Prepare for volatility

Simon Turner

Thu 1 Feb 2024 5 minutesAfter three straight months of global equity markets rallying driven by expectations that the Fed has paused its rate raising cycle, volatility is currently unusually and arguably unsustainably low. The historical data suggests it’s unlikely this situation will continue for much longer. In short, it’s probably the right time to prepare for volatility to return in the coming weeks or months.

The pause party

Global equity markets have been rallying since the Fed paused its rate raising cycle late last year. In response, buoyant global equity markets have priced in a soft US economic landing along with future rate cuts.

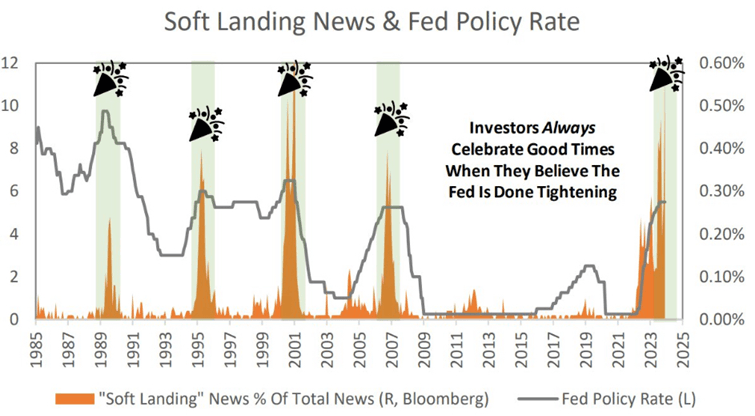

It’s not the first time this has happened. As shown below, talk of a soft economic landing generally booms and peaks during the few months around interest rate pauses by the Fed.

The reason is simple. After Fed pauses, rather than facing the risk of more rate rises, investors start pricing in future interest rate cuts, and a market headwind is transformed into a tailwind.

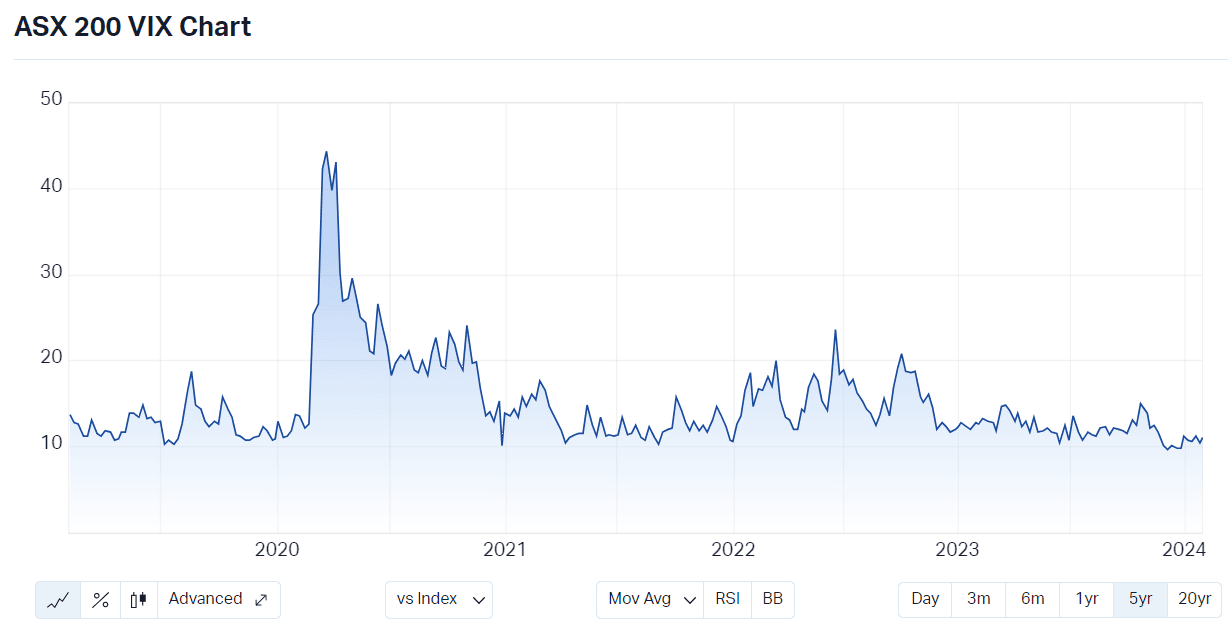

Unsurprisingly, the recent pause party has led to lower market volatility. As shown below, ASX volatility is around five-year lows, and the picture is similar in the US.

