To hedge or not to hedge

Simon Turner

Wed 14 Aug 2024 8 minutesWhen the words ‘hedge fund’ run through investors’ minds, cocaine-fuelled images of Leonardo DiCaprio in The Wolf of Wall Street, may accompany them.

Fair dues. In the past, the global hedge fund sector attracted more than its share of larger-than-life alpha males not known for their ethics or compassion. But that was then and this is now. And with global equity markets getting rockier, investors are increasingly looking for reliable absolute return strategies to protect their portfolios from market volatility.

So we’ve taken a look under the hood of the global hedge fund sector for a glimpse of the potentially stabilising role absolute return funds may play in investors’ portfolios.

What are absolute return funds?

Absolute return funds, or hedge funds as they’re often known, aim to generate a positive investment return regardless of the market’s direction. The strategy dates back to 1949 when Alfred Winslow Jones established the first absolute return fund in New York.

The most common absolute return approach is a long-short strategy whereby a long portfolio is hedged against a short portfolio. A long portfolio comprises stocks and assets which are expected to appreciate in value, whereas a short portfolio comprises borrowed stocks which are expected to decrease in value (the fund profits when they do). The fund must pay a cost of borrow to the investors lending it the stocks it intends to short sell.

It’s important to understand that a hedge fund’s net market exposure is the difference between the value of its long and short portfolios. For example, a fund with a 100% long book and a 50% short book is 50% net long—which means it has half the net market exposure of a traditional fund. The lower a fund’s net exposure, the less sensitive (in theory) it should be to market movements.

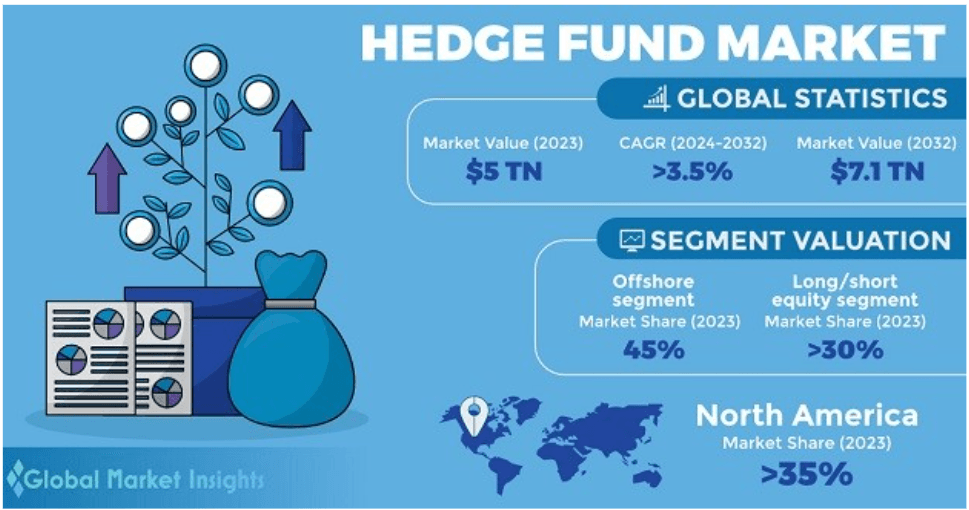

The hedge fund sector is no minnow. It is already managing $US5 trillion, and its assets under management are expected to grow at 3.5% p.a. over the coming decade.

Pros and cons

The main pro of hedge funds is that they are likely to outperform traditional (long only) strategies during periods of market weakness, when volatility tends to be higher. This is the main reason to invest in hedge funds: for exposure to strategies which aim to generate a positive return regardless of market direction.

Of course, no investment strategy is perfect. There are also some cons of investing in hedge funds. For example, absolute return funds don’t always deliver the positive returns investors expect. They are also likely to underperform traditional funds in a rising market because their short portfolios are likely to generate a negative return.

The other noteworthy con is the common use of leverage. The majority of hedge funds have gross exposure above 100%, which means their financial risk is generally higher than for traditional funds. For example, a fund with a 100% long portfolio and a 50% short portfolio has gross exposure of 150%. So hedge funds’ apparent lack of market risk may be offset by their heightened financial risk. On that note, hedge funds with gross exposure of 200%+ should be regarded as higher risk since leverage tends to accentuate the potential downsides if a fund is unravelling.

