilst reducing CapEx, and continuous improvements in all of our routing algorithms.” Head of IR, Q4 2024 earnings call

“By building greater flexibility into our logistics operations, we have developed slow shipments which offer additional shipping options for buyers and efficiencies for MercadoLibre. Slow shipments occur when a buyer chooses a slower shipping option than would be otherwise available to them, because it may be more convenient or in some circumstances it may come with a lower shipping cost.

“This enables us to take advantage of moments of idle capacity in two key cost areas of our network. Firstly, the processing in our fulfillment centers and, secondly, the line haul trucks that travel between cities. With slow shipments, the shipping window becomes larger and more flexible for MercadoLibre, which means we can choose the moments of greatest idleness to process products in our fulfillment centers and ship them between cities and line hauls to maximize network capacity utilization.

“MELI Delivery Day is another innovation which has slightly different benefits to slow shipping. The main efficiency built into the MDD model is in the last mile, where several deliveries at a single address on a single drop means that last-mile vans can drop more packages at fewer addresses. This helps us to dilute our last-mile costs.” Head of IR, Q2 2024 earnings call

Replicating Amazon’s robotics playbook:

“In June 2024, we took another major step in our innovation journey with the launch of robotics in our distribution center in Cajamar, just outside the city of Sao Paulo. A total of more than 300 robots will have arrived by the end of the year, with a hundred of those already up and running.

These robots will collaborate with the human workforce and will handle tasks such as transporting shelves containing products from storage areas. This optimizes processing time by 20%. It also enables us to automate repetitive tasks like product sorting whilst reducing the distance that our workforce has to walk around the distribution center. It also increases total storage capacity by up to 15% per square meter.” Head of IR, Q2 2024 earnings call

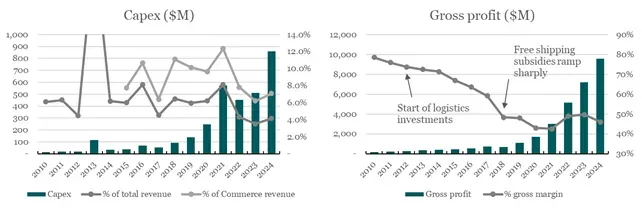

Looking at capex as a percentage of revenue, MELI is as capital light as it has ever been, including prior to the establishment of logistics operations in 2012. This is partly because of the growth of Fintech revenues, but even taking total capex over Commerce revenue only shows capital intensity near historical lows. Of course, given MELI leases substantially all its assets, the “intensity” does materialize as gross margin compression, but the offset is higher revenue and gross profit dollar growth.

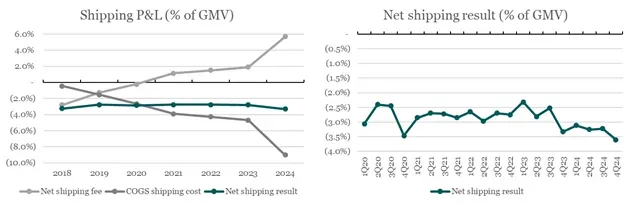

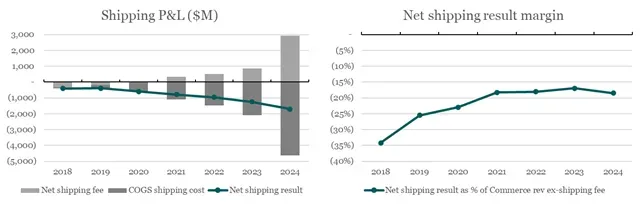

Now, looking at the logistics operations from a P&L perspective, we believe that “net shipping fees” (revenue) and “shipping operating and carrier costs” (which include warehousing costs; COGS) in the MD&A and footnotes of MELI’s filings captures most, if not all, of the logistics impact down to gross profit level. We are not certain if all fulfillment costs are captured as there is no mention of lease costs in the above, yet the opex line item descriptions do not mention lease expenses either. Nonetheless, piecing together the disparate shipping-related revenue and cost disclosures along with our own estimates where necessary, we arrive at the following picture for MELI’s logistics operations.

