The EV winter: A brief pause or cause for concern?

Ankita Rai

Fri 9 Feb 2024 6 minutesElectric vehicle (EV) stocks are experiencing a challenging start to the new year. Tesla's price cuts, higher-for-longer interest rates, and concerning economic data from China have dampened investor sentiment, casting a shadow over the once-bullish EV market.

The ripple effect extends to major players, with BYD missing profit expectations despite achieving record sales. GM, Ford, and Hyundai are all scaling back their EV production targets due to sluggish demand, while Renault has cancelled the IPO of its EV unit, Ampere, amid a slowdown in the European market.

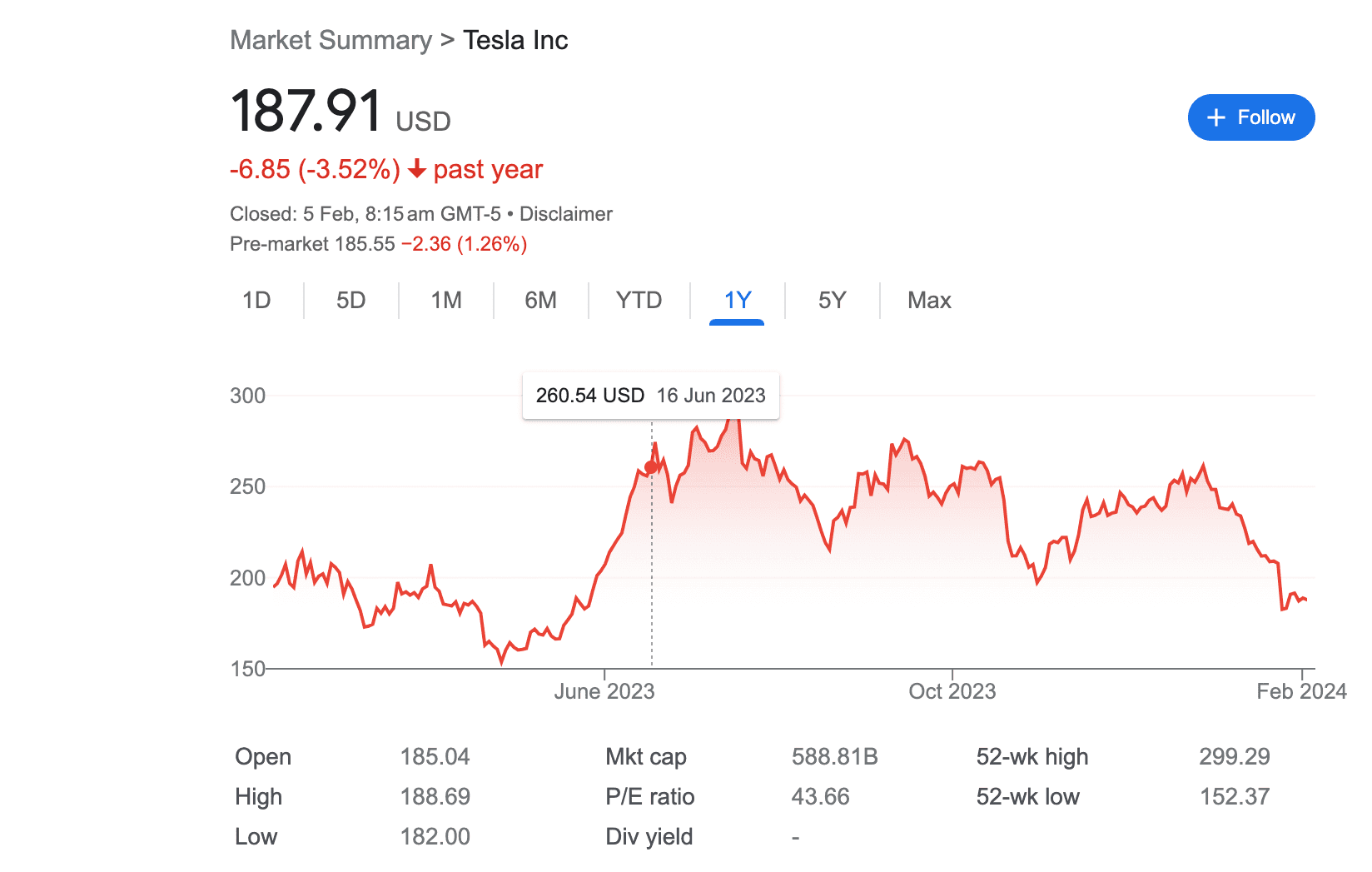

As shown below, Tesla's shares have tumbled nearly 25% so far this year after a more than 100% rise last year. Steep year-end discounting to meet its sales goals has not significantly boosted demand as management had hoped.

