What the WFH revolution means for investors in 2025

Simon Turner

Thu 9 Jan 2025 7 minutesAre you happier working in an office or working from home?

This is the question millions of Australian workers have been voting with their feet on in recent years.

It’s fair to say the work from home (WFH) revolution has been one of the biggest social shifts we’ve witnessed in modern history. It’s brought with it profound changes in the way many of us work, as well as workers’ confidence in requesting WFH as an option.

Mind you, that shift has already happened. Or has it?

The truth is WFH is a dynamic trend which reveals as much about the relationship between companies and their workers, as it does about the perception of quality of life. As with all dynamic trends, it’s fair to assume more change is coming, which means more investment implications to be aware of...

WFH is now commonplace in Australia

According to the ABS, 36% of Australians were working from home in August 2024 — which is roughly the same portion as a year earlier (37%), implying a degree of stabilisation.

To put that number into context, according to the Melbourne Institute, only 6% of the Australian population mostly worked from home before the pandemic.

So there’s been a sea change since the pandemic.

Behind the numbers is a more complicated story

However, there’s a challenge to be aware of behind the rise of WFH … workers and their employers rarely agree on the optimal amount of time spent working from home. In fact, research by Roy Morgan and the Melbourne Institute showed that (in July 2023) workers and their employers agreed just 37% of the time on working from home.

Many workers are clearly pro-WFH. There’s plenty of research confirming that a large portion of people prefer working from home for a range of reasons including: saving the time they’d have otherwise spent commuting or chatting with co-workers, as well as greater flexibility.

To this point, one survey found that staff value WFH as equivalent to an 8% pay rise.

However, Australian employers don’t share workers’ enthusiasm for WFH … understatement of the year.

In fact, a recent KMPG survey of over 1300 Australian CEOs found that 82% of them believed that their white collar workers would resume working five days a week in the office within three years. What was even more surprising was that the comparable 2023 figure was much lower at 66%.

So the vast majority of Australian CEOs are clearly not enamoured with the WFH movement and are ready to call time on it. Their criticisms of it tend to be similar:

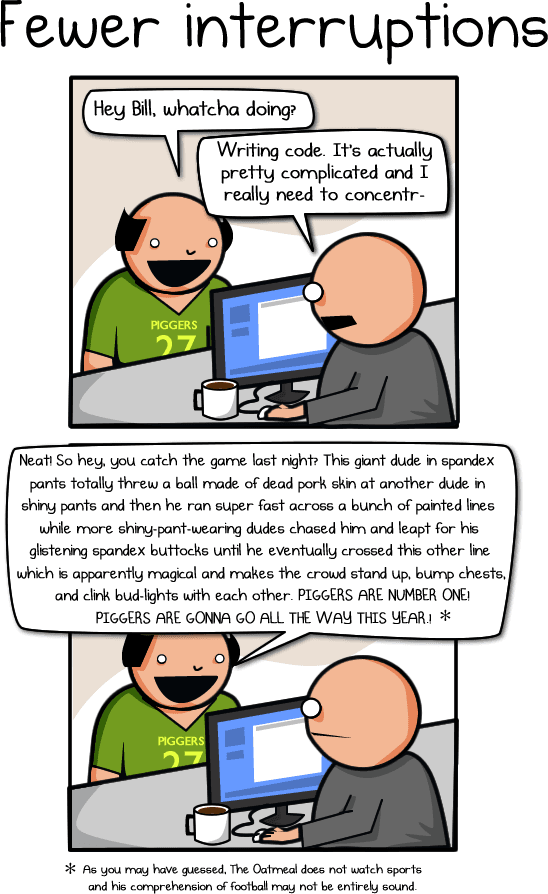

WFH is not as conducive to collaboration within a team;

Productivity may not be a high for all workers who work from home;

It can be perceived as inequitable if some staff are expected to show up every day whilst others are allowed to work from home;