Time for markets to sober up

The more sobering news for investors is shown in the table below.

So looking back, 6 of the 9 times equity markets have interpreted Fed pauses as harbingers of soft economic landings and thus worthy of celebration, they were wrong to do so. Despite investors’ enthusiasm during those periods, hard economic landings were just around the corner. Of course, the silver lining is that 3 times out of 9 investors were right to celebrate.

Some market experts are proclaiming this time is different from the 6 out of 9 times markets were wrong in the past. That may be the case. The US economy in particular has continued to surprise on the upside over the past year. However, financial history is littered with cautionary examples of periods when investors collectively ignored the inherent danger of believing it’s different this time.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Why it may not be different this time

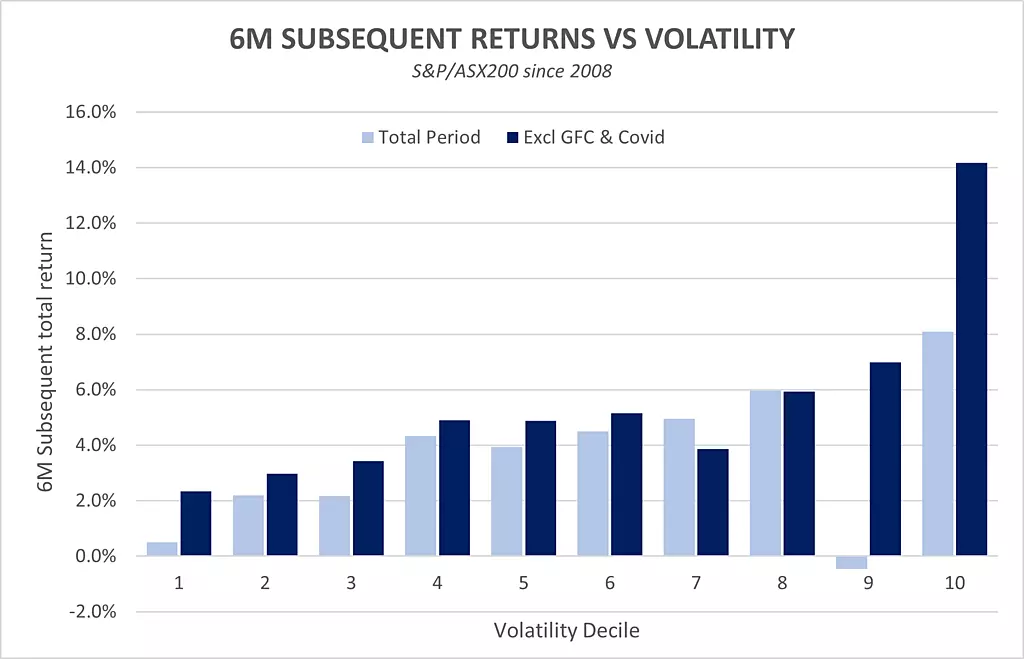

We just need to look to the historical data for a picture of how equity markets generally perform after periods of extremely low market volatility like we’ve experienced in recent months. Here are the 6-month ASX200 returns versus the full spectrum of market volatility.

The good news is the 6-month returns are positive on average for all volatility deciles, although these numbers undoubtedly mask a lot of market ups and downs throughout each period. The more useful lesson from the data is that lower volatility generally leads to lower 6-month equity returns.

It’s easy to understand why. Market volatility tends to be lowest when investors are least fearful and thus most complacent. It’s during periods of low volatility that investors are least focused on valuing the market’s risks, and hence most likely to ignore fundamentals in favour of momentum.

