Will the Fed throw kerosene onto the fire?

Simon Turner

Thu 7 Mar 2024 5 minutesWith global equity markets celebrating the prospect of impending rate cuts by the Fed, some investors have been wrong-footed by the extent of the recent enthusiasm, particularly in US tech stocks.

If you’re underinvested and are considering joining the equity party in earnest, it’s worthwhile digging into the market’s Fed fund rate expectations for an understanding of whether market expectations are on point, or not. This situation may well dictate global and Australian equity market performance in the coming months.

Fed expected to cut rates throughout 2024

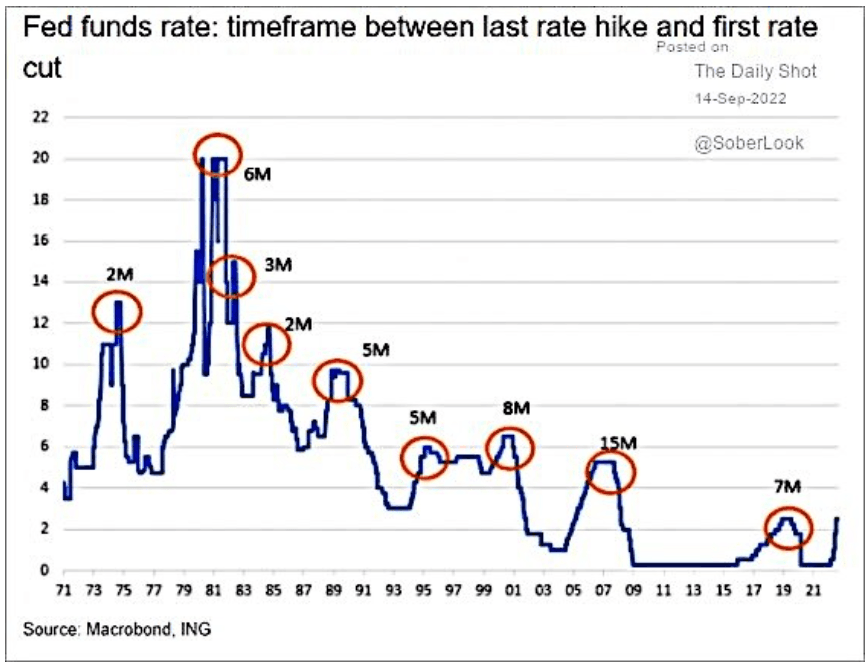

As always seems to be the case, the Fed’s fund rate expectations have been front and centre for US and global equities during the first months of 2024. Markets are acutely aware that the Fed tends to start cutting within a few months of rates peaking as shown below.

As a result, the markets’ Fed fund rate expectations have adjusted downwards leading to the strong rally we’ve witnessed across US and global equity markets in recent months. The S&P 500 is now up 130% from its March 2020 low, and has rallied 1000 points since October last year.

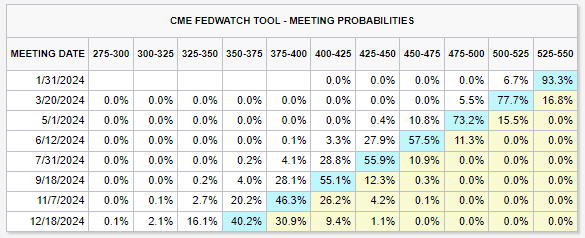

Post this shift, financial markets are now expecting the Fed to cut rates at each and every Fed meeting this year from March onwards, as shown below.

If these expectations are met, the Fed funds rate would be lowered from the current 5.5% to 3.5-3.75% by the end of the year. That outcome would be good news for US and global equities, hence the celebratory mood across markets.

There’s a but

But … markets may have run ahead of themselves on these key Fed fund rate assumptions.

There’s more than one voice highlighting this inconvenient truth.

