Don’t ignore the liquidity feedback loop

Simon Turner

Thu 22 Feb 2024 5 minutesWith the US economy and stock market continuing to drive global markets, Aussie investors increasingly need to understand what’s driving American fund flows. Spoiler alert: it’s not just corporate earnings. There are liquidity drivers at play in the US that are creating remarkably strong feedback loops with stock valuations and the broader economy.

Understanding how these liquidity feedback loops work may well provide clues as to what’s coming next for global equity markets, including the ASX…

The two main US liquidity manipulators

There are two main liquidity manipulators in the US: the Fed and the US Treasury.

As most investors are aware, the Fed uses its policy toolbox to ensure inflation remains under control (defined as 2% p.a. inflation), whilst the US Treasury is a politically motivated organization which has a multitude of objectives, including promoting equitable economic growth and protecting financial stability.

The US Treasury is directly impacted by the Fed’s actions. For example, when the Fed raises interest rates, the US Treasury pays more interest on its mountain of debt. So after the Fed’s recent rate raising cycle, the US Treasury is facing an annual interest expense of over $US1 trillion p.a.

The Fed vs the US Treasury

It’s important to understand that the Fed and the US Treasury don’t always share the same goals or strategies.

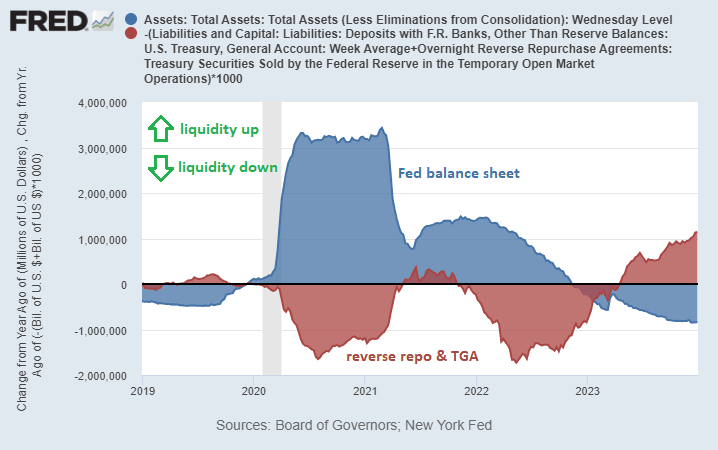

In fact, since Q4 2022 when US market and liquidity conditions were weak, the US Treasury has been overriding the Fed’s actions by drawing down their Treasury General Account in order to pump funds back into the financial system. This has occurred while the Fed has been removing liquidity via its quantitative tightening activities targeted at reducing inflation.

In other words, the Fed and the US Treasury have been operating in direct opposition with one another.

Here’s the counteracting tussle between the two organisations in a picture:

This strange state of affairs has had profound implications for US stocks, so it’s been vital that investors follow what the US Treasury is doing rather than focusing purely on the Fed. Unfortunately, investors who were bearish last year based on the Fed’s talk and actions missed the bigger picture, and were thus wrong-footed by the equity market strength we’ve since witnessed.

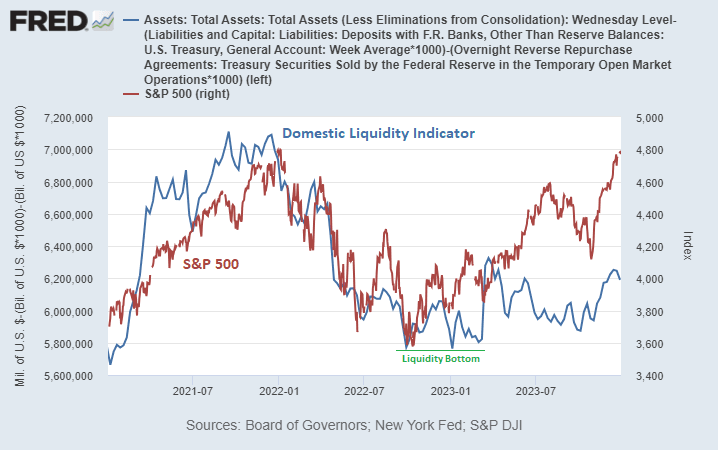

The key point for investors is that net liquidity in the US bottomed in Q4 2022, and has been gradually improving since then. Here’s the net result of the Fed and the US Treasury’s opposing liquidity altering strategies:

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

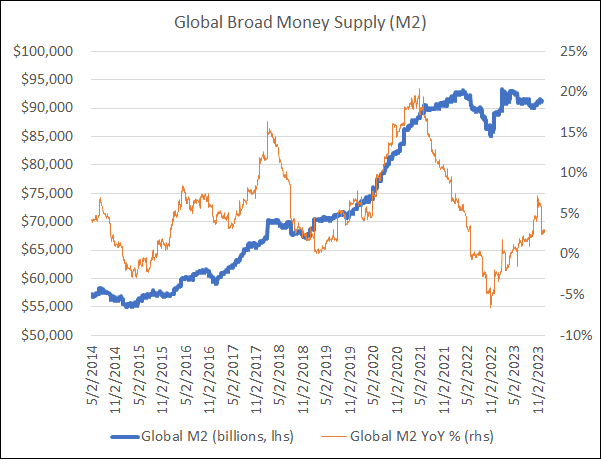

Global liquidity has followed suit

If you need proof that the US leads the global financial system, check out how closely the global liquidity indicators have followed the US situation:

So Q4 2022 was also the turning point for global liquidity levels with a gradual improvement occurring since then.

