The shifting sands of the property fund sector

Simon Turner

Fri 16 Feb 2024 6 minutesThe fastest rate rising cycle in history was always going to test the commercial property fund sector. With typical loan to value ratios of 40-70%, it’s an asset class which is at the mercy of the RBA’s cash rate decisions. As such, investors tend to be bullish on commercial property funds when rates are falling, but rising rates generally spell bearish sentiment.

With most economists expecting the RBA to begin cutting rates later this year, now may be time to revisit this out-of-favour sector. We investigate below.

The impact of higher rates

Higher interest rates are bad news for commercial property on two key fronts.

Firstly, higher interest rates cost a larger portion of a commercial property’s available cash flow, which means lower distributions for equity investors.

Secondly, the RBA cash rate directly influences the capitalisation rate investors use to value commercial property. So all other things being equal, a higher cash rate translates into a higher capitalisation rate and lower commercial property valuations.

Interest rates in the driving seat

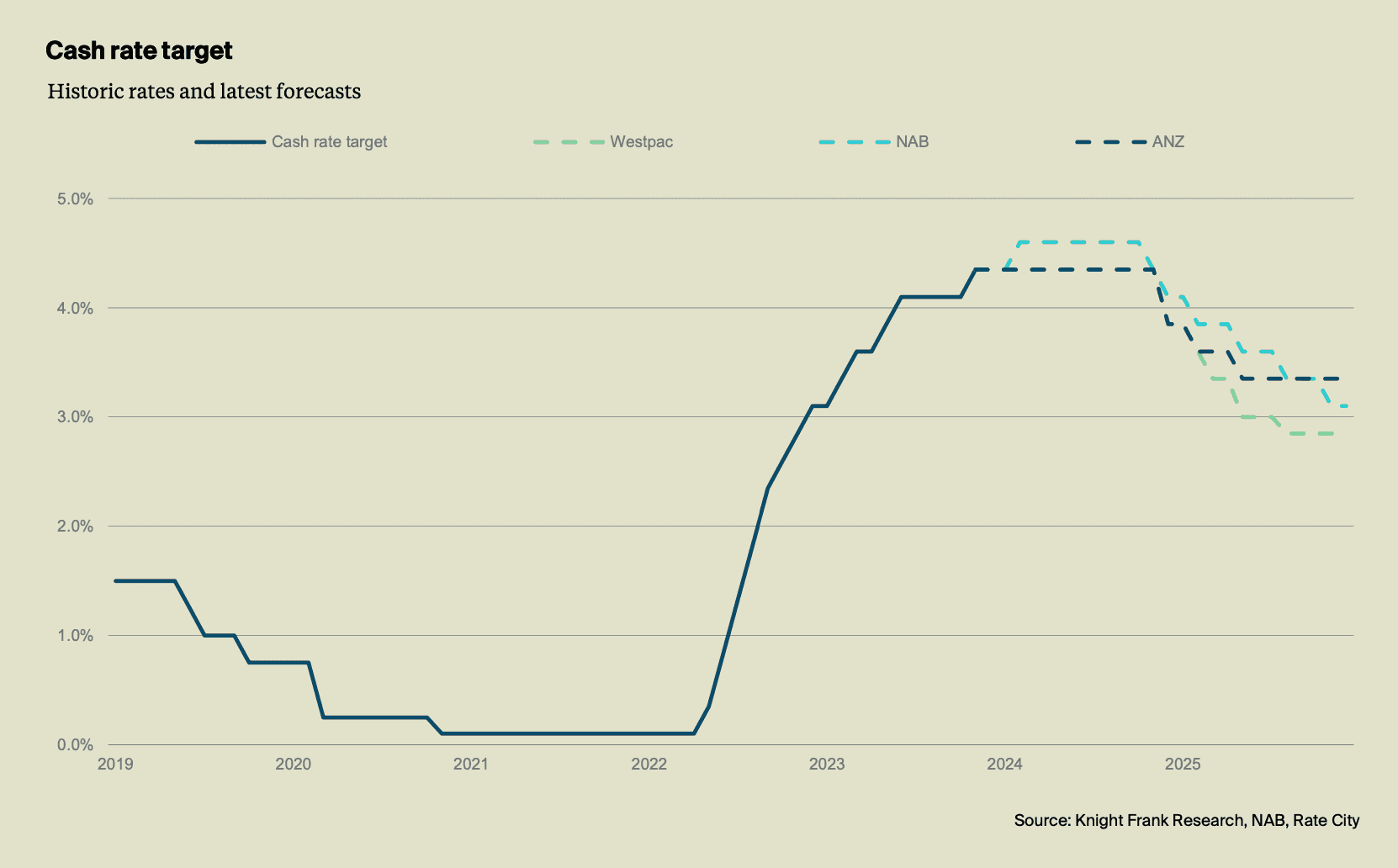

With interest rates affecting commercial property valuations as much as they do, it’s no surprise that most commercial property investors watch interest rate expectations like a hawk. The RBA’s cash rate expectations are charted below.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Assuming most economists are correct about rates cuts being just around the corner, that would be a very positive development for the commercial property fund sector. It would mean the main tailwind which has impacted commercial property capital values is close to turning into a tailwind.

