What you need to know about the electric vehicle thematic

Simon Turner

Thu 26 Oct 2023 8 minutesHeadlines about Elon Musk’s idiosyncratic behaviour have become inextricably connected with the public’s perception of electric vehicles (EVs).

Even after Tesla’s recent Q3 earnings call, some analysts were more concerned about Elon Musk’s off-topic remarks about everything ranging from the economy to weight loss than they were about the company’s numbers. Research group Investor Trip said of his Q3 earnings call performance: ‘Elon Musk's behaviour reminded me of an aging NBA star who struggled with the fact that younger, more agile NBA players were coming for his throne.’

With the interpretation of such a big personality often overshadowing the facts, now’s a great time for investors to be on top of one of the more prominent global decarbonisation investment themes: the electric vehicle rollout…

Electric vehicle adoption rates on the rise

You’ll no doubt have noticed more EVs on the roads as adoption rates are on the rise.

At the start of 2023, there were 27 million EVs on the road globally, and that number should exceed 40 million by the end of the year—which represents 3% of the total global fleet.

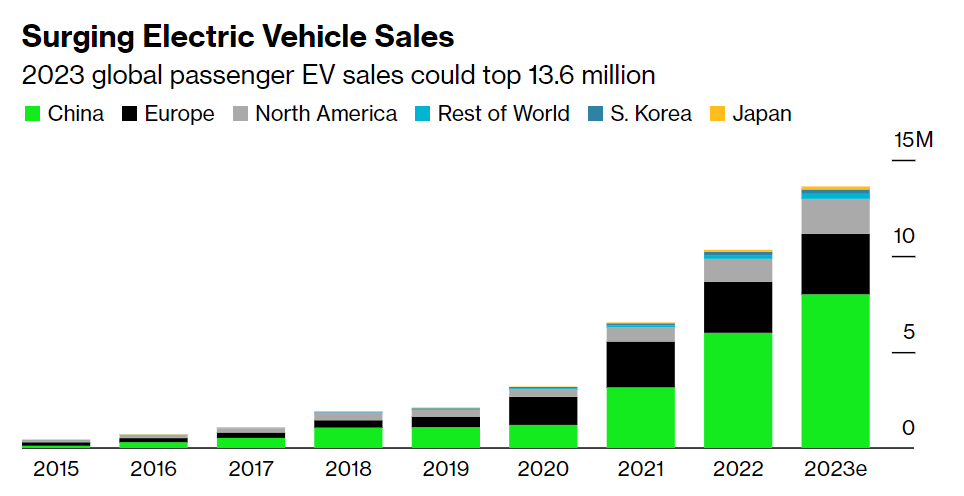

EV new vehicle market share is more impressive. As shown in the chart below, BloombergNEF is forecasting 13.6 million electric vehicle deliveries in 2023, up from 10 million in 2022. That translates into a global new vehicle market share of over 15%. The comparable number in Australia was 6.8% during the first half of 2023.

China continues to dominate the global market with an expected 8 million EV sales this year despite the phasing out of supportive subsidies.

In the US, the market is experiencing a relative lull with 1.6 million EV sales expected in 2023 ahead of new EV manufacturing capacity and refreshed federal tax credits which should boost growth from 2024.

And European growth is moderating as some legacy automakers are awaiting the tightening of emissions regulations in 2025 before they increase their EV supply.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

