The Fed’s cut may be the starter gun for small cap outperformance

Ankita Rai

Thu 24 Oct 2024 5 minutesWith the Fed initiating a rate cutting cycle in September, investors are increasingly focusing on asset classes positioned to outperform in a falling rate environment.

Enter smaller companies. Historically, small-cap stocks have outperformed their larger counterparts during periods of declining interest rates — and this trend seems to be taking hold as both global and domestic small-cap benchmarks have shown improved performance in recent months.

With low valuations and the prospect of easing rates, small-cap funds could present compelling opportunities at this juncture.

Small caps present an attractive value opportunity

Global equity markets have experienced a significant rally this year, largely driven by large-cap growth stocks in the technology sector. In Australia, the market is similarly dominated by heavyweights like the Big Four banks and the resources sector, which have been the main drivers of market growth.

Small-caps have struggled to keep pace, but with global interest rates showing signs of stabilising or beginning to fall, capital may start flowing back into small-cap stocks.

Recent data from investment firms like JP Morgan points to the unwinding of short positions on small caps globally, further supporting this trend.

Signs of recovery are already emerging, as evidenced by the S&P/ASX Small Ordinaries Index, which has increased nearly 5.8% over the past month, while the larger S&P/ASX 200 Index has only risen by 2.2%.

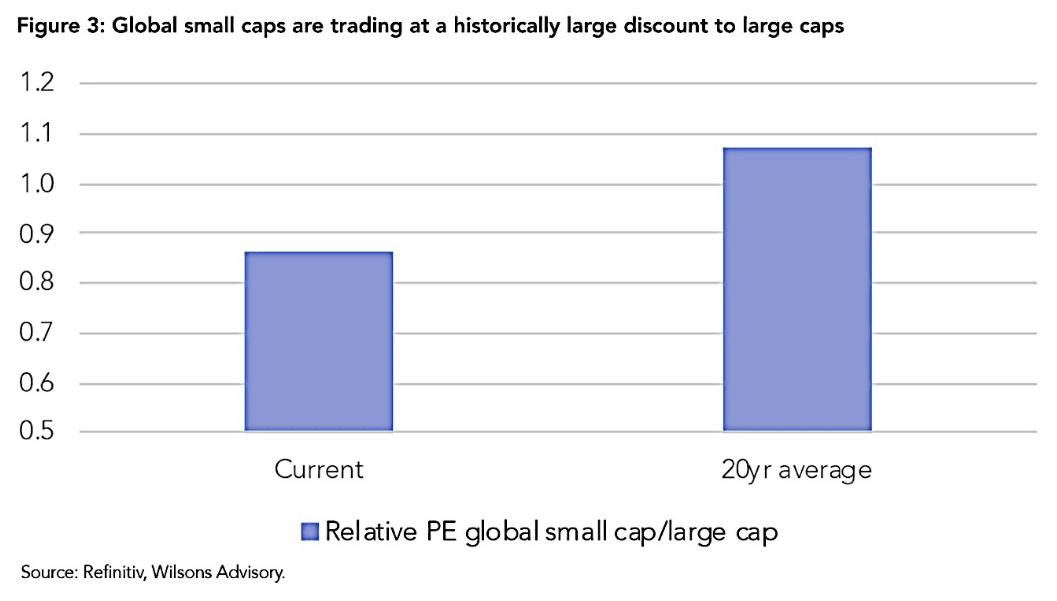

Despite this recent outperformance, small caps still trade at attractive discounts relative to large caps. Small-cap stocks have historically offered strong investment opportunities when their price-to-book value (P/BV) ratios are lower than large caps, especially during favourable economic conditions—which is the case now.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Navigating economic cycles with small caps

