Reading the world’s emotional tea leaves

Simon Turner

Wed 8 Jan 2025 5 minutesIt’s tempting for investors to believe that their personal experience of the world’s emotional state allows them to accurately assess the global zeitgeist.

However, the reality is most investors are only exposed to a miniscule fraction of the global population, and it can be challenging to understand others’ emotions at the best of times. Reading the world’s emotional tea leaves is easier said than done.

But investment markets are driven by emotions, so understanding the global mood is an important part of successful investing. So as 2025 begins, it’s worthwhile checking in on how the world is feeling so we know how investment markets are likely to behave over the course of the year…

Are you talkin’ to me?

In recent years, a lot has been written about how angry people have become all around the world.

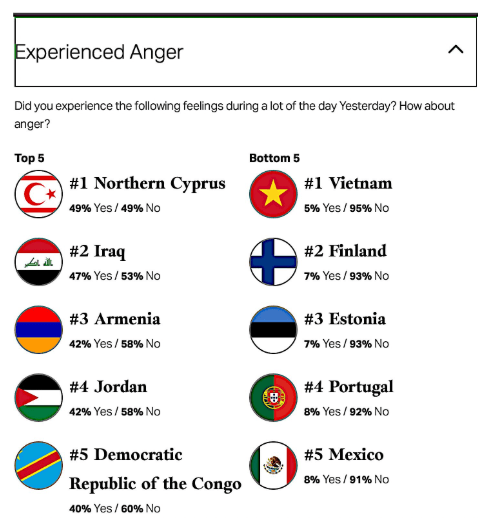

According to the most recent Gallup data, a solid portion of the global population are indeed angry. Whilst this is a global issue, Africa and Asia are particularly affected by this unfortunate epidemic.

Australia isn’t immune from this issue, although thankfully it’s not a global leader in anger like Northern Cyprus, Iraq and Armenia. Having said that, there are plenty of less angry countries to learn from including Vietnam, Finland, and Estonia.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Implications for investors:

The relatively angry state of world as we begin 2025 means investment markets are probably susceptible to short sharp selloffs throughout the year ahead. If that happens, just don’t ask investment markets what you’ve done to upset them.

When others are angry, staying calm is likely to represent a competitive advantage. In other words, buy when others are angry.

More people not getting no satisfaction

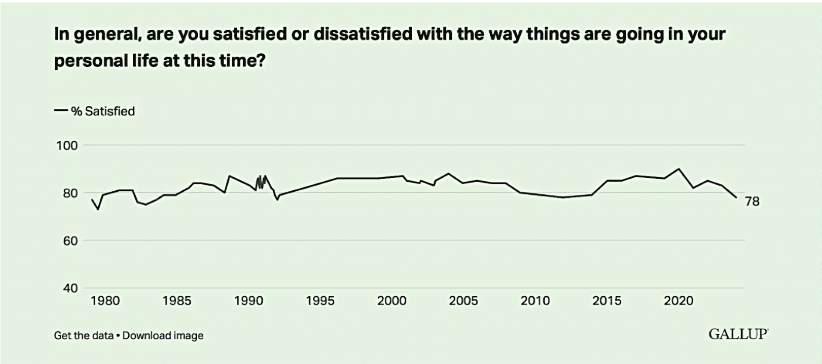

Most people would agree that satisfaction with one’s personal life is core to emotional wellbeing. So it’s noteworthy that after an initial post-pandemic bounce, global personal satisfaction has fallen to cyclical lows—as shown below.

The reasons for this downward shift are more debateable.

There’s plenty of research showing that social media and broader digitalisation trends are leading to less connection and a deterioration in personal wellbeing. Then there’s the aftermath of one of the most complicated pandemics in modern history to contend with. Social scientists are having a field day trying to interpret so much social change.

Implications for investors:

The good news is the vast majority of the global population remain satisfied with their personal lives. However, investment markets are more influenced by recent changes than absolute numbers. So the recent decline is a little concerning.

Let’s hope for a bounce back from current cyclical lows on this metric, otherwise we may be on track for global conflict trending upwards in the coming years.

In the interim, the main implication for investors is that some investors are likely to overreact to news-flow in 2025. That may translate into higher volatility than last year, and may provide buying opportunities for steadier hands.