EV competition is on the rise

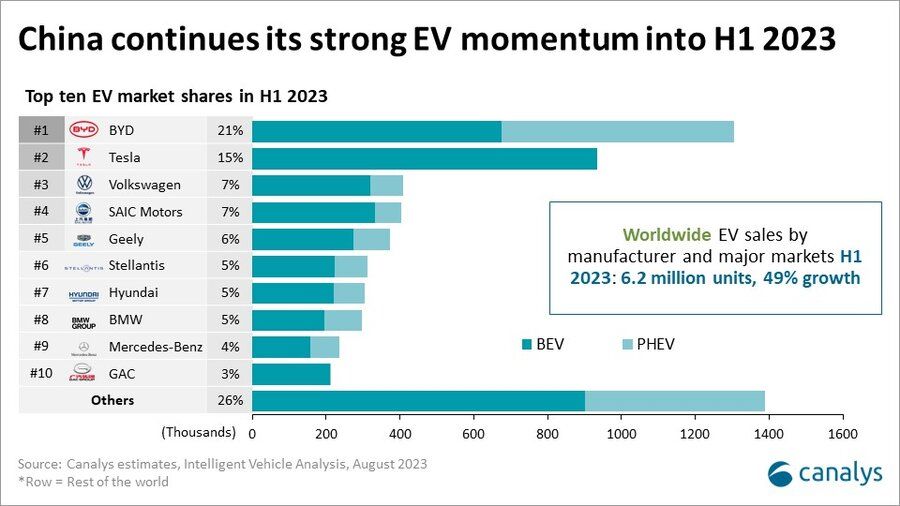

Long gone are the days when Tesla was the one and only player defining the EV category. The entire automotive industry is embracing the EV rollout to varying degrees as shown in the global market share breakdown below.

The tussle for global EV market leadership has been fascinating to watch. Whilst Tesla still has a 50% US market share, its 15% global market share is now below BYD’s 21%. It’s also noteworthy that beyond the top ten players, the ‘Others’ category represents a 26% global market share. That spells growing competition looking forward.

In fact, the competitive environment is about to get a lot tougher. Here’s a selection of the upcoming EV product releases due to hit the market in the coming months:

Lucid: The Lucid Air.

Rivian: The R1T and R1S.

Ford: The F-150 Lightning.

Mercedes: The Mercedes EQ Class.

Volkswagen: The Volkswagen ID Class.

Porsche: The Porsche Macan and Taycan EVs.

Fisker: The Fisker Ocean.

BYD: The BYD EV Line.

Nio: The Nio EV Line.

Lower prices are the name of the game

The EV rollout has long been expected to play out like the smartphone rollout with prices declining ahead of mass market adoption. Tesla is following this playbook closely. In an effort to defend its share of an increasingly competitive market, the company has cut its US prices by 6-24% and its Australian prices by 5-12% since the start of the year. As a result, its operating margin crashed to 7.6% in Q3.

When one of the market leaders is cutting prices so aggressively, it’s almost impossible for its competitors to do anything but follow suit. Hence, the race is on for EV manufacturers to reduce their cost of goods sold so they can further reduce their prices and thus increase their market shares.

But… the inflation monster is throwing a spanner in the works

In a low inflation environment, the strategy adopted by Telsa and the rest of the EV manufacturers would be regarded by most investors as executable by industry leaders with the relevant IP. However, in a world facing structurally high inflation, as we appear to have entered, a business model which is dependent upon reducing the cost of production faster than competitors is up against significant macro headwinds.

In addition, with rising interest rates and inflation causing havoc for global disposable income levels, the EV sector is also up against a growing headwind in the form of an expanding population of consumers who are not able to afford their premium-priced products.

Case in point… a recent poll by the Energy Policy Institute at the University of Chicago and the Associated Press-NORC Center for Public Affairs Research revealed that nearly half of Americans have no plans to buy an EV in the future. According to car buying platform Autolist, many consider EVs to be ‘too expensive and out of reach’.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Will Tesla’s Cybertruck be a game-changer?