What jumps out to us immediately is that MELI has done a surprisingly good job of managing the net shipping result (net shipping fee minus COGS shipping costs) over time. Net shipping result has remained just under 3% of GMV even as MELI ramped up its logistics investments, including taking fulfillment penetration up from 6% to over 50% and rising free shipping penetration as well. It has exceeded 3% of GMV only twice – in 2018 when MELI sharply increased shipping subsidies in the face of Brazil postal price hikes, and in 2024 amidst the plan to double Brazil fulfillment capacity by end of 2025. We suspect the relaunch of Meli+ in Q3 2023 with its lowered free shipping thresholds also had an impact, as we see a step-change in net shipping result from Q4 2023. Once again we remind readers that the jump in net shipping fee and COGS shipping costs in 2024 is due to reclassification of certain shipping revenues from net to gross (principal vs agent), and washes out at the net shipping result level.

“I would say, broadly speaking, we continue committed to running shipping with a very disciplined P&L, and you can see that clearly when you look back into the longer-term picture, right? So if you go back to 2019, you can see that our net shipping cost remains broadly flat or even improving if you were to add our flat fee revenues into that one. And in that same period, we moved fulfillment penetration from 6% into 50%. We moved free shipping up 30 percentage points. We increased our square meters by 5x, all this across the region.” Commerce President, Q2 2024 earnings call

“For sure, the extra capacity that we built over the last few quarters helped us cope with that demand while also improve that productivity. A typical warehouse will get to its peak utilization in a few years. So it's not that you open a warehouse and from one day to the other, you do reach 100% utilization.” Commerce President, Q4 2024 earnings call

With the rapid expansion of fulfillment capacity in Brazil, which front-loads increases in fulfillment costs while these facilities ramp to full utilization over time, we expect net shipping result to continue rising as an absolute percentage of GMV this year, but remain under 4% of GMV. As utilization increases, we should see the ratio stabilize as efficiency gains are potentially offset by rising penetration of Meli+ free shipping.

In dollar terms, we estimate that it cost MELI $1.7 billion net to run its logistics operation in 2024. This translates to ~18% of Commerce revenue excluding net shipping fees, largely unchanged over the past four years. We expect this margin to remain stable or decline moving forward, even with the Brazil fulfillment capacity expansion, due to favorable revenue mix evolution as 1P sales and advertising have proportionally lower or zero associated shipping costs, respectively.

Lastly, more extensive monetization of fulfillment services beyond (we assume) pure cost recovery remains an opportunity for MELI. The question of fulfillment monetization was raised semi-regularly on earnings calls through 2022 and 2023, and management consistently pushed back on monetization until Brazil fulfillment penetration (sub-50% at the time) reached Mexico levels of 70%+. Management did disclose on the Q3 2022 call that fulfillment was monetizing at a “closer to $10 million a quarter” rate, which is obviously not very material in the scheme of nearly $6 billion Commerce revenue in 2022. The last time management commented on fulfillment monetization was in Q4 2023:

“I think, as we've been saying many times, in the long run, there will be opportunities for us to continue monetizing our logistics network. We are not desperate for that. We think long-term not only in monetization, but also in remaining competitive in terms of prices to our buyers and to our sellers, and we are conscious on how to execute around that opportunity.” Commerce President, Q4 2023 earnings call

We believe low hanging fruit for fulfillment monetization include higher storage fees, additional handling fees, subscriptions for VAS such as inventory management software, and greater arbitrage of shipping charges. Given the sheer scale of MELI’s shipping operations (nearly 1.8 billion items in 2024), there is likely still a wide margin between the shipping prices that MELI offers marketplace merchants, and what the merchants could negotiate on their own. The possibility of opening up the logistics network to off-marketplace merchants is not something we’ve seen discussed, but may be a long term monetization opportunity.

For paid subscribers, we continue with our breakdown of MELI’s key business lines, before turning our attention to gross margins and the earnings profile. We assess the various risks that MELI faces, and conclude our deep dive as usual with our perspectives on the company’s future prospects.

Disclaimer: This article is prepared by Bristlemoon Capital. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.