Firstly, there’s the Fed’s actual guidance which implies only 3 rate cuts throughout 2024. That’s a lot less that the 7 rate cuts financial markets have already priced in, and creates an unusually large (read: concerning) expectations gap.

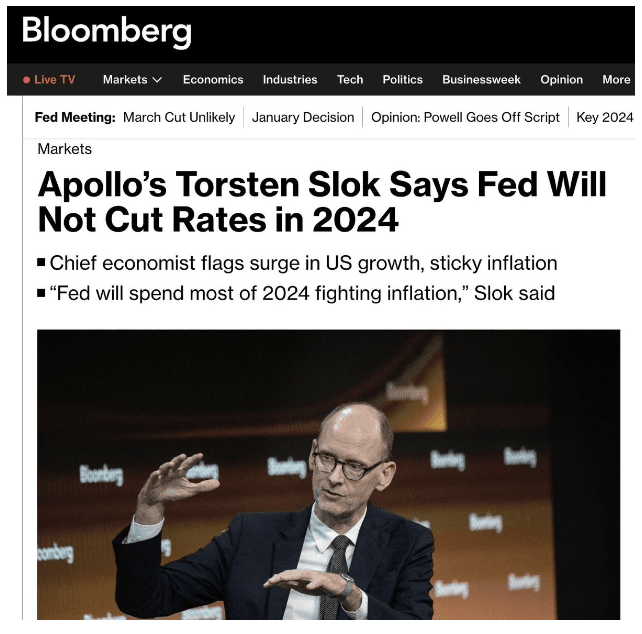

Secondly, there’s a growing chorus of market experts who are expecting the Fed to disappoint investors this year versus their own guidance of 3 cuts, never mind the markets’ expectations of 7 cuts.

For example, Apollo’s chief economist Torsten Slok recently announced: "The Fed will not cut rates this year, and rates are going to stay higher for longer."

Mr Slok believes the US economy is unlikely to slow, particularly since the recent Fed pivot has added an economic tailwind since December. He also believes inflation is once again trending upwards, and references the recent increase in supercore inflation (which includes services but excludes energy and housing) to 4.4% in January, as well as rising rents across the country. In short, he believes, “The Fed's job is far from done.”

Is the Fed’s job done? is the key question global investors need to ask themselves at this juncture.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

What if the Fed’s 3 rate cut guidance is right?

Let’s start with the scenario in which the Fed follows its own guidance and cuts rates 3 times this year. That would suggest US economic growth is in line with expectations which would be good news from a macro perspective.

However, this scenario would leave financial markets needing to increase their end of year Fed funds rate expectations by a full 1%. That change would impact upon discounted future cash flows in analyst valuation models.

Whether the positive economic and negative valuation implications of this scenario would roughly offset one another in this scenario is debateable. What’s less debatable is that this scenario would likely catalyse some volatility between now and the end of the year.

What if Apollo’s no rate cut assumption is right?

We’re entering uncharted waters in this scenario given the size of the expectations gap.

First, the good news. The Fed would only hold rates steady this year if US economic growth was much stronger than expected throughout 2024. From a macro perspective, that would be very positive.

However, the problem is 7 rate cuts, or 1.75% in total, is a major adjustment for financial markets versus current expectations. At the very least, this would lead to even more volatility in the coming months.

And worst case, this scenario could push markets into crash territory at some point, particularly if the expectations adjustment process is short, sharp and shocking for markets.

Chuck Prince, the former Citigroup CEO concurs, although he believes remaining invested for now is the optimal strategy: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing.”

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Historic times in the making

How the Fed navigates the glaring rate expectations gap will test the value they place on the US economy versus the US stock market. It will also test the way investors value economic growth versus the discount rate used in their stock valuations. It’s fair to say this unusual set-up is positioning global financial markets for an historic 2024.

Being aware of the leveraged importance of the Fed’s upcoming rate decisions on global equity markets is likely to serve Australian investors well.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.