History concurs. The previous end of RBA cash rate hiking cycles back in 1994, 2000 and 2010 led to above average returns for commercial property in the ensuing five years.

Sectors diverging

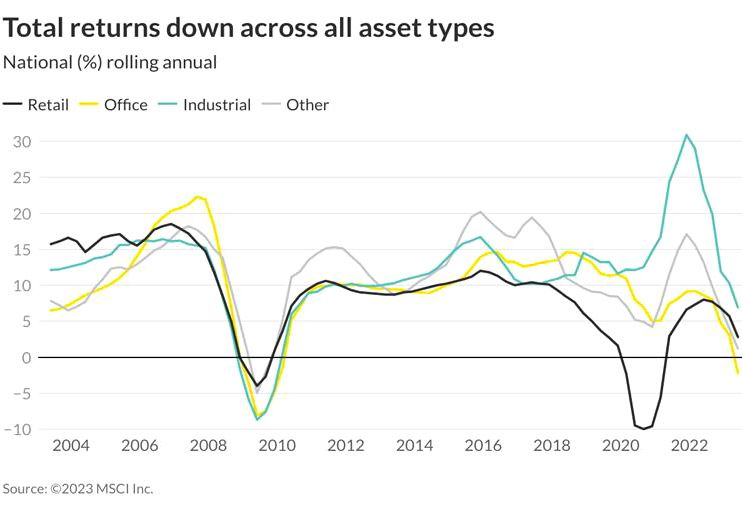

The aftermath of pandemic has been a big deal for the commercial property world. The retail and office property sectors have suffered in the face of structural changes in the way people live and work, whilst the industrial property sector has benefitted from the acceleration in the shift to doing more business online.

As shown below, total returns have remained positive for industrial and retail despite falling capital values due largely to the income returns on offer, whilst office has entered negative total return territory reflecting the extent of recent capital declines.

Outlooks will continue to diverge

The outlook for commercial property remains on course for a continuation of last year’s divergent outcomes by sector:

Office property is expected to continue facing challenging conditions in the short term. The continuation of work-from-home trends is resulting in rising incentives (discounts) which are likely to further reduce effective rental rates. Most office assets facing lower rental returns are likely to lose more capital value. However, within a few years, a lack of new supply is expected to translate into a sector recovery.

Retail property assets continue to face growing competition from the digital world which may keep capital growth subdued. However, rental payments are expected to remain relatively unscathed, particularly in good locations. As such, prime retail assets generating rental growth are expected to remain in high demand.

Industrial property continues to face a bright outlook as the shift to online continues unabated, while the sector remains undersupplied across the country. Further rental growth is expected to bolster the sector’s income returns which is likely to translate into ongoing capital growth.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

REITS vs unlisted property funds at this juncture

Property fund investors must decide whether to invest in publicly listed REITs (or funds investing in REITs) or unlisted property funds.

