Is the medtech sector set to party like it’s 1995?

Simon Turner

Fri 1 Mar 2024 7 minutesBetter treating chronic disease has long been a core objective for the global medtech sector. Whilst steady progress in that direction has the name of the game for decades, the medtech sector appears to be at an inflection point with a secular improvement in treatment standards occurring in recent years. Less-young investors (I’m being polite) will remember a similar feeling in the global technology sector back in 1995, during the early stages of the tech boom.

Since chronic disease is such a significant global healthcare challenge, the innovative companies leading the secular improvements in treatment standards are positioned to generate growing and defensive revenue streams for decades to come. To the sector’s victors will go the spoils.

Similarities with the global technology sector

The global medtech sector develops technology and therapeutic platforms engaged in drug discovery, clinical R&D, and commercialisation. In contrast to the biopharma sector’s focus on biological solutions, the medtech sector is technology-focused, as the name suggests. The sector’s products range from basic products like stethoscopes and syringes to advanced technologies like robotic surgical systems and medical imaging equipment.

The primary goal of the medtech sector is to enable the world’s ageing population to live a longer and better quality of life through improved patient care, enhanced diagnostic accuracy, and more efficient and less invasive medical procedures.

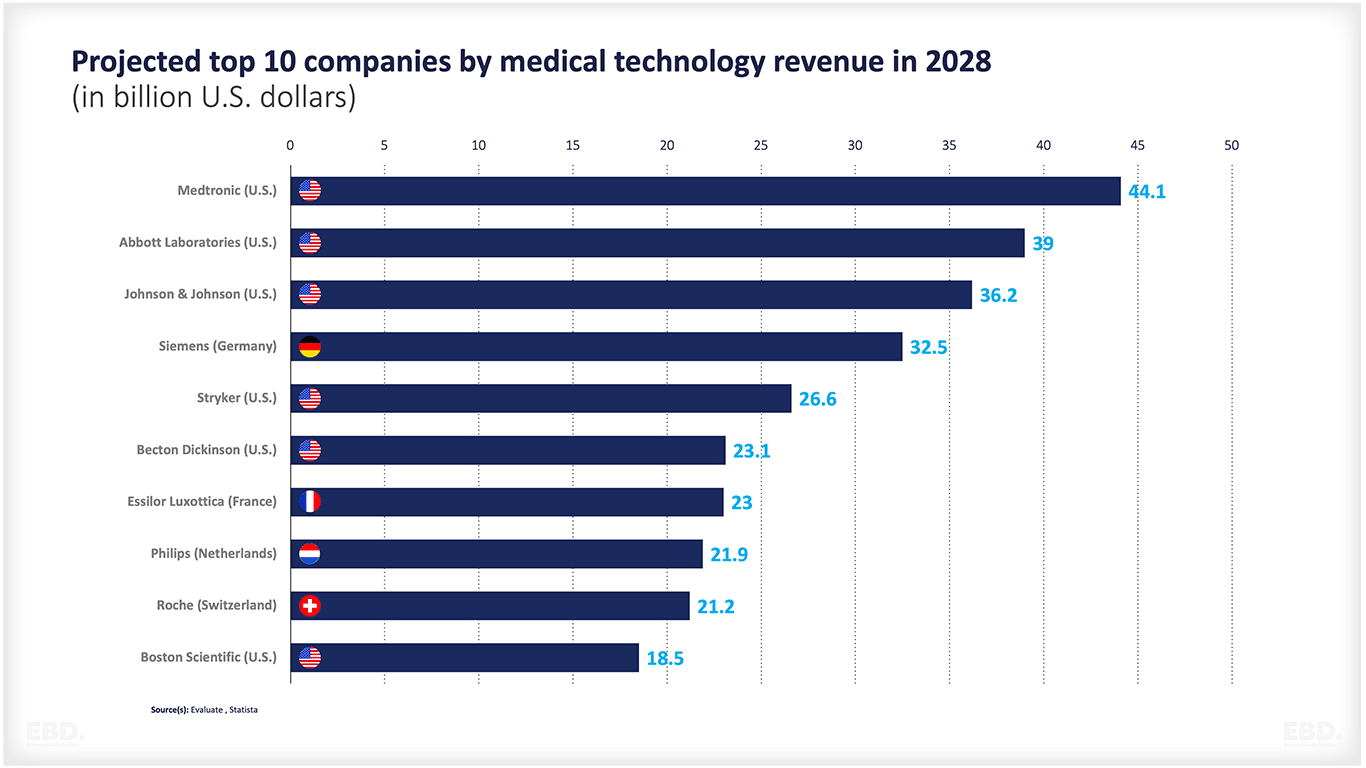

One of the key themes evident across the global medtech sector are the wide moats and high barriers to entry enjoyed by the sector’s leaders, many of whom are listed in the US (eg. Boston Scientific, Stryker, Intuitive Surgical, The Cooper Companies). In that respect, the medtech sector shares noteworthy similarities with the global technology sector.

