Why the big switch from equities to bonds hasn’t happened yet

Simon Turner

Wed 6 Sep 2023 5 minutesMost market experts believe equities are expensive right now while bonds are cheap. Despite this fundamental backdrop, the much talked about switch from equities to bonds hasn’t happened yet. During market extremities like this, it’s worth asking why fundamentals are being so ignored in favour of momentum.

Equities vs bonds: the extreme reality

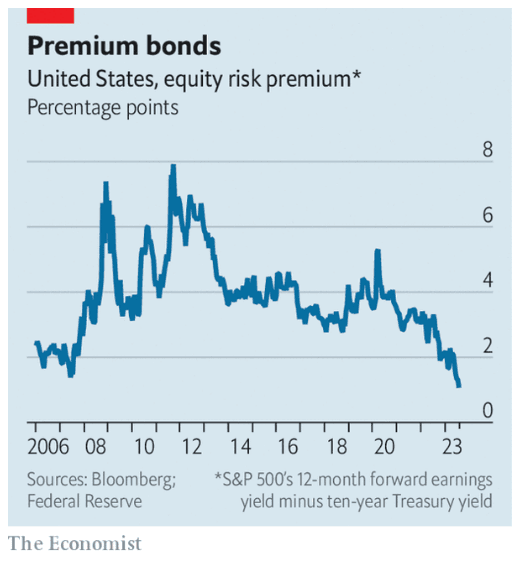

Let’s start by comparing the yields on offer in the equity and bond markets. The best way to do this is by looking at the equity risk premium which is defined as the forward earnings yield minus the ten-year Treasury yield. Here’s the all-important US equity risk premium:

The translation of this chart is that based on yields US stocks are currently at their most expensive level versus bonds—and they are even more expensive than just before the GFC struck. In fact, the extremity of this situation is unprecedented.

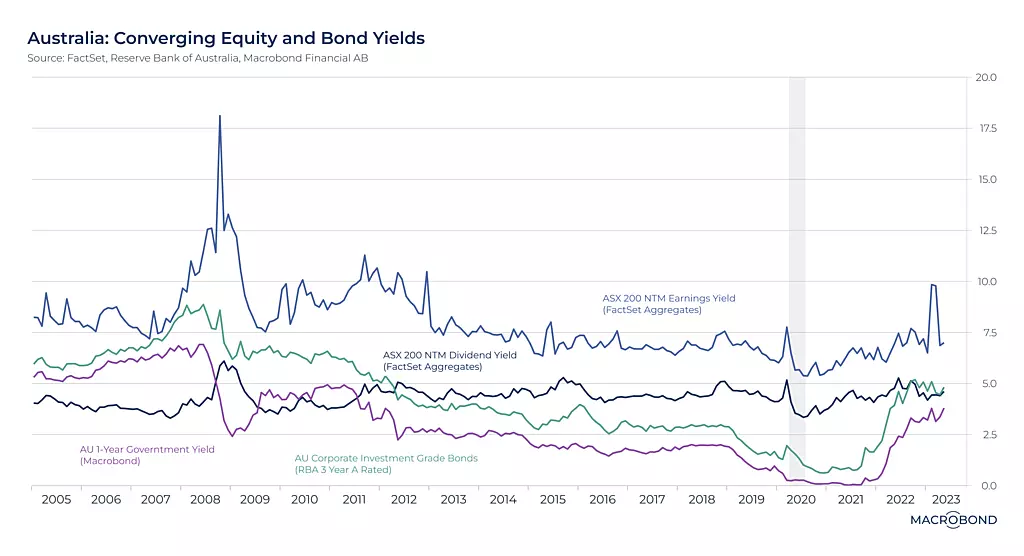

The situation in Australia is similar, but not as extreme. Thankfully, ASX 200 earnings yield still exceeds the yield on Australian Government bonds by a small margin—at least for now (as shown below).

What’s more surprising is that despite the extreme relative overvaluation of equities versus bonds, global and Australian investors are still allocating significant funds to equities as stocks continue to rise, while they’re generally dismissing bonds as they continue to underperform. In fact, long-duration bonds remain in market crash territory.

So at this point, both equity and bond investors are totally ignoring the fundamental yield differentials which have historically mattered a lot to markets.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What’s going on?

In simple terms, momentum is creating momentum.

In the equity markets, investors have become conditioned over many years to buy stocks during periods of weakness. This mentality becomes ingrained in investors’ thinking when a strategy works time and time again—as it has in recent years.

The converse has been happening across bond markets, where we’ve entered unchartered waters. The weakness in bond markets has proven extremely costly for investors over the past year, and it’s starting to become ingrained in investors’ thinking that bond investing is associated with making losses.

So the positive momentum in equities continues to drive stocks higher despite the high relative valuations, while the negative momentum in bonds continues to push bonds lower despite the attractive yields on offer.

The challenging outlook for bonds

Of course, there’s more to it than just momentum.

Bond markets are also facing two challenging headwinds in the short term.

Firstly, if interest rates continue rising as they have over the past year, the negative momentum in bonds is likely to be compounded by rising yields. There’s no arguing with the devastating impact central bankers have already had on bond markets. If inflation remains high longer term, the potential for central bankers to continue wreaking havoc on bond markets remains a real concern.

And secondly, there’s been a sea change in the way bond investors are valuing government risk, with the high debt levels in the US and other developed markets causing growing concern. In the past, markets were more forgiving of developed market government debt levels, particularly in the US, reflecting a deep-held confidence in the stability of those governments. But there’s been a noteworthy decrease in confidence in developed market governments of late. As a result, investors are increasingly valuing government risk more like they value corporate risk. That means ascribing higher yields for government bonds in countries like the US where government debt levels are high.

So on balance, it looks like more blood on the street is likely in the bond markets in the short term despite the asset class’s extreme undervaluation versus equities. If that is the case, the big switch from equities to bonds is likely to remain postponed—at least for now.

That’s not to say it won’t happen, but markets are likely to require a capitulation event to inspire a return of momentum to the bond markets.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The status quo is likely to be maintained until it isn’t

As many investors learn the hard way, markets can remain irrational for a lot longer than investors can remain solvent.

In a rising interest rate environment which is causing pain across the bond market, it’s anyone’s guess how much lower bond markets will fall before they regain momentum and investors begin to switch from equities to bonds en masse. So for the foreseeable future a continuation of the status quo appears likely. But watch out for a capitulation event which catalyses a momentum shift in both the bond and equity markets.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.