One final angle to be aware of is the sector’s storied history. Let’s call it Wolf of Wall Street risk. It’s no understatement that drug-taking, alcoholism, and misogynistic behaviour were common across the hedge fund industry prior to the GFC. Full disclosure: I witnessed this up close and personal during my time as a fund manager. However, the GFC catalysed enormous industry change in the form of increased accountability and transparency, better risk controls, and more professional cultural standards. So thankfully, the excesses of the past are far more likely to be witnessed on the big screen these days than within hedge fund teams.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Read the price tag carefully

Fees should also be front of mind for investors considering absolute return funds since these funds often charge higher management fees than traditional funds do.

By way of background, the hedge fund sector made famous the 2 & 20 fee structure: a 2% management fee plus a 20% performance fee. That adds up to a fair chunk of change. For example, if a hedge fund charging 2 & 20 fees generates a 20% return, investors only receive a net return of 14% after fees.

It’s worth adding that not all hedge funds charge 2 & 20 fees these days. With some research, it’s possible to invest in high quality absolute return funds with more competitive fee structures.

How do they do it?

There are 8 main absolute return fund strategies to be aware of:

Equity long-short – This is the most common hedge fund strategy (as mentioned above) which involves investing in a long portfolio, which is expected to appreciate in value, and is hedged by the fund’s short portfolio, which is expected to fall in value. The goal is to generate a positive return, even during periods of market weakness.

Long biased – This is an equity long-short strategy with a bias to the long portfolio. For example, a long biased fund may have net market exposure of 80%, well above a market neutral strategy with 0% net exposure. In reality, many hedge funds are long-biased for the simple reason that equity markets tend to rise over the long term.

Quant – This is generally an algorithmic strategy that uses AI and internal systems to make investment decisions and manage the fund. Without depending on the opinions and emotions of human fund managers, this strategy has the advantage of being free of human biases.

Credit – This is a debt-focused strategy which generally combines long/short portfolios of debt, event-driven debt positions, and distressed debt positions.

Event – This is a strategy which aims to exploit pricing inefficiencies before or after a corporate event such as earnings results, acquisitions, or special dividends.

Macro – This strategy aims to generate returns by positioning a portfolio to benefit from a manager’s macroeconomic and political views and forecasts.

Arbitrage – This is a strategy that takes advantage of relative price discrepancies which are expected to diverge or converge over time.

Multi-strategy – A combination of the above.

Do they deliver?

The theory behind hedge funds is all good and well, but do they deliver what it says on the tin?

