The biggest risk in the market right now

Simon Turner

Tue 1 Oct 2024 5 minutesYou may remember when the yen carry trade revealed itself as the catalyst for August’s sharp selloff across global markets. The knock-on effects of its unwinding surprised more than a handful of investors at the time.

The sobering news is that the yen carry trade continues to linger and is arguably the market’s biggest risk right now. It may well be prudent for investors to prepare for a repeat of August’s volatility.

How the yen carry trade works

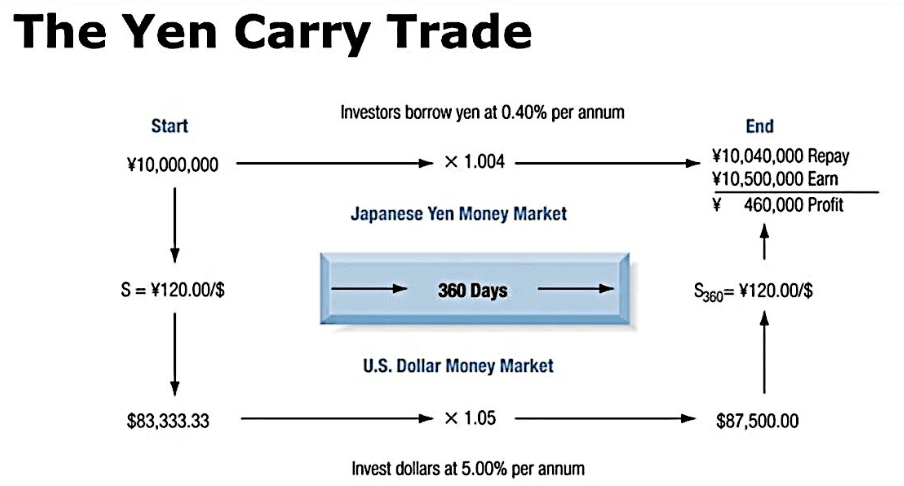

The yen carry trade is a timeworn strategy that effectively generates an almost risk-free margin.

In short, investors borrow yen at a low interest rate of around 0.4%, and invest those funds in income-generating assets such as US dollar money market accounts and US listed stocks where they can generate a 5%+ return.

This unusually attractive set-up was made possible by the widening spread between rising US interest rates and negative Japanese rates. But as soon as the Bank of Japan began raising rates a couple of months ago and markets started expecting Fed rate cuts, the carry trade began to unwind.

This resulted in a stronger yen, which led to more yen carry trades being margin-called, which in turn led to a selloff in the underlying assets and pushed global investment markets lower.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A strategy that never dies

History has a way of repeating in financial markets and it’s the same with the yen carry trade.

From all reports, since the August selloff the yen carry trade has been revisited by a long list of hedge funds with a love for leveraging their short yen positions. It’s this use of leverage which is most concerning for global investment markets.

Peter Boockvar, chief investment officer at Bleakley Advisory Group, addressed this risk in a recent report: ‘Never in my wildest market dreams and any analysis I've done had I any idea of the extent of the epic leverage that was built up in the yen carry trade that is now clearly evident in the unwind.’

Hence, this risk is worth focusing on. Leverage has a way of turning unprofitable trades into market calamities, particularly when multiple players are leveraged in the same crowded strategy.

But the yen is still rising

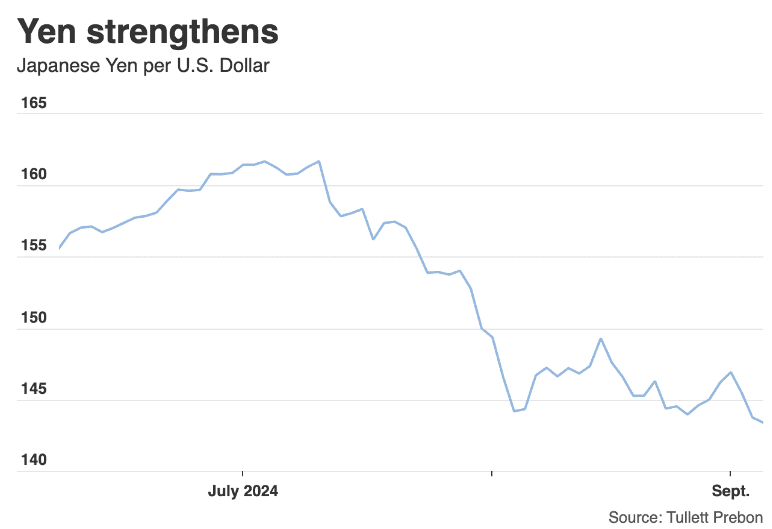

Importantly, since the August market selloff the yen has continued to strengthen versus the US dollar.

