Don’t ignore innovation: the engine of superior investment returns

Ankita Rai

Thu 3 Oct 2024 5 minutesInnovation has moved beyond being just a nice-to-have at the periphery of most portfolios—it’s now a key focus in investment strategies. With sectors like AI, renewable energy, and biotech leading the way, more investors are adjusting their portfolios to capture the growth potential of these cutting-edge technologies.

There are clear tangible benefits of this approach: companies at the forefront of innovation are not just making waves; they have consistently achieved higher shareholder returns.

For instance, GlobalData’s Innovation Indices show an alpha of 3-8% p.a. over the S&P 500 over the past six years. This trend is particularly pronounced in AI, where GlobalData's AI Innovation Index has achieved an impressive 8.5% p.a. alpha compared to the S&P 500.

Unlocking the innovation premium

Long-term data supports the role of innovation in driving investment performance.

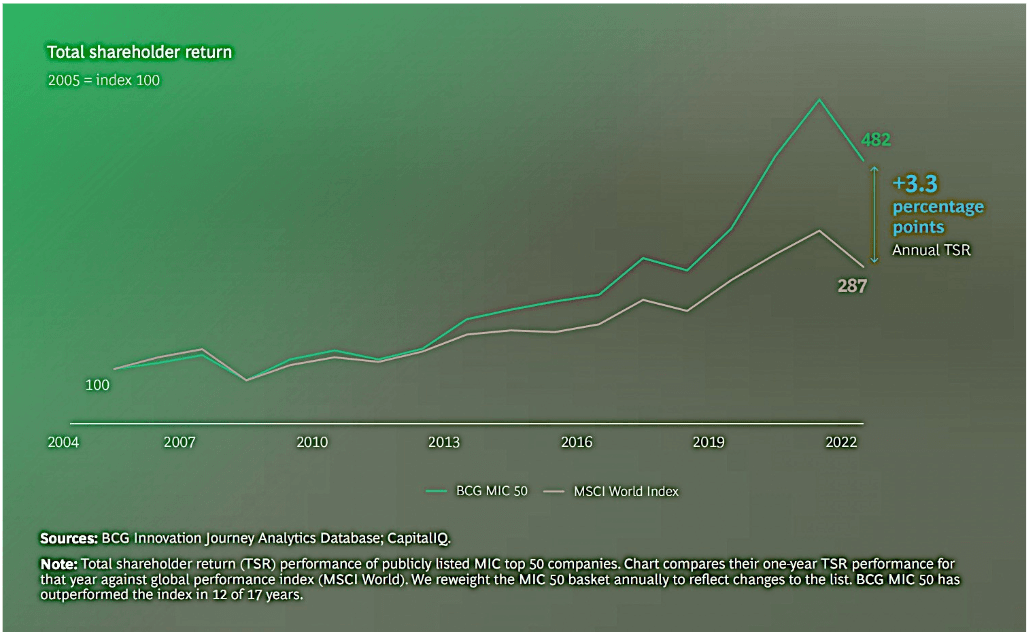

For example, McKinsey's studies indicate that innovative companies have regularly secured shareholder returns above industry medians from 2012 to 2022. Additionally, BCG's 2023 report reveals that the top 50 innovative companies outperformed the MSCI World Index by an average of 3.3% p.a. since 2005—as shown in the chart below.

Innovative companies also exhibit 2.2 times higher future earning potential compared to their less innovative counterparts.

So the innovation premium is more than just attractive; by offering higher quality products and services, companies are able to build a strong economic moat that boosts their pricing power and profitability, ultimately generating long-term value.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Capturing innovation through thematic funds

While innovation has yet to be formally declared as a distinct sub-asset class, investors are increasingly finding avenues to gain exposure to cutting-edge technologies and industries through managed funds.

These funds allow investors to capitalise on the significant growth potential of leading global innovators while diversifying their portfolios.

For instance, the BetaShares Nasdaq 100 ETF grants exposure to the Nasdaq 100 Index, featuring some of the world's most innovative companies and significant R&D spenders.

With its strong focus on technology, the ETF provides diversified access to a high-growth sector that is underrepresented in the Australian share market, boasting a five-year return of 20.6% p.a.

