The seismic shifts afoot in fixed income markets

Simon Turner

Mon 28 Oct 2024 5 minutesMore than a few fund managers have highlighted that fixed income investing these days is a world away from what it used to be. They’d be right. The very structure of global fixed income markets has changed since the Global Financial Crisis.

As with all structural shifts, it pays to revisit the here and now on occasion to ensure your current strategy is fit for purpose. The reality is the strategies necessary to generate alpha in fixed income markets are different from the past.

Fixed income markets have changed

Prior to the pandemic when risk parity and 60/40 strategies dominated many investors’ portfolios, investing in fixed income was as simple as filling your targeted bond exposure with cheap composite bond funds that delivered the expected yield and liquidity. Job done. It was an easy means of gaining exposure to a ubiquitous asset class which had earnt a long term and defensive position in most investors’ portfolios.

But then everything changed. Or rather, five important things changed:

Banking regulations were tightened after the Global Financial Crisis which led to stricter capital requirements.

As a result, the banking sector was forced to adopt a more transactional, capital-light mode. Translation: the major banks had less cash to lend and thus lost market share to alternative players.

Interest rates rose fast

Higher rates have historically spelt good news for lenders because net interest margins have tended to be higher. The fastest central bank rate rising cycle in history changed the market backdrop, and created the perfect conditions for the third shift.

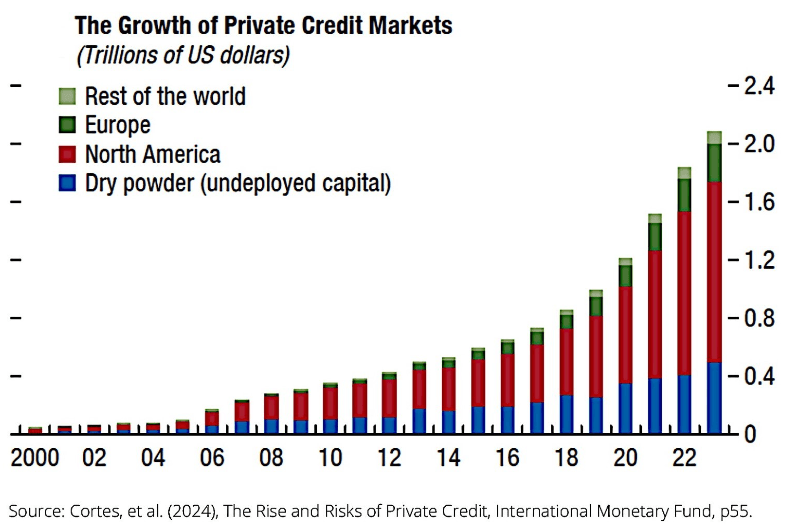

The non-bank lending market boomed.

With the banks forced to lose lending market share due to the above-mentioned regulatory changes, the non-bank lenders stepped in to fill the gaps. In particular, private credit funds, hedge funds, and other non-traditional lenders have significantly increased their market share and in the process they’ve helped reshape the fixed income market landscape.

The non-traditional lenders brought non-traditional approaches to fixed income markets such as AI strategies and algorithmic trading which allowed them to identify attractive risk-adjusted returns faster and more efficiently than in the past.

As a result, new alpha generation opportunities have been emerging across the previously slow-moving fixed income world. It’s been good news for the managed funds and ETFs positioned to benefit.

Liquidity and volatility have both increased.

With these new players managing a growing portion of the fixed income pie with strategies which are often shorter term in nature than in the past, both liquidity and volatility have increased across global fixed income markets.With so much change afoot, fixed income investors clearly need to adapt.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What’s a fixed income investor to do?

Here are a few strategies which may help investors generate fixed income alpha in this new world:

Accept that volatility is structurally higher in listed fixed income markets and adapt your strategy accordingly.

That may involve less setting and forgetting and more active management of your fixed income exposure than in the past.

Accept that private credit has taken market share from the bond market and allocate a greater portion of your fixed income exposure to this thriving market.

Equally, it’s important to understand that private credit yields tend to be higher than bond fund yields due to the illiquidity premiums on offer. That means private credit exposure needs to be considered as longer term and illiquid, in contrast to most investors’ bond exposure.

Be realistic about where you can find liquidity across the various fixed income markets.

With the growing and illiquid role private credit is playing in many investors’ portfolios, the excellent liquidity in bond markets means bond exposures will increasingly be tactically increased and decreased as and when investors want to adjust their liquidity position.

The implication of this trend is that global bond markets are likely to correlate more with equity markets, thereby becoming less defensive during periods of market stress.

Maintain a flexible mind-set about fixed income investing.

This may sound obvious, but with so much change afoot investors who are able to understand the evolving market dynamics will be best positioned to profit from them.

That means no longer simply looking at your fixed income exposure as the defensive portion of your portfolio that will automatically outperform during equity market selloffs. The new world of fixed income investing is more nuanced than it used to be.

In recognition of these shifts, now may well be an ideal time to invest in fixed income through best-in-class managed funds and ETFs with the requisite experience and resources to adapt to and profit from the new world of fixed income investing.

Position yourself to benefit

Fixed income investing has changed in profound ways since the Global Financial Crisis. Navigating this new world depends upon understanding the shifts and what they mean. That means adopting an active, flexible, forward-thinking investment strategy that leverages the benefits of the market evolutions whilst protecting your portfolio from the more challenging knock-on effects of the changes.

For most investors, the best way to do this is to invest in leading managed funds and ETFs which are positioned to benefit from the changes.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.