Boost your returns with founder-led investing

Ankita Rai

Thu 22 Aug 2024 5 minutesInvestors may struggle to determine if a company’s management team are aligned with shareholders’ interests, wondering if they are truly invested in the company's long-term success or merely focused on receiving their weekly salary.

There’s one metric which is better than all others when it comes to assessing how invested management teams are in the future of their companies: significant, long-term skin in the game. Hence, recognising outperforming founder-led businesses can be a game-changer for investors.

Take, for example, companies like Berkshire Hathaway, Nvidia, Amazon, and Microsoft—or closer to home, Life360, Harvey Norman, Reece, Pro Medicus, and WiseTech. What ties these success stories together is not just their impressive financial performance, but the visionary leaders who remain deeply connected to the companies they built.

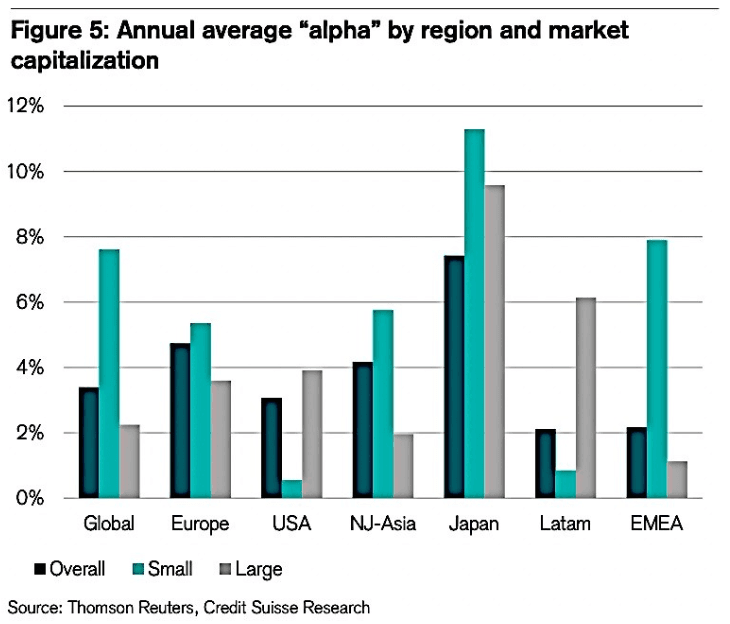

It’s this unique dynamic that founder-led investing taps into. According to research from Credit Suisse, founder-led companies globally have delivered an annual sector-adjusted alpha of 3% since 2006, underscoring their potential for superior returns and stable growth.

Founder-led investing consistently beats the market

Founder-led investing isn’t just about following a trend; it’s about recognising the unique strengths that founders bring to their businesses and betting on their ability to keep driving success.

There’s plenty of research that shows founder-led companies tend to significantly outperform their benchmark share market indices, both globally and in Australia.

For example, a study by Bain & Company, tracking 200 founder-led S&P 500 companies over 25 years, found that founder-led businesses consistently outperformed their peers.

Similarly, Solaris Investment Management revealed that over the last five years, the 12 largest founder-led companies on the ASX have returned 420% while the benchmark accumulation index only returned 65%.

Skin in the game matters

The key to founder-led outperformance lies in the skin-in-the-game mentality it instils in management teams. Numerous studies show that companies with founders who retain significant ownership and stay involved in management and governance usually succeed long-term.

Bain & Company research highlights that companies retaining the founder’s mentality as they mature are four to five times more likely to be top performers. For instance, an index of S&P 500 companies with active founders performed 3.1 times better than others over the past 15 years.

The success of these founder-led firms can be attributed to three main factors:

A sharp sense of purpose instilled by the founders,

A ‘front-line obsession’ that emphasises detailed attention and supports front-line employees, and

A strong, positive culture that aligns with the founder’s vision.

These factors tend to lead to long-term outperformance as noted by Credit Suisse, with founder-led companies consistently delivering returns on capital that are 1.5% to 2.0% higher than those of non-founder firms.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How to gain exposure to founder-led investing

Choosing founder-led companies requires more than just picking the stocks. With the vast array of such firms available, it's crucial to perform thorough due diligence to align with your portfolio goals.

For most investors, an effective alternative is investing in funds that focus on these businesses. To get started, consider managed funds that focus on founder-led businesses which are leading in their respective markets.

For example, the Luminary Global Founders Fund aims to outperform the MSCI All Country World Net Index, and has delivered a compound annual return of 10.8% p.a. since its inception.

Another option is the Truebell Investment Fund, which targets founder-led companies like CSL, Reece, and Cochlear. It achieved a 14.8% p.a. return from 2007 to 2021, significantly surpassing the All Ords, which returned 5.6% p.a. over the same period.

Investing in such founder-focused funds offers several advantages. They provide diversification into global equity markets, exposure to a portfolio of high-quality companies with strong growth potential, and the chance to invest in visionary founders who are driving innovation and the associated outperformance.

What are the risks of founder-led investing?

Not all founders are great, and not every founder-led company will become the next Nvidia. While founder-led investing can be rewarding, it also carries risks. A significant risk is over-reliance on the founder’s vision, which can lead to poor decision-making if the founder becomes complacent or resistant to change. Key person risk is also high. If a founder is forced to step back, the impact on the business may be significant.

The alignment between the founder and shareholders can also weaken if the founder sells off a significant portion of their shares. Governance issues are another concern. Without a strong board or management team to hold the founder accountable, the business might suffer.

Additionally, high turnover in management roles can be a red flag, potentially impacting the company’s stability and performance.

To mitigate these risks, investors should consider investing in managed funds that focus on founder-led companies across various sectors and stages of maturity, including both small-cap and large-cap companies. Investing in funds that combine well-established, stable companies with younger, high-growth businesses can provide a diversified and balanced investment portfolio.

The founder-led advantage

For investors looking for better returns and stability, founder-led companies can provide a significant advantage and boost their portfolio with innovative, growth-oriented assets. These businesses typically prioritise long-term value creation over short-term metrics, making them a good fit for those interested in sustainable growth.

However, no strategy is entirely foolproof, so investors are well advised to watch for potential red flags before diving in.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.