The thing with private equity returns

Simon Turner

Tue 27 Aug 2024 5 minutesRecent private equity return data from Preqin reveals that growing divergence of private equity returns is the name of the game. That’s both good news and bad news for investors.

It means having the right private equity exposure is likely to remain fruitful, but ensuring you have the right exposure may take more due diligence than in the past. In other words, being informed as a private equity investor is more important than ever.

Private equity rules the private markets roost

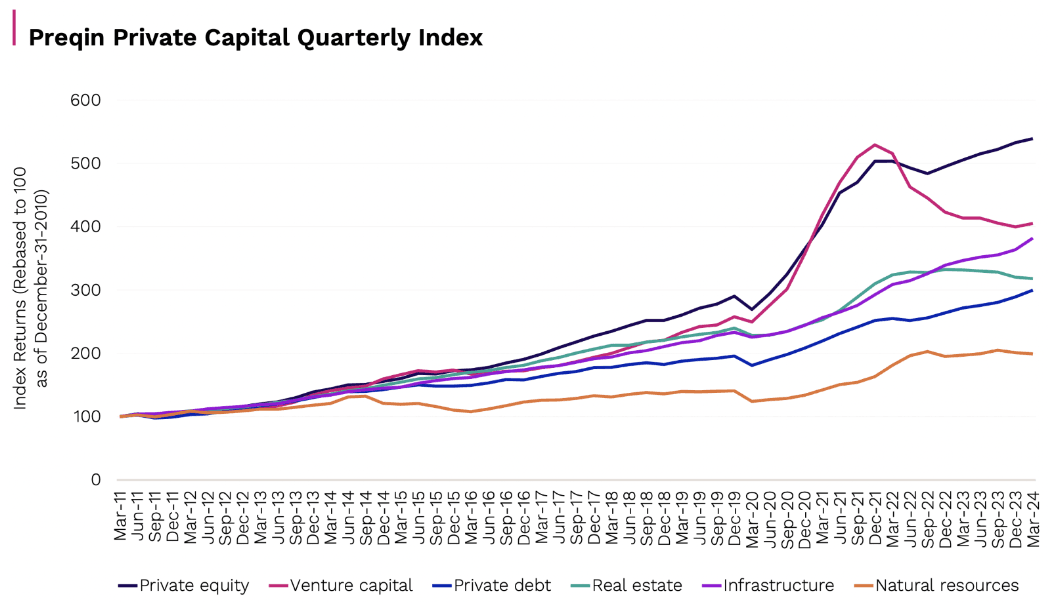

Of all the private market asset classes, private equity continues to rule the roost. As shown below, the asset class has strongly outperformed venture capital, infrastructure, real estate, private debt, and natural resources over the past 13 years.

Based on this chart alone, private equity should have investors’ attention.

The thing with private equity returns

So the thing with private equity returns is that they tend to be lumpy and only become apparent as and when a fund is liquidated.

In other words, we only discover what the returns are for various vintages of private equity funds at least a couple of years later. In most cases, the wait is much longer since the majority of private equity funds have an investment horizon of 5-7+ years.

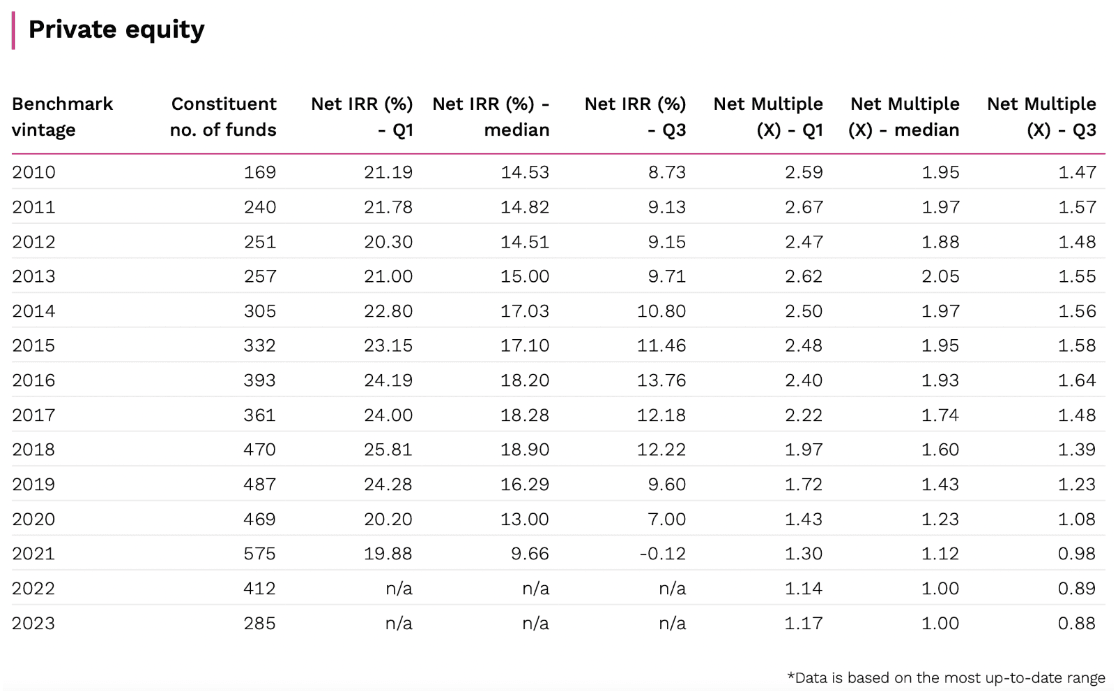

On that note, Preqin have released the most recent global private equity data so investors have a rare opportunity to make sense of it. As shown below, the most recent data is for the 2021 vintage, which generated a median return of 9.7% p.a.