Tesla has not provided any targets for the year ahead. Analysts expect 20% revenue growth for the year, falling well short of the 50% p.a. revenue growth the company has promised in the past. Its global vehicle deliveries increased by 38% in 2023.

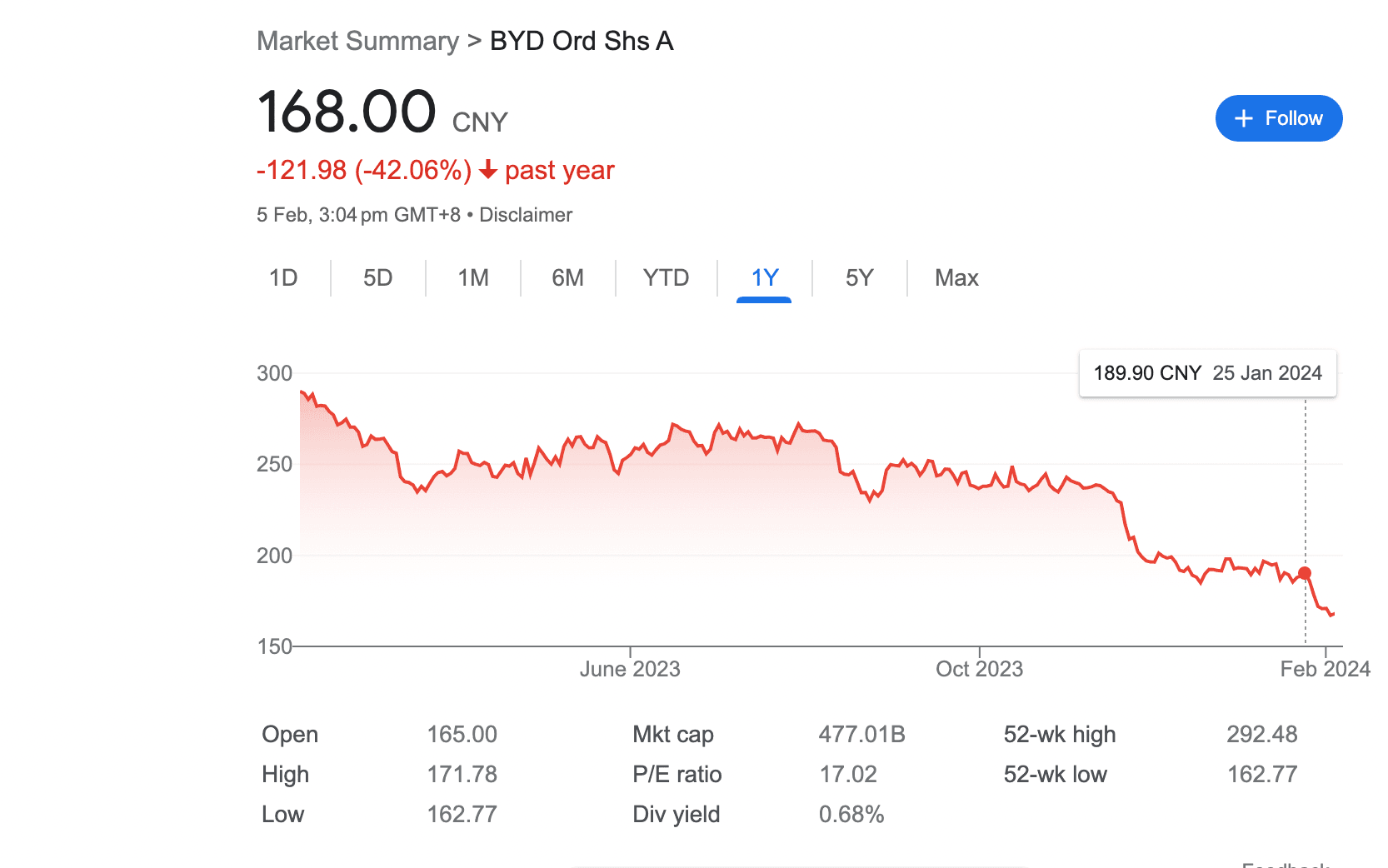

Even the global market leader, BYD, has seen its shares fall by 16% since January (as shown below), despite outpacing Tesla in Q4 with a record 526,409 deliveries. However, BYD fell short of its profit targets, primarily for the same reason as Tesla: steep year-end discounts.

