Time to concentrate on over-concentration

Ankita Rai

Fri 12 Jul 2024 6 minutesIndex concentration is increasingly becoming a concern for investors worldwide.

Consider the S&P 500 Index, the most popular benchmark for US stocks. Over the past decade, the top 10 companies' share of the index's market value has surged from 14% to 33%. This means investing in the S&P 500 largely hinges on the performance of these top 10 companies, the majority of which are tech giants.

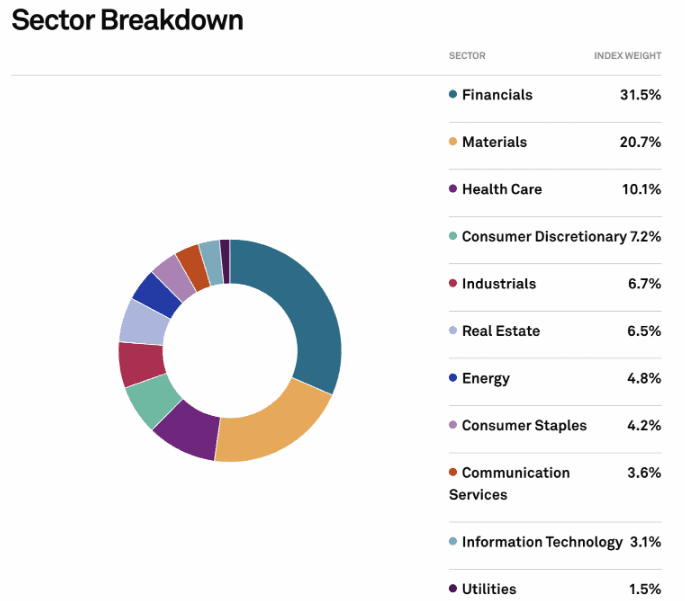

Back home, the concentration issue is even more pronounced. The top 10 constituents of the ASX 200 account for a significant 47% of the index, with banks and material companies dominating. Unlike the S&P 500, which is concentrated in emerging trends such as technology, the ASX 200 remains heavily weighted towards traditional sectors. The financial and materials sectors make up a hefty 52% of the ASX 200 index’s total weight.

Concentration risks: A call for diversification

This trend of a few stocks dominating major equity indices can significantly impact investor returns given most equity strategies, both passive and active, are benchmarked against the major indices like the S&P/ASX 200 or 300.

Since banks and materials stocks dominate the local market, a purely passive exposure to the S&P/ASX 200 will be heavily skewed towards these sectors, which can pose noteworthy risks for investors.

For instance, the top 10 megacaps on the ASX 200 are primarily major banks heavily leveraged in property, or miners dependent on global iron ore demand, particularly from China.

Commonwealth Bank was also recently downgraded by Citi along with other major banks like Westpac, ANZ, and NAB due to intense mortgage competition, slowing credit growth and stretched valuations. Despite these sectoral headwinds, banks make up 30% of the ASX 200.

So investors who buy ASX 200 ETFs to achieve diversification are more exposed to the top stocks such as BHP, CBA, ANZ, Westpac and NAB than they may realise.

An equal-weight approach to avoid concentration risks

The big challenge for Australian investors is diversifying away from the largest stocks without taking on too much risk.

One way to add diversification in a narrow, top-heavy market like Australia is to use an equal-weight approach instead of the typical market-cap-weighted exposure.

Unlike a market-cap-weighted index, which allocates investments based on the market value of the stocks it covers, an equal-weighted ETF spreads investments evenly across all the companies in the index. This approach reduces the impact of any single stock on the overall portfolio.

For example, BHP Group makes up 9% of the ASX 200 index, while the financial sector accounts for around 30%. But in an equal-weighted ETF like the VanEck Australian Equal Weight ETF (ASX: MVW), the financials sector's share drops to just 20%, and materials, including BHP, come in at 17%. Moreover, it includes mid-tier mining companies like Lynas Rare Earths and Pilbara Minerals. With 76 holdings, the VanEck Australian Equal Weight ETF provides a more balanced exposure across large and mid-cap Australian shares.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Mid-caps are a sweet spot for diversification

While the largest-cap stocks trading on the ASX are undoubtedly formidable entities due to their size, their growth potential is limited and less attractive than their smaller peers.

FactSet forecasts indicate that the S&P/ASX 20 is expected to report earnings per share growth of 3% this financial year compared to 11.1 per cent for the S&P/ASX Midcap 50.

It’s fair to say the dominant large-cap stocks may not the sweet spot on the ASX at this point.

