The Warning Lights Few Are Watching

Simon Turner

Mon 23 Jun 2025 6 minutesThe global equity market landscape is starting to feel a bit surreal. Key valuation metrics are flashing red, geopolitical stress is escalating, Wall Street professionals are heading for the exits, and the macroeconomic signals are anything but straightforward. Yet, global stock indices are flirting with all-time highs while retail investors appear unfazed by the mounting risks.

Rarely has it been more important to have a long term investment plan you’re committed to, as well as an awareness of what may be coming in the short term…

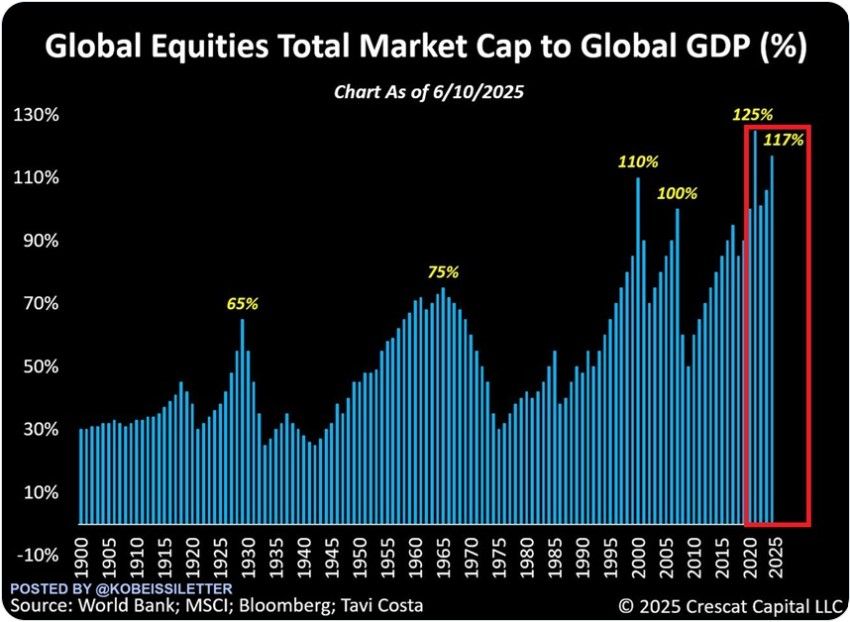

The Market Cap vs GDP Ratio is Flashing Red

One of the most striking valuation signals today is the soaring ratio of global stock market capitalisation to GDP. At 117%, this indicator is sitting at its second-highest level in recorded history, and is trailing only the euphoric highs of early 2022.

In the U.S., the situation is even more extreme with the stock market capitalisation to GDP ratio recently hitting 201%, just a hair’s breadth from its all-time high. The fact that this is occurring while markets digest the global economic impacts of Trump’s new tariffs is remarkable.

For older investors, this disconnect between valuations and fundamental economic risks is raising serious concerns. It suggests there’s an increasingly fragile link between global stock prices and reality.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

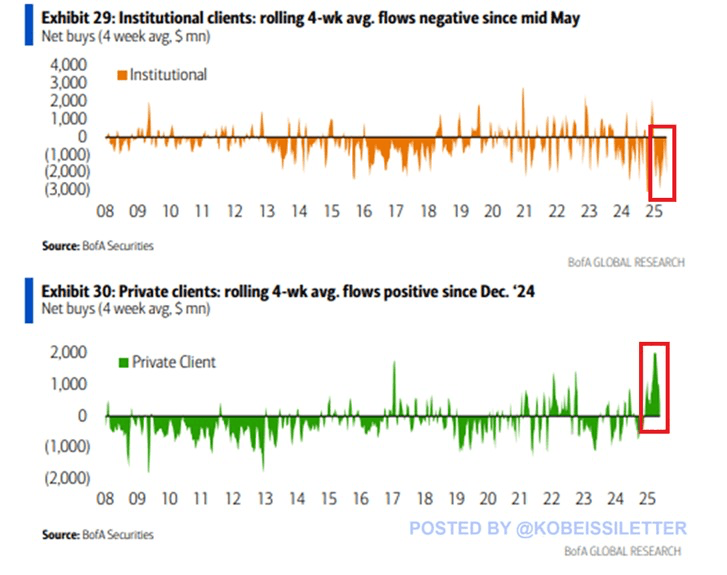

Retail Optimism vs. Wall Street Scepticism

Perhaps the most puzzling development in recent weeks is the stark divergence between retail and institutional investor behaviour.