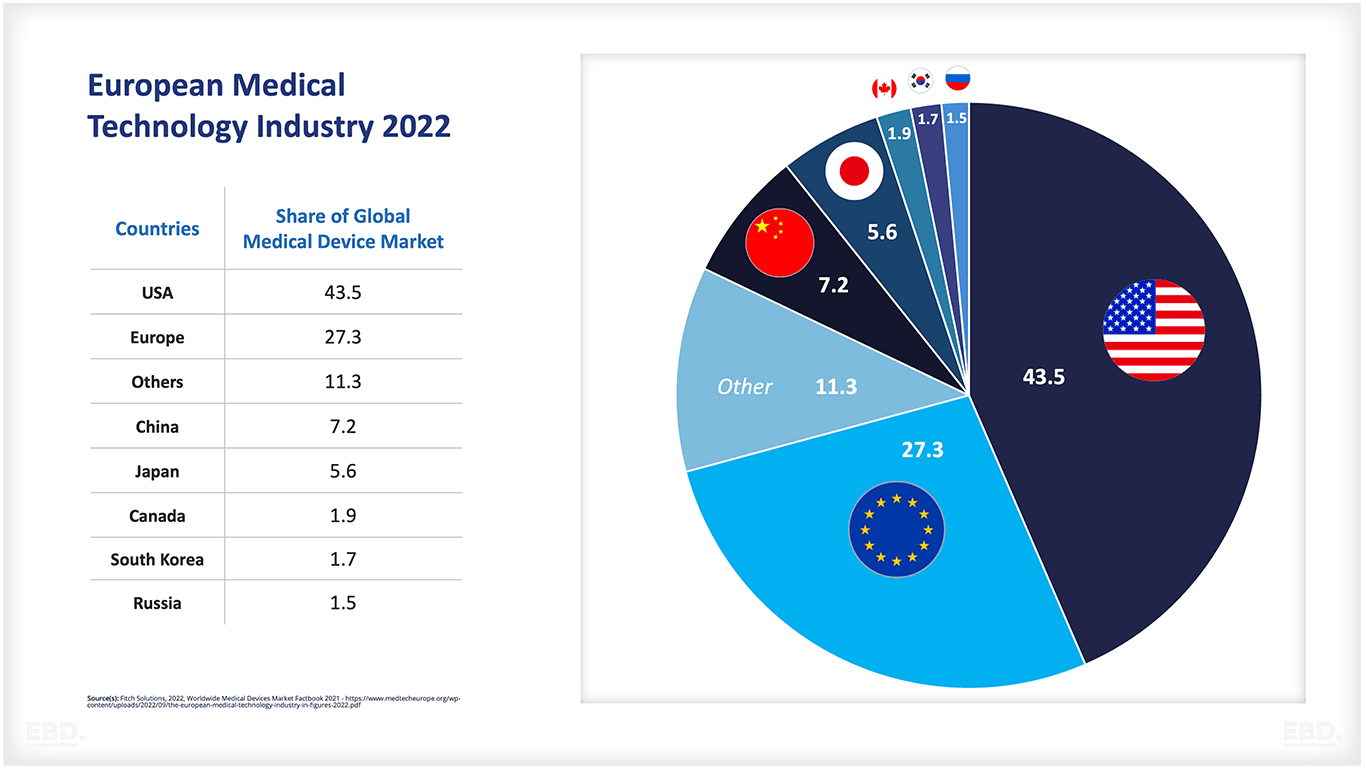

The US is the global leader with a 43.5% share of the sector’s revenues, whilst Europe has a 27.3% share, China has 7.2%, and Japan has 5.6% (as shown below).

Medtech at an inflection point

Numerous experts and studies have noted the medtech sector’s recent rollout of significantly more sophisticated technologies for the treatment of many chronic diseases. It’s often referred to as a revolution since the medtech sector’s technological advancements have the potential to dramatically improve healthcare outcomes for billions of people.