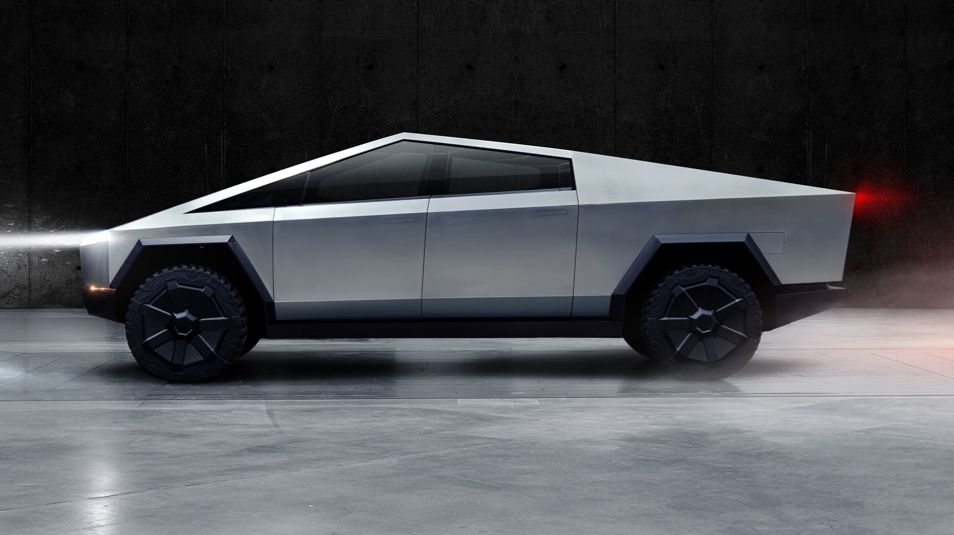

Tesla is responding to these market challenges by doing what it does best… releasing innovative new products which raise the bar for the sector—namely, the Cybertruck. During Tesla’s Q3 results call, Elon Musk called the Cybertruck (shown below) the company's ‘best product ever’. It’s due to be launched on November 30th, 2023.

Many consumers are certainly excited by the Cybertruck’s launch, which is expected to start selling at $US50,000 for the base version. By the end of July, Tesla had already received a massive 1.9 million Cybertruck reservations which pales in comparison with the company’s expected production capacity of 250,000 vehicles p.a. by 2025.

Early information on the Cybertruck suggests its capabilities will challenge the top selling pickup trucks (utes). It’s too early to tell if the hype is justified but the Cybertruck appears likely to boost Tesla’s volume growth in the coming years.

The full self-drive opportunity

Full self-drive (FSD) could also be an important long-term growth driver for the EV sector.

Surprise, surprise, guess who’s in the driver’s seat when it comes to FSD innovation? Once again, it’s Tesla.

In fact, on the Q3 results call, Elon Musk referred to FSD as ‘the future of AI’. The company is certainly investing on this basis. Tesla vehicles have already amassed an impressive 0.5 billion miles of FSD beta to be used as a data repository for refining and enhancing its AI-driven systems.

With so much investment already sunk into FSD, it’s hard to imagine anyone but Tesla dominating the FSD market as and when it scales. Watch this space.

Key investor takeaways

The EV sector remains on track for strong volume growth for many years to come as adoption rates grow.

The EV sector’s growth trajectory is both dependent upon and defined by the extent of the price reductions in the coming years.

High volume growth + price pressure in a high inflation environment spell one thing: operating margin pressure for the EV manufacturers, particularly those who don’t secure a dominant market share early.

In this environment, the Chinese EV manufacturers like BYD (SHE: 002594) and Nio (NYSE: NIO) have a natural competitive advantage reflecting their lower cost of labour and cost of goods sold.

Tesla (NASDAQ: TSLA) continues to innovate hard and is likely to remain a leading player but gradual global market share loss appears inevitable as more players enter the EV market. Having said that, FSD could be a game-changer for Tesla as and when that opportunity translates into scalable revenues.

EV suppliers won’t be immune from the price pressure across the EV sector as they are exposed to a similar dynamic as the carmakers: i.e. those who achieve scale are set to flourish longer term, whilst the smaller players will lose out. That battle for scale implies price pressure and thus lower profitability in the short term.

Innovative and scalable battery solutions are likely to remain in high demand given the pressure across the EV sector to reduce costs. ASX listed stocks like Novonix (ASX: NVX) and Li-S Energy (ASX: LIS) may be positioned to benefit.

Choose your EV exposure wisely

The EV sector is likely to support a number of long term winners who are focused upon innovation and cost leadership. However, it’s hard to ignore the growing short term headwinds in the form of falling prices, growing competition, and structurally high inflation. It’s easy to see why Elon Musk has been getting so off-topic on recent earnings calls.

Investors who want exposure to this important global decarbonisation investment thematic are advised to focus on business models which incorporate cost leadership and innovation as core competitive advantages. The leading Chinese EV players such as BYD stand out as being well positioned on this front.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.