What’s the right timeframe for investing in equities?

Simon Turner

Wed 13 Sep 2023 6 minutesAussie investors are generally overweight equities so establishing the right timeframe for equity investment is a common question. It’s also core to ensuring your portfolio delivers the performance you want and deserve. And with average holding periods moving in the wrong direction, the chances are high that many investors are leaving valuable returns on the table.

So it could well be time to ask yourself… what’s the right timeframe for investing in equities?

The spread of impatient-itis

Let’s start with the reality before we delve into the ideal.

The reality is average holding periods have plummeted in recent decades. Based on the best available market data (from the US), stock holding periods were eight years back in the 1950s but have since fallen to only 5.5 months (Visual Capitalist, June 2020 data). That’s a massive 94% decrease over the past seventy years.

So drastic change has been afoot across the financial markets.

There are a number of reasons for the huge decrease in average holding periods, not least of which is the ease and widespread availability of cheap online stock trading.

But it’s not just that. There’s also been a mind-set shift across the investing community. Whilst investors once invested in stocks ahead of largely forgetting about them during their holding periods, the constant availability of stock price data and information on investor’s phones, as well as the rise of meme stocks, keeps many investors addicted to watching the daily, and often hourly, movements of their stocks.

The excitement inspired by this addiction is hard to match with the inaction and discipline required for long term investing. And it’s at the heart of the reason why most investors prefer to trade rather than invest these days.

However, it won’t surprise most investors to hear that a 5.5 month holding period is a long way from ideal when it comes to investing in equities.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Enter the all-important financial plan

The first point to highlight is the right holding period is different for everyone.

With the help of a financial advisor, you’ll hopefully have a financial plan you’re working towards which details your financial goals, risk tolerance, and investment timeframe.

If you haven’t taken this step, this is worthwhile spending time on as the vast majority of investors find it much easier to execute a financial plan than to customise one on the go. Arguably, many would-be investors have become traders for the simple reason they haven’t yet customised or committed to a financial plan.

A realistic financial plan will reference a realistic timeframe to achieve your financial goals on the equity portion of your portfolio. With that said, let’s delve into what’s a realistic timeframe to optimize your returns in the world of equities.

What’s the right timeframe for investing in equities?

To answer that question, we need data.