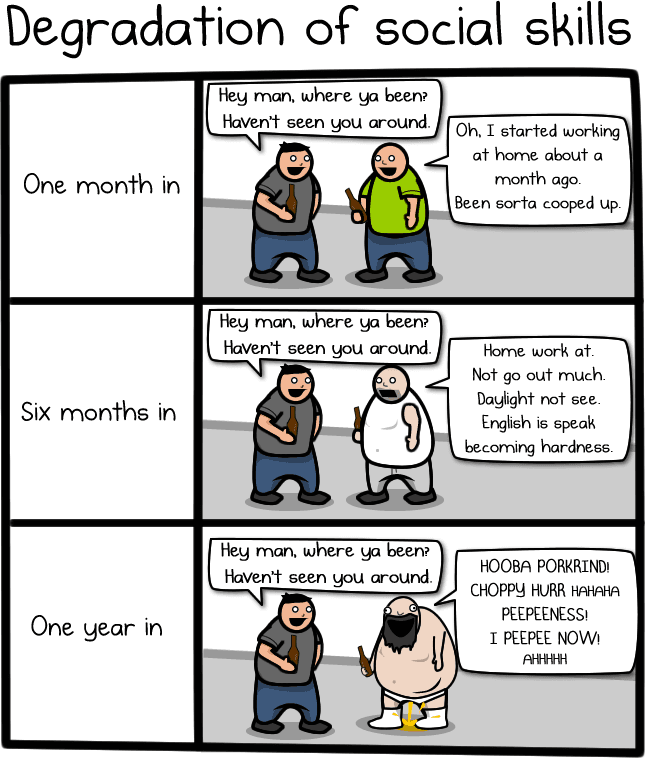

WFH can lead to a deterioration in all-important social skills…

Having said that, there are also plenty of employers who are leveraging the benefits of embracing a WFH culture, including:

Lower office costs,

Access to a bigger pool of potential workers;

A greater likelihood of holding onto top performers.

It’s fair to say WFH remains a contentious issue which inspires very different responses from workers and employers alike.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What’s coming next for WFH?

So what’s coming next for WFH? Here a few possibilities based on recent trends:

The current 3.9% Australian unemployment rate remains on the low side which suggests workers have a fair amount of power to keep requesting WFH at this juncture. That aligns with the stable portion of workers working from home over the past year, and suggests the trend is likely to continue in the short term.

However, unemployment rate is expected to increase to 4.6% this year, so the power is likely to shift more into the hands of Australian employers in the coming months.

As the unemployment rates trends higher, more employers, particularly larger companies, are likely to request that more of their staff return to the office. In other words, the portion of workers working from home is likely to be somewhat inversely correlated with the unemployment rate.

In a more bearish economic scenario in which unemployment were to rise significantly, to say 6%+, the power dynamic would likely shift more to the corporate world with a much bigger impact on the WFH movement.

To incentivise a return to the office, more companies are likely to link office attendance to bonuses. Since money speaks loudly to many workers, this could also lead to a lower portion of people working from home.

So whilst WFH is here to stay, there are reasons to expect employers will have greater successful in their RTO (return to the office) movement during 2025 and beyond.

Investment implications of the evolving WFH story

We see two main investment implications of the evolving WFH story in 2025:

1. Some office property is likely positioned for a gradual recovery.

The office property sector has borne the brunt of the dramatic WFH shift in recent years.

But with more employers pushing for a return to the office, it appears likely that WFH has peaked — at least in the short term.

So office property as an asset class may be positioned to benefit from a gradual increase in demand in the coming years.

If you’re looking for office property exposure, it’s advisable to invest in diversified funds managed by quality managers with strong track records. Not all office assets are created equal, particularly after the post-pandemic interstate migration we’ve witnessed.

2. WFH may play in favour of nimble, smaller companies.

All other things being equal, the companies which choose to embrace WFH are likely to attract more of the best staff.

So if a growing number of larger companies push their workers to return to the office, as appears to be the trend, that presents a compelling opportunity for smaller, nimble businesses to leverage the benefits of WFH whilst managing its challenges.

That trend is clearly favourable for smaller companies as an asset class.

If you’re looking for smaller companies’ exposure, a managed fund run by a best-in-class manager is likely to be your optimal strategy.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

All that’s certain is more change is coming

What a fascinating social trend the WFH revolution has evolved into. It cuts to the heart of major corporate challenges such as productivity, trust, and culture, whilst it is also core to personal health and wellbeing for employees.

2025 is likely to further test the relationship between Australian companies and their staff in a way which is likely to spill over into the investment world.

Office property is the most obvious way to play a gradual decline in WFH, whilst more holistically, smaller, more flexible companies may be better positioned than their larger peers to benefit from WFH as a business tailwind.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.