The implications for the yen carry trade are significant: an appreciating yen means the hedge funds who are shorting it are losing money—and the leveraged hedge funds who are shorting it are potentially losing a lot of money. That translates into growing financial stress amongst the community of investors involved in the yen carry trade.

And the BoJ is likely to raise rates again

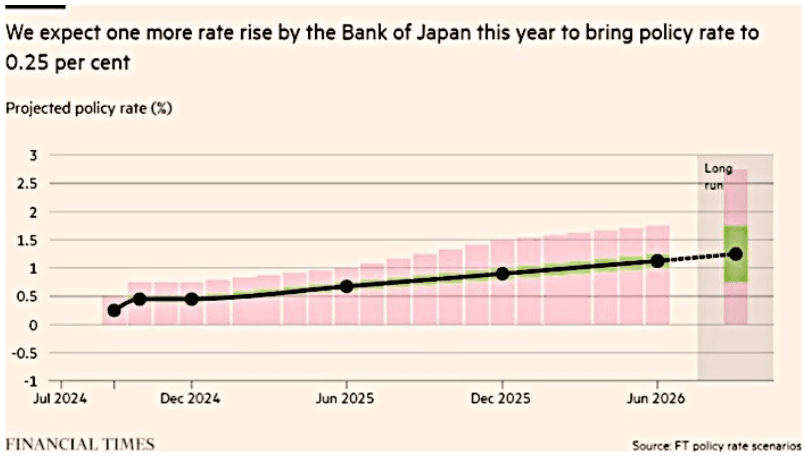

There’s another important issue at play here: the Bank of Japan is widely expected to raise rates again in the short term. They’ve signalled that a rate rise in October is likely.

It’s likely that another rate rise would cause additional financial stress for investors partaking in the yen carry trade. Namely, the differential between their cost of borrow and their return on investment would narrow, and the yen would probably further strengthen—both contrary to their investment goals.

The next Bank of Japan meeting is scheduled for October 30th/31st. So if the yen carry trade doesn’t have an unwinding catalyst before then, the end of October could prove to be a testing period for global financial markets.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Translation: market risk is elevated at present

So markets currently face an unusual risk cocktail with the yen carry trade being back on, the yen continuing to appreciate, and the Bank of Japan likely to raise rates again.

Steve Barrow, head of G-10 strategy at Standard Bank translated that backdrop for investors in a recent note: ‘Carry trade unwinding does represent a serious threat to any rosy view of risk assets going forward.’

He also mentioned that the ‘carnage’ created by August’s yen carry trade unwinding could be ‘a taster of what’s to come. For all the good a modest and steady Fed rate cut profile might be for riskier assets, the BOJ may blow all of this out of the water should its rate hikes create enormous carry-trade unwinding.’

The main mitigating factor against another carry trade unwind is that market awareness of this risk has risen. In the words of Tom Nakamura, a currency strategist at AGF Investments: ‘The fact that markets have recognized this risk helps to moderate the impact; the worst unwinds are unanticipated.’

Here’s hoping Tom is right.

Be ready to take advantage of more volatility

You’re likely to once again hear the words ‘yen carry trade unwinding’ in the not too distant future as the market is at a similar cross-roads as it was in August. Given how large, crowded, and leveraged the yen carry trade is, the knock on effects of another unwinding would likely reverberate throughout financial markets in form of a market selloff.

For long term investors, this could present a buying opportunity in your favourite funds and stocks in the coming weeks. Now’s a great time to have a decent cash holding while remaining committed to your long term investment plan.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.