Crystal ball gazing at 2025

Simon Turner

Tue 31 Dec 2024 12 minutesHappy new year! We hope it’s a healthy and happy one for you.

While no one knows exactly what’s coming in the year ahead, most investors will be asking themselves similar questions as the new year begins. For example, will 2025 be a repeat of 2024’s US-led market resilience and euphoria? Or will markets follow a different playbook this year which requires investors to make tactical adjustments?

With these questions in mind, it’s time to do our best at crystal ball gazing to help investors make sense of what may be coming in 2025…

Five key investment themes we expect to play out in 2025

Here are five of the main investment themes we believe investors will have to contend with in 2025…

1. Slightly slower global economic growth with widening divergences

Slightly slower US and global economic growth in 2025 is hardly newsworthy given it’s a reflection of consensual economic expectations.

What’s less understood by some investors is the implications of growing divergences between the world’s main economic players.

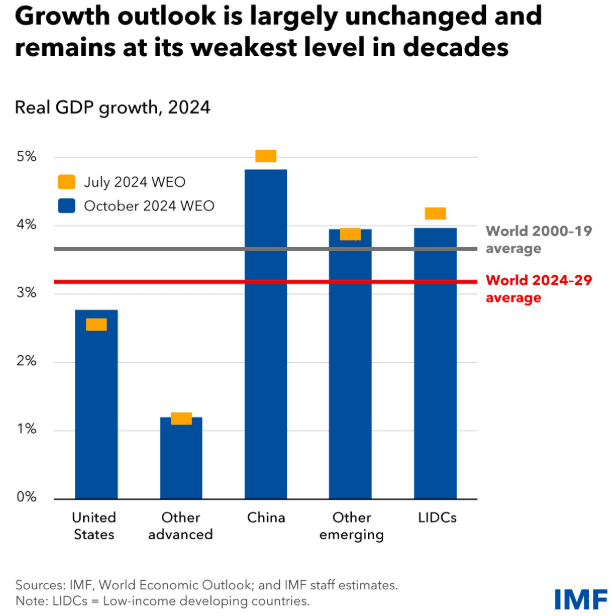

As shown below, the US is expected to significantly outperform other advanced economies, whilst China, emerging markets, and low income developing counties (LIDCs) are expected to strongly outperform.

At a global level, the US arguably remains the main driver of any potential upside surprises in the year ahead—as has been the case over the past couple of years. With Donald Trump’s lavish spending plans likely to be enacted in the short term, it’s becoming more likely that the economic gap between the US and Europe and Japan widens versus current expectations.

So whilst US economic growth is currently expected to be 2% in 2025, that number may prove to be conservative. In contrast, euro zone and Japanese economic growth is likely to be weaker at around 1%. Economic growth in the euro zone in particular looks vulnerable to underperforming versus current expectations.

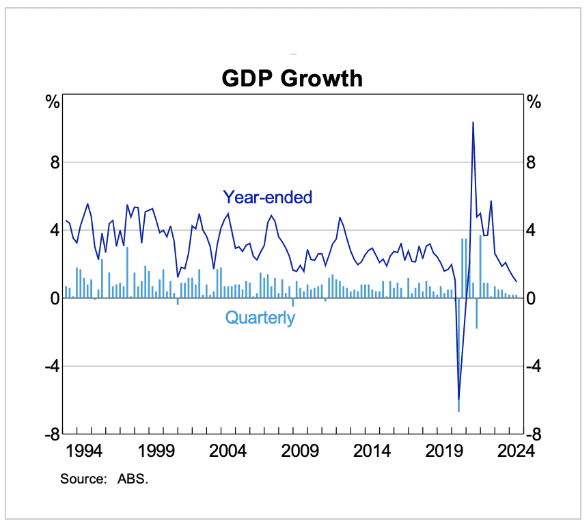

Australian economic growth is expected to be 1.8% in 2025, but in contrast to the US, the RBA’s rate setting strategy remains hawkish and thus more economically restrictive. Hence, the local economic risks appear to remain on the downside after a challenging couple of years.

So overall, the 2025 global economic outlook is cautiously optimistic with 3% global economic growth expected along with some glaring geographic variances. Paying heed to those growing global economic divergences is likely to make a significant difference for investors this year.

2. Rising geopolitical risks

If Trump enacts his planned 10-20% tariffs on all imports, and 60% tariffs on Chinese imports, there’s a significant risk of a global trade war, which would surely raise the geopolitical risks investors need to navigate in 2025 and beyond.

In addition, the wars in the Middle East and Ukraine continue to rage with uncertain outcomes and knock-on effects in both cases. The energy sector remains vulnerable to upside surprises in the event of any war-related shocks during the year.

Given the economic nature of the risk of a global trade war in particular, 2025 could be the year that geopolitical risks become a key driver of investment markets for the first time in a long while.

