Why you should be dollar cost averaging

Simon Turner

Wed 27 Sep 2023 6 minutesIt’s long been recognised that stock markets have a habit of making intelligent people look stupid.

The fundamental reason is simple but often ignored… share price movements can be wild and unpredictable, and often confound investor’s expectations. And yet, with investors increasingly watching their stock price movements like hawks the temptation to account for unexpected stock moves with rational explanations often leads to sub-optimal results.

With closer to optimal in mind, it may be time you benefitted from dollar cost averaging, a simple strategy which helps many investors achieve their long term goals.

Portrait of an investment mistake

We’ve all been there. A stock you’ve been meaning to buy for years decreases significantly in value and you go all-in by buying the stock into the weakness..

At first, you feel clever for having awaited the amazing buying opportunity. But then, you check the stock price of your new purchase a couple of days later. It’s down 5% on the price you paid. It irks that you got the timing wrong, but you shrug it off because you’re thinking longer term about the stock.

Another couple of days later, you check the stock price again. It’s down another 5% and the chart is starting to look scary. It reminds you of the often quoted investment advice, never catch a falling knife. It makes you wonder if you’ve attempted to do that very thing despite all your years of investment experience. The initial irk of getting the timing wrong has turned into anger with the market—which masks your anger with yourself.

Are the other investors in this stock idiots? you ask yourself. Keen to understand what others are thinking, you turn to Hotcopper where well-informed investors can surely confirm that the stock is about to bounce hard. You notice there are a surprising number of similarly frustrated voices there who’ve also been wrong-footed by the stock’s weakness.

Initially, the sharing of everyone’s woes makes you feel better about your mistake since so many other seemingly intelligent people made the same error. But eventually, the collective disappointment parading as confidence about the stock’s future is opposed by a dissident voice who highlights with a cocky tone that he sold the stock before recent weakness because he expected the selloff for obvious fundamental reasons.

This sets the cat amongst the pigeons. A number of the frustrated investors call the cocky poster out for being arrogant and insensitive, and soon the posts become abusive as the collective upset is directed at the cocky poster who avoided the bullet everyone else took fair and square.

To make matters worse, the stock price seems to be reacting negatively to all the bitching and moaning on Hotcopper. It’s down another 5% since you started following the posts to alleviate your pain. By now, you’re feeling the negativity from Hotcopper at a deeper level, and you’re starting to believe the stock is destined to keep falling forever.

Unable to take any more pain from this stock, you decide to sell it 15% below your entry price. It’s a painful decision but at least you’ve protected yourself from further losses. You move on and try to forget about that disastrous investment.

A few weeks later, you decide to check how much further the stock has fallen since you sold it. You don’t admit it to yourself, but you want to feel better about your decision to sell it at such a large loss.

When you see the stock price chart, you immediately regret checking it, selling it, everything. It turns out you sold the stock at around its lows—at the point of maximum negativity. Since then, it’s bounced by 20%, to well above the price you paid for it.

It’s salt in a wound. You wonder if you’re the seasoned investor you thought you were.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

It’s not you, it’s the market

It’s time to make you feel better about your investment mistakes… it’s not you, it’s the market.

Financial markets exploit our emotional biases by inspiring us to take the wrong action at the wrong moment. As such, rather than being about IQ, being a successful investor often comes down to having a repeatable investment process which takes into account how our emotional biases work against us as investors.

Dollar cost averaging… a simple strategy to safeguard your returns

The good news is there’s a remarkably simple way to avoid many of the emotionally-driven pitfalls of investing… dollar cost averaging.

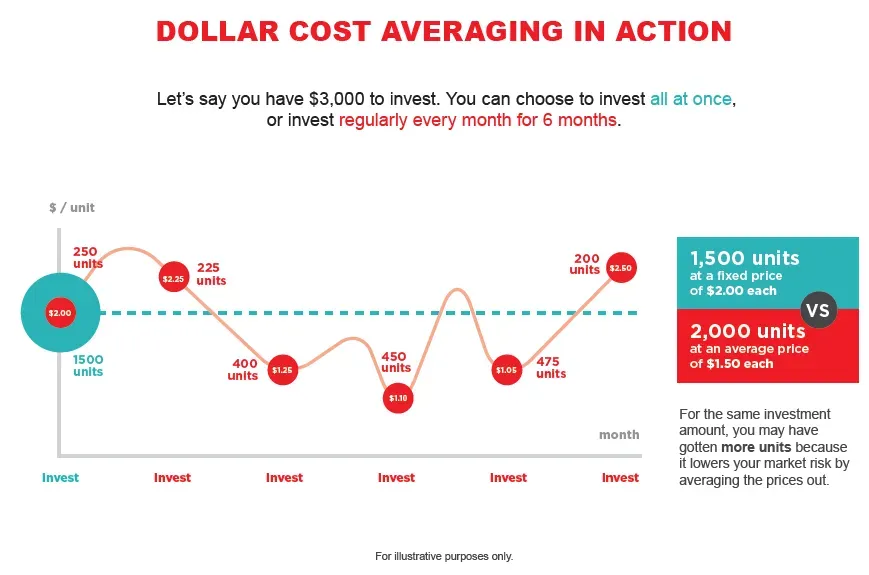

As the name implies, dollar cost averaging involves investing in stocks or funds at regular intervals rather than going ‘all-in’ via one larger purchase. This simple strategy ensures investors benefit from a stock or fund’s long term value creation rather than attempting to trade its highs and lows, which most investors would agree is close to impossible.

As shown in the example below, a disciplined dollar cost averaging approach often results in better average entry prices as well as a larger quantity of stock or units owned over the long term. Both are significant advantages in the long term investing game.

The benefits don’t stop there.

Dollar cost averaging allows investors to sidestep the emotional bias traps illustrated in the example above. For example, if a stock or unit price falls after a recent purchase, it can be viewed as good news rather than bad news since investors can take advantage of that weakness by buying more.

And importantly, investors who dollar cost average are less driven to sell their holding at exactly the wrong moment. The long term mind-set core to this strategy is a game-changer when it comes to generating solid investment returns in stocks and funds alike.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Sleep better at night by dollar cost averaging

If you’ve found yourself making investment mistakes like the example mentioned, it could be time to start dollar cost averaging.

By dollar cost averaging, investors are able to side-step many of the emotional bias challenges common to investing while they build their long term wealth. It helps investors sleep better at night since the arrival of market volatility is transformed from a source of stress into an opportunity.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.