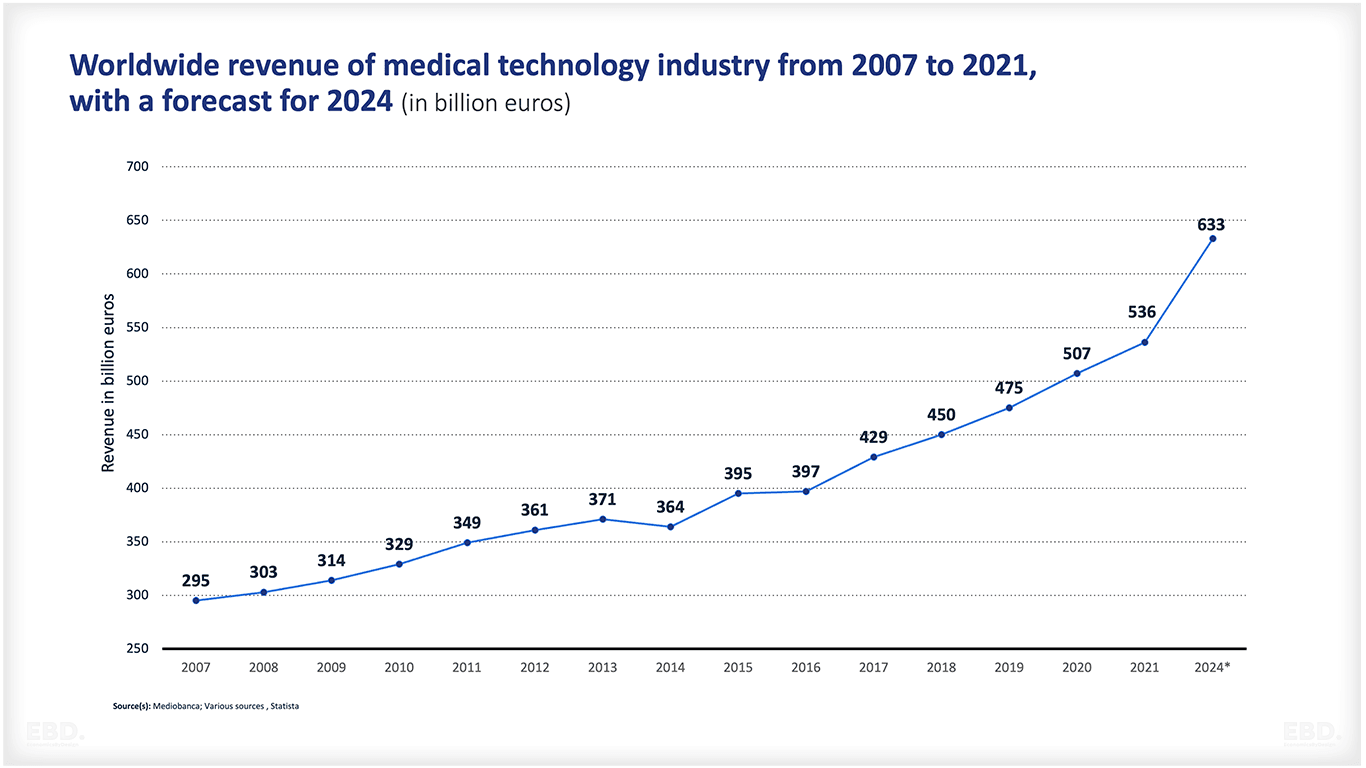

This inflection point can be seen in an upward shift in the global medtech sector’s revenue growth rate of late:

Reaching this inflection point has taken longer than the rest of the global technology sector due to the many years of clinical trials needed, as well as the gathering of the requisite operating theatre evidence. Through this process, a growing number of medtech companies have achieved the safety and efficacy profile needed to scale up their new and improved technologies.

The analogy with the global technology sector in 1995 may have some merit. Back then, technology capabilities and use cases grew exponentially, and the companies exposed to those themes outperformed in the ensuing few years for the simple reason the theme was so obvious and compelling.

The medtech revolution couldn’t be happening at a better time for the global healthcare sector. With burgeoning healthcare costs, medtech solutions which can reduce costs by lowering surgery times and admission rates are just what the sector needs.

Given the ageing of the global population and the likelihood that higher for longer cost inflation is entrenched within the healthcare sector, strong demand for improved medtech solutions is likely to last for decades and beyond. It’s the ultimate sustainable investment theme.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Recent medtech secular shifts

Some examples of recent medtech secular shifts include:

Generative AI is increasingly being used to interpret medical results and generate personalised recommendations with a view to improving diagnostic accuracy and speeding up decision-making processes to help healthcare professionals deliver better care.