3. The re-emergence of higher inflation

With Trump’s increased spending plans about to create more demand for US goods and services, not to mention the inflationary impact of his planned tariffs, it’s likely that higher inflation will return at some point during 2025.

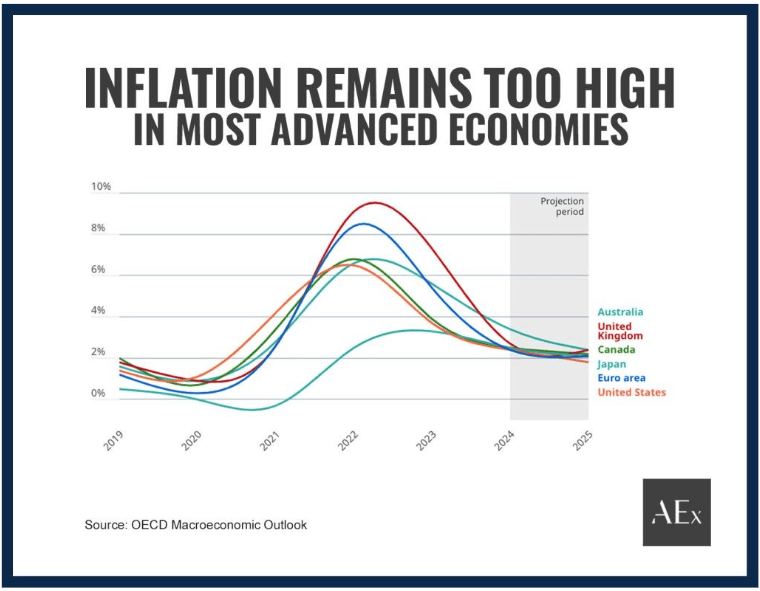

Given inflation remains above most central bankers’ targets, the re-emergence of stronger inflationary forces would be an unwelcome economic development, particularly in Australia where inflation remains relatively high at 2.8% (in the year to September 2024).

If global and local inflation does indeed trend higher, there’s likely to be an impact on future interest rates (see below). Markets are likely to react negatively if that scenario eventuates.

4. Interest rates likely to be cut—but possibly not as much the market expects in the US

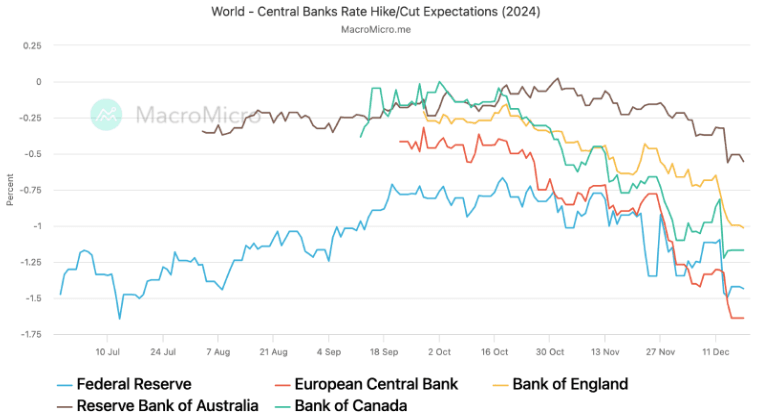

As always, central bankers are likely to pay a pivotal role in investment markets in the year ahead, particularly the Fed. It all comes down to how reality plays out versus current rate expectations.

The Fed funds rate is currently 450-475 bps. Markets expect a chunky 150 bps of Fed cuts by the end of 2025, which would bring the funds rate down to 300-325bps.

The RBA’s cash rate is currently 4.35%. Markets currently expect 60 bps of cuts by the end of 2025, bringing the cash rate down to 3.76%. You’ll note in the chart below that the RBA is marching to a different tune (read: more hawkish) than the rest of the world on this front.

Given rate cut expectations are much more bullish in the US and the re-emergence of higher inflation remains a key risk, there’s ample room for disappointment in the US market on the rate cutting front.

There’s also a growing possibility that this global interest rate cycle becomes less synchronized than it has been thus far. That could lead to significant economic and currency knock-on effects during 2025 and beyond.

As a result, investors’ geographic exposure is likely to play a significant role in their 2025 performance. Translation: being exposed to countries with more dovish central banks is likely to provide a helpful investment tailwind—and vice versa.

5. Volatility is likely to return in force

With US valuations looking expensive, bond spreads on the tight side, and the yield curve remaining inverted, it’s likely that volatility will intermittently return during 2025.