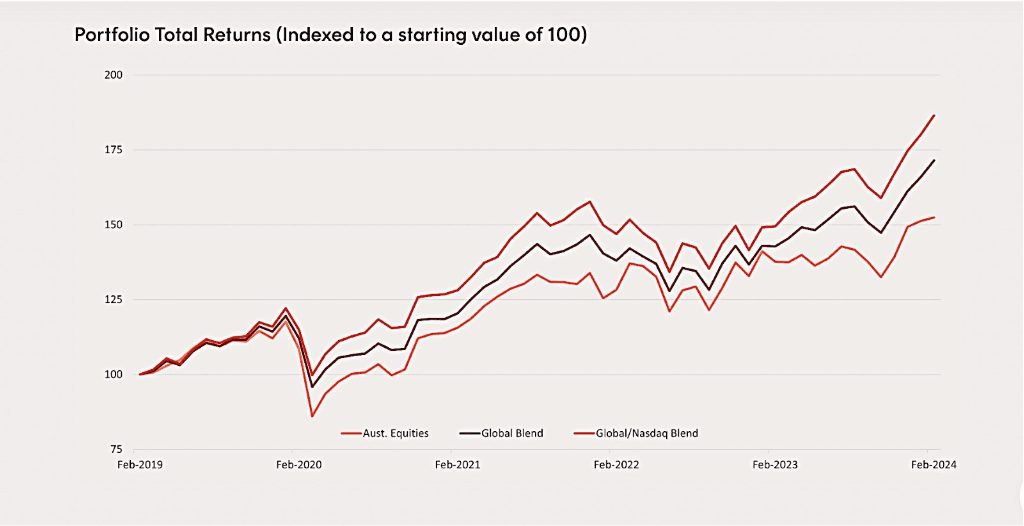

So by combining Australian equities with Nasdaq 100 and global markets, this fund has the potential to offer better risk-adjusted returns for Australian investors—as shown below.

In addition, specialised investment funds focusing on disruptive innovators in areas such as AI and blockchain have also historically outperformed standard benchmarks. For instance, the Global X Robotics & Artificial Intelligence ETF, which invests in companies benefiting from the growing adoption of robotics and AI, has achieved a five-year return of 8.1% p.a.

Medical technology is another sector that offers a vast market with significant investment opportunities, driven by advancements in AI, biotechnology, pharmaceuticals and robotics. The global AI in medical devices market alone is projected to reach $97.07 billion by 2028, growing at a remarkable CAGR of 44.4%. Given this rapid growth, the sector is rich with potential for long-term capital growth.

Funds like the SGH Medical Technology Fund, which invests in biotechnology, pharmaceuticals, medical devices, e-health, and robotics, delivered a 13.7% return last year. Similarly, the Cordis Global Medical Technology Fund benchmarked against the S&P Global 1200 Healthcare Index, has outperformed over the past three years, with a return of 22.1% p.a. by focusing on offshore investments in the medical technology sector.

Private market opportunities to invest in innovation

While public markets have traditionally dominated the innovation-driven investment opportunities, much of the real growth is now occurring in private markets. In fact, the number of publicly listed companies has significantly declined. According to JP Morgan, only 10% of investable companies in the US are traded on public exchanges.

Moreover, many companies are choosing to remain private for longer. In the technology sector, for example, the average age of firms at their initial public offering increased from 4.5 years in 1999 to over 12 years by 2020.

This trend is evident in high-profile companies like Uber and Airbnb, which delayed their initial public offerings for 10 and 12 years respectively. Such delayed listings have resulted in missed opportunities for investors to capitalise on substantial gains during the companies' early growth stages, further strengthening the case for alternatives when building an innovation-focused portfolio.

One such option is the GAM LSA Private Shares AU Fund, which focuses on late-stage, high-growth, innovation-focused companies. The fund provides investors with a diversified portfolio of leading privately-owned firms that are in their final non-public funding rounds, and has achieved a year-to-date return of 13%.

Enhance your risk-adjusted returns with innovation

Investing in disruptive technologies like clean tech, medical tech, and AI offer significant growth opportunities with the potential to enhance investors’ returns. However, because these sectors rely heavily on future developments and cash flows, their valuations can be impacted by uncertainty around new tech adoption and market changes.

That said, long-term innovation trends often rise above market cycles, making managed funds focused on innovation attractive for long-term, risk-aware investors aiming for higher returns.

For investors looking to capitalise on the innovation theme, it is advisable to consider funds that provide a blend of competitive costs and diversification. This approach is likely to lead to a more balanced and sustainable investment strategy in the rapidly evolving innovation space.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.