Retail stocks shining despite bearish expectations

Ankita Rai

Fri 23 Feb 2024 5 minutesIn a surprising turn, the retail sector has defied bleak projections this earnings season with consumers demonstrating unexpected resilience.

Discretionary giants like JB Hi-Fi, Myers, Wesfarmers, Temple & Webster, Nick Scali, and Cettire witnessed significant share price gains in February following strong first-half results, signalling a departure from bearish expectations for consumer-facing stocks.

Most retail analysts had painted a bleak picture of the sector last year, more so after retail spending plunged in December following a brief November surge from the Black Friday sales. The first half of the 2023/24 financial year was expected to be characterized by a substantial decline in top and bottom-line figures. However, as half-year results are released, a different story is emerging.

Investors seeing the glass as half full

At face value, the retail sector has been in a tough spot for a while now.

While the Australian economy managed to avoid a recession in 2023, real spending declined for three consecutive quarters as consumers tightened their belts. High costs and frequent discounts further squeezed the sector’s margins.

Despite this, earnings for the first half of this year were not as bad as expected, potentially indicating a reversal of the sector’s fortunes.

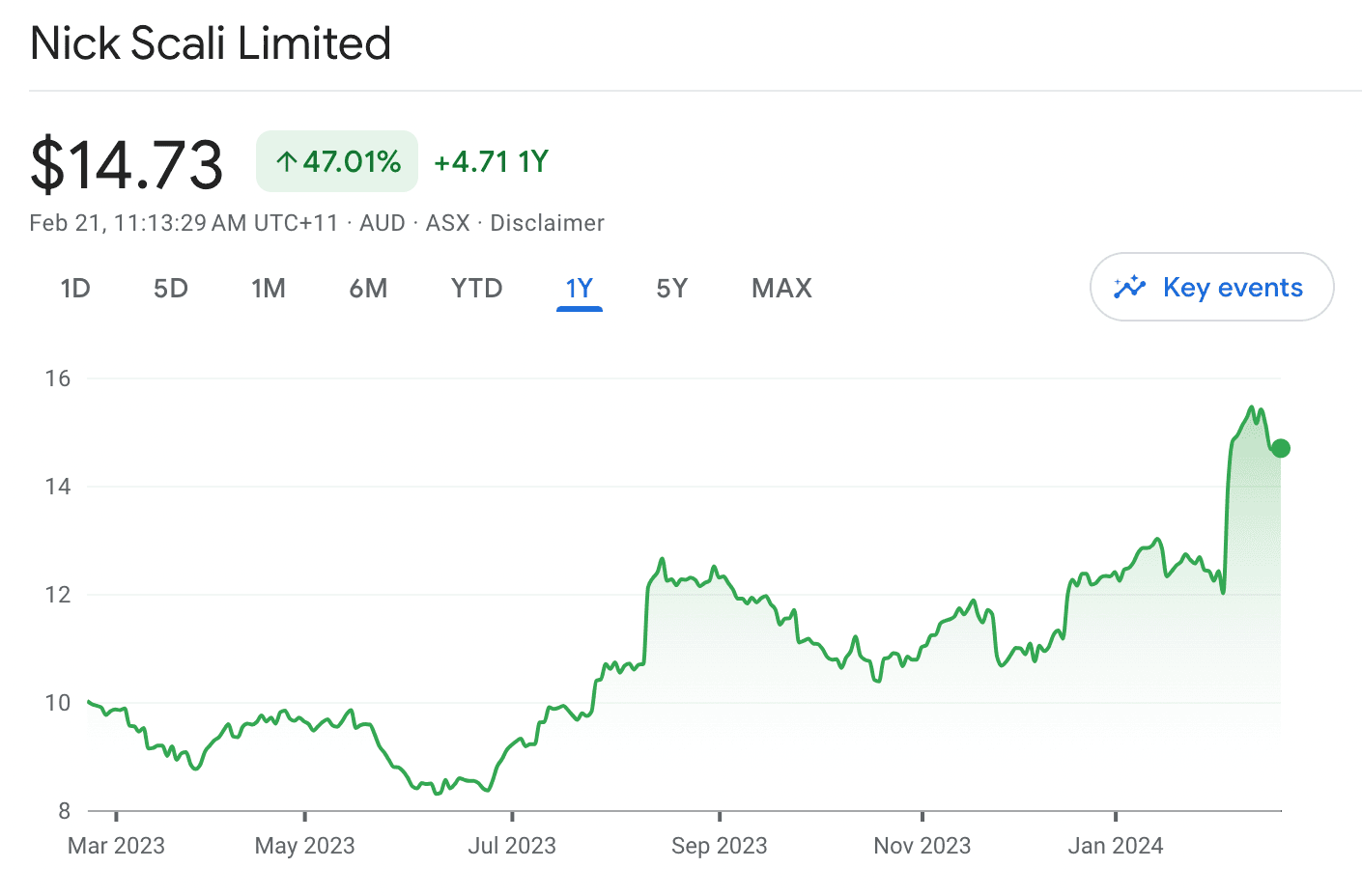

Consider Nick Scali. Its shares rallied to a two-year high (see below) after the furniture retailer topped net profit expectations, posting a 29 per cent fall to $43 million in the six months to December 31. Interim sales fell 20.2 per cent to $226.6 million and gross margin was robust at 65.6 per cent.

Likewise, Myer's shares surged as it projected a net profit of $49-53m for the six months ending January 27th. While the group's comparable sales for FY24's first half remained flat, up 0.1% year-on-year, they still matched the company's best first-half sales on record. This is despite rising cost pressures and higher promotional activity during the period.