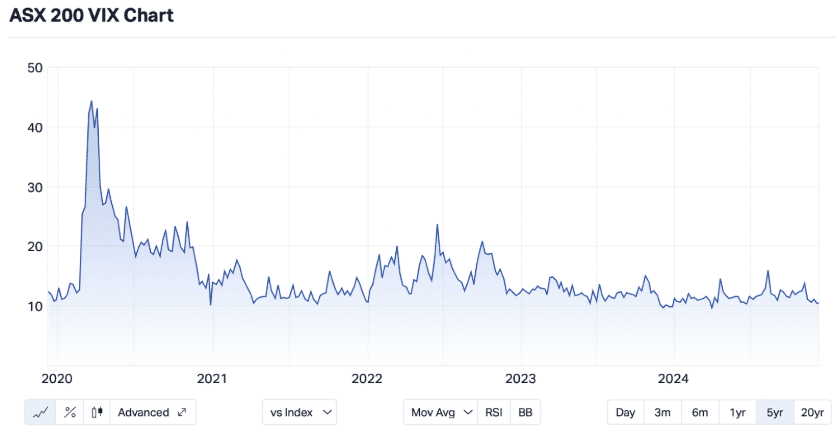

This risk is further compounded by the fact that volatility is currently suspiciously low in most global equity markets—including Australia (see below).

There’s no shortage of significant risks (e.g. US Government debt levels, the carry trade, Trump’s tariffs) to scare markets into selling off during the year ahead.

Being ready for these likely selloffs by holding a decent cash weighting is likely to help investors remain on the front foot as and when buying opportunities arise.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Investment strategies to succeed in 2025

If we’re close to being on the mark with our crystal ball gazing above, here are some investment strategies aimed capitalising on what may be coming across the main asset classes…

1. Focus on the best risk-adjusted returns rather than following the herd into expensive assets

In general, a soft US and global economic landing suggests that higher risk asset classes such as equities and private market assets are likely to continue outperforming over the full year ahead.

However, the context of valuation has become much more relevant.

There’s no escaping the fact that we’re starting 2025 with unusually high US and global equity valuations which means the risk of market selloffs is pronounced.

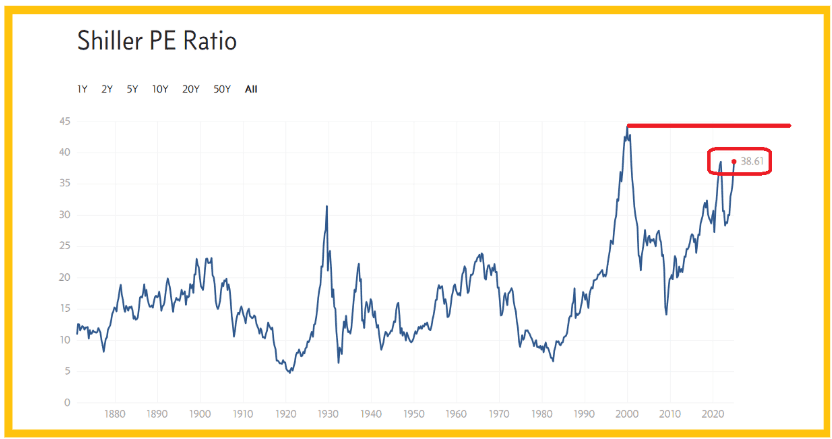

The US market is the most concerning on the valuation front with the cyclically adjusted Shiller Ratio approaching levels last witnessed during the dot-com bubble.

Further valuation upside in the US market can only come from a scenario in which the current very high valuations extend even further. Whilst that’s not outside of the realms of possibility, a more likely/healthy scenario is that valuations trend lower, at least in the short term. That means higher volatility is likely to test investors’ conviction more than it did in 2024.

Hence, even if risk assets do outperform over the full year ahead, the prospective risk-adjusted returns may be more attractive in fixed income markets such as private credit and other more defensive asset classes.

2. Diversify beyond the Magnificent 7 stocks into undervalued assets

- 2025 may be the first year in many when it pays to be less focused on the US mega cap tech stocks, otherwise known as the Magnificent 7, and more diversified elsewhere.

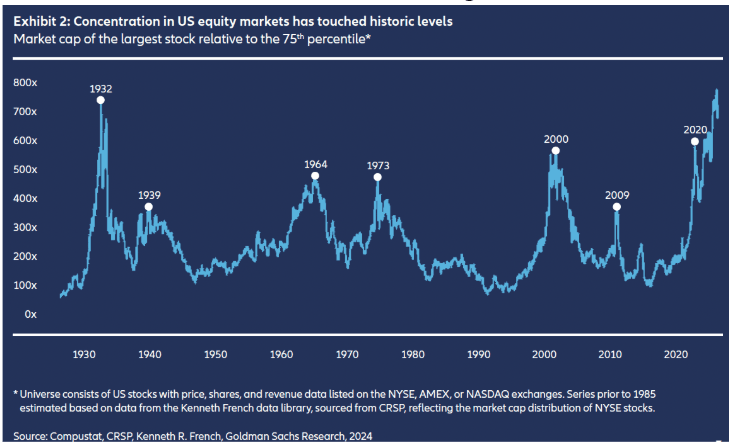

Case in point: US market concentration hasn’t been this high since the 1930s—as shown below.

