Time to be overweight Japan

Simon Turner

Tue 16 Jul 2024 5 minutesFor many years since its 1989 peak the Japanese stock market underperformed its developed world counterparts, and most global investors’ Japanese allocations trended lower.

But that was then and this is now. The Japanese market recently broke through its 1989 peak propelled by improved governance, yen weakness, and better capital management.

At a time when most Australian investors are underweight the country, there are compelling reasons to expect sustained outperformance from the Japanese market looking forward. It’s a global opportunity worthy of attention.

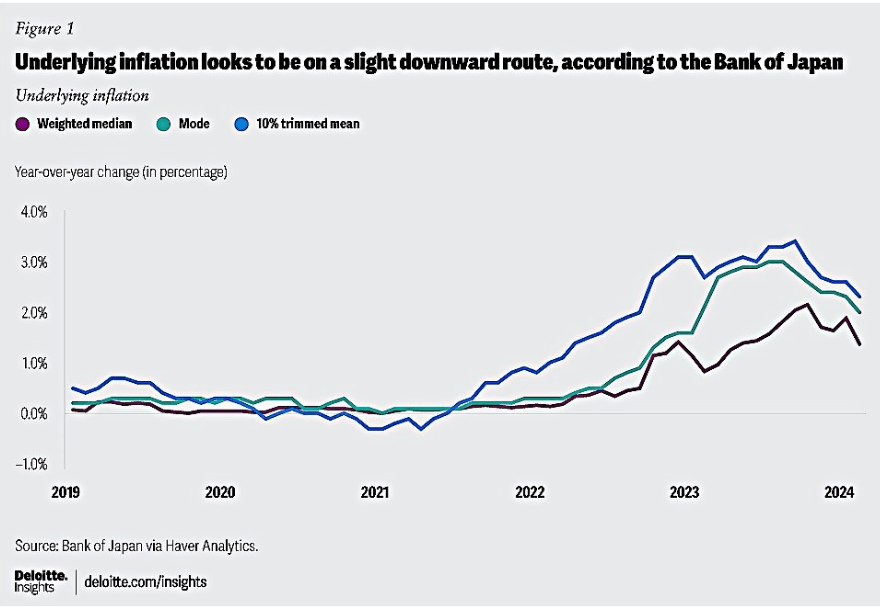

Inflation normalisation the name of the game

While the rest of the developed world has been fighting against higher inflation, the return of a healthy level of inflation to the Japanese economy after a long period of deflation is arguably the dominant (and positive) Japanese investment theme which has been driving recent outperformance.

Core inflation has exceeded 2% p.a. for the past two years, which effectively turns the Japanese bear case on its head.

Inflation normalisation is expected to lead to stronger consumption growth as Japanese households adapt to a world in which buying goods now makes more economic sense than waiting for them to become cheaper in the future—as was the case when deflation reigned supreme.

Wages growth inspiring productivity gains

Wages growth is a key driver of higher Japanese inflation, although it continues to lag the core inflation rate. However, given there are relatively severe labour shortages in Japan it seems likely that wages growth will increase from here.

Higher wages are also an important driver of productivity growth: an area in which Japan has historically lagged the developed world. Money is a powerful motivator. In response to higher wages, Japanese companies are demanding better productivity from their employees.

As a result, productivity growth is becoming an important value creation driver for Japanese companies.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

