Are small caps out of the woods?

Simon Turner

Wed 14 Feb 2024 8 minutesIt’s been a torrid couple of years for ASX smaller companies with most investors turning their backs on the asset class like the plague. The extent of their recent disfavour has been hard to fathom given the positive trend in equities since the pandemic.

This raises the question: is now the right time to revisit small and micro caps whilst others remain fearful? To answer that, we’ll need to delve into the reasons for the recent underperformance for a steer as to what’s coming next…

Small and micro caps defined

In Australia, the Small Ordinaries Index is generally regarded as the main benchmark for small cap investors and managers. The Small Ords includes stocks which are included in the ASX300 but not in the ASX100. These companies are usually valued at between $500m and $2bn, while the median market cap is around $1.2 billion.

Micro caps are smaller than small caps. They are usually defined as being the largest 600 companies on the ASX excluding the companies in the Small Ordinaries Index. These stocks generally have market caps of $500m and below.

In general, the smaller the company the higher the risk profile since larger companies tend to be more mature and established, whilst smaller companies are often emerging and innovative.

The small cap effect

You may have heard of the small cap effect. It’s a well-established financial theory which suggests that smaller companies should outperform their larger peers over the long term.

The reasoning behind the small cap effect theory makes intuitive sense to most investors:

Smaller companies have greater growth potential than larger companies because they are starting from a lower base and have a longer growth runway ahead of them.

Smaller companies are more likely to be undervalued than larger companies because less investors and analysts follow them. In other words, smaller companies are a less efficient asset class than larger companies.

Smaller companies often have more innovative business models than larger companies and are more adaptable to changing market conditions and opportunities.

Smaller companies are regarded by most investors as higher risk due to the higher risk of capital loss by unproven business models with limited financial resources. Higher risk investments are generally expected to generate a superior rate of return to compensate for the additional risk.

Sounds good, right? Now for the more sobering local news.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Reality bites

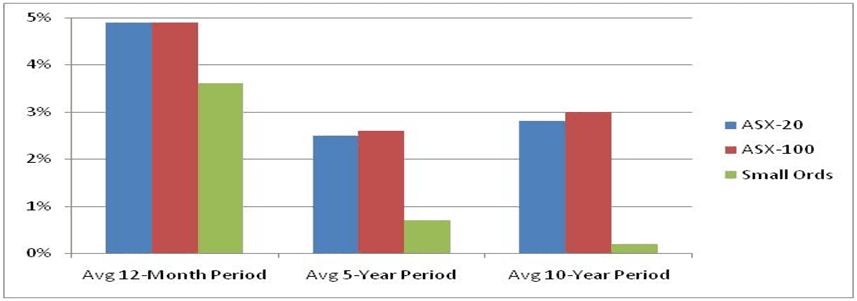

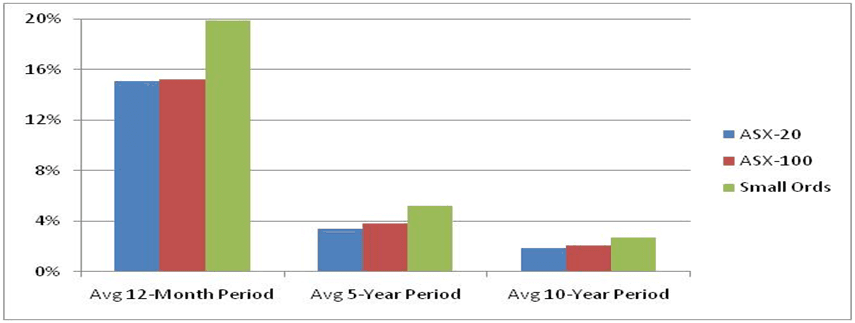

Despite the intuitive power of the small cap effect, ASX listed smaller companies have underperformed the ASX100 and the ASX200 over all timeframes of up to ten years, and the longer the timeframe the greater the underperformance—as shown below. This trend has continued since the data period which ends at June 30th 2023.

In addition, the standard deviation of smaller company returns (to June 30th 2023) has been higher in each timeframe—as shown below. In other words, volatility and risk has been higher in small caps.

Hence, ASX smaller companies’ investors have be exposed to greater risks without being compensated for it. This contradicts the small cap effect theory.

Why the underperformance?

So what’s going on to explain smaller companies’ short and long term underperformance?

Firstly, smaller companies have generally faced greater operational challenges than their larger peers during and after the pandemic due to their smaller critical mass and greater dependence on key staff and assets. Some would argue the extent of their higher risk profiles was laid bare by the pandemic.

Secondly, whilst the trend in equities has been upward since the pandemic, most investors have been focused on buying equities with lower risk profiles and defensive attributes. So larger defensive stocks have generally outperformed, whilst smaller and more cyclical companies have tended to fall off investors’ radars. Given cyclicality is greater and liquidity is lower at the smaller companies end of the market, this period of subdued interest has led to accentuated underperformance across the asset class.

And thirdly, evidence-based fund managers have rightly avoided smaller companies in recent years in favour of better value and momentum elsewhere. In the words of Chris Leitner at Leitner & Company …

“Since our formation in 1999, we’ve increasingly avoided small-cap stocks. That’s because they’ve mostly and usually offered mediocre and often poor value, and their overall returns prove it. Yet there are always a few diamonds in the rough, and we also seek to own individual under-priced securities regardless of their capitalisation. Value, in other words, trumps size.”

Chris’s comment that value trumps size is hard to argue with.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Buy when others are fearful?

