Volatility’s back: stay calm and carry on

Simon Turner

Tue 6 Aug 2024 5 minutesIt’s been a wild ride for investors of late with volatility returning to global markets catalysed by the unwinding of the Yen carry trade. Whilst intermittent volatility shouldn’t surprise anyone, it has surprised the investors who’d grown to believe that equity markets gradually increase in value forever.

What investors do next will arguably define whether 2024 is a good or a bad year for their portfolios…

Why markets spat the dummy

The main driver of recent volatility was the Bank of Japan raising rates by 0.25%, which effectively ended their negative rate policy.

Whilst a 0.25% rate rise may not sound like a big deal, it led to the unwinding of the Yen carry trade.

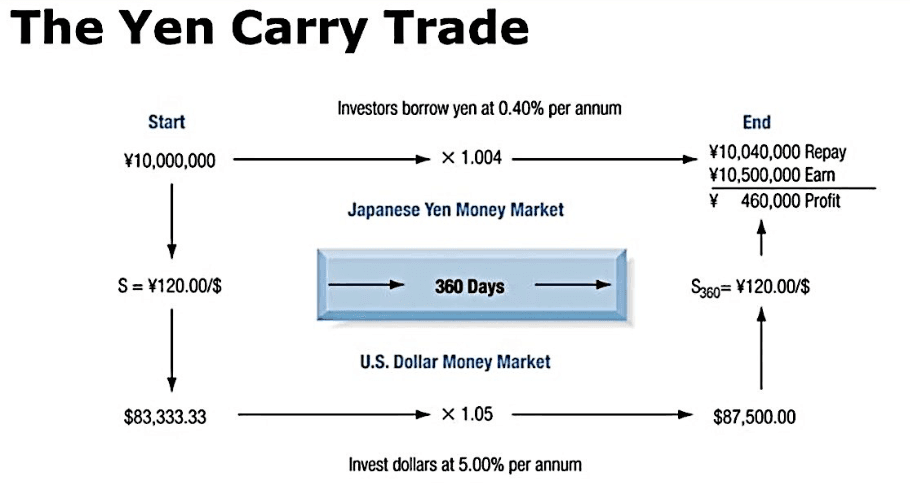

By way of background, the Yen carry trade allowed investors to borrow Yen at a low rate of around 0.4%, and invest those funds in income-generating assets such as US dollar money market accounts where they could generate a 5%+ return. This strategy effectively generated an almost risk-free margin.

This unusually attractive set-up was made possible by the widening spread between rising US interest rates and negative Japanese rates. But as soon as the Bank of Japan began raising rates and markets started expecting Fed rate cuts, the carry trade began to unwind.

It doesn’t stop there. As the Yen strengthens, more Yen carry trades are being margin-called. That’s leading to a continued sell-down of the underlying assets, which is pushing global investment markets lower.

Add in growing concerns of a US recession and a global economic slowdown, and investors who are inclined to worry are finding plenty to worry about.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Meet complacency’s long lost cousin

