How to identify outperforming funds

Simon Turner

Thu 2 Nov 2023 9 minutesAustralia has a famously large population of highly qualified fund managers considering the size of the country. According to KPGM, Australia’s 647 fund management groups manage $4.3 trillion across 6,451 products. That represents around $170k under management for each and every Australian resident, so it’s a sizeable portion of the nation’s wealth. This translates into opportunity for individual investors who know what to look for in the vast smorgasbord of fund management options at their disposal.

Here’s our list of nine factors to help you identify the funds best positioned to outperform…

1. Solid long-term track record

The best place to start is with a fund manager’s long-term track record. Of course past performance isn’t necessarily a guide of future performance (as the world’s compliance departments like to remind us whenever they get the opportunity), but fund managers’ long term track records will give you a picture of how they’ve navigated the market’s ups and downs.

An important piece of advice when comparing fund performance data is to always focus on net returns (after fees) rather than gross returns (before fees). Net returns are the only number that matter for investors.

Also, focus on the longer term data. It is important to look at both the fund manager’s longer term absolute and relative track record for a gauge of how successful (or not) they’ve been. Many performance-driven investors only invest with managers who are in the top quartile of their peer group over 3 and/or 5 years (or longer).

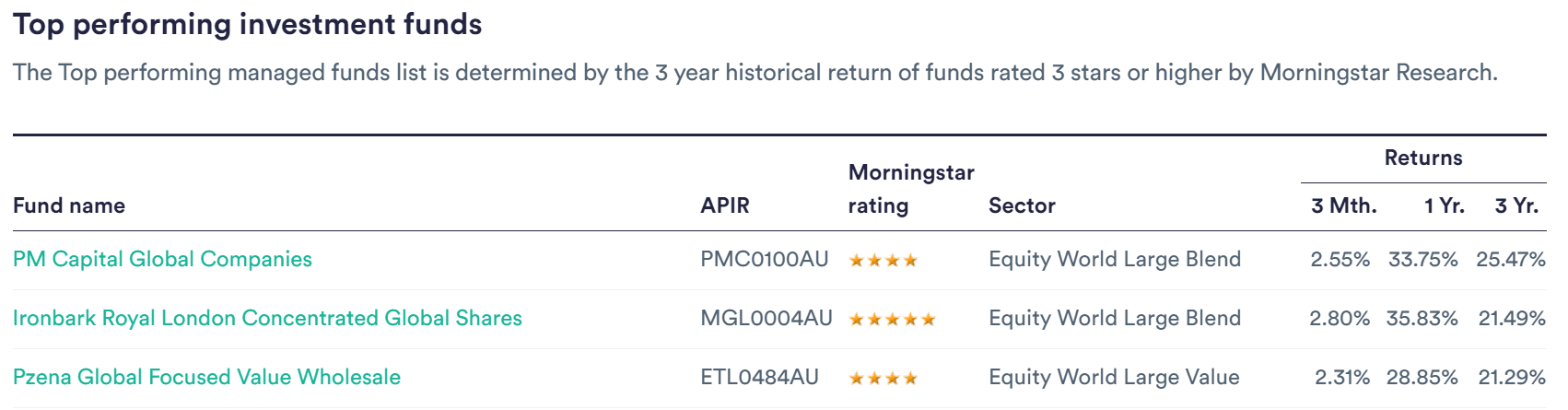

Here’s an example of the type of basic performance data typically used to compare funds:

Fund ratings can also help with assessing and comparing fund managers’ track records. For example, Morningstar’s ratings are a backward-looking measure of funds’ past performance—if they’ve been up and running for at least three years. A 5-star Morningstar rating is generally an easy way of ticking the fund manager track record box.

What if the fund manager you’re assessing doesn’t have a long-term track record? This is a key piece of information. Even if you decide to invest in a new fund manager’s product, it may be advisable to adjust the size of your investment in the fund downwards to reflect this immeasurable risk.

2. Clear investment strategy

An investment strategy is a plan to help investors achieve their investment goals. Having a clear, well-documented investment strategy is core to professional investment management. In general, the more easily understandable a fund manager’s investment strategy, the better.

When assessing fund managers’ investment strategies, it’s important to focus on the asset class they are investing in and all the elements of the strategy they intend to employ to generate superior returns. It’s also important to ensure a fund manager’s strategy aligns with your own risk tolerance and investment goals.

For example, if you’re a conservative investor, a fund manager with a hedged and leveraged equity investment strategy may be too risky for you. Equally, if you’re a more aggressive investor, a fund manager investing only in the top fifty stocks on the ASX may be too conservative for you.

3. Robust investment process

An investment process is the framework through which the investment strategy is executed. It includes the stock analysis approach, stock selection criteria, the challenge/debating process and other inputs in the buying decision, the fund’s portfolio management/rebalancing practices, and the all-important sell decision making process.

