The US-Europe Fund Flow Dance

Simon Turner

Wed 30 Apr 2025 5 minutesA year ago, the US equities story was the about the only investment game in town. How things have changed since the US tariffs were announced and the ‘Trump Dump’ began.

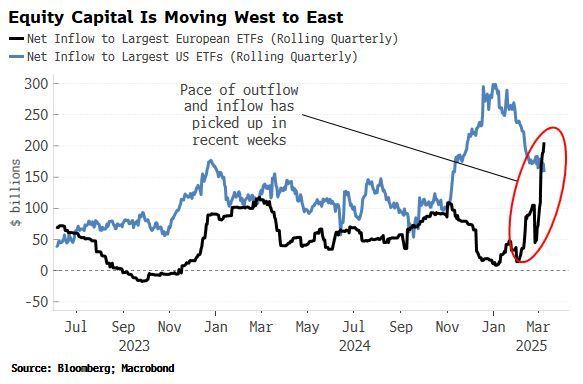

One of the most interesting resulting trends of 2025 has been the reversal of the capital flows into U.S. equities in favour of European stocks, which were previously about as out-of-favour as any regional equities.

If this trend continues, the potential implications for investors are significant…

US Funds are leaking Eastward

When one market loses, another generally wins in the connected world of global investment markets.

So during the Trump Dump in recent weeks, some of those US outflows have been finding a home in European markets. Investors have been attracted by rising European defence spending as a theme, and the lack of American tariffs targeting Europe.

For example, during the week ended April 16th, investors sold a net $US0.6 billion worth of US equity funds and bought a net $US1.1 billion of European equity funds. This represents a continuation of a trend reversal that’s been occurring since the start of the year.

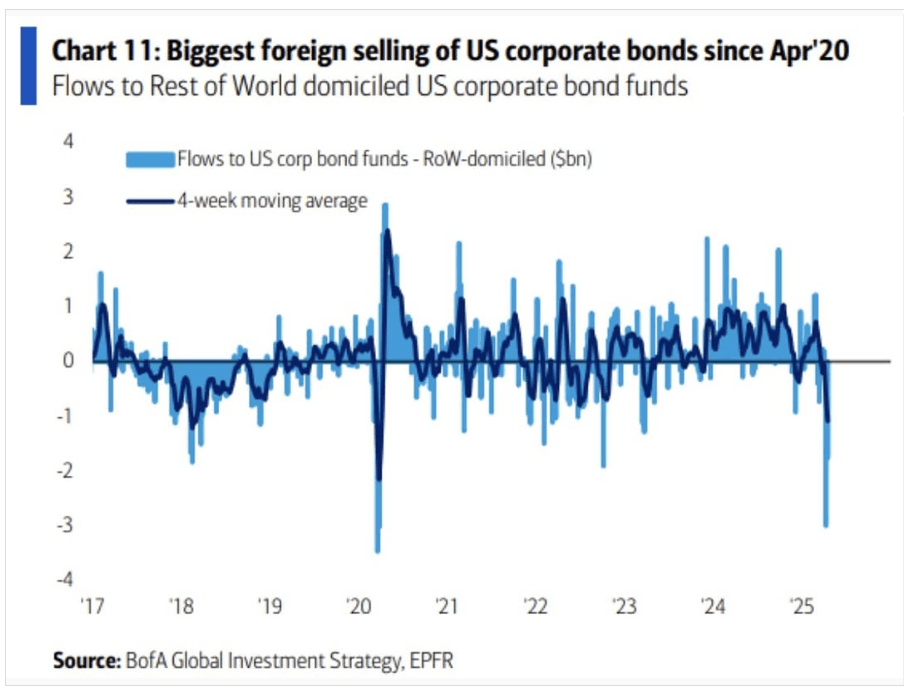

It’s a similar story in the US corporate bond market where we’ve just witnessed the biggest fund outflows since April 2020.

In short, 2025 is emerging as a very different beast to 2024. The name of the game is: shifting fund flow patterns away from the US.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Is this a shorter term blip or a longer term trend?

Of course, the million-dollar question is: is this a shorter term blip of the beginning of a longer term trend?

The answer probably relates more to events in the US than Europe since this shift relates more to Trump’s protectionist policies than it does to a resurgence in bullish growth drivers in Europe.

There are a number of noteworthy issues at play which may help answer this question…

- US insiders have started buying again.

US management teams have a solid track record of buying when their stocks are low and selling when they are high. So it’s worth keeping an eye on their trading activity.

Interestingly, net US insider buying has started trending upwards from cyclical lows of late. Over the past month, insider buy-sell ration trended upwards to 0.46 (according to Washington Service data), a 16-month high.

Whilst this ratio is improving which is bullish, the ratio of buyers to sellers is still more than 50% below the 1.0 recorded during the 2022 bear market.

- Buy the dip mentality no longer entrenched in US investors’ minds

In contrast to the past few years, US investors have become hesitant to buy the dips as market sentiment has deteriorated.

The most noteworthy example of this was when the recent 90-day tariff pause was announced. Rather than inspiring investors to aggressively buy an oversold market, as it would likely have done in 2024, it led to a tepid market response. That’s bearish at best.

