Should you have more private equity exposure?

Simon Turner

Thu 8 Feb 2024 7 minutesIn recent years, the private equity sector has increasingly cast its fund raising net to include individual investors who are aiming to generate strong risk-adjusted returns over the long term. With more investors considering the private equity opportunities on offer, it’s worthwhile delving into this opaque sector’s unique benefits and challenges.

The benefits of private equity

Private equity has a well-defined role to play in the Australian and global economies and it offers investors a number of benefits:

Filling important gaps in the private corporate world - By leveraging their funding and management advantages, private equity investors have a unique ability to bring the required funding, management expertise, and investment planning to create value in ways beyond the capabilities of the existing management teams of many private companies.

Freedom to make required changes - By executing the required changes outside the gaze of the public markets, private equity managers have the advantage of being able to make difficult management decisions without upsetting or scaring other shareholders. This is a significant benefit in businesses which require significant restructuring.

Strong performance - The long term performance data confirms that private equity is an asset class which generates solid risk-adjusted returns. The global private equity sector generated returns of 10.5% p.a. over the twenty years to June 30th, 2020.

Lack of volatility - It’s noteworthy that these returns were generated without the volatility inherent in public markets. This is an advantage for investors who find the volatility of public markets challenging to navigate.

So in essence, the attractions of private equity centre around the sector’s solid long term returns which are generated without the stresses of public market volatility.

The challenges of investing in private equity

As with all asset classes, private equity faces a number of challenges investors should be aware of:

Potential short termism - Given most private equity firms tend to invest in businesses for 3-5 years, there’s a risk they don’t invest enough capital or management time, look after employees, or adopt the owner mind-set that tends to be associated with successful businesses. In other words, by adopting a shorter term mind-set some private equity investors may be limiting the value creation process within the businesses they own.

Handling of debt - Most private equity investment cases are based upon each investment company repaying the debt used to acquire their business as opposed to the private equity firm themselves. This means investors generally carry all the financial risk whilst the private equity investors are largely only exposed to the upsides of a successful investment. Some investors may regard this as an unfair distribution of risk, and an unequal footing to begin the long term partnership a private equity investment entails.

Fees - Private equity firms charge annual fees which erode investment returns over the long term. An average private equity fee structure is 2% of committed capital plus 20% of the net upside upon exit. These fees can add up to a substantial chunk of the upside on a typical five-year investment case.

Legal protections - Private equity firms tend to be adept at protecting themselves from legal liabilities even when investors’ funds are at risk of loss. Whilst most people would regard these legal protections as a sensible business practice, the risk it creates is that some private equity managers may not be fully aligned with their investors.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A more active 2024 expected

So what should investors expect from private equity as an asset class in 2024?

By way of background, the Australian private equity sector experienced a subdued 2023 with deal numbers down 29% on the previous year. The combination of higher interest rates and economic fears took their toll.

2024 should be a more active year for the sector. The reason is simple. The longer investors’ capital is tied up in existing private market opportunities, the higher the opportunity cost and the less impressed investors tend to be. This opportunity cost is particularly high when public markets have been rallying, as they have been in recent months. Unimpressed private equity investors are less likely to reinvest their capital into new deals with the same manager, so local private equity managers face growing pressure to transact this year.

Then there are the fees. Private equity performance fees generally depend upon the manager achieving successful exits in the form of IPOs or trade sales. This financial incentive adds to the sector’s pressure to complete more exits this year.