The liquidity feedback loop

What’s really interesting about these liquidity developments has been the feedback loop that has developed between US liquidity and economic growth.

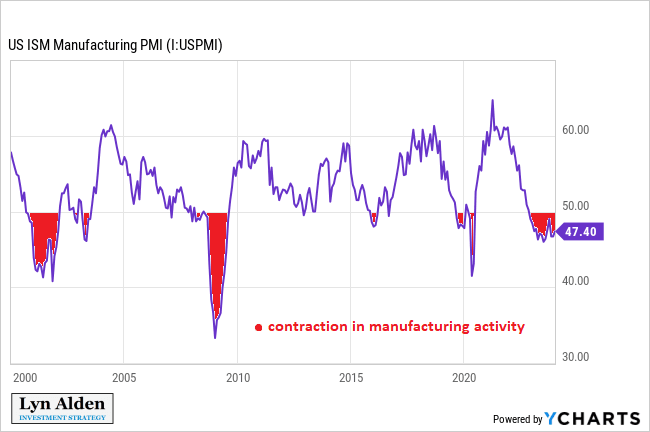

Case in point… US manufacturing (and other leading US economic indicators) stopped declining and started to bottom in Q4 2022—as shown below:

This feedback loop between US liquidity and economic growth largely derives from the unbelievable wealth inequalities in America which have effectively transformed the stock market into a wealth generator for the wealthy.

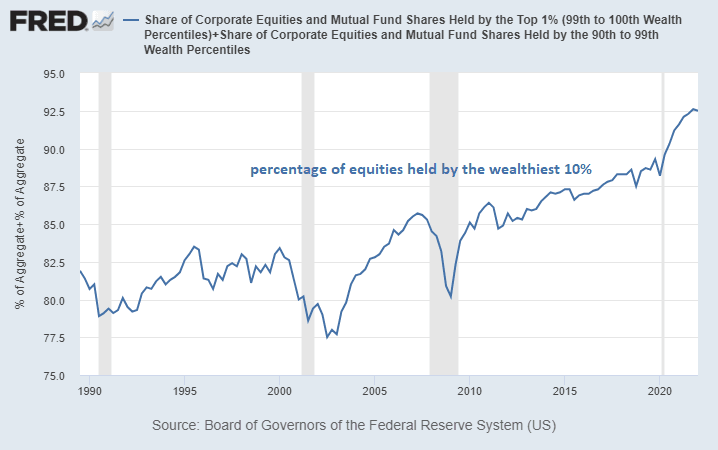

As shown below, the top 10% wealthiest US investors own a massive 92% of the equities. The extent of this inequality is accentuated by the fact that over 70% of S&P 500 CEO compensation is in the form of stocks and options.

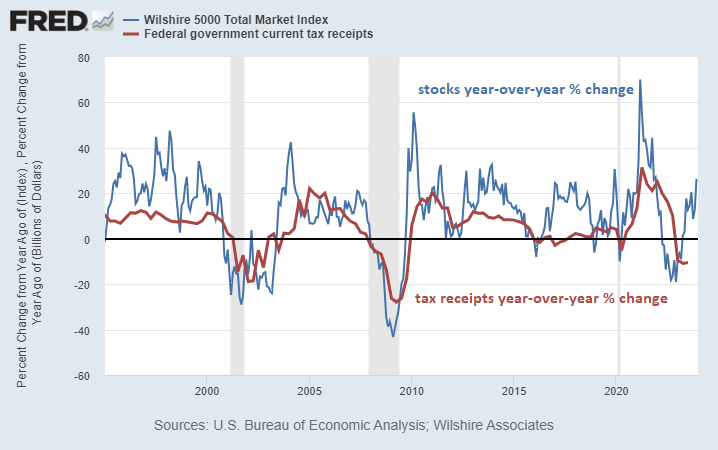

As a result, US tax receipts are highly correlated with annual stock performance—as shown below.

As you can imagine, this provides a strong incentive for the US Treasury to do everything within its power to ensure equities trend upwards longer term and continue feeding into better outcomes for the broader economy. Hence, this feedback loop is now entrenched and set to continue.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

US equities to be supported by guiding hands

The US Treasury has made its intentions clear: it will continue to support the US economy whenever it considers it necessary. The implications are bullish for US and global equities over the longer term, although these liquidity factors won’t stop volatility from re-emerging from time to time.

There are a number of key takeaways for investors:

US fiscal policy currently matters more than monetary policy;

US economic performance continues to affect the stock market’s performance as per traditional financial theory;

However, US stock market performance affects US economic outcomes more than most investors realize because the wealthiest investors own a such a large portion of equities;

Hence, changes in net liquidity levels create a strong feedback loop which impacts both stock market performance and economic outcomes.

The effectiveness of this lever as a tool to be used by the Fed and the US Treasury whenever they see fit is long term bullish for US and global equities.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.