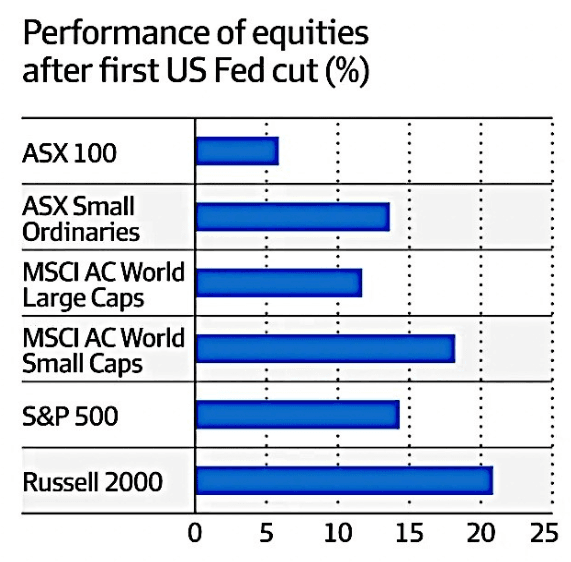

The global monetary policy cycle has a significant impact on small-cap stock performance. Typically, during periods when central banks are cutting rates, small-caps tend to outperform large-cap stocks by more than 10% on average.

This trend is especially promising for small-cap stocks in Australia, particularly when we look at the historical data. Over the past 30 years, the S&P/ASX Small Ordinaries Index has outperformed the S&P/ASX 100 by 8% in total returns within one year after the Federal Reserve begins an easing cycle.

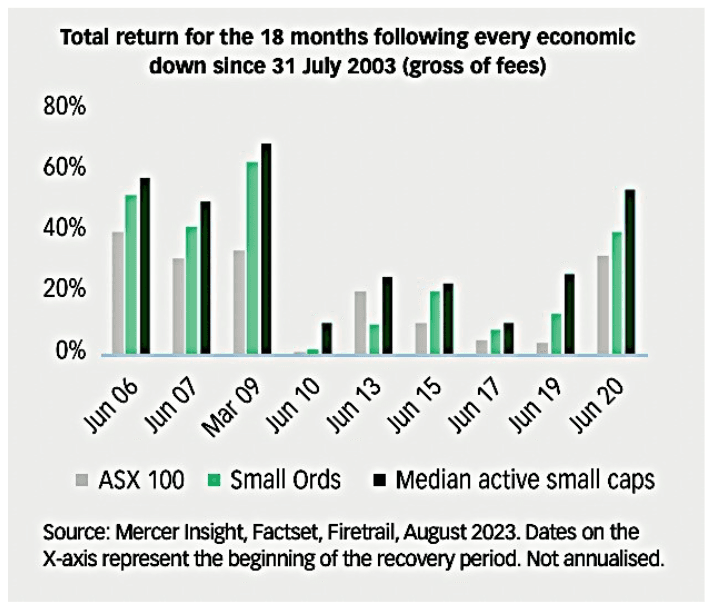

This context highlights the resilience of small-cap managed funds during the recovery phases. For example, according to Firetrail Investments, the Australian economy has gone through nine periods of slowing growth in the last two decades. And in each recovery phase, the median active manager of small-cap funds has outperformed the ASX 100 index, achieving an average total return of 37%—nearly double the ASX 100's 20% return.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Active management could be key to small cap success

While attractive valuations in small-cap stocks present outperformance opportunities, they also require careful consideration. These stocks come with inherent risks, including the small size of both the market and the companies, volatility, and a lack of competitive advantages compared to larger firms.

In fact, the total market cap of the Small Ordinaries is only about $360 billion, and many of these companies are still in their startup phases.

Therefore, identifying small caps with low debt levels, high returns, and strong growth potential requires an active management approach to effectively navigate market fluctuations and capitalise on emerging opportunities.

Managed funds can help mitigate some of these risks associated with the cyclical nature of small-cap performance. Instead of a static allocation to small caps, managed funds enable investors to adjust their exposure based on market conditions and company fundamentals.

Take the Montgomery Small Companies Fund as an example. It invests in emerging companies in Australia and New Zealand that have strong growth potential and has returned 17.7% in the last year. It has outperformed the S&P/ASX Small Ordinaries Index by 33% since its inception in 2019.

Another option is the Pengana Emerging Companies Fund, which targets high-growth smaller companies. During the year to September, the fund posted a return of 20.5%.

Maximising alpha in small caps

Given their tendency to perform well during economic recoveries—particularly when interest rates decline—now could be a strategic time for investors to consider increasing their exposure to small-caps.

With valuations looking attractive and the potential for growth as the economy stabilises, small caps could offer significant upside, especially when paired with active management.

While investing in small cap funds is not without its challenges, the current asset-class tailwinds indicate that these funds could generate solid returns over the long term. It’s worth considering them as part of your investment strategy.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.