Importantly, the Trump-led deregulation of various non-tech sectors is likely to support higher valuations across a broader number of stocks and industries.

If the US market’s breadth does indeed widen as expected, relatively undervalued market segments like smaller companies and commodities are more likely to participate on the upside during 2025.

Given the US market’s global leadership role, these trends are likely to filter across global investment markets, including the ASX.

So 2025 may be the year when more micro-cap funds, small-cap funds, and other less mainstream funds outperform the broader market.

Emerging markets continue to offer strong demographic tailwinds but be selective.

The emerging markets opportunity remains attractive from a valuation and momentum perspective, so it’s worthy of investor attention.

For example, India stands out as a growth-oriented market with particularly strong demographic tailwinds behind it.

But, in contrast, China remains a high risk market despite recent government support initiatives as the multi-year deleveraging of the property sector continues.

Pick your emerging markets exposure wisely.

Sustainability is here to stay as an investment theme regardless of who’s in the White House.

With a growing number of fund managers integrating ESG factors into their investment processes, and the energy transition gathering pace, sustainability remains an investment thematic which is rich with opportunity.

So even if Trump’s climate policies aren’t as supportive as Biden’s, the energy transition remains a powerful long term global investment theme.

Being positioned to benefit is likely to prove fruitful.

Prepare for volatility by focusing on quality and megatrends.

In preparation for the likely higher volatility mentioned above, investors should arguably focus on funds invested in high quality assets across a range of investment styles (e.g. growth, value, and income), and which are positioned to benefit from megatrends like AI and the energy transition.

3. The fixed income opportunity set has become more attractive

Lower interest rates are likely to provide a tailwind in most fixed income markets.

If the Fed cuts rates by 150 bps as expected in 2025, that will translate into higher capital values across most global fixed income markets. Of course, there’s a risk that central banks don’t cut as much as markets currently expect, but some cuts appear likely.

The yield curve is likely to steepen in the US and the euro zone.

There’s a simple reason why this is likely: longer term bond investors aren’t being adequately compensated for the inherent risks they’re exposed to in an easing environment.

Hence, increasing your exposure to short-dated bonds and reducing your long-dated exposure is likely to be prudent in 2025.

Bond market volatility is here to stay.

In 2025, global bonds may once again prove to be less defensive as an asset class than it used to be before the pandemic.

The implication is that investors who are investing in bond markets primarily for bonds’ perceived defensive attributes, should possibly reduce their exposure versus historic guidance.

Private credit is likely to further grow its share of the fixed income pie as the risk-adjusted returns on offer are arguably more attractive than many fixed income markets.

In other words, investors are likely to generate equity-like returns from private credit this year without taking on equity-like risks.

As a result, private credit is expected to take more investment market share from the bond market.

More fixed income investors are likely to reposition their portfolios to benefit from this trend.

4. Ensure you’re positioned to benefit from growing private markets deal activity

The private markets are likely to take more investment market share from the public markets.

Illiquid private market assets have long been an important diversifier, but the fast expanding private markets opportunity set suggests the private markets are likely to continue growing their share of the global investment pie.

In particular, the growing private debt and infrastructure markets are positioned for strong growth. Both offer investors compelling opportunities to diversify their portfolios into assets which have historically delivered attractive risk-adjusted returns with low correlation to equity markets.

More private markets deal activity is likely.

If deal activity increases as expected in 2025, investors are likely to face more opportunities to both enter and exit private markets’ opportunities. That’s potentially good news after a slower few years for deal-making.

An expanding universe of private markets opportunities.

Investors are likely to be presented with a wider range of private markets opportunities in 2025 including impact funds, secondary offerings, infrastructure debt, and a wider range of private credit opportunities.

Having some cash ready to invest in the most compelling private markets fund opportunities may prove useful.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Some trend continuations, some changes likely

So 2025 is shaping up as a similar but different year to 2024. At the heart of the likely changes is the context of valuations as the year begins: US equity valuations are very high so global investment markets are more vulnerable to selloffs than they were last year.

The good news is that some fixed income markets such as private credit are likely to deliver equity-like returns without equity-like risks. So thinking in terms of risk-adjusted returns is likely prove fruitful.

Having said that, the building blocks are in place for a continuation of the 2024’s broader investment trends: equities and private markets are likely to outperform most fixed income markets over the full year, despite the likely return of higher volatility along the way.

InvestmentMarkets is here to help you identify the best funds to enable you to outperform in 2025 and beyond. Start your search with the best available fund information.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.