These charts tell the story of volatility’s return…

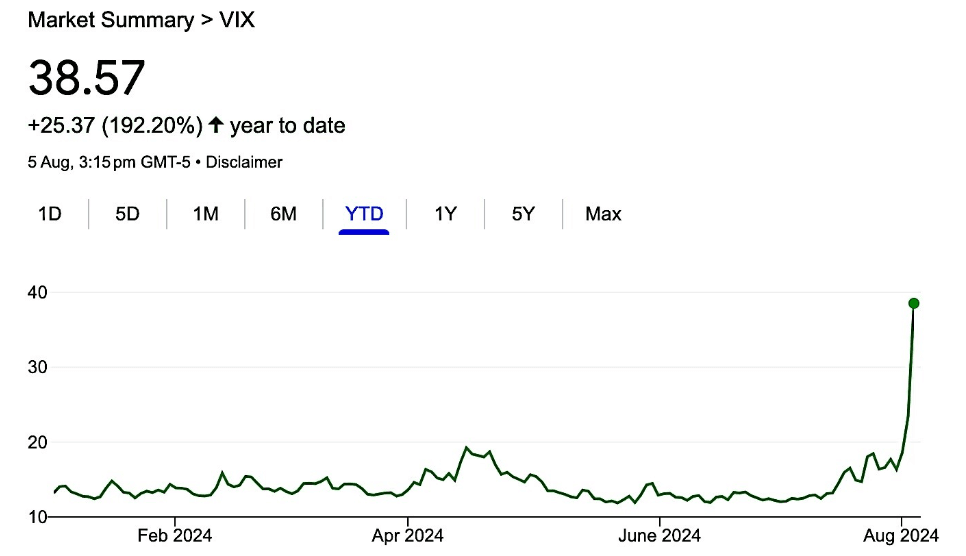

1.Volatility has spiked higher for the first time this year.

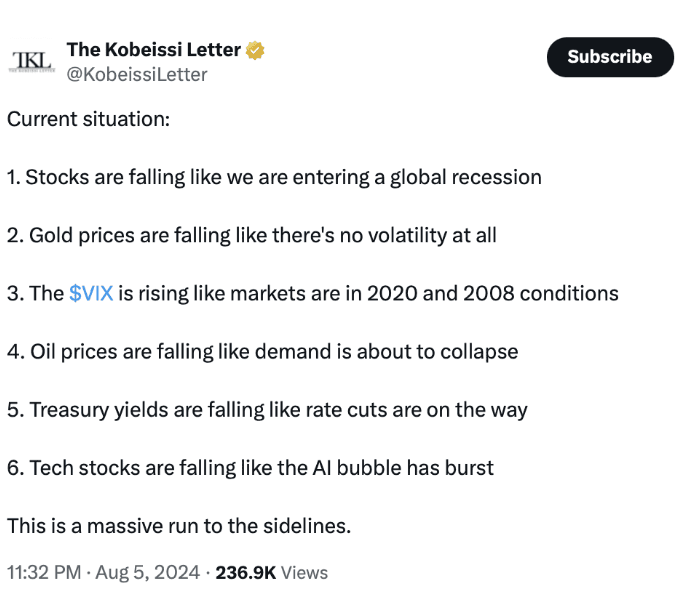

There’s been no rhyme or reason to the market moves: investors have been selling everything.