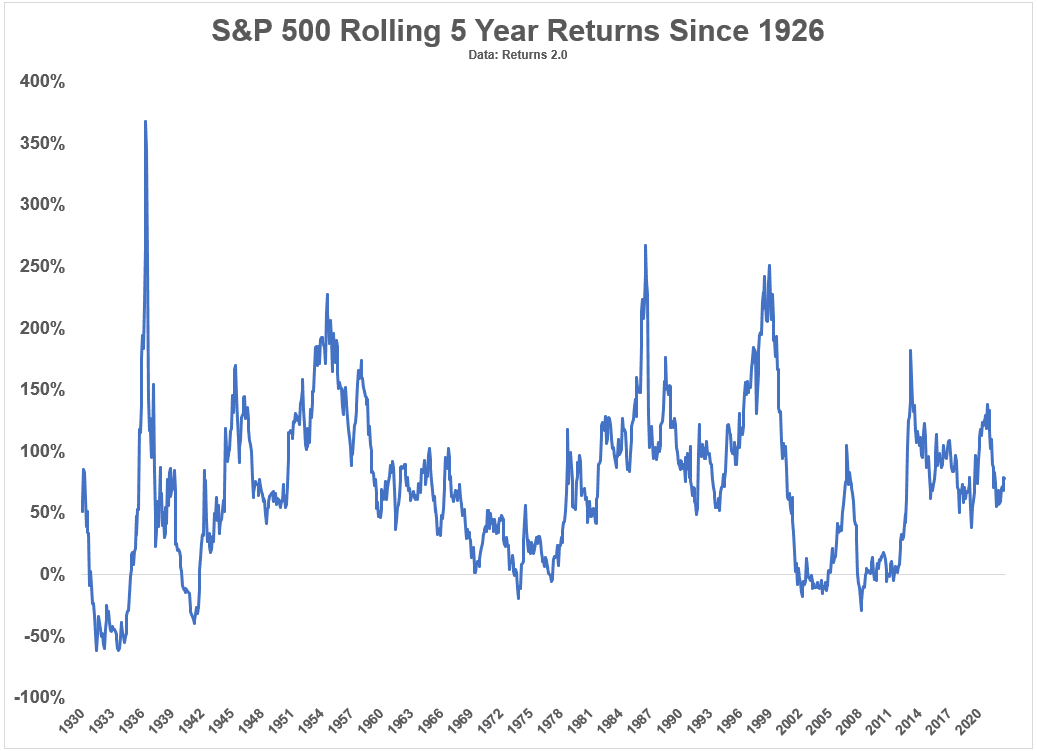

Here’s the best available equities data, which is the rolling 5 year returns of the S&P 500 over the past century (this data is not a perfect reflection of the Australian market but it reveals the long term trends at play in developed market equities):

The importance of looking at rolling 5-year returns is it provides context on how effective 5-years is as a timeframe for equity investing. As the chart shows, the rolling 5-year returns have been positive 88% of the time with some noteworthy exceptions.

The range between the best 5-year returns (+367% during the recovery from the Great Depression) and the worst (-61% during the Great Depression) is extreme—as is the distribution of returns across the market.

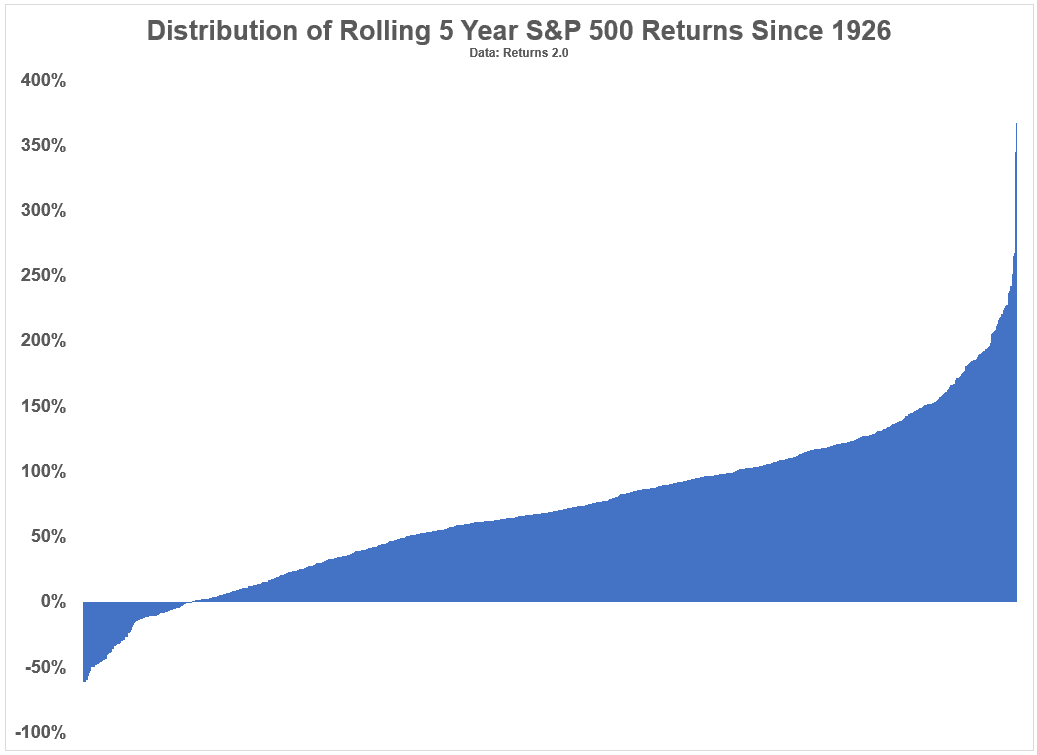

Here’s the same data ranking those 5-year rolling returns from worst to best:

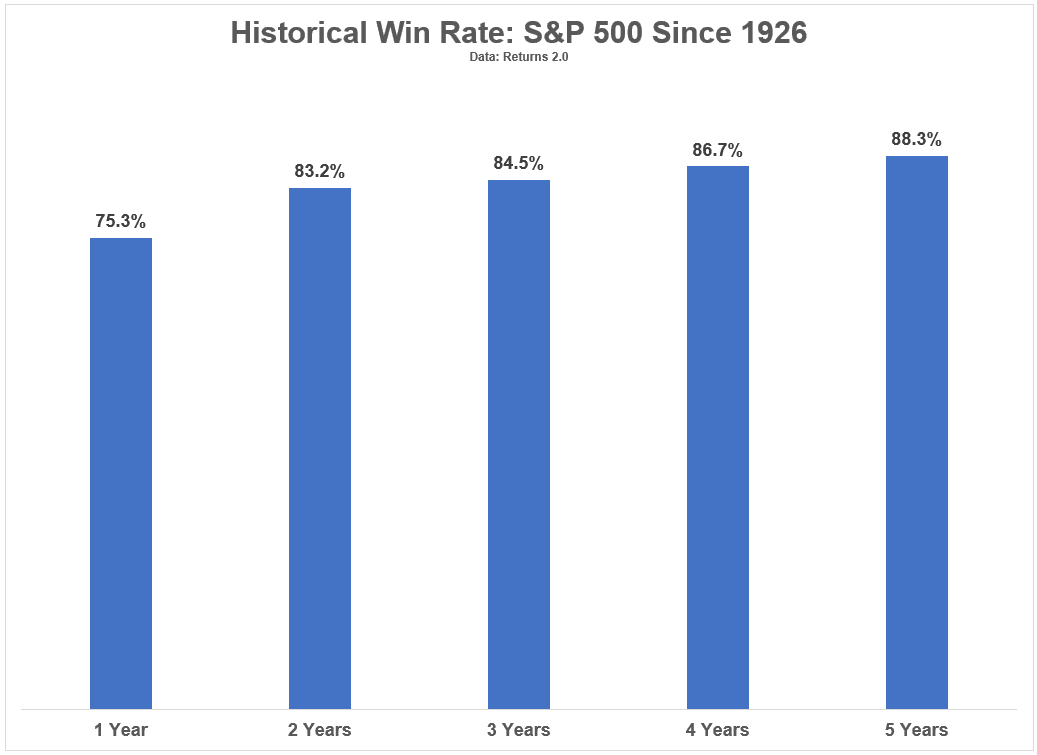

Here are the historical win rates over 1, 2, 3, 4 and 5-year time horizons for U.S. stocks:

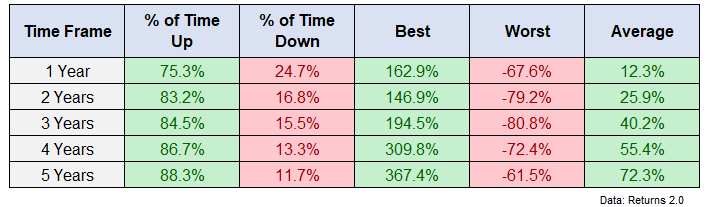

And here are the best, worst and average returns for those same periods.

If only we could rely upon average performances year in year out. Most investors would be happy with each of those timeframe averages, but most would also be unhappy to be exposed to the worst performance for each respective period.

Herein lies the dilemma core to settling upon the right timeframe for investing in equities… there are extreme ups and downs along the way, and they are often unpredictable.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

So is 5 years the right timeframe?

It’s worth reiterating that the right timeframe is different for everyone.

However, there are a few key takeaways investors should be aware of when deciding upon the right timeframe for equity investment:

The risk of being exposed to a period of negative returns significantly decreases with more time in the market. In other words, the longer your timeframe, the more likely you are to generate the type of wealth-building returns you’re invested in equities for.

However, being invested in equities means there will be down periods along the way, potentially involving very negative returns. Accepting this truth seems to be what differentiates successful investors from the rest of the pack.

The data suggests 5-years should probably be a minimum holding period for most investors as evidenced by the 88% win rate. Followers of Warren Buffet will know his favourite holding period is forever at which point the win rate is almost certain to be 100%. Of course, not everyone has Mr Buffet’s steely discipline levels, but in general aiming for a long-term holding period is likely to improve your win rate and thus your investment returns.

Let your portfolio do the heavy lifting for you with the right timeframe in mind

There’s no escaping the fact that on average the more time in the stock market, the better.

So maybe the key to improving your investment returns is to stop watching your stock price movements on an hourly basis, to stop trading your stocks based on the short term technical picture, and to sit back and relax whilst your portfolio does the heavy lifting for you over the long term.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.