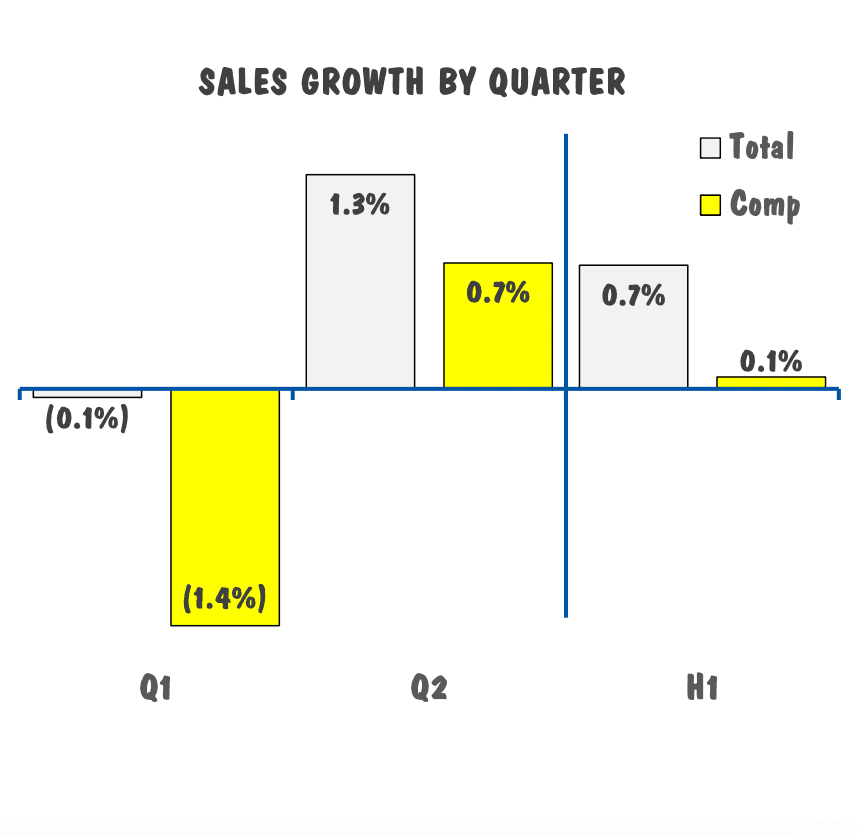

JB Hi-Fi, meanwhile, beat market expectations, delivering first-half sales of $5.16 billion and achieving a smaller-than-anticipated top-line decline of 2.2%. Sales at JB Hi-Fi's Australian stores rose by 0.7% to $3.62 billion, (as shown below), with comparable sales remaining flat. Interim net profit fell nearly 20% to $264.3 million, also better than feared. The momentum has continued in the second half, with January sales in its Australian stores up 2.5%.

At Wesfarmers also, retail proved pivotal to its earnings success. It posted a stronger-than-anticipated interim net profit of $1.42 billion in the first half driven by record performances from Kmart and Target. Profit margins also remained steady at Bunnings and Officeworks despite flat earnings. Kmart Group sales increased by 4.8% to $5.99 billion as more households shopped for value.

Online retailers like Cettire and Temple & Webster have also contributed to this wave of retail profit beats. Cettire reported an outstanding 1H24 result, with its shares soaring over 20% as half-year sales surged by 89% from the previous year. Similarly, Temple & Webster delivered a solid 1H24 performance, with revenue increasing by 23% to $254 million and net profit rising by 6%. Moreover, the company's gross margin improved from 32.3% to 33.3% due to reduced shipping costs and fewer refunds.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Moderating inflation is driving the rise

Expectations matter. While investors were expecting negative news from these retailers, the latest trading updates have not been as bad as expected. In fact, although Black Friday sales may be distorting the data, there is no doubt that many retail firms have benefited from consumers’ willingness to accept higher prices over the past year.

In confirmation of the retail sector’s renewed optimism, the Westpac Melbourne Institute Consumer Sentiment Index reached 86 in February, its highest level in 20 months. Signs of hope are emerging as inflation moderates.

Coupled with anticipated income tax cuts later in the year, this improving consumer sentiment sets the stage for a more bullish environment for retailers who’ve been battling a broader spending slowdown.

Disinflation risk on the horizon

Despite the ‘less bad’ retail environment in recent months, there’s a noteworthy risk looming in the form of potential disinflation.

According to MST Marquee's 2024 retail outlook, much of the retail sector’s top-line growth over the last two years was supported by price inflation. Hence, as and when prices fall, sales growth could be negatively impacted.

As a result, if the RBA’s rate rises have successfully quelled inflation, retail investors could soon face the risk of disinflation and its broader impacts upon the sector.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

All hopes on rate reductions, Stage 3 tax cuts

As inflation declines, retailers are pinning their hopes on Stage 3 tax reductions and interest rate cuts to stimulate consumer spending. Investors may view this as a positive sign, anticipating buoyant retail activity as consumers benefit from the stabilising cost of living.

However, profit margins are likely to remain under pressure due to intense competition, increased discounting, rising wages, and subdued demand.

Key takeaways for investors

Retail sales growth over the past year has been stronger than expected largely due to higher prices.

Reductions in interest rates and the implementation of Stage 3 tax cuts could bolster retail sales this year, but uncertainties remain regarding rising wages and a tight labour market.

While price inflation is likely to weaken, costs are likely to remain high for retailers. This coupled with supply chain issues and heavy discounting could dent the sector’s margins.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.