How to invest in start-ups without losing your shirt

Simon Turner

Wed 23 Oct 2024 6 minutesWith ‘brain drain’ increasingly being the name of the game in the publicly listed markets, not to mention the ever present pull of the US market for innovative emerging Australian businesses in the need of capital, it’s hard to ignore the growing role of private equity and direct start-up investing in most investors’ portfolios.

It’s also hard to ignore the fact that start-up investing entails its own unique risks. Many investors have been wrong-footed by the marked differences of start-up investing versus investing in publicly listed companies.

The good news is with the right strategy it’s possible to invest in a portfolio of start-ups without losing your shirt.

The unique risks of start-up investing

Investing in the equity of any publicly listed company involves taking on stock specific and market risks. That’s the nature of the investing game.

On that note, publicly listed stocks generally have a long term history of supplying detailed financial data to the market, so the list of known risks is generally well understood. Of course, there are also unknown risks with all investments, but they tend to be inversely correlated with the clarity of the known risks.

As a result, public market investors are generally able to assess and price most companies’ known specific risks with a degree of accuracy. Having said that, most research confirms that the publicly listed markets are not perfectly efficient, particularly at the smaller end of the market.

However, the public markets are a lot more efficient than the start-up investing world, where the list of known risks is generally shorter and the list of unknown risks is often significantly longer.

So the best way to come to start-up investing is with your eyes wide open. That means understanding both the known and unknown risks you’re likely to have to navigate if you invest in this asset class.

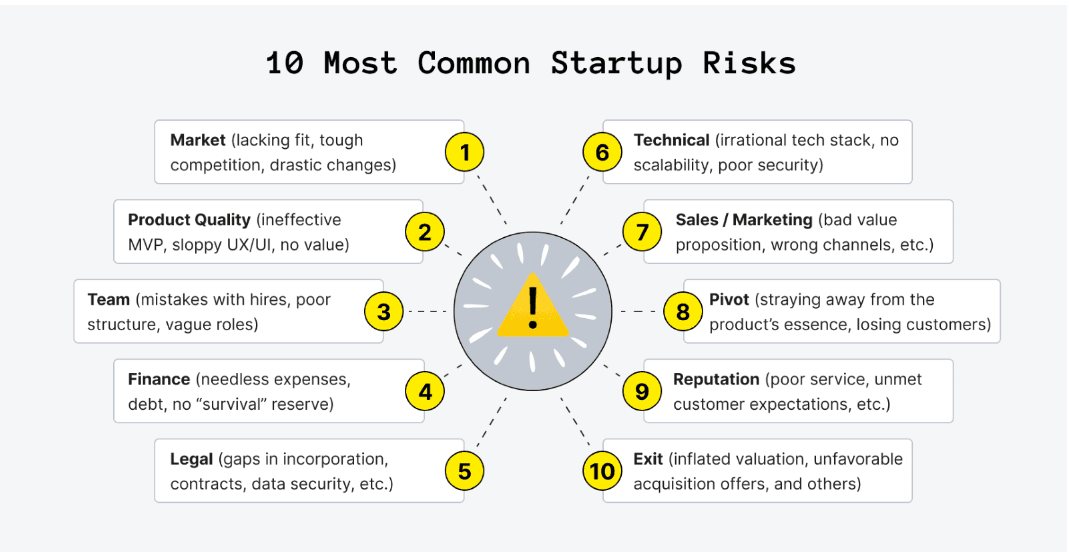

Here are 10 of the most common risks it’s safe to assume are par for the course when assessing potential start-ups for investment:

Market Risk: All start-ups must meet a real need in the market. However, many fail to achieve product-market fit, or they face market size limitations, overwhelming competition, or market changes that jeopardize their success. So conducting proof-of-concept testing is essential.

Product Quality Risk: All start-ups must provide high quality products or services if they have a chance of carving out a market share. During the all-important transition from proof-of-concept to creating a minimum viable product (MVP) quality and cost must also be balanced.

Team Risk: Establishing a competent and well-structured management team with aligned goals is crucial for all start-ups. The truth is mismanagement in hiring, team dynamics, and maintaining a good work-life balance often impedes their progress.

Financial Risk: Financial management is critical for all start-ups. For example, start-up management teams need to be able to plan expenses, prioritise spending, avoid excessive debt, and establish an emergency fund to manage unexpected costs. Failure to do so can be fatal.

Legal Risk: Start-up management teams must be able to navigate legal complexities, such as proper incorporation, intellectual property protections, and clear contracts to prevent future disputes. Litigation and compliance issues can arise without proper legal safeguards.

Technical Risk: Prudent technology selection is essential for all start-ups so they can scale in a secure manner. Functional technology integration, robust security measures, and avoiding dependencies on single vendors are needed.

