What the great wealth transfer means for markets

Simon Turner

Thu 21 Sep 2023 5 minutesThe baby boomers have long been recognised as the wealthiest generation ever. But as per the famous expression, you can’t take it with you. With baby boomers’ ages ranging from fifty-nine to seventy-seven, there’s no escaping the fact we’re close to witnessing a passing of their wealth to the next generation.

Given the extent of this impending wealth transfer, the investment implications of this thematic are worth being aware of.

The wealthy generation

Let’s start by highlighting how wealthy the baby boomers are.

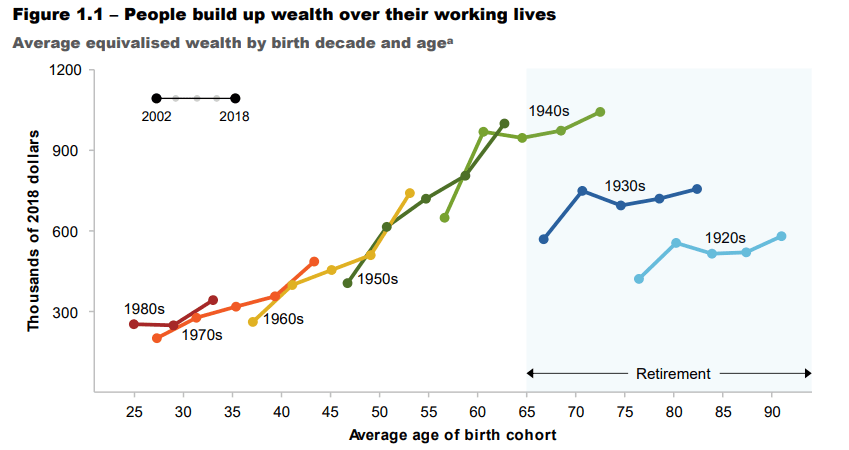

As a group, they represent around 25% of the Australian population but it’s estimated they own a massive 53% of Australia’s national wealth—which is worth around $3.5 trillion. That’s an extraordinary degree of generational inequality. As shown below, the baby boomers born in the 1940s and 1950s are more wealthy than both their successors and predecessors. The baby boomers truly are the wealthy generation.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Inheritances are set to quadruple

The passing of wealth through inheritance is obviously a normal part of life. Over the past 20 years, Australian inheritances have amounted to $1.4 trillion, which equates to around $67 billion p.a. That translates into an average inheritance of around $125,000.

However, that’s all about to change. With the baby boomers’ $3.5 trillion of wealth likely to be passed on to their children and grandchildren over the next three decades, the Productivity Commission has projected a fourfold increase in the value of inheritances over that period. They expect a large portion of this wealth to be passed on to the children of baby boomers when they’re mainly in their fifties.

So we’re talking about a structural shift occurring over the coming years and decades.

The investment implications of the great wealth transfer

The great wealth transfer represents the largest intergenerational wealth transfer in Australian history, and will bring with it significant investment implications:

Property ownership – One of the greatest long term challenges for the younger Australian generations has been getting a foothold on the property ladder as prices continue to rise. The impending wealth transfer is likely to change this situation for many children of baby boomers. The implication is that a portion of the younger generations who are currently renting are likely to inherit property they can either reside in or sell. Alternatively, those younger generations may receive their inheritance in the form of non-property assets which they can choose to sell in order to buy property with the proceeds. This backdrop is likely to provide a growing tailwind for the property market which is expected to increase the portion of wealth tied up in property over the coming three decades. Just when you thought the Australian population couldn’t love property any more, an additional long term demand driver emerges.

A step-change in risk appetite – As most financial planners will testify, risk appetite decreases with age. So by definition, the passing of wealth from one generation to the next is likely to lead to an increase in the risk profile of the strategy with which those assets are reinvested. For example, a portion of a typical investment portfolio which was primarily invested by a baby boomer in income generating stocks and bonds may be sold and reinvested into growth equities. The implications are significant for all higher risk asset classes such as growth equities, property, and private equity.

An increase in consumer spending – As most parents will agree, consumer spending peaks when there are children being raised within a household. The combination of food, healthcare, and schooling costs can add up to a significant portion of a household’s spending. By passing wealth from an older generation with lower spending requirements to a younger generation with higher spending requirements, it’s likely that consumer spending will increase.

A short term reduction in wealth inequality – Given the great wealth transfer will take place over three decades, it’s like to gradually reduce the wealth inequality created by the baby boomers’ wealth dominance. Having said that, by the end of that timeframe Gen X and the Millennials will control the vast majority of their parents’ wealth, so they’ll end up in a similar position of dominating Australia’s wealth as their parents had been in. As a result, it’s hard to see long term wealth equality returning. The good news is this means Australia’s ageing population is generally positioned to enjoy a comfortable retirement.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Pay attention to the great wealth transfer

With the impending transfer of the baby boomers’ immense wealth to Gen X and the Millennials, there’s likely to be a growing tailwind for property in particular, whilst growth assets are likely to benefit from a structural tailwind in the form of higher risk appetites. Whilst these investment implications are very long term in nature, it’s worth investors being aware of this approaching thematic.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.