One of the more interesting takeaways from this data is the trend in median private equity returns: they trended upwards between 2010 and 2018 to a peak of 18.9% p.a. Since then, they’ve been trending downwards to 9.7% p.a. for the 2021 vintage.

The pandemic no doubt played a significant role in that shift, but this trend has definitely served to highlight the importance of private equity fund selection.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The devil’s in the detail

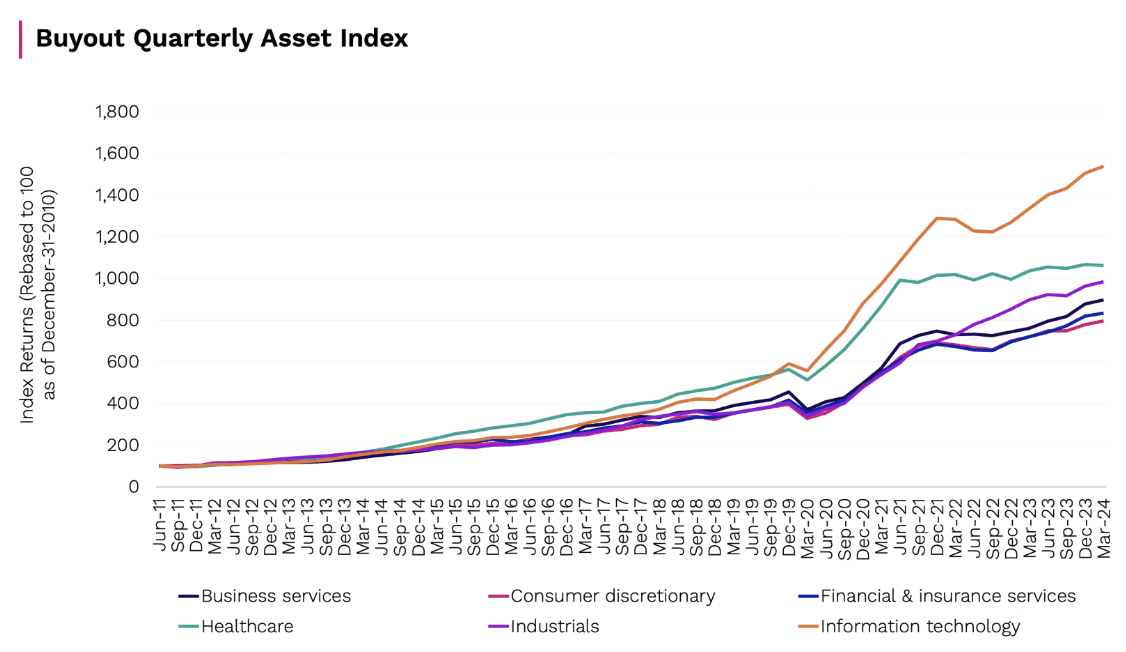

As shown below, the longer term private equity buyout returns by sector reveal wide divergences.

Here’s a summary of what’s happening at a sector level (the return data quoted are gross internal rates of return, or IRRs before fees):

- Business services has been a lucrative space for private equity investors with median returns in the 2017 vintage running at an impressive 32.6% p.a. Since then, returns have trended downwards to 12.2% p.a. Whilst that’s a major downward shift, the sector is still generating a solid performance versus the broader private equity median.

- Consumer discretionary has been more reflective of the private equity average with median returns peaking at 22.8% p.a. in the 2020 vintage. Since then, they’ve trended down to 9.9% p.a. in the 2023 vintage.

- Financial & insurance services have held up better than most sectors in recent years with returns consistently running above 20% p.a. Even the 2023 vintage generated a 21.2% p.a. return, which represents more than double the private equity median.

- Healthcare has been less defensive than many investors may have hoped for in recent years. Whilst the 2020 vintage delivered a solid 23.2% p.a. median return, since then returns have fallen dramatically. The (minor) 2023 vintage is currently running at only a 6.8% p.a. median return, which is weak by asset class standards.

- Industrials has historically been a great sector for private equity with median returns sometimes reaching 30% p.a. However, there’s been a dramatic decrease in returns in the 2023 vintage with a 2.9% p.a. median return.

- Information technology has been through a similar downward shift in returns with the 20-30% p.a. median returns the sector has generally achieved decreasing to 6.5% p.a. in the 2023 vintage. That’s possibly at odds with what investors may have been expecting given the recent AI boom in the listed world.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Pick your private equity exposure wisely

Change is afoot in the global private equity world.

Whilst information technology remains the sector’s standout winner over the long term, the most recent vintage data shows IT returns have been trending lower, along with other previous winning sectors such as industrials and healthcare. Conversely, financial and insurance services is a standout performer in the most recent vintage.

Whilst the recent vintage data may partially reflect a lack of realised opportunities to create a sensible dataset, it may also reflect an increasingly competitive private equity space. Investors are well advised to invest with managers who are able to navigate this evolving landscape without significant return erosion, including in recent vintages.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.