The standout risk for global equities

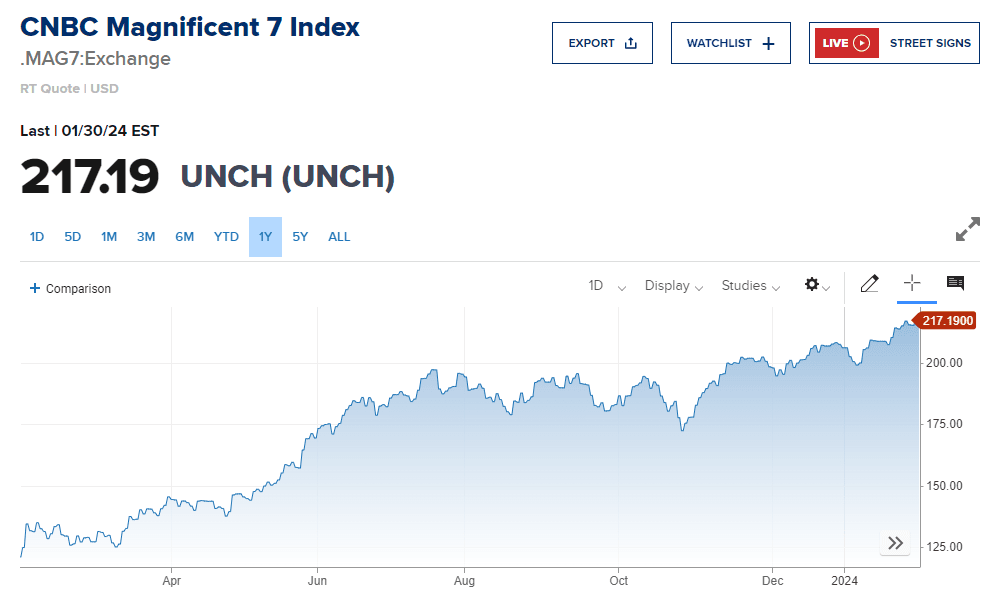

There’s one standout risk which warrants investor attention when global equity market volatility is as low as it is … the implications of the recent stampede buying in the MAG7 stocks (Apple, Microsoft, Alphabet, Amazon, Nividia, Meta Platforms and Tesla).

Buying interest in the MAG7 stocks has arguably escalated more for psychological than fundamental reasons. In particular, with the majority of benchmark-aware US and global fund managers having underperformed the MAG7 stocks in 2023, many of them have been buying these stocks to catch up with their benchmarks so as to avoid longer term underperformance.

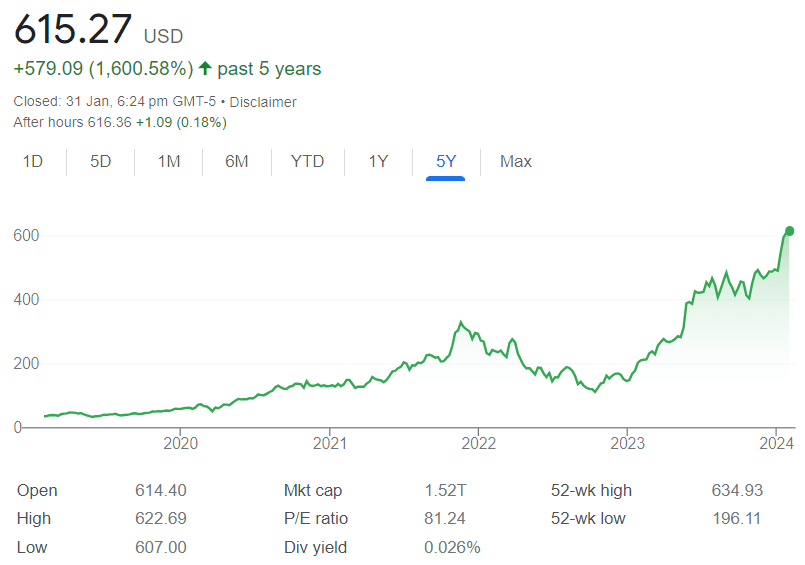

As shown below, the MAG7 index has ripped higher as a result.

The longer fund managers play this tail-chasing game, the more overvalued the MAG7 stocks are likely to become, and the more capital is likely to be sucked away from other stocks and sectors.

More worryingly, these episodes tend to predate broader market selloffs. You’ll note in the chart below what happened the last time Nvidia, the strongest performer of the MAG7, was so aggressively bought—toward the end of 2021.

If history were to repeat, a selloff in Nvidia and the rest of the MAG7 stocks could well be the catalyst that drives volatility higher across global equity markets, including on the ASX.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Prepare for the return of volatility

Recent low volatility after such a strong rally in global equity markets suggests investors should prepare for a return of volatility in the short term. Having said that, long-term investors are generally advised to stick with their investment plan as equities remain on track to outperform most asset classes over the long term.

However, maintaining a higher than normal cash balance and ensuring you aren’t too exposed to overbought stocks such as the MAG7 stock at this juncture may prove strategic in the coming months. The potential bursting of the MAG7 bubble may well prove to be the shorter term catalyst that drives volatility higher and global equity markets lower.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.