EV demand continues to soften

Cracks in the EV market became evident last year when Tesla and BYD initiated aggressive price cuts to stimulate demand. The main concern for investors is that EV demand remained weaker than expected despite these lower prices.

Since the price cuts were announced, the whole EV sector has been affected. Newcomers like Rivian and Vietnam’s VinFast Auto, once more valuable than established rivals BMW and Ford, have seen their EV shares plummet. Lucid, and Xpeng have followed suit with nearly 90% share price declines from their respective highs.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Still expensive compared to the alternatives

Despite the recent price reductions, EV prices remain a significant obstacle to widespread adoption.

The issue is that EVs are typically more expensive than their petrol counterparts—often by up to 30% before factoring in incentives. This price differential exposes the sector to a number of noteworthy economic headwinds. In particular, higher interest rates, the end of EV incentives, expensive and inconsistent charging networks, and a limited range of electric models are compounding the industry's challenges.

With so many industry challenges taking their toll, it’s hard to envisage the EV winter ending in a hurry. The sector may well be due some more financial pain.

Suppliers are affected too

As EV sales cool and automakers rethink their investments, the market is recalibrating. This is impacting the key stakeholders in the EV value chain, including battery suppliers and critical minerals miners.

Top EV battery makers China’s CATL and BYD, and South Korea’s LG Energy all anticipate lower profit growth in 2024 amid the uncertain EV sales outlook and intense competition.

CATL, a major supplier to Tesla, has forecast net profit growth of up to 48.1% in 2023, down from the 92.89% net profit increase the company reported in 2022.

Its South Korean peer, LG Energy Solution, which supplies to Tesla, General Motors, and Japan's Honda, is predicting mid-single percentage revenue growth in 2024. However, the company's profit declined by more than half compared to last quarter due to weak European EV demand.

All this takes a toll on battery metals

Once considered the bedrock of the EV revolution, the critical minerals needed for manufacturing EV batteries are now in limbo as prices have collapsed while mine closures loom with several Australian mines operating in the red.

On that note, the price of lithium has fallen 85% over the past 12 months. Nickel and cobalt are down 40%, and copper has lost 10%.

This sharp decline in battery mineral prices has triggered several mine closures in the last month alone. For example, Core Lithium suspended its operations near Darwin, while IGO is shutting down its Cosmos nickel mine. Panoramic Resources and First Quantum have also ceased their operations in Western Australia.

The recent announcement of over 1,500 mining job cuts in Western Australia alone largely reflects the wider downturn across the EV sector.

But the long-term outlook is intact

Amidst this prevailing sense of doom across the EV sector, there is a silver lining. Despite the current market imbalance, most market experts anticipate robust demand growth for battery metals while lower commodity prices are bolstering the margins of EV manufacturers.