Bio-printing for organ transplants is an emerging interdisciplinary field which is stepping closer to commercialisation and offers significant longer term potential.

Augmented and virtual reality is increasingly being used to improve education and training, as well as diagnostics and treatments.

Remote patient monitoring uses connected medical devices to collect and transmit patient data that enables better management of chronic diseases.

Nanotechnology is being used to develop drug delivery systems which can target specific cells in the body, thus enabling more accurate and effective treatments.

Automated medical image analysis allows doctors to diagnose and treat chronic diseases such as cancer faster and with greater accuracy.

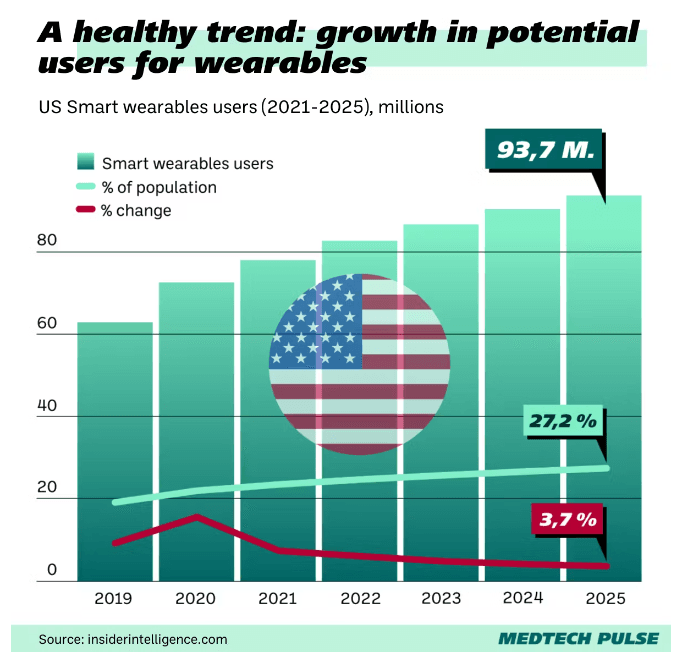

Wearable health tech and the internet of medical things are becoming more sophisticated and more popular, as shown below. These devices enable continuous health assessment through real-time data combined with detailed information about patients’ health.

Q4 results confirm the sector’s growth has inflected

After the release of solid Q4 2023 results across the global medtech sector, the good news is set to continue with last year’s double digit revenue growth expected to continue throughout 2024. In addition, the medtech sector’s earnings growth rate is expected to improve this year with efficiency improvements flowing through after years of supply chain challenges.

According to investment bank Baird, demand is currently particularly strong for hip and knee replacements, diabetes devices, contact lenses, ophthalmology products, cardiovascular and neuromodulator devices, and surgical robotics. In contrast, the dental technology market is experiencing weaker than expected growth.

In terms of noteworthy sector themes, the aesthetics segment is benefiting from an industry shift from liposuction to body contouring, whilst companies involved in skin-tightening technologies (eg. InMode) are likely to benefit longer term from the growing popularity of GLP-1 weight loss drugs.

Similarly, investment bank BTIG has bullish expectations for the medtech sector this year as last year’s concerns about the impact of GLP-1 weight loss drugs, rising interest rates, and supply chain issues are dissipating: ‘With GLP-1 fears cast aside, we think MedTech is poised to have a better year in 2024 on the back of a stable-to-improving environment.’

Longer term analyst expectations suggest the sector’s leaders are on track to become much larger companies in the coming few years:

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

An enduring investment theme

The global medtech sector could well be in the early stages of partying like it’s 1995.

The sector’s inflecting technological standards translate into one of the most intuitive and understandable investment themes in global markets today. Not only is the medtech sector positioned to benefit from improved chronic disease treatment standards, it’s worth remembering the sector’s growth is also underwritten by an ageing global population with a universal desire to live longer and with a high quality of life. That’s a strong natural tailwind that’s as sustainable as they come.

Beyond Resmed, many of the global medtech leaders are based in the US (eg. Boston Scientific, Stryker, Intuitive Surgical, The Cooper Companies), so Australian investors may find it more efficient to gain exposure to this compelling theme by investing via a specialist healthcare fund with the requisite global experience and track record.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.