The American economy is viewed as a growing risk

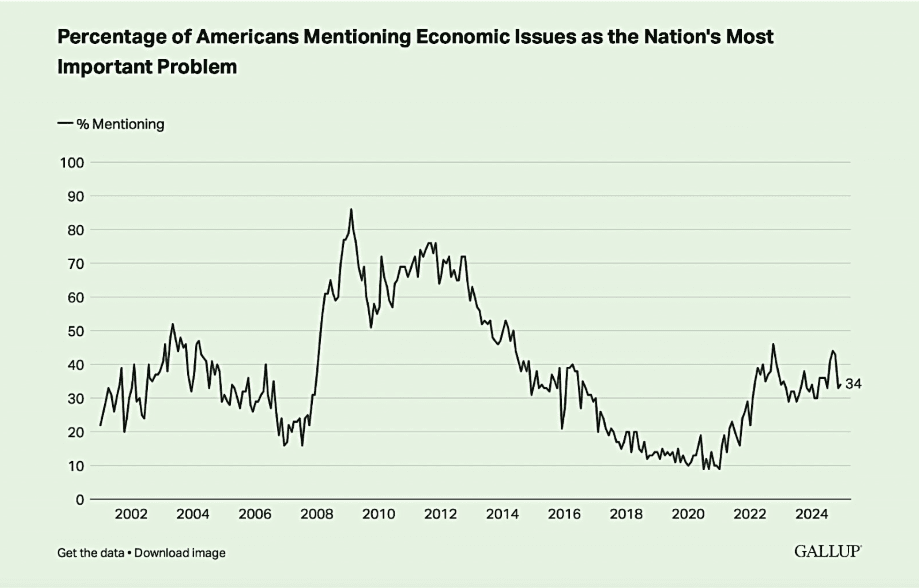

Despite the ongoing strength of the US economy, the portion of American investors who are concerned about it has been gradually rising in recent years—as shown below.

Whilst being focused on the US economy as a problem is hardly newsworthy, it reveals a mismatch between the official US economic data and how Americans feel about their economy. That’s surely a measure of the growing inequalities evident across the US economy.

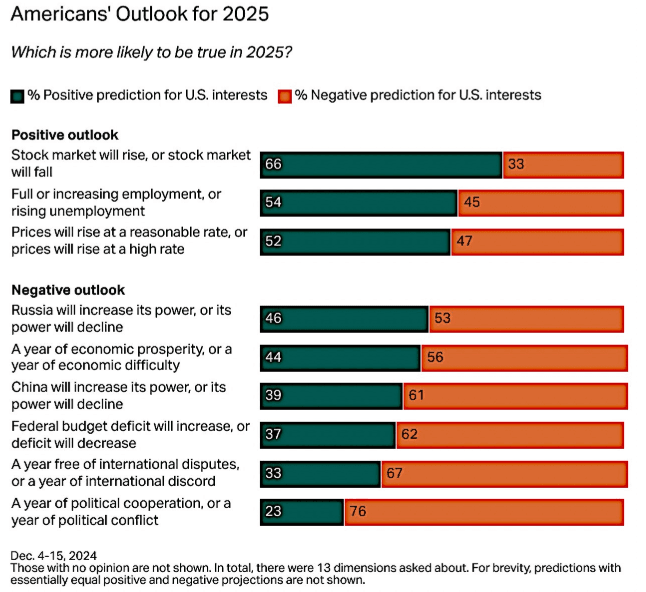

This mismatch is confirmed by a recent Gallop poll about the 2025 outlook in the US. As shown below, the themes are clear: local economic uncertainty and negative international expectations.

Implications for investors:

Whilst the US economy has been the main engine of global growth since the pandemic, it’s riches aren’t being shared equally across the American population.

The glaring gaps between the real economic narrative in the US and the economic narrative experienced by many Americans are likely to expand in 2025.

That means investors are likely to be inundated with stories validating a bear case in the US this year. However, the real economic data is likely to prove more useful, and may remain more positive than many of the narratives being told. Be careful managing your emotional response to negative narratives in the months ahead.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Don’t throw the baby out with the bathwater if others do

The world’s emotional pulse is relatively angry and negative at this juncture. So as the new year begins, there are compelling reasons to expect more market volatility this year versus last year.

For long term investors, this backdrop is likely to present opportunities to profit from future selloffs by remaining calm and committed to their investment plans.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.