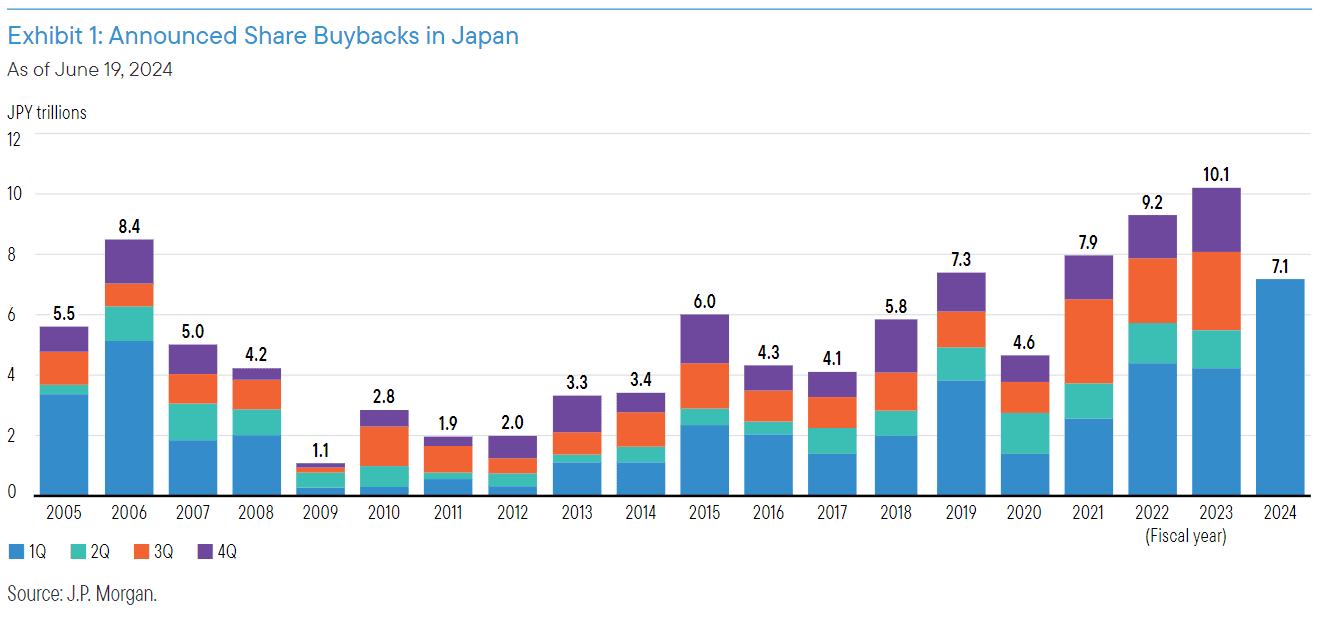

Corporate Japan in better shape

Japanese companies weren’t always known for being shareholder friendly, but they’ve upped their game in recent years. Most have started managing their balance sheets with a view to increasing their return on capital employed. With that goal in mind, buybacks are growing in popularity which is music to the ears of the investment world.

Attractive valuations & underweight investors

Despite the recent outperformance, Japanese equities are still trading at a significant discount to the MSCI World Index. As shown below, the MSCI Japan Index is trading at a forward price/earnings ratio of 15.6x—a 16% discount to the MSCI World Index.

The other compelling valuation metric is Japan’s price/book ratio. The MSCI Japan Index is trading at only 1.6x book value, which represents a chunky 54% discount to the MSCI World Index. And at a stock level, it’s still possible to find deep value Japanese stocks trading at a discount to book value. That’s unusual in a global context.

Low rates probably here to stay

The Japanese Government has long been focused on addressing the country’s deflation dilemma with currency weakness being a key instrument. A weaker yen has effectively imported inflation into the country as imported goods have become more expensive.

Whilst the yen has probably weakened more than the government would like, the Bank of Japan is unlikely to take any action that compromises the country’s economic progress. That means rates are unlikely to be raised significantly from current low levels, which creates a positive backdrop for Japanese stocks.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

