Cash rules the roost as rates remain high

Ankita Rai

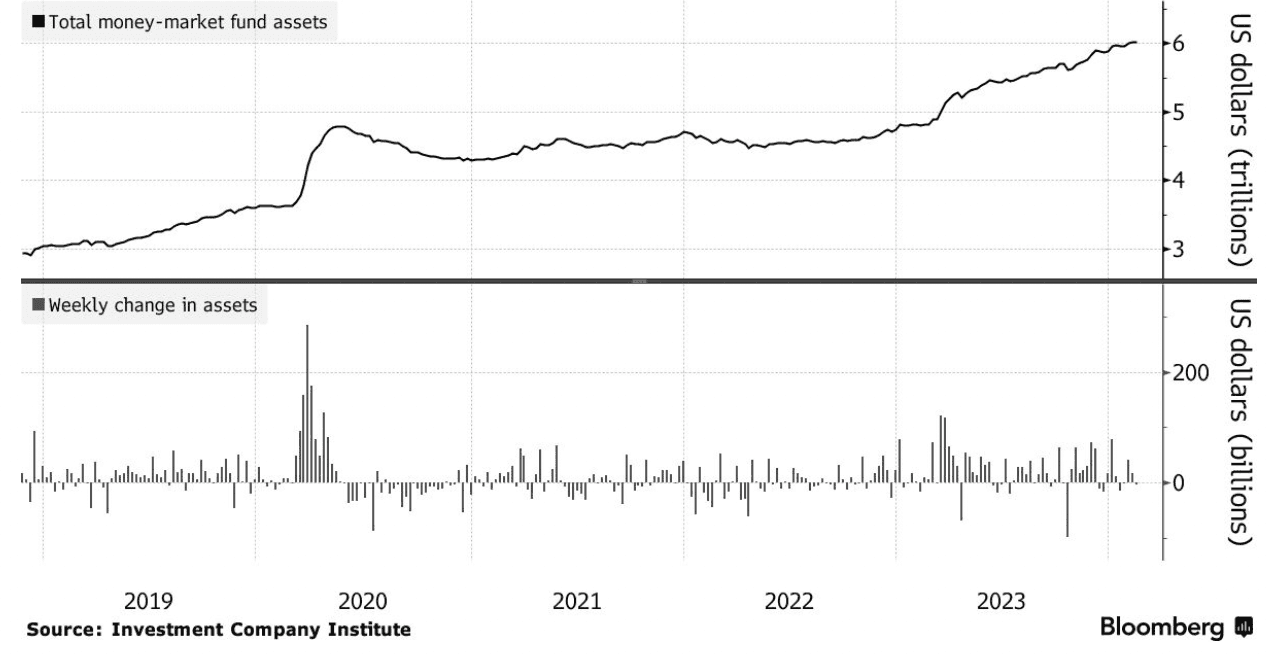

Tue 5 Mar 2024 5 minutesDespite the overall bullish trend in equities, there's been a notable surge in cash being held by money market funds with an all-time high in those assets recently reached.

In fact, total assets in US money market funds, which invest in cash-like securities such as short-term Treasury bills, grew to $US6.02 trillion last month, with both retail and institutional funds increasing their allocations due to the higher short-term rates on offer.

Yields on money market funds are currently topping 5%, while the S&P 500 dividend yield, at 1.47%, has fallen below its long-term average of 1.84%, making cash investments more appealing.

The corporate world is following suit. For example, 2023 saw Berkshire Hathaway put considerable money into treasuries and cash equivalents and short-term securities. Other companies like Meta Platforms and Amazon.com also increased their money fund allocations to $32.9 billion and $39.2 billion respectively.

Cash is king when rates are high

Higher for longer rates have bolstered the outlook for money market funds. Thanks to the Federal Reserve's eleven straight interest rate hikes, cash investments are now more attractive than they have been in the past two decades.

Consequently, investors have flocked to cash products like term deposits and money markets, seeking both safety and income. This marks a notable shift from their previous status as low-risk, low-return investments.

To be sure, this trend doesn't mean that the stock market is in trouble. It’s revealing that the S&P recently surpassed the 5,000-mark for the first time ever, while the ongoing surge in money market fund inflows has been occurring. It means investors have a lot of dry powder to strategically buy future dips in equities.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Deposit wars heating up

Increased inflows into cash instruments has also been a signal for the banks to adapt their strategies accordingly.

As interest rates rise, bank customers seek better returns on their savings, sparking heightened competition among banks for deposits. Recent Australian bank earnings reflect this situation with deposit costs becoming a top priority for analysts.

According to Oliver Wyman's "The New Monetary Order" report, if inflation persists and the RBA's cash rates remain high, banks could face greater challenges as competition for deposits will further increase. This situation creates the risk for many banks of losing deposits as customers turn to higher yielding money market funds, a trend currently being witnessed in the US.

Clearly, money market funds shouldn’t be overlooked given that monetary policy easing is not expected by the RBA any time soon. On that note, the strong employment and inflation data released this month have further tempered expectations for an early rate cut.

The longer the central bank delays lowering its benchmark rate, the more cash held in money-market funds can earn. Hence, 2024 could be another big year for cash inflows.

Money market funds versus term deposits

Balancing a cash portfolio can be challenging, especially when aiming to ensure stability, liquidity, and yield simultaneously. Focusing on one aspect may come at the expense of the others.

Investors may also be starting to consider which cash instrument is preferable once the expected rate-cutting cycle is underway.

In general, money market funds offer diversified portfolios of highly liquid assets, in contrast to term deposits that represent unsecured liabilities on balance sheets.

The drawback with term deposits is that the banks may adjust their rates before the RBA initiates rate cuts since they tend to react swiftly to market signals. Typically, rates on longer-term deposits are expected to decline faster as they are more closely tied to economic fluctuations.

Money market funds are more closely tied to the central bank's benchmark rate. This dynamic results in bank deposit rates generally lagging behind rate hikes and money market yields during a hiking cycle. Hence, the significant inflows into money market funds that we are witnessing at the moment.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Outlook for cash

Amidst the ongoing global economic uncertainties created by inflation, geopolitical tensions, and recession fears, investors are finding refuge in cash-like investments.

However, while the historically high yields offered by money market funds may seem attractive, it's important to consider the potential impact of upcoming rate cuts expected from central banks.

Waiting too long on the sidelines may result in missed opportunities to secure higher yields for the longer term. Moreover, ongoing inflation could further erode the attractiveness of cash, incentivising the importance of exploring alternative investment options.

Key points for investors:

Money market funds are experiencing record-high inflows into cash investments, which recently reached $US6.02 trillion in total assets.

Yields on money market funds have surpassed 5%, which is significantly higher than the S&P 500 dividend yield, making cash investments more attractive on a relative basis.

The surge in money market funds provides investors with a lot of dry powder for strategic investments, allowing them buy dips in the stock market while maintaining liquidity and stability in their portfolios.

Major companies like Berkshire Hathaway, Meta Platforms, and Amazon.com have increased their allocations to cash, reflecting a broader trend of seeking safety and returns in cash equivalents amid market uncertainty.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.