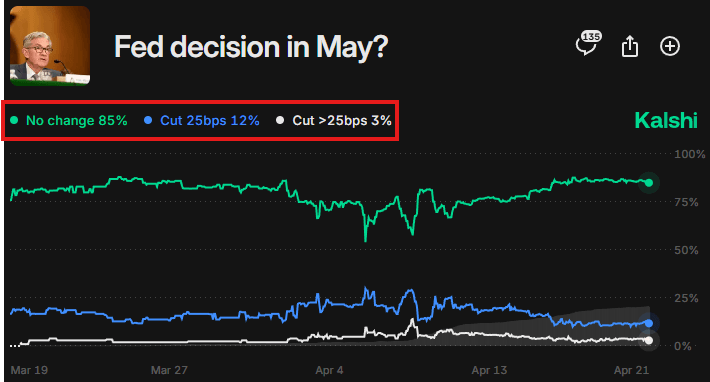

Markets have priced out a May Fed rate cut

Despite President Trump’s increasingly desperate calls for rate cuts from the Fed, markets have priced in an 85% chance of no rate cut occurring in May.

Fed Chair Powell responded to the growing presidential pressure by saying he’s ‘not in a hurry’ to cut rates. That’s not what Trump or investors wanted to hear.

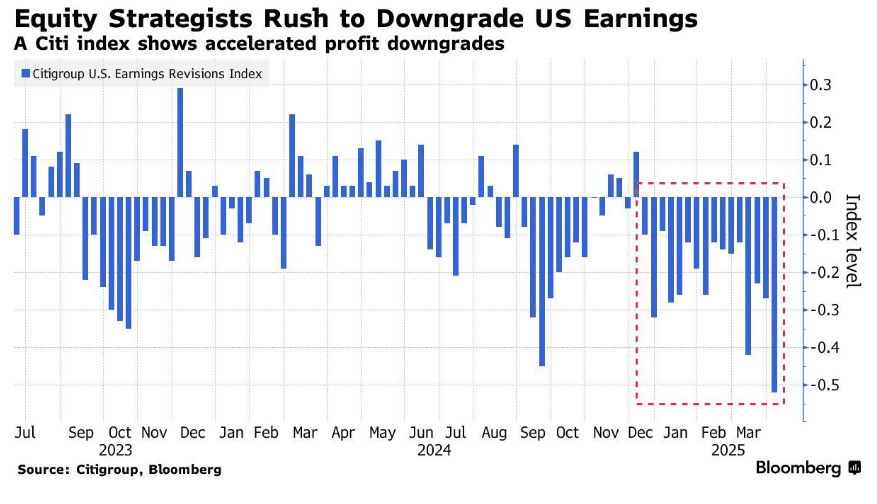

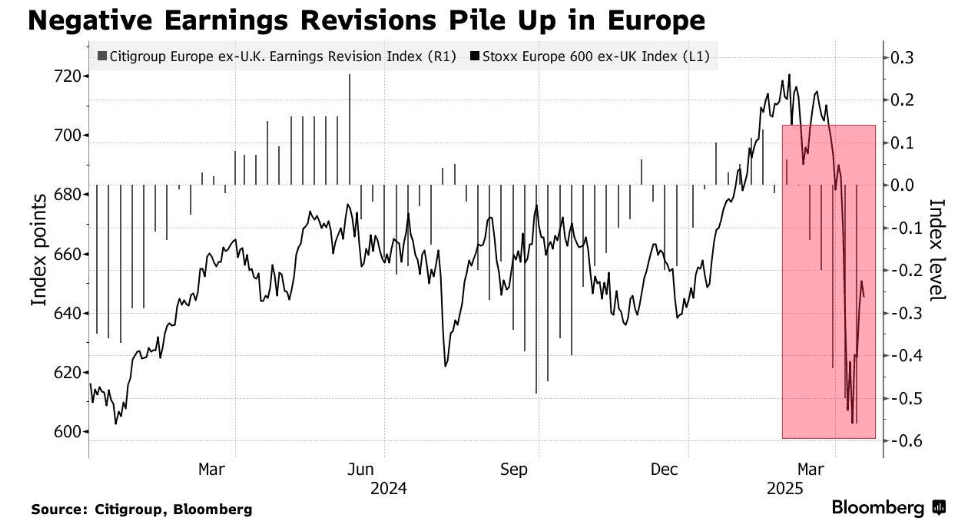

Earnings downgrades are happening in both the US & Europe

Of course, the direction of earnings estimates is also a key determinant of fund flows. Unfortunately, there’s bad news from both the US and Europe on that front.

In the US, earnings downgrades have been the name of the game since the start of the year.

The situation is similar in Europe where earnings downgrades have been flowing through in recent months.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Implications for Investors

We see two main implications for investors:

1. Remember the relative long-term track records of the US vs Europe

Don’t forget that the US-Europe fund flow dance has historically be won by the US due to its superior long-term economic growth, and a corporate culture focused on supporting earnings per share growth through consistent innovation and buybacks. Those drivers are structural in nature, and are unlikely to be altered by Trump’s presidency.

2. Longer term trends require longer term drivers

Most analysts would agree that the recent fund flows into Europe have been driven more by investors turning their backs on the US than by improving European growth prospects. That’s not necessarily a solid foundation for a longer term continuation of this trend.

The Fund Flow Dance will Continue

The trend is often your friend as an investor. At least, it is until it isn’t.

As such, the reversal of the long-term trend of funds flowing into US equities at the expense of other regions, including Europe, is causing many investors to reconsider their asset allocation.

However, the arguments in favour of long-term US stock ownership remain as compelling as ever. Make sure you don’t get sucked into the wrong side of the fund flow dance just before the tune changes.

Click here to view our latest debate - The S&P 500 during Trump 2.0

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.