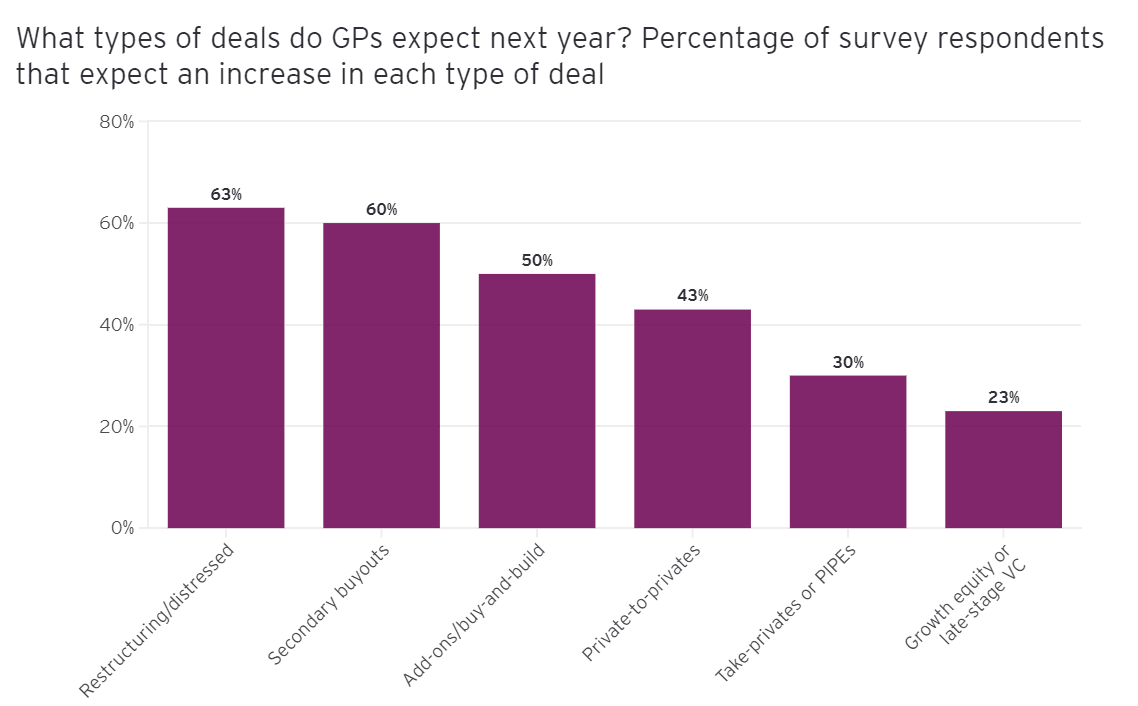

In terms of expected private equity deal types, 2024 is likely to be a particularly busy year for restructurings, secondary buyouts, and buy-and-build strategies—as shown in the EY global survey results below.

Confession session approaching

With more private equity trade sales and IPOs likely in 2024, existing investors are on track to find out whether the carrying values of their private investments bear any resemblance with reality. Whilst all private equity managers will be hoping to achieve premiums versus their investments’ carrying values, it’s unlikely this will be the case for each and every transaction.

Dry powder overload

The other major theme for the sector this year is the amount of dry powder ready for investment.

S&P Global estimate there was a massive $US2.59 trillion of global private equity dry powder sitting on the side-lines at the end of 2023. That’s an unprecedented amount of private equity cash looking for a home.

The possible end of the Fed’s rate raising cycle could provide the more stable financial conditions the private equity world has been waiting for to deploy more of this immense dry powder stash. That means investors should be ready for more takeovers across private and public markets alike in 2024.

Value accretive funding options

Dry powder is not the only source of capital the private equity sector has at its disposal.

The booming private credit market is positioned to provide an abundant supply of funding this year, whilst the under-leveraged syndicated banking market is also likely to prove supportive.

As a result of the healthy funding environment, there’s likely to be a growing number of private equity investors in search of high quality companies with low quality capital structures. By bringing their superior fund raising position and expertise to these types of businesses, private equity investors are well positioned to generate an immediate valuation uplift for minimal effort.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Right for some investors

Private equity is here to stay as a mainstream asset class.

Whether or not you should be increasing your exposure to private equity really comes down to whether it aligns with your investment goals. It’s a higher risk asset class which remains on track to deliver superior long term risk-adjusted returns, but it’s also an opaque sector which charges high fees and is highly dependent upon the skill of the manager.

For investors looking for private equity exposure, it’s worth focusing on managers with a successful long term track record who are adept at navigating the above-mentioned sectoral challenges. It’s also worth focusing on managers with competitive fee structures and an awareness of their longer term and cultural impacts on their investment companies.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.