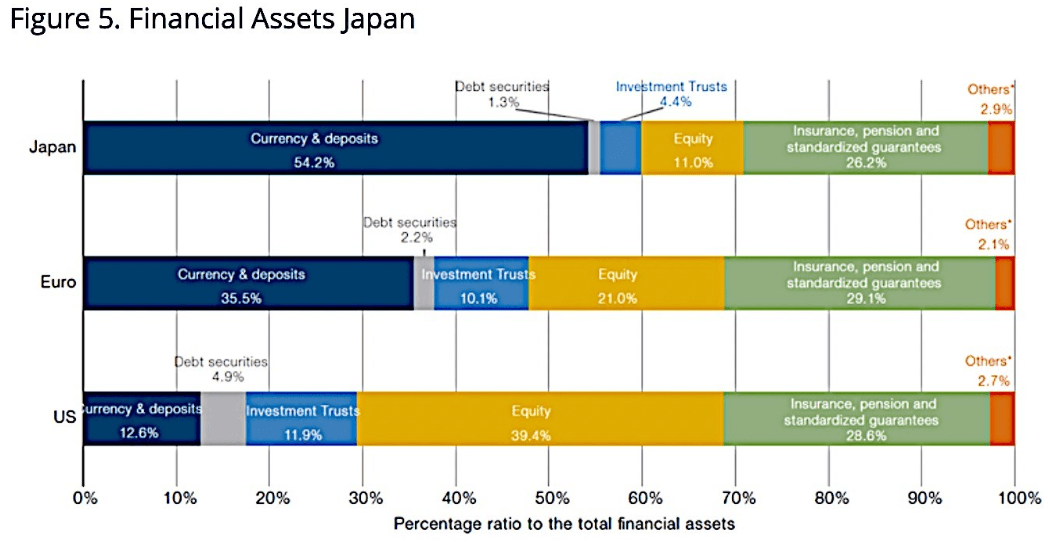

Japanese households’ growing risk appetite

Japanese investors are famously risk averse. According to the Bank of Japan data below, Japanese households hold a massive 54% of their financial assets in bank deposits versus only 11% in equities.

With many bank deposits now generating negative real returns, this ultra-conservative positioning appears likely to change. As more households reach the conclusion that inflation is here to stay and thus their bank deposits will continue to erode in value, it’s likely they’ll increase their equity exposure to gain exposure to an asset class with inflation protecting attributes.

This situation is likely to be exacerbated by the Japanese government’s recent Nippon Individual Savings Accounts (NISAs) changes which have tripled the maximum that can be invested while extending the tax deferral period. NISA inflows have quadrupled as a result, with a much higher than normal portion flowing into Japanese equities.

How to gain exposure

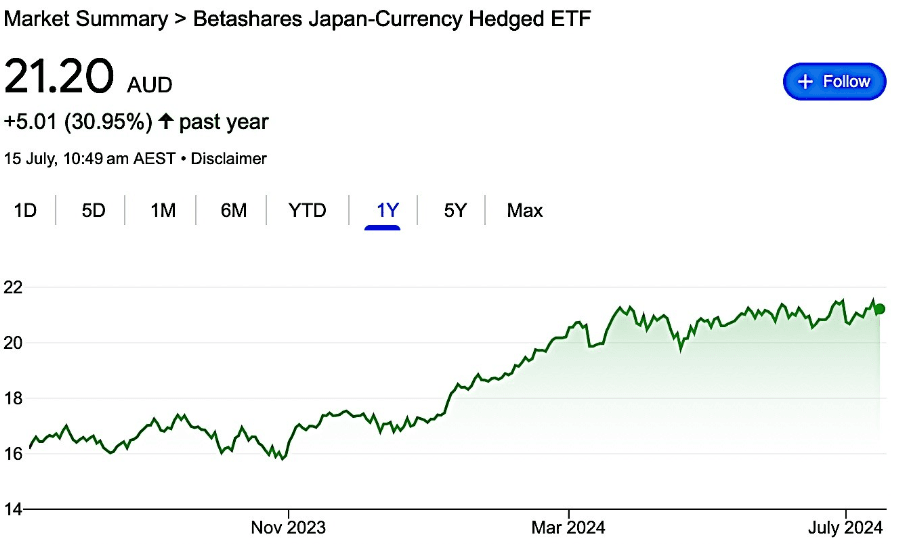

For most Australian investors, funds and ETFs such as Betashares Japan ETF (ASX: HJPN) will be the easiest way to gain exposure to the Japanese investment theme. You can search for funds with Japanese exposure at https://www.investmentmarkets.com.au/investments.

A compelling global opportunity

There are structural reasons to expect further Japanese outperformance in the coming months and years.

Return on equity is trending upwards and valuations remain attractive. At the same time, demand for Japanese equities is structurally rising driven by the return of inflation and corporate Japan becoming more shareholder friendly. Bearing in mind most global, Japanese, and Australian investors are underweight Japan, the country’s undervaluation versus other developed markets seems unlikely to last forever.

Japanese-focused funds and ETFs stand out as one of the more compelling global opportunities at this juncture.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.