Marketing Risk: Start-ups need clear value propositions and targeted marketing strategies to engage their audience effectively. Tracking and analysing data is essential for optimizing their sales and marketing efforts.

Pivot Risk: Business pivots can be risky as they might upset existing customers and can lead to ongoing business challenges.

Reputational Risk: Protecting start-ups’ reputations involves safeguarding user data, delivering on promises, maintaining software quality, and ethical business practices. The downside of a poor reputation is long-lasting damage to the business.

Exit Risk: Start-up management teams must consider their investors’ long-term exit plans, whether it be selling or going public. Ensuring realistic valuations, favourable terms during acquisitions, and readiness for public scrutiny is crucial for a successful exit strategy.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Why diversification is crucial in the start-up world

So you’ve accepted the fact that the risks of investing in start-ups are significantly higher than for investing in publicly listed stocks. That means you’ll need a customised strategy for start-up investing aimed at maximizing the potential upsides and minimizing the potential downsides.

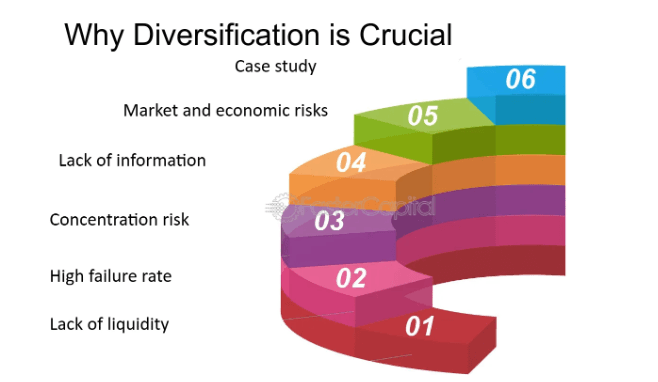

Enter the role of diversification. Portfolio diversification is essential if investors are to successfully navigate the inherent illiquidity, high failure rate, lack of information, and the other risks of investing in start-ups mentioned above.

In Sir John Templeton’s words: ‘The only investors who shouldn’t diversify are those you are right 100% of the time.’

Given a realistic success rate for start-up investing will almost always be much lower than for the publicly listed markets due to the higher risk profile, the implication is that a lot more diversification is warranted in the start-up world.

While 10-20 stocks may be sufficient diversification for a portfolio of publicly stocks, the comparable number is likely to be much higher for a start-up portfolio (think 40+).

Also, a more nuanced approach to diversification than purely the number of stocks in a portfolio is likely to prove useful.

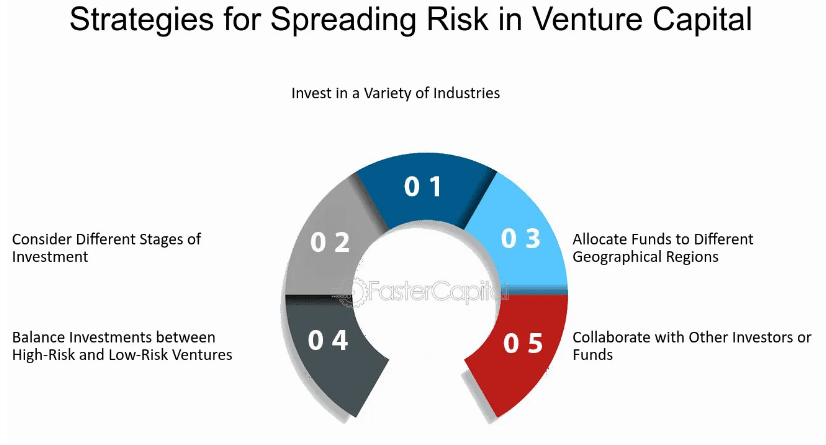

For example, most successful start-up investors tend to diversify their risks across companies involved in a variety of industries, with a range of risk profiles, at various stages of investment, and in different geographies.

In addition, there’s another important diversification strategy to be aware of: by exit strategy. Ensuring your start-up portfolio is invested in companies positioned for a range of trade sales, IPOs, and management buyouts is likely to reduce your risk of being exposed to the dynamics of one particular market.

By diversifying your start-up portfolio across all these attributes, you’re more likely to be positioned to generate the type of risk-adjusted returns the asset class is famous for.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Prepare yourself to succeed as a start-up investor

Plenty of investors have made their fortunes by investing in start-ups that have increased in value by 10x or even 100x. But many have lost a lot of money by underestimating the risks of start-up investing.

The key to success in this asset class is to understand that a small portion of your start-up portfolio is likely to increase many-fold over the long term whilst a large portion will fail. By investing across industries, risk profiles, geographies, and exit strategies, investors are far more likely to generate the solid risk-adjusted returns they’re aiming for in this higher risk asset class.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.