According to Bank of America, professional investors sold $US4.2 billion in U.S. equities last week alone, continuing a broader trend of steady institutional outflows which have averaged $US2.0 billion per week over the past month.

In contrast, retail investors have been undeterred. Over the last twelve weeks, retail investor purchases of U.S. equities have averaged $US1.6 billion per week. So as institutions sell into strength, retail investors continue to buy with unwavering confidence.

This sentiment gap is historic and troubling. In many ways, it echoes past periods of euphoria, where Main Street became a late-stage buyer while professional money began to rotate out of global equities. While extreme retail optimism can, on occasion, be justified, it often lags mounting macroeconomic and market risks that institutional players are quicker to discount from their position at the coal face.

Short Term Geopolitical & Economic Headwinds

So why is Wall Street turning bearish all of a sudden?

The current confluence of geopolitical and economic headwinds is especially acute:

1. The escalating military conflict between Israel and Iran is creating uncertainty across energy markets and beyond. Geopolitical risk is often hard to quantify and that’s the real risk in this case. No one knows whether this conflict will be resolved in the short term, or will grow into a bigger problem.

2. U.S. tariff rates have surged to near-century highs, signalling the return of protectionist policies that could stifle global trade and economic growth. That’s surely bearish even in a positive scenario.

3. The Fed continues to delay anticipated rate cuts, keeping U.S. financial conditions tighter than many investors had priced in.

4. The 10-year U.S. Treasury yield is once again climbing toward 4.50%, in theory putting downward pressure on growth-oriented valuations.

5. Crude oil prices have surged nearly 40% in the past two months, reintroducing inflationary fears that had only just begun to subside.

6. U.S. Government fiscal discipline remains absent, with debt ceiling debates and ballooning deficits contributing to long-term structural concerns.

In more normal times, these risks would cast a shadow over equity markets. Yet, the S&P 500 is just 2% below its all-time high. Sentiment, which only recently hit a twelve-month low, has quickly bounced back to historic norms care of retail investors’ enthusiasm who appear to be pricing in a near-perfect economic scenario in an increasingly imperfect world.

What Should Investors Do?

This type of macro environment doesn’t lend itself to binary thinking. Markets are neither entirely irrational nor fully detached from reality. At any given time, they reflect a fluid combination of optimism, liquidity, and risk-blind behaviour.

For long-term investors, this is a moment that calls for strategy over speculation.

Here are five guiding principles for navigating today’s market:

1. Have a Plan and Stick to It: An investment plan grounded in time-tested principles and a long term horizon can help filter out noise and emotional reactions.

2. Expect More Volatility: This is not the time to assume smooth sailing on a daily basis. Be ready to ride through future market turbulence without abandoning your long-term goals.

3. Maintain Higher Cash Reserves: Optionality is a powerful asset. A healthy cash position allows investors to act decisively if markets do correct.

4. Focus on Defensive Sectors: Sectors like healthcare, and utilities offer relative stability and pricing power in times of uncertainty.

5. Don’t Chase Momentum: In many parts of global markets, valuations already assume best-case scenarios. A defensive posture may underperform in melt-up scenarios but will provide ballast during upcoming market downturns.

Strange Doesn’t Mean Uninvestable

This is, undeniably, an unusual market characterised by record-high valuations, conflicting signals from institutional and retail investors, and a macro backdrop that feels more fragile by the week. But strange does not mean uninvestable.

For educated, disciplined investors, this environment presents an opportunity to position yourself for long-term resilience regardless of these shorter term risks. That means honouring your investment plan, resisting crowd psychology, and preparing for rather than fearing the return of volatility.

In times like these, it’s not the boldest or the most reactive investors who thrive. It’s the ones who stay grounded, informed, and ready.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.