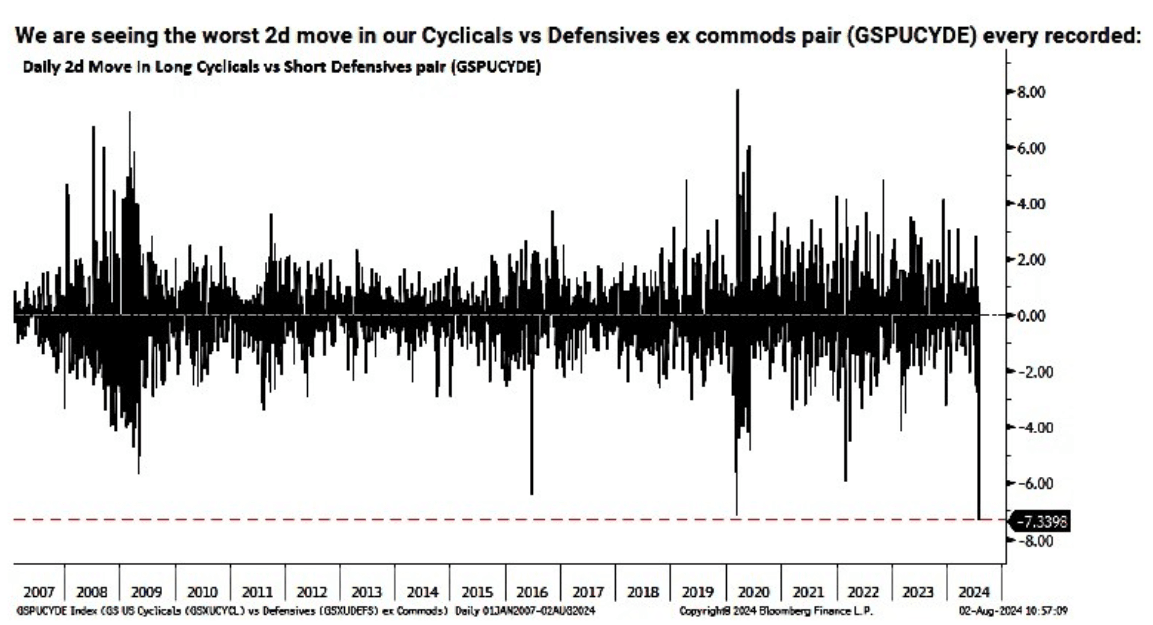

2.The switch from cyclicals into defensives is the largest ever recorded in the US.

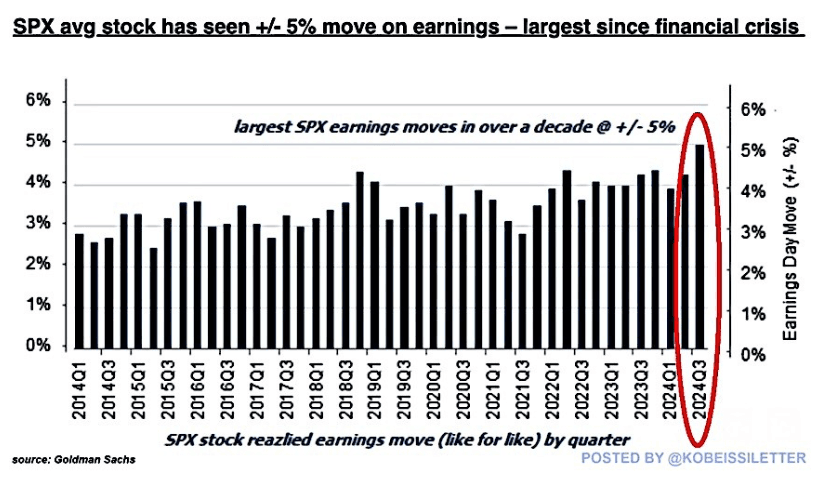

3.The average stock price movement in S&P 500 stocks post earnings is at the highest level since the Global Financial Crisis.

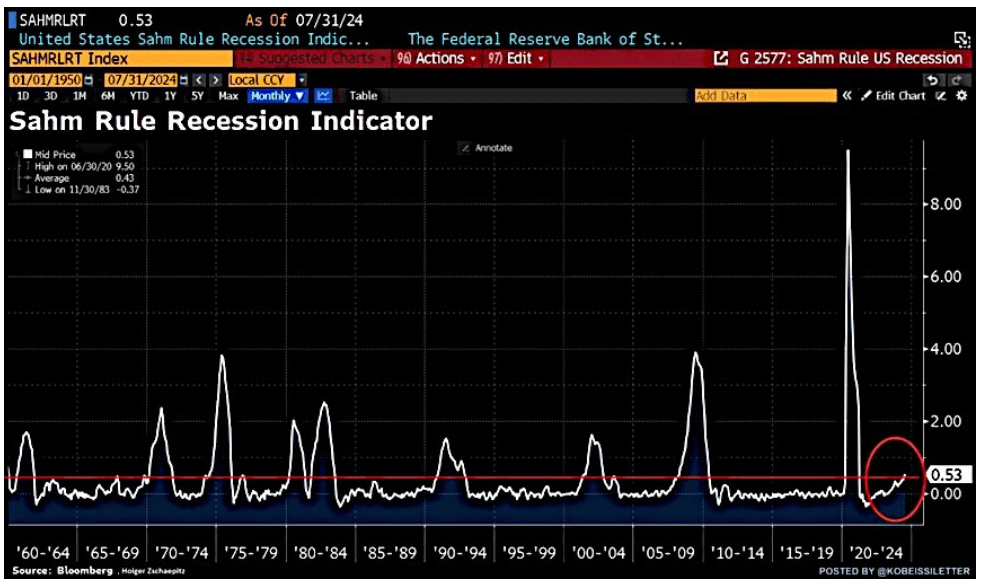

4.The Sahm Rule Recession Indicator is flashing red for the first time since the pandemic.

