The Lowdown on the Recent Surge in Leverage

Simon Turner

Mon 28 Apr 2025 4 minutesThere’s an interesting trend afoot in global investment markets of late: appetite for leverage had risen to unusually high levels over the past couple of weeks. That may surprise you to hear given financial leverage tends to be best suited to more stable, predictable market conditions than we’ve witnessed of late.

We investigate what it means for investors below…

What is Financial Leverage?

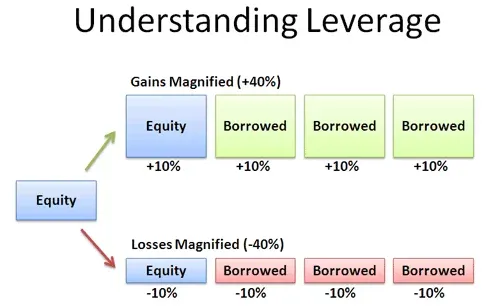

Financial leverage is the use of debt to help purchase an investment with the objective of improving returns. It amplifies investment returns on the upside and downside, so it’s generally considered a high risk investment strategy.

For example, an investment fund employing a 4x gearing ratio (assets/equity) is positioned to generate a 40% gain when its underlying assets increase in value by 10%. Conversely, the same fund is positioned to lose 40% when its underlying assets fall by 10% in value.

Whenever you’re considering the use of leverage, it’s worth focusing on how leverage works on the way down to ensure you understand the risks.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Leverage Appetite has been Off-The-Charts

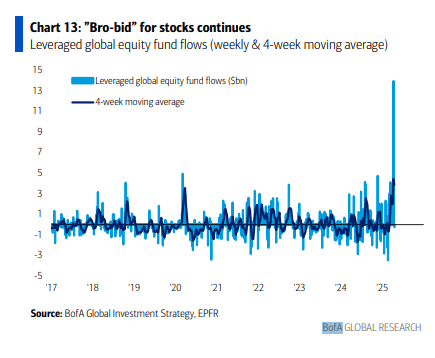

It’s noteworthy that global leveraged equity funds attracted a record $US14 billion in net inflows two weeks ago, almost triple the previous peak which occurred during the 2020 pandemic.

Leveraged ETFs were front and centre amidst this fund in-flow action. In fact, US leveraged long ETFs alone witnessed a record $US6.6 billion in inflows last week while the 3x leveraged Nasdaq 100 long ETF experienced $US2.3 billion of inflows.

The crypto sector also benefitted from this rise in leverage appetite, particularly AI-related tokens and trading pairs.

The Investment Implications of Rising Leverage

We see two main implications of this surge in leverage:

1. Volatility could be here to stay

The obvious implication of such a dramatic rise in leverage is that volatility is here to stay.

With a growing number of retail investors’ expectations tied to short term market movements, it’s likely that they’ll be scared by any more selloffs that emerge, which could lead to even more selling in that scenario.

With leverage at such high levels, the seedlings may even be in place for a larger capitulation selling event to eventuate in the coming weeks or months.

2. Or it may signal we’re close to a market bottom

The more bullish implication is that the market has bottomed, or is close to bottoming.

By way of comparison, the last time there was a surge in leverage like this was during the depths of the pandemic-inspired market selloff. Investors who geared up at the time to invest in equities became extremely wealthy in the ensuing couple of years. In fact, that remarkable event and its money-making aftermath has no doubt inspired more investors to take on leverage in anticipation of a market recovery this time around.

Having said that, this is not an exact science. It’s worth remembering that retail investors have gotten this wrong in the past.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Most Prudent Takeaway for Investors

The most prudent takeaway for most investors may be that buying weakness is almost always a sensible long term strategy without leverage adding to the wildness of the rollercoaster ride.

In short, forward-thinking investors can use this volatility to invest at valuations which are likely to look attractive when looking back in a couple of years.

Invest for the Long Term, Ignore the Noise

The recent spike in financial leverage is one of those data points that is likely to mean something significant in hindsight. Whether it marks the bottom of 2025’s market selloff or the beginning of a period of even higher volatility remains to be seen.

For most investors, the best thing to do is keep calm and carry on. Leave the leverage to the shorter term speculators of the world who are hopefully ready to lose a significant amount of their capital in the event they are wrong.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.