Does momentum investing work?

Simon Turner

Tue 20 Aug 2024 4 minutesMomentum is defined as ‘the impetus gained by a moving object.’ It’s an important concept that's at the heart of most success.. Tony Robbins explains why: ‘People who succeed have momentum. The more they succeed, the more they want to succeed, and the more they find a way to succeed.’

It’s the same in the investing world where momentum investing means buying the stocks that are going up and selling the stocks that are going down. It sounds easy in theory, but it’s far from easy when investors are at the coal face of financial markets. The reality is stocks rarely go up or down in a straight line, so it’s challenging to execute a momentum-driven strategy that’s based entirely on price action.

Despite the practical challenges, the strategy’s potential begs the question: does momentum investing work?

The 5 rules of momentum investing

Momentum investing is a rule-based, trading-driven strategy with a heavy focus on risk controls.

There are 5 cornerstone rules of momentum investing:

1. Focus on highly liquid stocks which allow investors to buy and sell their positions easily, quickly, and cheaply. For a strategy that’s so focused on price action, it’s vital that investors can trade whenever they want with minimal price impact.

2. Use stop losses which allow stocks just enough downside movement to allow the expected upside to come into fruition. For example, a 10% stop loss is a common risk control utilised by momentum investors.

3. Enter stocks before the expected catalysts that are likely to lead to improved momentum. For example, momentum investors may buy a stock before an earnings result which they expect to significantly exceed market expectations. It’s by positioning themselves ahead of the expected catalysts that momentum investors are able to optimise their stock gains.

4. Manage positions in line with a planned investment horizon, and exit positions early if the expected momentum doesn’t eventuate within that period. In other words, holding period is regarded by momentum investors as an important risk control because the risk of being wrong increases the longer an underperforming stock is held for.

5. Sell when stocks reach overextended technical positions. Momentum investors are generally adept at knowing when to sell stocks since this strategy is more trading oriented than a typical buy-and-hold approach. Hence, they often use technical analysis to help with their sell decisions.

Does momentum investing work?

There’s plenty of data available which confirms momentum investing’s merits.

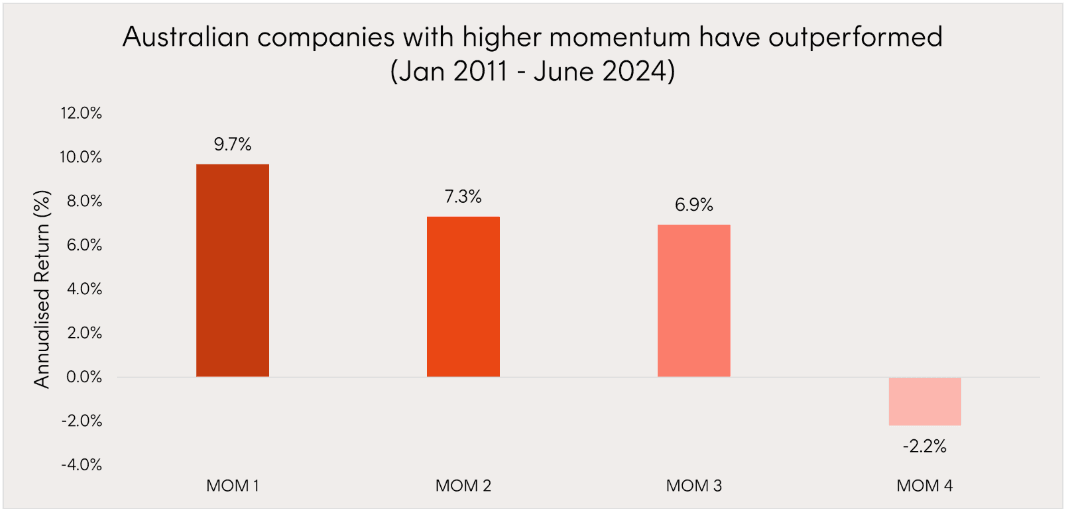

For example, Betashares compared the performance of the 200 largest Australian companies broken down into momentum quartiles and ranked their performance between January 2011 and June 2024. The top quartile highest momentum stocks were categorised as MOM1, the second quartile as MOM2, and so on. The results are shown below.

So this study shows the top quartile highest momentum stocks returned 10% p.a. over the thirteen-year period, and the lowest quartile returned -2% p.a. That 12% p.a. difference is compelling evidence of the power of momentum investing.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How to gain exposure to momentum investing

In practice, few investors have the time, energy, or focus needed to follow the trading and risk control rules of momentum investing, and thus optimize their returns with this strategy.

The good news is there are plenty of funds and ETFs which investors can use to gain exposure to the momentum investing style. For example, the Betashares Australian Momentum ETF (ASX: MTUM) provides exposure to a portfolio of Australian stocks with above-average momentum scores. There are also a number of managed funds which incorporate momentum into their investment philosophy to great effect.

Momentum investing is a strategy worth considering

Momentum investing doesn’t just work in theory. It’s a strategy which consistently outperforms over the long term, and is worthy of consideration. For most investors, ETFs and managed funds are likely to provide the most practical means of gaining access to this trading-driven investment style.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.