In other words, the chances of a US recession are on the rise.

5.Previous market darling Nvidia has been front and centre in the selloff, falling 30% from its all-time high.

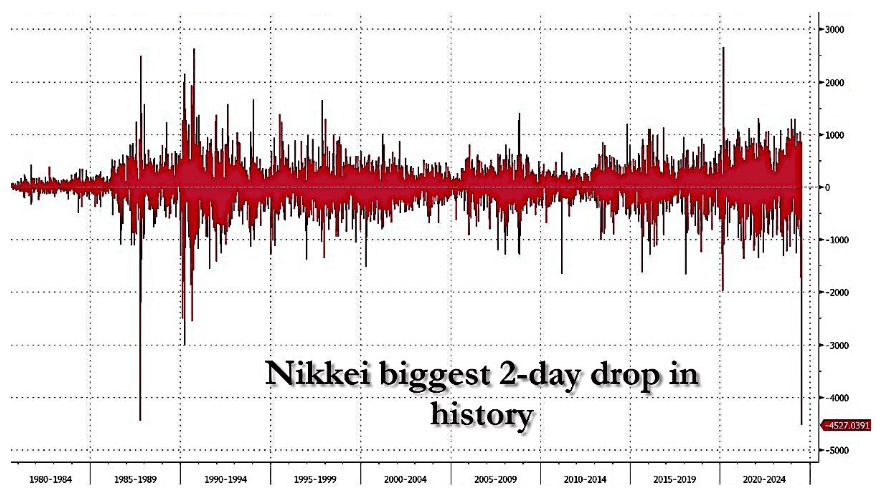

6.The Nikkei suffered its largest 2-day drop in history after the Bank of Japan rose rates.

7.As a result, the Japanese Yen has strengthened against the US dollar, which recently hit a year-to-date low.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Strategies to use this volatility to your advantage

After such a prolonged period of low volatility, it’s easy to forget that navigating volatility is a normal part of investing. It is. It’s generally when investors accept this that they’re able to use volatility to their advantage.

Here are 5 strategies which may help:

Ignore the noise. Stop checking your portfolio of stocks and funds on a daily or hourly basis. Watching the volatility won’t help you navigate it any better. In fact, the opposite is likely to be true. The more you watch falling share prices and negative headlines, the more inclined you’ll be to react like everyone else. You don’t want to effectively transfer your wealth into the hands of those you are calmer and more patient than you are.

Accept that volatility is a healthy part of the investing journey which can help improve your long term returns if handled properly. That means not selling as soon as the crowd becomes fearful—like now.

Dollar cost average into weakness. By buying more of your favourite funds and stocks into weakness, you’re able to lower your average entry price which enhances your long-term returns. In this way, volatility offers investors a compelling opportunity to improve returns.

Stick with your investment plan and think long term. Hopefully you’ve got an investment plan you’re following. If you do, it probably references a long term investment horizon. Now’s not the time to forget this. Hold strong and stick with your plan.

Let your fund managers worry on your behalf, or rather not worry on your behalf. Investing in funds is a great way to ensure your portfolio is being professionally managed without the day-to-day stress of navigating volatility and other market challenges.

An opportunity in the making

The headlines may appear scary, but volatility usually brings with it more opportunities to make money than bull markets do. If you’re in any doubt about this, just remember what happened after the initial pandemic-inspired market selloff. Many of us look at charts of that period and wonder why we weren’t able to take advantage of the opportunity at the time.

All you need to take advantage of the current opportunity is a long-term mind-set and the intent to be greedy when others are fearful.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.