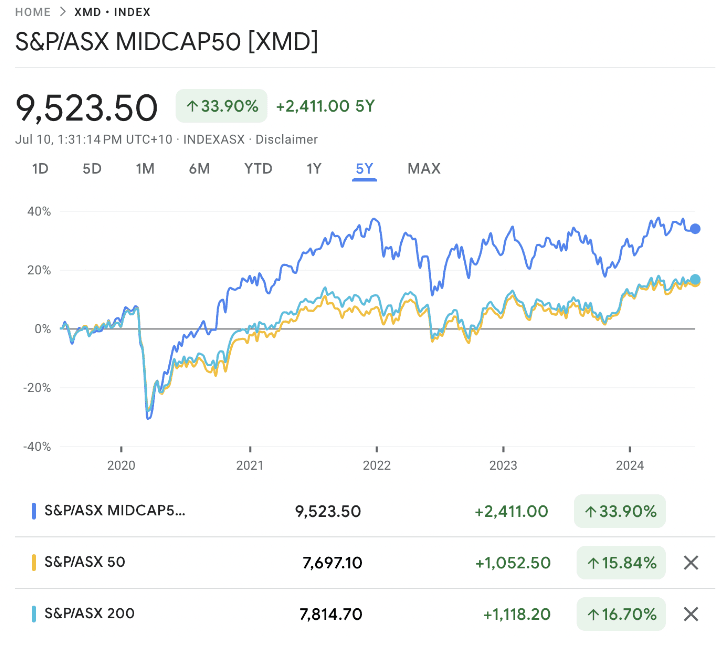

In fact, the S&P/ASX MidCap 50 is up 4.7% in the last six months, outperforming the S&P/ASX 50. The mid cap segment has also demonstrated superior performance over a 5-year period.

The S&P/ASX MidCap 50 is also much less concentrated than the large-cap and broad market indices.

For the S&P/ASX 50 and S&P/ASX 200, the top 10 companies represent 60% and 48% of the index weight, respectively, with Financials accounting for half of the top 10 weight in both indices. In contrast, the top 10 companies in the S&P/ASX MidCap 50 comprise 35% of index weight, reflecting a more diverse sector spread.

With reduced exposure to financials and materials, the S&P/ASX Midcap 50 provides greater representation of the industrials sector, along with many companies poised to benefit from technological advancements and disruptive innovation.

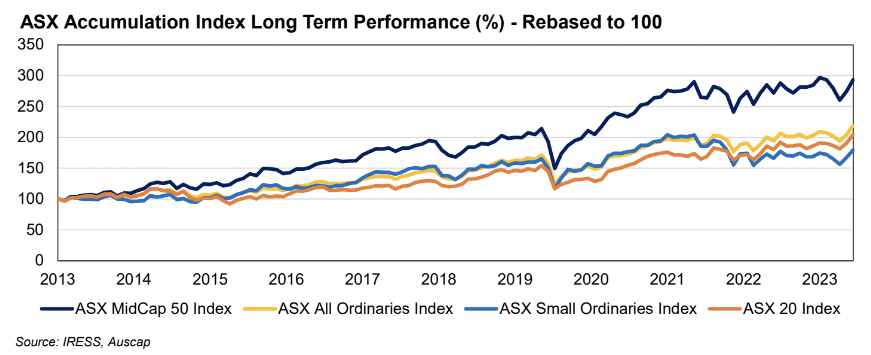

Not just this, over the past decade, mid-caps have consistently outperformed large and small-caps. Since 2013, the ASX Mid Cap Accumulation Index has risen 193%, compared to returns of 119% for the All Ordinaries Accumulation Index and 104% for the ASX 20 Accumulation Index.

Despite this, mid-cap companies constitute 12% of a broad-based portfolios on average. This limited exposure may lead investors to overlook promising mid cap ETFs and funds exposed to technology, healthcare, resources, and building materials, which offer better growth potential than mega-cap stocks.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Maximising returns and managing risk

While mega-cap stocks on the ASX provide stability, relying solely on the 'winner takes it all' strategy of investing in the biggest companies is not always the most profitable.

Including mid-cap stocks in your portfolio, as well as employing equal-weight strategies, is likely to boost your long-term returns while reducing your reliance on megacaps. This approach has the potential to help investors better navigate markets over the long term.

What it means for investors

With nearly half of the ASX 200 concentrated in just 10 companies, primarily banks and materials, diversifying into mid-cap companies can help mitigate risks and tap into emerging sectors like technology and healthcare.

Utilising equal-weight ETFs such as the VanEck Australian Equal Weight ETF offers a balanced approach by distributing investments evenly across all index components. This strategy reduces reliance on a few large-cap stocks, potentially increasing exposure to overlooked mid-cap companies.

Investing in index-agnostic managed funds which are heavily exposed to mid-caps is another potentially fruitful strategy to gain exposure to the growth-focused segments of the market rather than being overexposed to the largest stocks.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.