Is a Volmageddon event brewing?

Simon Turner

Tue 21 Jan 2025 6 minutesIn the words of Russell Napier: ‘Financial history is the most important thing to study for anyone seeking to avoid the mistakes of the past.’

So what does financial history suggest may be coming in early 2025? And is a Volmageddon event (read: an extreme volatility event) brewing as a number of experts are warning?

To answer those questions, we’ll focus on the main game in town, the S&P 500, since US stocks continue to drive global markets…

The market disagrees with the Fed

It’s been a wild ride for US Treasuries of late.

Up until a few weeks ago, markets were far too optimistic about the number of Fed rate cuts coming. The base case now implies a 44% chance of no rate cuts through to June 2025, versus 5+ rate cuts expected only a few months ago.

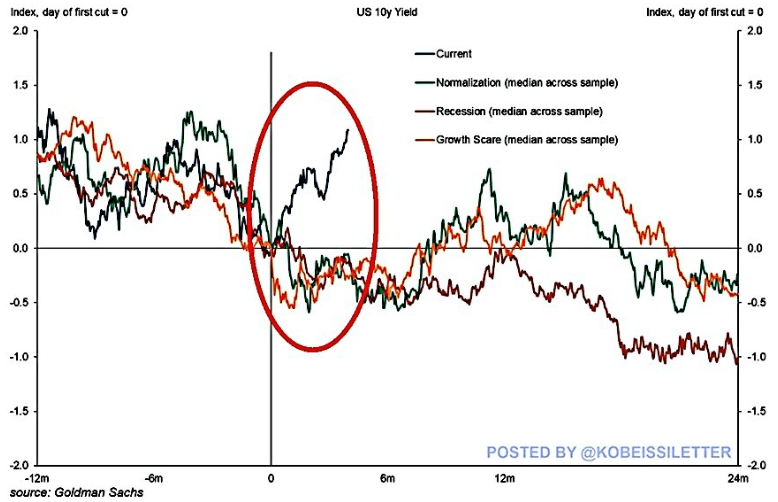

What’s more shocking is the extent to which the rise in 10-year Treasury yields to nearly 5% now defies the Fed’s guidance—as shown below.

In other words, markets have gone rogue versus the Fed’s guidance. This divergence is historic, and signals that the market and policymakers are as out of sync as they’ve ever been.

This situation has significant implications for investors:

The bond market is now calling the shots, and is pricing in higher inflation than the Fed appears to be expecting.

For US equities, it’s a red flag since higher yields mean tighter financial conditions, which could hit growth stocks and debt-heavy sectors hard.

For the crypto market, it means likely turbulence ahead. Rising yields tighten liquidity, making it harder for risk-on assets like Bitcoin to maintain their positive momentum. Having said that, this situation also underscores why investors value decentralised currencies so highly.

The January 29th Fed meeting is shaping up to be pivotal. If the Fed can’t align with the market’s altered macro view, expect higher volatility across the board.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A confusing shift in the bull-bear ratio

As per Buffet’s famous, investors tend to do best by buying when others are fearful and selling when others are greedy. So it’s worthwhile checking in on the bull-bear ratio for a gauge of market sentiment.

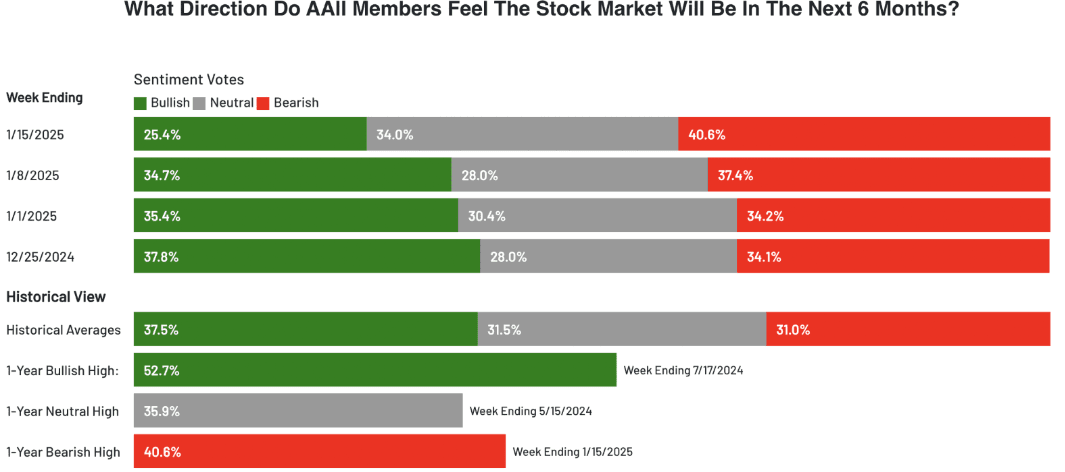

There’s been a remarkable shift in this indicator in recent weeks. As shown below, market sentiment has swung dramatically in favour of the bears over the past month despite the S&P 500 rising during that time.

Only 25.4% of surveyed investors are bullish at this juncture, down from 37.8% a month earlier, and versus an historic average of 37.5%.

More importantly, 40.6% of investors are now bearish, up from 34.1% a month ago, and versus an historic average of 31.0%. The bear ratio is at a one year high.

As a result, the bull-bear spread (bullish minus bearish sentiment) is currently at –15.2%, well below its historic average of 6.5%.

That’s an unusually strong signal that investors are very fearful. Ordinarily, this would be a bullish signal that would occur after a significant market selloff.