High quality investment teams tend to be focused on following their investment process to the letter as it’s a means of ensuring the fund does what it says on the tin. In addition, investment processes are generally designed to minimise the negative impact of the emotional biases that make investing so challenging—so they’re there to help fund managers outperform.

For example, objectively reassessing investment cases when stocks underperform is a core element of most investment processes. Rather than being reactive to stock price movements, many investment processes will suggest fund managers buy more of their underperformers when a stock’s weak performance is at odds with its fundamentals. Equally, if the opposite conclusion is reached and a stock’s fundamentals have deteriorated, the investment process will generally suggest selling the position.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

4. Aligned and appropriate target returns

A fund’s target returns should align with the manager’s track record and investment strategy—and they should also align with your own financial goals if you’re considering investing.

Most funds have a relative performance target. For example, a long term target for an Australian equity fund may be 2-3% p.a. outperformance of an appropriate benchmark over rolling 5-year periods. Longer term targets like this are generally more useful than one-year (or lower) targets due to the poor predictability of shorter term returns.

5. Effective risk management

Risk management is an important part of fund management, yet it’s a subject few fund managers agree on.

A core component of risk management for most fund managers is assessing the upside risk versus downside risk prior to investment. For example, some fund managers have a target of at least 2-3x upside risk versus downside risk before they’ll decide to purchase a stock. The argument is that if their risk quantification is on point, the portfolio’s risk exposure can be optimised through the stock selection process.

Other fund managers will argue that effective risk management comes more from knowing their stocks better than the rest of the market—this is commonly referred to as ‘edge’. They’ll argue that their superior understanding of the stocks in their fund allows them to ride through the market’s ups and downs in the knowledge that the companies are on track to achieve their long-term goals. Whilst this makes intuitive sense, it’s challenging for investors to gauge how much edge an investment team really has.

The number of stocks in a fund (and positioning sizing) is also a component of risk management, although the benefits of portfolio diversification decrease dramatically from 8-10 stocks upwards. This is important to understand since some funds are extremely diversified in the name of reducing risk. However, it’s worth remembering a fund holding 100+ stocks may not offer significantly lower portfolio risk than a fund holding 20 stocks—although superior returns may be harder to achieve with the 100+ stock portfolio.

The list of risk management strategies goes on and includes the analysis of stock and portfolio volatility, the standard deviation of returns, ESG factors (which are often regarded as a proxy for quality), value at risk, and a host of other risk metrics.

High quality fund managers will eat and breathe risk management and are likely to incorporate a number of these (and other) risk management factors into their investment process. A sensible and intuitive risk management strategy is essential for all fund managers.

6. Low key staff turnover

Many fund of fund investors focus on key staff turnover when assessing fund managers because low turnover of key staff is often indicative of a positive culture and a happy investment team. There are so many soft factors that go into building a high performing investment team and most of them are invisible to outsiders. Staff turnover is a rare visible factor which provides valuable insight into what’s really going on behind closed doors.

By focusing on fund managers with stable teams, investors can help maximise their chances of success in the fund investing game.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

7. Skin in the game

We recently wrote an article about the importance of skin in the game for fund managers. Skin in the game is a great way of ensuring fund managers’ interests are aligned with their investors. It’s also a great way of ensuring their conviction levels are suitably high.

Fund of fund investors have long focused on investing with fund managers with significant skin in the game to great effect. Individual investors can also benefit from being focused on this revealing factor.

8. Competitive fee structure

The boom in ETFs has partially occurred due to the lower fees on offer as more investors have become aware of the significant long term impact of fees on performance.

According to Morningstar, the average management fee for Australian actively managed funds is 0.8% p.a. of assets under management, compared with 0.25% p.a. for a passively managed fund (ETFs). In addition, most actively managed funds charge a performance fee for relative or absolute outperformance.

Being aware of a fund’s fee structure can make a significant difference to long-term returns. Investors should assess fund managers’ fee structures versus competitors and the fund managers’ track record within the context of their asset class.

9. Informative investor communications

Investors who understand what’s going on within their funds’ investment portfolios are much more likely to remain invested in the fund for the long term. This is important since investing for the long term increases the probability of generating the type of investment returns investors are investing for.

Hence, fund managers who communicate openly with their investors through regular letters and reports build trust amongst their investors. It’s all part of succeeding over the long term in the fund management game.

Do your research before you invest in funds

With 6,451 investible funds at their disposal, Aussie investors have access to a wonderfully large world of fund investment options. It’s a great opportunity and it’s no surprise that investing in funds is a core component of most investors’ financial plans.

By looking into the above nine factors prior to investing in funds, investors can improve their chances of investing in outperforming funds over the long term.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.