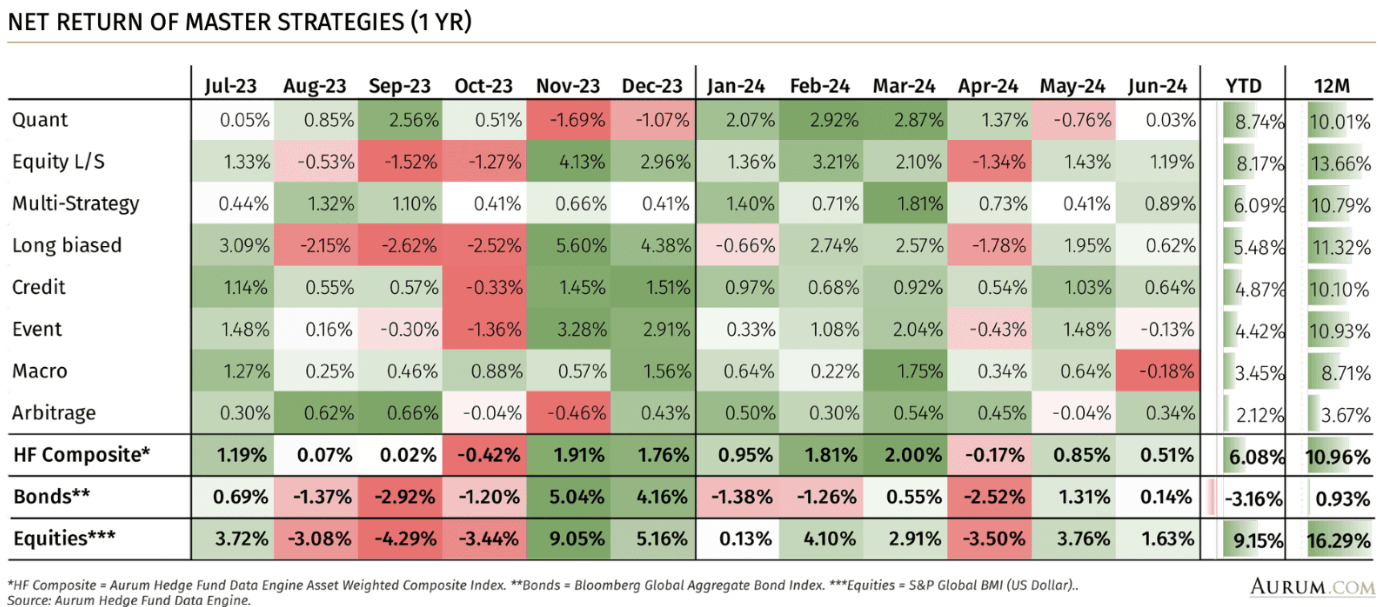

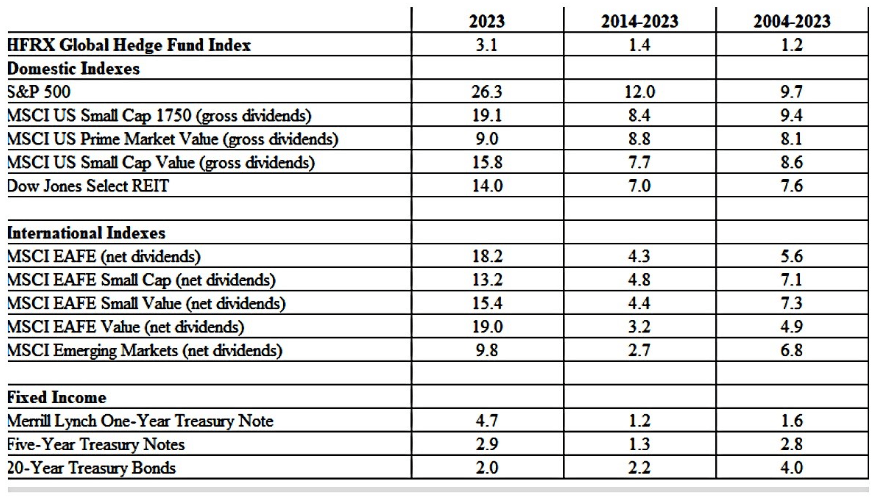

Over the year to June 2024, the global hedge fund sector delivered a composite return of 10.96%. That’s a pretty solid result for an asset class focused on generating absolute returns.

As you’d expect, most hedge funds have outperformed bond funds and underperformed most traditional equity funds over the past year. And most types of absolute return strategies have performed reasonably well in that timeframe, apart from arbitrage funds which delivered average returns of only 3.7%.

But the longer term data tells a different story. The global hedge fund index has generated an average return of only 1.2% p.a. during the twenty years to 2023.

The sector’s longer term performance challenges appear to range from the limitations of a shorter term investment horizon to the market saturation caused by an abundance of similar strategies.

So the answer is yes and no. The hedge fund sector has delivered on expectations of late, but there are longer term performance challenges to be aware of.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Tips for investors

In summary, here are a few tips which may help when selecting absolute return managers:

-Focus on managers with a long term track record of generating positive returns in up and down markets.

-Pay close attention to fees. The days of 2 & 20 fee structures are largely over.

-Pay close attention to leverage (read: gross exposure). Focus on funds with gross exposure well below 200%.

-Focus on hedge funds that actually hedge. That means funds with a net market exposure of 50% or lower.

-Understand that most absolute return strategies will underperform a rising equity market.

Hedge funds have a role to play

Thankfully, investors no longer need to be on the lookout for wolves of Wall Street within the hedge fund world. These days, accountability, transparency, and high professional standards are the name of the game for most managers.

Absolute return funds’ role of improving risk-adjusted returns regardless of market direction is an important one for many investors. As the word ‘hedge’ implies, these funds can play a stabilising role in investors’ portfolios during periods of market volatility. But do your research. Not all hedge funds are created equal.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.