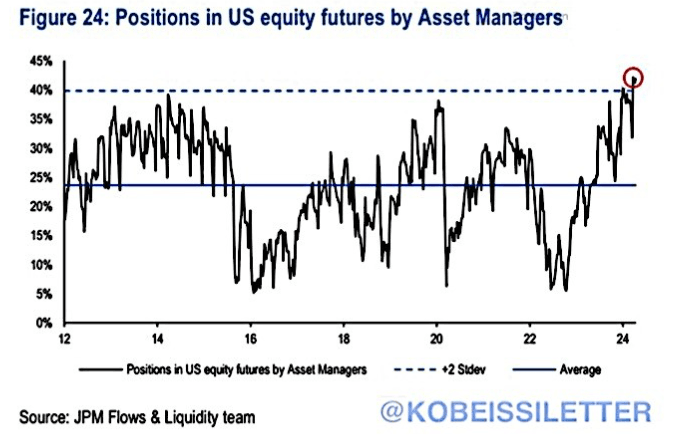

Adding to the confusion is the fact that asset managers are as overweight US equity futures as they’ve ever been—as shown below.

Whilst these data points are contradictory, the key takeaways for investors are that investors in the US are now very bearish whilst fund managers are very bullish. Make of that what you will.

The VIX remains eerily low

The VIX index is also an important gauge of market sentiment.

As shown below, the VIX index has increased during the first few weeks of 2025, but remains low versus its historical range.

Market selloffs tend to lead to much higher volatility than we’ve seen thus far.

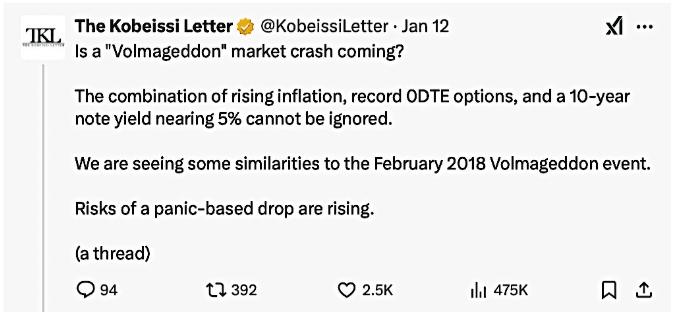

In response to the sharp rise in Treasury yields, a number of experts are expecting a Volmageddon event in the coming weeks.

It’s impossible to know if volatility will indeed spike higher, but the main takeaway for investors is that volatility is low and tends to peak at a much higher level.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Trump 2.0 is a wildcard

Of course, we can’t ignore Trump taking over as president for his second term.

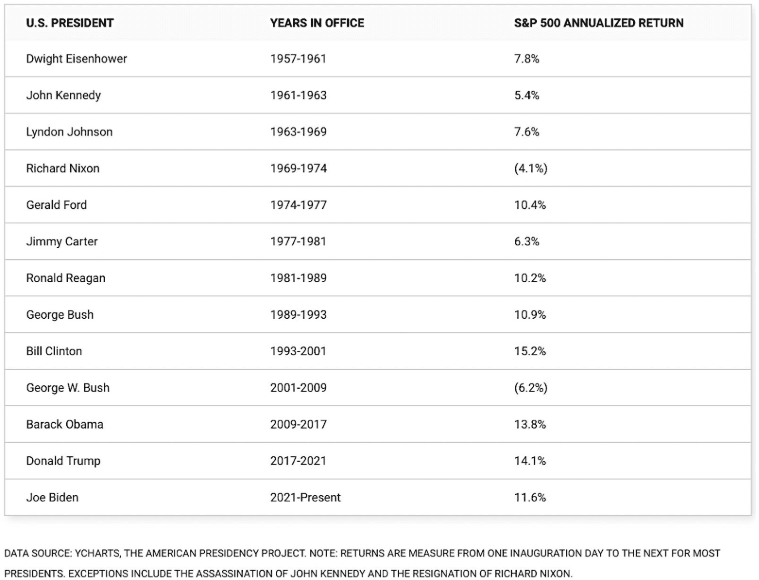

By way of background, Trump’s first presidency resulted in a 14% p.a. S&P 500 return, which compares favourably with other US presidents’ tenures and the market’s long-term average of 7% p.a.

There are reasons to expect a similar performance during Trump 2.0, including a likely economic boost from Trump’s planned deregulation and tax cuts.

However, there are also reasons to be bearish.

Arguably the biggest issue is that the S&P 500 is trading at a much higher valuation than during Trump’s first presidency with its forward price-earnings multiple of 22.2x at the end of December (according to Yardeni Research).

There have only been two recent periods when the US market traded at a similar valuation: during the dot-com bubble, and during the aftermath of the pandemic. In both cases, the market fell significantly.

In addition, we’re facing a likely global trade war in response to Trump’s proposed tariffs, not to mention the destabilising market impact of Trump and his wife launching their own cryptocurrencies — as though that’s a normal thing to do as the incoming president.

Surely these factors suggest investors should be ready for more volatility during Trump 2.0.

The risk of a Volmageddon event is elevated

The market outlook is confusing to say the least. There are reasons to be bullish at this juncture, but there are also reasons to be bearish, particularly in the short term.

The net outcome may well be that the market trends gradually higher during the year with numerous selloffs along the way. If that’s the case, the sharp rise in Treasury yields suggests the chances of a Volmageddon event are currently elevated.

This is a time to stay sharp, manage your risk, and position yourself for what may be coming.

And if you’re a long term investor, 2025 could be another year when sitting tight and not watching your portfolio too often is your optimal strategy.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.