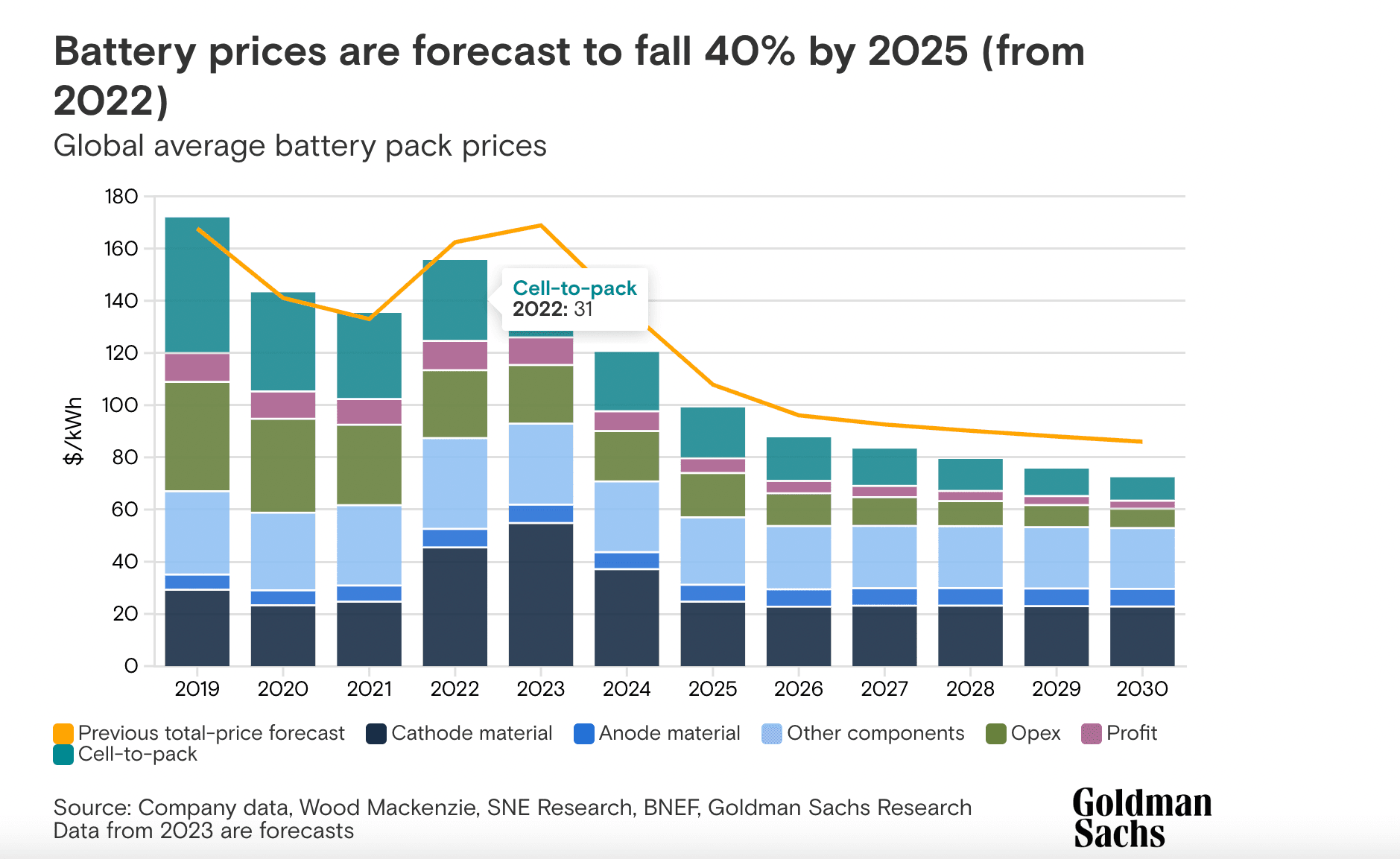

A recent report by Goldman Sachs suggests that the decreasing costs of raw materials such as nickel, lithium are expected to lead to a 40% reduction in EV battery prices within the next two years (as shown below). This decline in battery prices may enable EVs to achieve cost parity with traditional internal combustion vehicles by 2025.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The introduction of Tesla's budget car by 2025 could further play a pivotal role in market expansion, making EVs accessible to a broader market who were previously unable to afford the existing EV lineup.

S&P Global Mobility projects global sales for battery electric passenger vehicles will reach 13.3 million units in 2024, comprising 16.2% of global passenger vehicle sales. In 2023, an estimated 9.6 million BEVs were sold, accounting for a 12% market share. This reflects a solid 39.5% yearly revenue growth by the EV industry.

Time for a reality check

While the odds of an imminent turnaround for the EV market don’t look promising, from a long-term perspective, the sector’s growth trajectory indicates continuous improvement in all the key points: improving battery technologies, decreasing costs, reduced EV prices, and a notable increase in public charging points installed worldwide.

This, coupled with the emergence of an affordable EV product range, could well open the market to a whole new set of buyers, making it an attractive prospect for investors looking to capitalise on the sectors’ long-term potential.

Key takeaways for investors:

1.The slump in lithium and nickel prices will help reduce battery costs, thereby improving EV margins.

2.Goldman Sachs predicts a 40% EV battery price drop in two years, driven by decreasing nickel and lithium costs.

3.The introduction of Tesla's budget car by 2025 is poised to play a pivotal role in market expansion, making EVs accessible to a broader market of mass-market buyers.

4.S&P Global Mobility forecasts 13.3m EV sales in 2024 which represents 39.5% YoY growth despite the sector’s short term challenges.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.