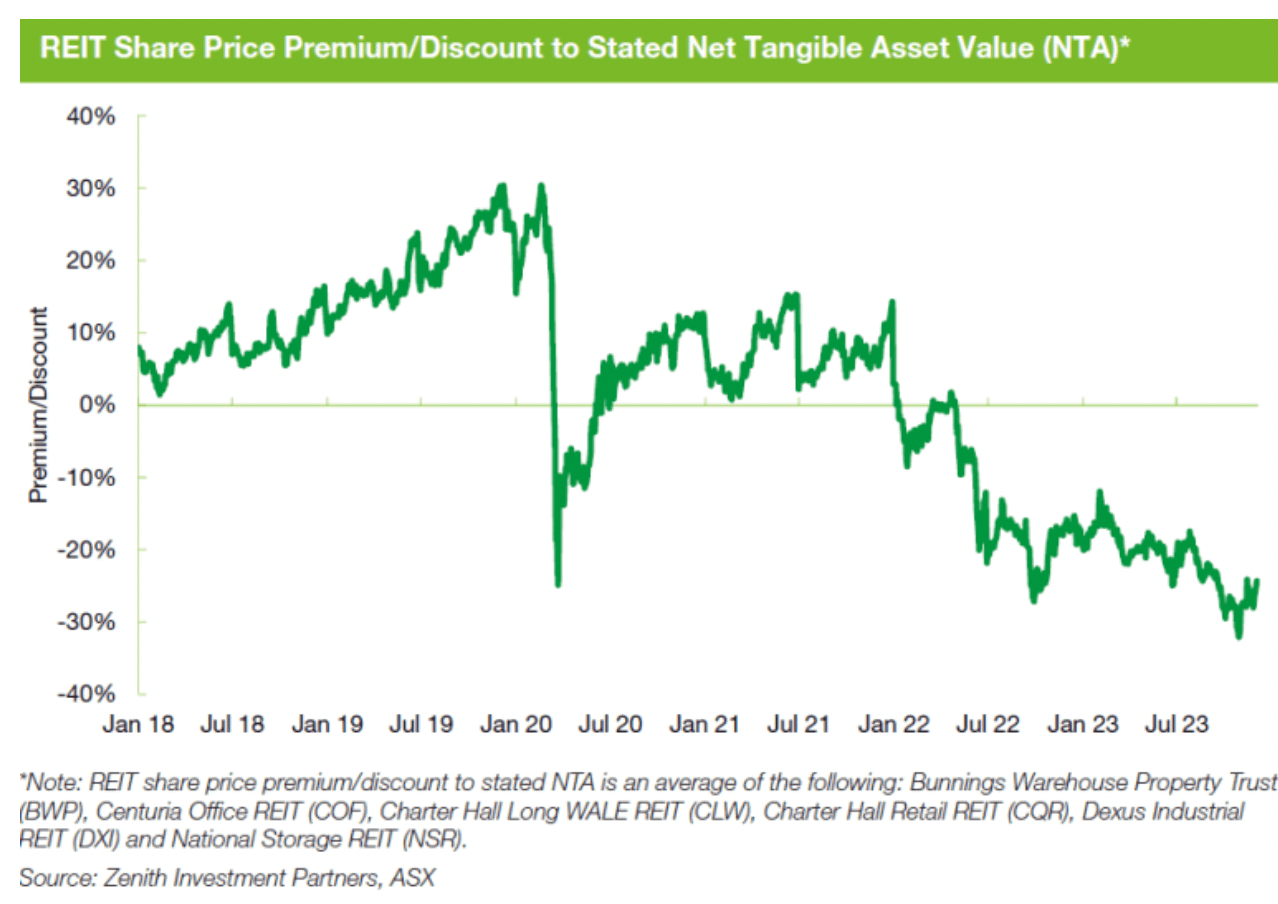

REITs are listed property funds with closed end structures which are traded on the ASX. Since these are publicly traded stocks, they can, and often do, trade at premiums and discounts to their net tangible assets (NTA).

Check out the unusually large discount to NAV on offer across the REIT sector at present:

The reason for the current NTA discounts is higher interest rates and the resulting bearish sentiment toward the sector. Of course, navigating volatility is par for the course for REIT investors, so the current discounts to NAV may spell opportunity for longer term investors.

Unlisted property funds are open or close-ended managed investment schemes that allow investors to directly invest in a fund’s property assets. These funds generally trade at close to NTA which should be regularly revalued by independent experts. On that note, independent valuations should be a must-have rather than a nice-to-have for unlisted property fund investors.

Whilst unlisted property fund investors aren’t exposed to the same public market volatility as REITs, liquidity is generally restricted. This means investors are unlikely to receive their funds back until a liquidity window or exit event is offered by the fund manager. This has been a noteworthy challenge for the sector in a rising rate environment with some investors demanding liquidity which hasn’t been forthcoming.

In general, REITs (or funds investing in REITs) are a better choice for investors who require liquidity and want to be able to profit from periods when the sector trades at a discount to NTA (like now), whereas unlisted property funds are a better choice for investors who prefer investing for the long term without the stress of navigating daily price volatility.

Being honest with yourself about your expectations is likely to help with this decision.

Property funds outlook defined by interest rates

If you believe interest rates have peaked and are likely to trend lower as per consensual economic expectations, buying property funds at this juncture could prove lucrative longer term. If, however, you believe rates are yet to peak, you may be better off to wait until that occurs.

In terms of the opportunities on offer, whether REITs or unlisted property funds are a better match for you depends on your investment timeframe and objectives. Having said that, the discounts to NTA on offer across the REIT sector are unusually attractive and worthy of attention. Sector-wise, industrial property remains the standout opportunity whilst the challenges faced by the office sector are likely to continue.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.