Reposition your portfolio to benefit from falling rates

Ankita Rai

Thu 26 Sep 2024 5 minutesCash and term deposits (TDs) have been popular with investors over the past couple of years, thanks to the RBA’s aggressive rate hikes. With cash rates peaking at 4.35%, investors enjoyed returns as high as 5% through TDs and high-interest savings accounts.

But now, with global rate cuts kicking in—most recently a supersized rate cut by the Fed—all the major Australian banks are starting to slash term their deposit rates.

While these drops in term deposit rates suggest it might be time to look beyond cash for better long-term yields, opportunities for improved returns still exist in assets similar to cash.

Is it time to switch from cash?

For now, term deposits still offer reasonable returns. Major banks are offering around 4% p.a. on five-year TDs, which compares well to the 3.6% p.a. expected from global investment-grade bonds tracked by the Bloomberg Global Aggregate Index (Hedged).

However, holding cash for too long has its downsides. Locking money up in low-risk TDs can lead to missed opportunities, and cash drag becomes a bigger risk.

As rate cuts loom, cash and money market funds and fixed income could offer better ways to generate income. More investors may turn to these options to maintain higher returns and flexibility before the rate-cutting cycle takes full effect.

Consider cash and money market funds to boost returns

Cash and money market ETFs offer more flexibility than traditional savings or term deposits by tapping into a larger universe of cash instruments. This can help them generate relatively higher interest rates, especially before the RBA rate-cutting cycle begins.

Some ETFs and managed funds in this space consistently pay interest above the RBA cash rate. For example, Remara Cash Management Fund offers returns that are at least 150-200 bps higher than the RBA cash rate.

Similarly, the Wealth Cash Income Fund generated a one-year return of 5.5% p.a., outperforming its benchmark of 4.35% p.a. (RBA Bank Accepted Bills 90 Days).

These options are arguably positioned to continue delivering better returns than term deposits.

For those looking for excellent liquidity along with higher returns, cash ETFs could also be a good option. These ETFs, in fact, are among the top 5 exchange-traded product categories on the ASX and attracted over $1 billion in inflows last year.

These ETFs offer more flexibility than major bank term deposits, while often providing higher interest rates. For instance, the BetaShares Australian High Interest Cash ETF has consistently outperformed the RBA cash rate since its inception in 2012.

By providing exposure to short-duration bonds that are highly liquid, these ETFs can generate more income in an environment of declining interest rates.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Maximising returns with fixed-income investments

Fixed income is another alternative for investors seeking to maintain income while preserving capital.

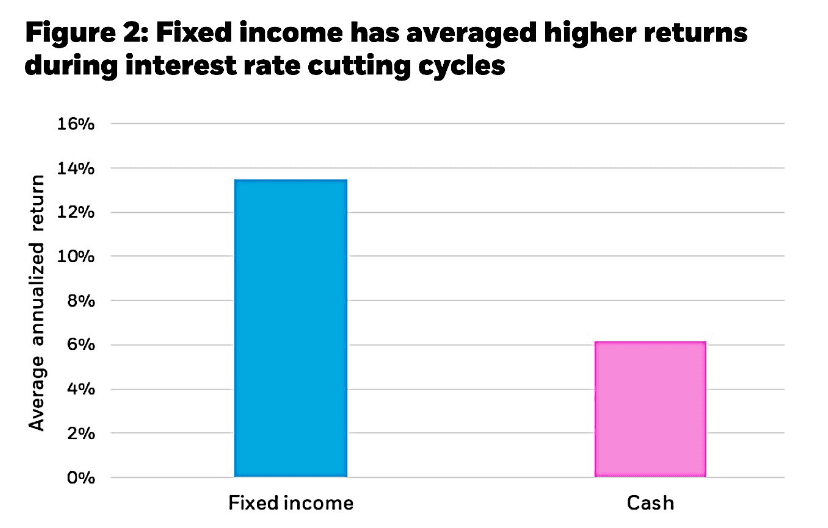

Historically, bonds often outperform cash when interest rates go down. So investors might want to consider longer-term fixed-income funds to benefit from rising bond prices as yields fall.

Entering the bond market now could be an opportunity to lock in historically high yields while benefiting from possible price gains if rates moderate.

Since most Australian investors hold equity-heavy portfolios with large cash buffers, fixed-income funds could be an option to generate income and diversify portfolios in the current rate-falling environment.

For example, fixed-income ETFs like BetaShares Australian Bank Senior Floating Rate Bond ETF offer regular income and capital preservation, with the majority of the portfolio invested in bonds issued by the big four banks. It has an all-in yield of 5.2% p.a. Additionally, these floating rate bonds typically have a low correlation with equities so they tend to act defensively in market downturns.

Another fund, JPMorgan Income Active ETF (Managed Fund) (Hedged), which invests in both high-yield and investment-grade corporate bonds has a net yield to maturity of 6.3% p.a.

These bonds, designed to invest across various debt markets, offer higher interest rates than term deposits and provide both income and potential capital appreciation.

Private credit: A high-yield alternative to cash

Private credit can serve as a significant complement to cash and fixed-income strategies. Over the past decade, the asset class has consistently outperformed bonds, delivering an impressive 10% p.a. return.

While not all private credit funds are the same, conservative senior secured loans generally provide yields of 6-9% p.a., making them an attractive choice for those seeking better returns than cash or lower-yielding bonds.

The Aura Core Income Fund, for example, prioritises capital preservation while aiming to provide stable monthly cash income and diversification through private debt assets. Its target return is the RBA Cash Rate plus 3.5-5.5% p.a.

Similarly, Rixon Income Fund invests in asset-backed senior secured credit within the Australian SME sector. It has a pre-tax cash return of 10-12% p.a. (net).

For investors with higher risk tolerance, this asset class can offer better returns than traditional fixed-income securities, although it typically comes with lower liquidity.

Reassessing your cash strategy

With yields still elevated and inflation returning toward target levels, now may be an opportune time for investors to reconsider their asset allocation.

Waiting for the first interest rate cut could result in missed opportunities, as markets often react ahead of central bank actions.

While term deposit alternatives such as money market funds and fixed-income ETFs come with their own risks, they offer flexibility, higher rates, and quick access to funds, allowing investors to respond to emerging opportunities. By adjusting their portfolios now, investors can position themselves for the potential market shifts ahead.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.