Bearing in mind the reasons for ASX smaller company underperformance, there are compelling reasons to expect an imminent reversal of the asset class’s fortunes. Namely:

A shift in the expected direction of future interest rates has occurred. When interest rates were rising, investors were focused on buying lower risk, more liquid, defensive stocks which were well-positioned to weather the potential economic fallout caused by the fastest rate rising cycle in history. However, with most economists expecting the RBA to begin cutting rates from September onwards, investors are likely to change their tune on this front. In a falling interest rate environment, it’s likely that the higher risk and cyclical market sectors will take over market leadership whilst defensives may underperform. A headwind for smaller companies could well turn into a tailwind which implies a brighter outlook.

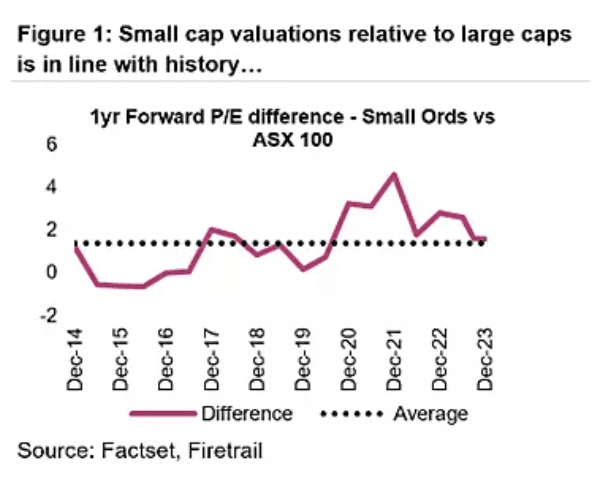

Valuations have decreased and many unprofitable companies have lost their lofty valuations. Whilst smaller companies have intermittently traded at premium valuations reflecting their superior growth prospects, in general that has changed over the past two years—as shown below. As a hunting ground, smaller companies are now far more interesting as a result.

Most investors are underweight smaller companies. One of the secrets to outperforming is to buy an undervalued company within an undervalued asset class before it inflects higher and attracts the momentum buyers. With most investors being so underweight smaller companies, now could well be a timely entry point into this asset class for longer term investors.

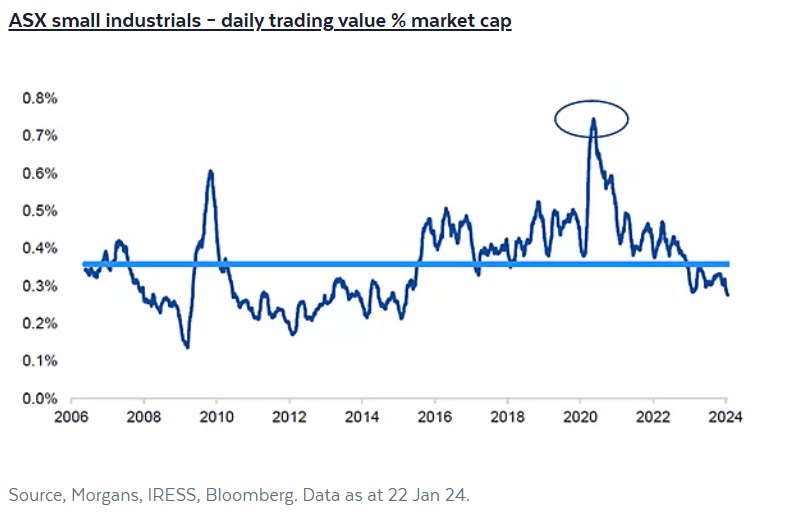

Glaring inefficiencies have emerged. With smaller companies’ liquidity levels having fallen significantly as shown below, the extent of the market inefficiencies at this end of the market has by definition increased. Inefficient markets spell alpha generation potential for seasoned investors, so it appears that a noteworthy investment opportunity is in the making here. It’s also important to understand that this has occurred whilst the fundamentals have been improving for a large portion of the smaller companies’ universe. According to Factset/Firetrail estimates, the 3 year forward EPS CAGR is 14.1% p.a. for the Small Ords versus 2.1% p.a. for the ASX100.

Based on these factors, it feels like there’s an unusually attractive investment opportunity within the smaller companies’ space at present. In the words of Andrew Smith, from Perennial Asset Management …

“Right now is unique. It’s the best opportunity set since the bottom of the GFC. It’s very unusual, the sector’s been deserted by institutional investors, retail investors and offshore investors, it’s significantly oversold. The riskiest end of the share market offers a window of opportunity to pocket huge capital gains in 2024 as micro-cap stocks trade at historically cheap valuations created by an exodus of institutional money from the sector.”

What to look for in a smaller companies fund

One of the lower risk, lower stress ways to enter the smaller companies’ asset class is by investing in a managed fund with the requisite specialist expertise. The long term performance data generally shows that smaller companies is an asset class well matched to alpha generation by fund managers due to the inherent market inefficiencies on offer.

When searching for a smaller companies manager, here are a few tips to bear in mind:

Focus on managers who focus on value. As per Chris Leitner’s quote above, smaller companies are not synonymous with value, but there are compelling value opportunities on offer. A quality manager will know where to find them.

Invest with managers with a successful long term track records of through-the-cycle outperformance of the benchmark and competitors.

Focus on conviction-led managers with concentrated portfolios and low turnover. High conviction is necessary to outperform in the often volatile smaller companies’ world.

Emphasise the importance of bottom-up research and management meetings. High quality smaller companies fund managers tend to spend a lot of time meeting management teams in order to generate the superior investment edge that drives alpha in this asset class.

Smaller companies will have their day again

Whilst equity markets may be overbought in the short term, smaller companies are currently on sale on a relative basis. This suggests that investors may be well advised to consider buying smaller company stocks or funds into weakness during 2024. Buying when expectations are so low tends to be a lucrative investment strategy over the long term.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.