Time to revisit your commercial property fund weighting

Simon Turner

Mon 20 Jan 2025 6 minutesInvesting in commercial property funds has been unusually painful for investors in recent years.

Rather than paying out rock-solid distributions and grinding out gradual capital gains each year as investors expected, the headwinds created by rising interest rates and the pandemic severely impacted the asset class.

But as Sameer Chopra, CBRE's Head of Research, advised at a commercial property event a few months ago: ‘When others panic, that is when you should be active.’

To that point, there are a number of emerging tailwinds for commercial property funds which could lead to a much better year for the asset class.

Now may well be a good time to revisit your commercial property fund weighting…

RBA rate cuts expected

First, some context.

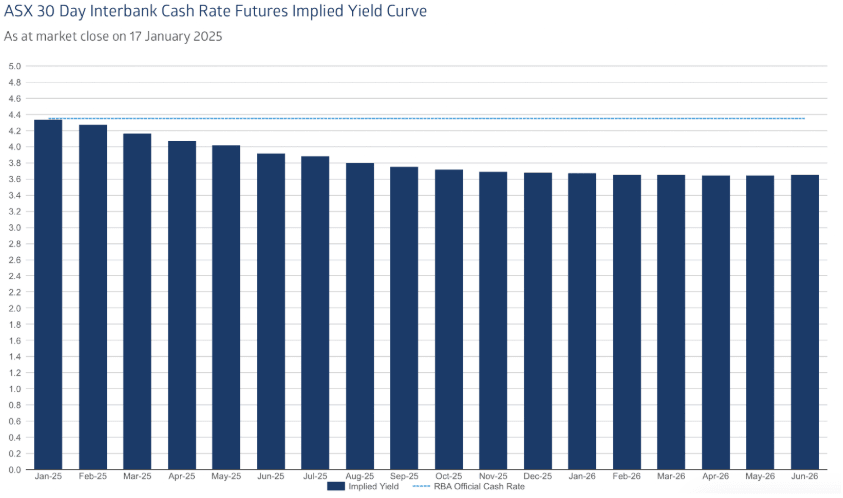

The RBA’s expected cash rate is always front and centre in investors’ minds when discussing the outlook for commercial property, so let’s check in on the latest expectations.

Morgan Stanley believe the RBA will hold rates steady until May 2025, when the first of three predicted cuts (25 basis points each) will begin, bringing the RBA’s cash rate down to a neutral level of 3.10% by 2026.

The consensual view is similar, although the expected RBA rates cuts are expected to start sooner and end sooner than Morgan Stanley’s forecasts—as shown below.

If this RBA rate cycle plays out as expected, a commercial property headwind will turn into a tailwind. This is an asset class which is particularly sensitive to interest rate changes since they impact both capitalisation rates and fund distributions.

Having said that, a more significant reduction in RBA rates could indicate a deteriorating macroeconomic environment which would not be positive for commercial property.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Rising investor interest due to the value on offer

On most measures, global markets, particularly in the US are looking expensive at this juncture.

In contrast, commercial property offers unusual pockets of value in a global context. This could lead investors to search for value in the sector, particularly in commercial property funds which are offering attractive yields.

It’s also worth noting that the Australian Prudential Regulation Authority (APRA) will phase out bank hybrids by 2032. This may also lead some investors to consider property funds as an appealing alternative for higher yields.

More deal activity expected in 2025

Deal activity is another piece of the puzzle which is expected to turn more positive this year.

As cash rates fall, more transaction activity is expected across the commercial property world.

Some property funds will be in acquisition mode, particularly open-ended funds with an expansion remit, whilst some funds will be looking for exit opportunities, particularly close-end funds nearing the end of their guided holding periods.

Amidst this more active market backdrop, we may see some consolidation of the smaller property funds trading below book value. In addition, high-quality and differentiated property fund portfolios are likely to be in high demand.

This sets the stage for a more eventful year ahead for commercial property as an asset class: good news for investors.

Expert opinion has turned bullish

According to Knight Frank chief economist Ben Burston: ‘Core industrial and CBD office assets in Sydney will lead the way before the recovery extends to other cities.’

Cushman & Wakefield are also bullish, projecting: ‘an overall 8% adjustment in Commercial Real Estate pricing during this cycle, with a rebound of 20% anticipated by 2030, beginning in late 2025. The pace and extent of this recovery will differ across asset classes, as the RBA shifts its stance and the economy emerges from a cyclical slowdown, paving the way for renewed market momentum.’

JLL’s Global Real Estate Outlook 2025 report concurs: ‘Investors deploying capital in 2025 are likely to see an early-mover advantage in terms of returns that will diminish as the cycle matures.’

Ben Burston summarised the opportunity when he said: ‘Investors acquiring assets now – after values have adjusted down but not yet commenced the recovery – will be well-placed to see strong returns in years to come.’

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

But pick your sector exposure wisely

Despite the positive outlook, not all commercial property sectors are created equal.

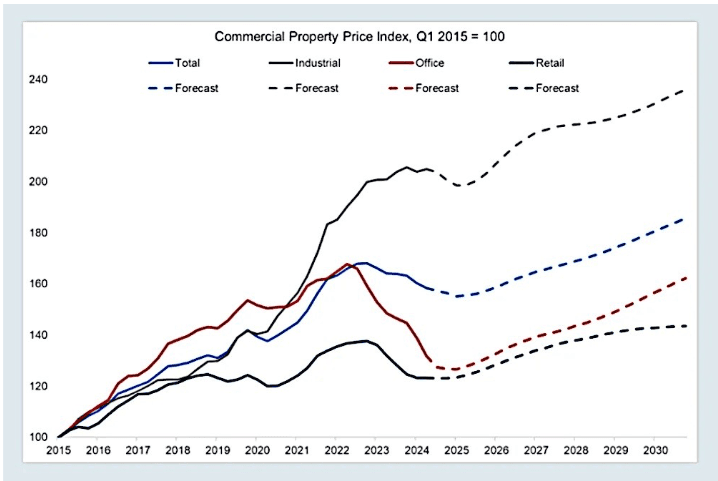

As shown below, historical performance has been vastly different across the main commercial property sectors.

Industrial property weathered the downturn much better than the other main sectors, and remains well-positioned for continued outperformance driven by the ongoing shift to online retailing which is driving demand for warehouse space.

Office property has suffered a brutal correction since the pandemic, but with valuations much lower and the WFH movement looking to have peaked, the outlook is looking more positive. Investors are expected to return to the asset class in 2025.

It’s similar with retail property, although the sector’s underperformance hasn’t been as dramatic as the office sector. Its recovery isn’t expected to be as pronounced either.

Then there are the emerging commercial property sectors (which aren’t on the chart) such as data centres, logistics, and alternative living, which are interesting growth segments of the market.

The main theme is similar across the board: the commercial property correction appears to have bottomed.

Commercial property funds may be about to shine again

Now may well be a good time to ensure you have sufficient exposure to commercial property funds.

The sector has been through a significant correction and prices are yet to factor in the impact of the emerging tailwinds which are expected to drive a recovery and possible outperformance versus more expensive asset classes in 2025 and beyond.

You can check out Australia’s best commercial property fund opportunities at Investmentmarkets.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.