You may be surprised by the minimum assets you need for an SMSF

Simon Turner

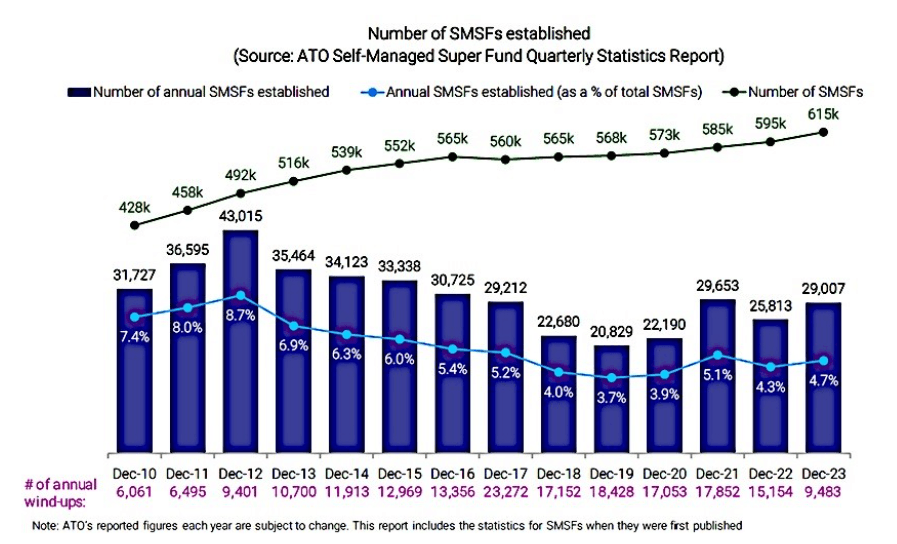

Mon 21 Oct 2024 5 minutesThe inexorable rise of the SMSF continues with the SMSF count reaching 616,400 in March and the number of members hitting 1.1 million. Whilst that’s less than 5% of the Australian population, SMSF investors account for an impressive 24% of the $4 trillion invested in superannuation. In other words, SMSF investors are a wealthy and powerful bunch with growing financial clout.

So why are so many people joining the ranks of SMSF investors each year? And what is the minimum level of assets needed for an SMSF?

The SMSF explosion

The number of SMSFs has been consistently rising, increasing by almost 50% over the past 13 years.

This trend is likely to continue. In fact, it’s expected that 2 million Australians will be SMSF members within the next 15 years. There are a few main reasons:

Greater control of their investment strategy – As an SMSF trustee, investors have greater control over the assets they invest in, including assets which super funds don’t typically invest in like property and collectibles.

Tax benefits – SMSF investors benefit from a host of tax benefits including:

-Capital gains tax (CGT) exemptions - Assets held for more than twelve months during the full pension phase are exempt from CGT.

-Income tax exemptions – SMSFs in the full pension phase are exempt from paying income tax on earnings.

-Concessional contributions – Employer and personal contributions are taxed at 15%.

The ability to pool funds across families – ATO figures show that 76% of SMSFs have at least two members, so this is clearly a popular benefit which helps enable SMSFs to achieve economies of scale and thus better investment returns.

Falling establishment costs – Automation and online platforms have helped streamline the process and thus reduce establishment costs for many investors.

With such compelling benefits on offer, setting up and managing an SMSF may well make sense for you, but there’s a caveat coming.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The lowdown on SMSF setup costs

The costs of running an SMSF directly affect the amount of assets that’s economic to manage in an SMSF structure, so this is valuable information for all investors considering SMSFs.

ASIC used to advise investors that average SMSF running costs were $13,900, but they removed that guidance in 2022 in response to industry pushback.

More recently, the ATO has guided that ‘fund expenses are proportionally higher, and net returns lower, for lower balance funds.’ The ATO’s most recent measure of SMSF running costs came in at $16,314 on average while the median was $9,104. That may be a bigger number than some budding SMSF investors may be aware of.

It’s also worth bearing in mind that in addition to high running costs, SMSFs require a serious commitment from their members since there are complex legal requirements to fulfil.

The magic minimum SMSF asset number

By way of background, during FY23, the average assets per SMSF was $1.6 million whilst the median was $877k. Per member, the average assets was $835k and the median assets was $498k. That tells us that there are some very large SMSFs which are skewing the average well above the median, and thus the median is the more useful number for typical SMSF investors.

That’s the reality, but what’s the right magic minimum asset number needed to carry the costs of running an SMSF?

Back when ASIC was providing SMSF guidance, they advised investors that a minimum of $500k was a prudent starting point for setting up and managing an SMSF.

To gauge whether this is the right ballpark, let’s start with the median SMSF running costs of $9,104.

The next question is: what’s a fair annual percentage fee to pay for the benefits of SMSFs?

I’ll take a stab at answering that question subjectively. Investing through SMSFs feels like a high value add service to me, so I don’t see it as comparable to low cost ETFs. Equally, I don’t see SMSFs as a significantly higher value add service than a top performing managed fund.

So let’s assume a fair running cost for SMSF is similar to an average managed fund fee—which is around 1.5% p.a.

Working backwards, that implies that the minimum total assets needed to justify the median SMSF running costs is $606,933.

Intuitively, around $600k feels about right as a realistic minimum. Given that’s well below the current SMSF median of $877k, this is likely to be more valuable and potentially surprising information to budding SMSF investors considering their options rather than the existing cohort.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

SMSFs may be right for those with sufficient assets

With SMSFs continuing to grow in popularity, you may feel tempted to investigate this tax-advantaged superannuation structure. The key point to be aware of is that there are compelling reasons to set up an SMSF, but only if you have sufficient assets to carry the not insignificant running costs.

Based on our calculations you’ll probably want at least $600k to invest in an SMSF to make it worth your while. Otherwise, you risk eroding your investment returns by bearing an excessive proportion of running costs.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.